- AllllSevens

- Posts

- Weekly Newsletter 2/26/24

Weekly Newsletter 2/26/24

SPY new ATH's with it's largest one-week again in 12 weeks. On it's lowest volume since early November...? In this newsletter I explain why this is NOT as bearish as most think.

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

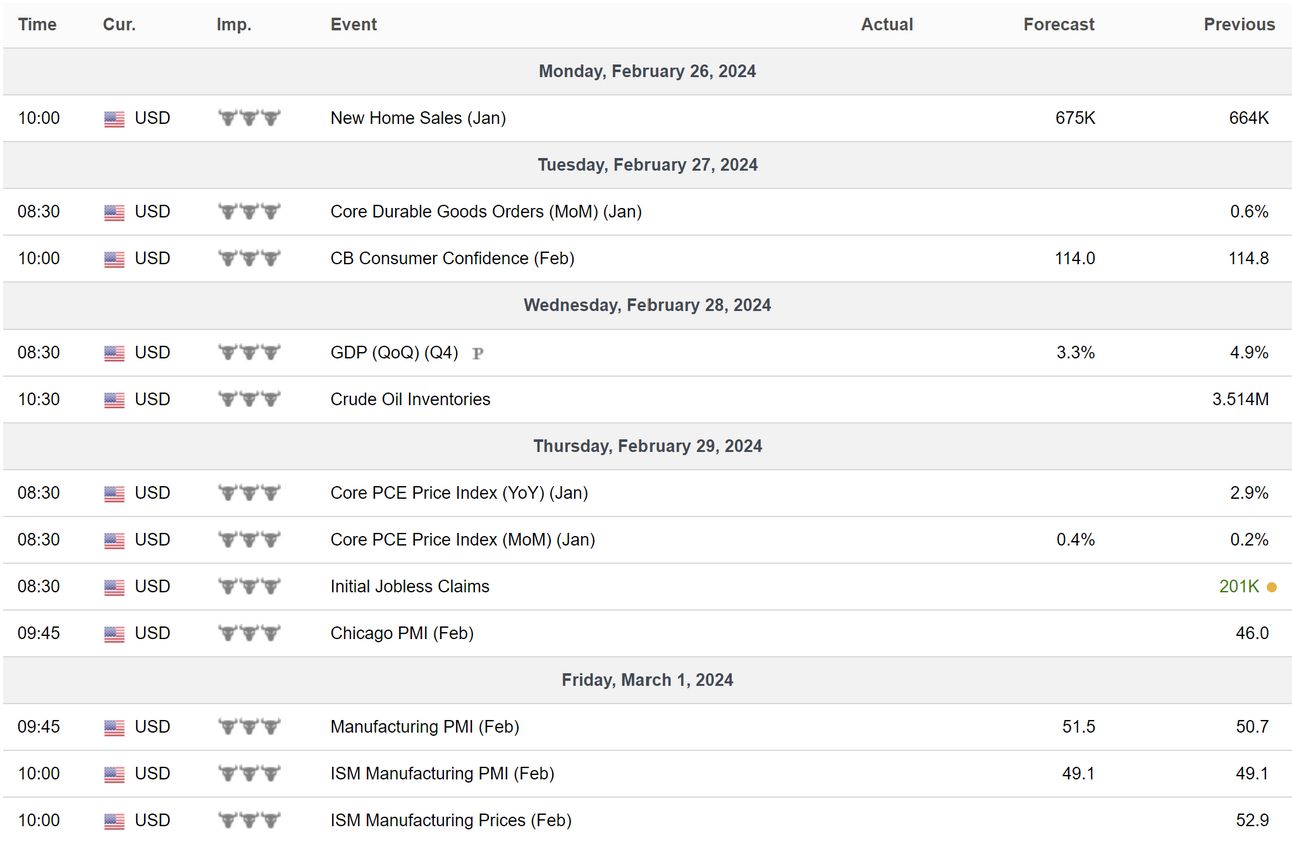

Calendar

SPY

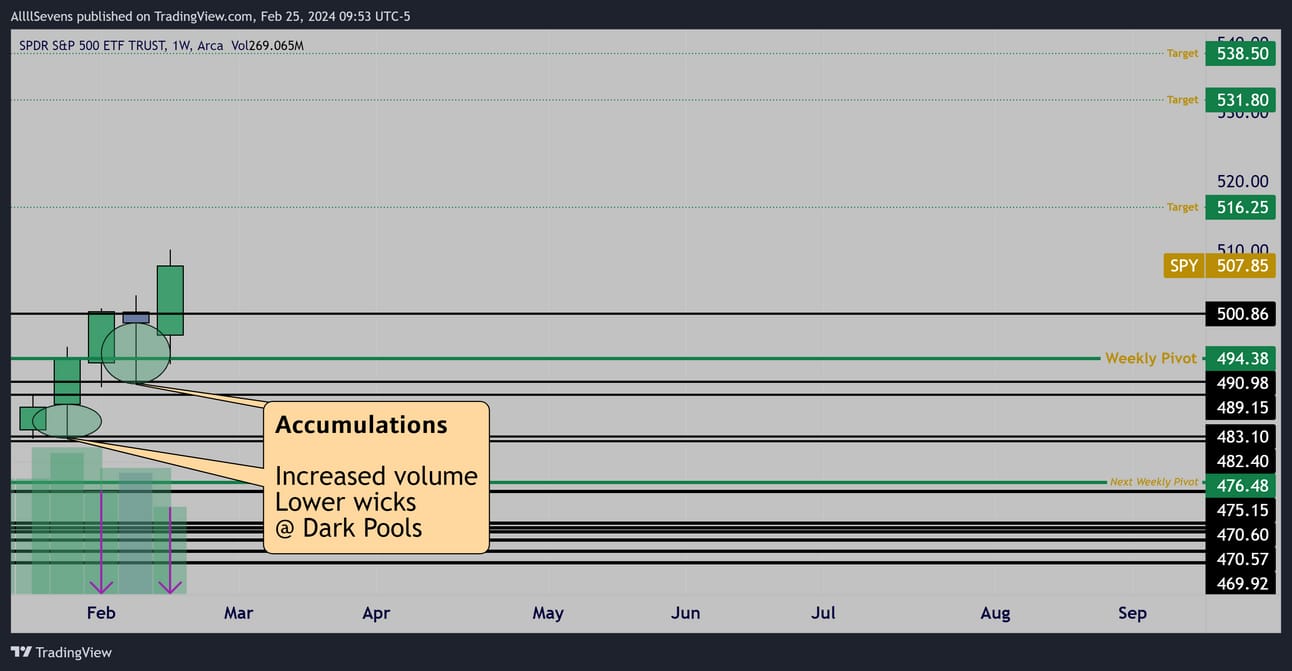

Weekly

Institutions are actively buying the S&P500 at new ATH’s-

Visible through increased volume lower wicks at large Dark Pool levels.

Short-term targets above are $516.25, $531.80, & $538.50

$494.38 is THE current pivot.

As long as weekly candles open above this level, trend is UP and dips are expected to be bought.

Price has repeatedly pushed to new highs over the last three weeks on decreased volume following these accumulations.

This recent candle is actually the SPY’s largest weekly gain since early November- On its lowest volume in 12 weeks…

That’s a notable anomaly between volume and price!

What’s it saying?

Institutions are focused on buying dips- not rallies.

Remember- retail participants are the drivers of short-term trend.

Not institutions. Let me show proof of this below.

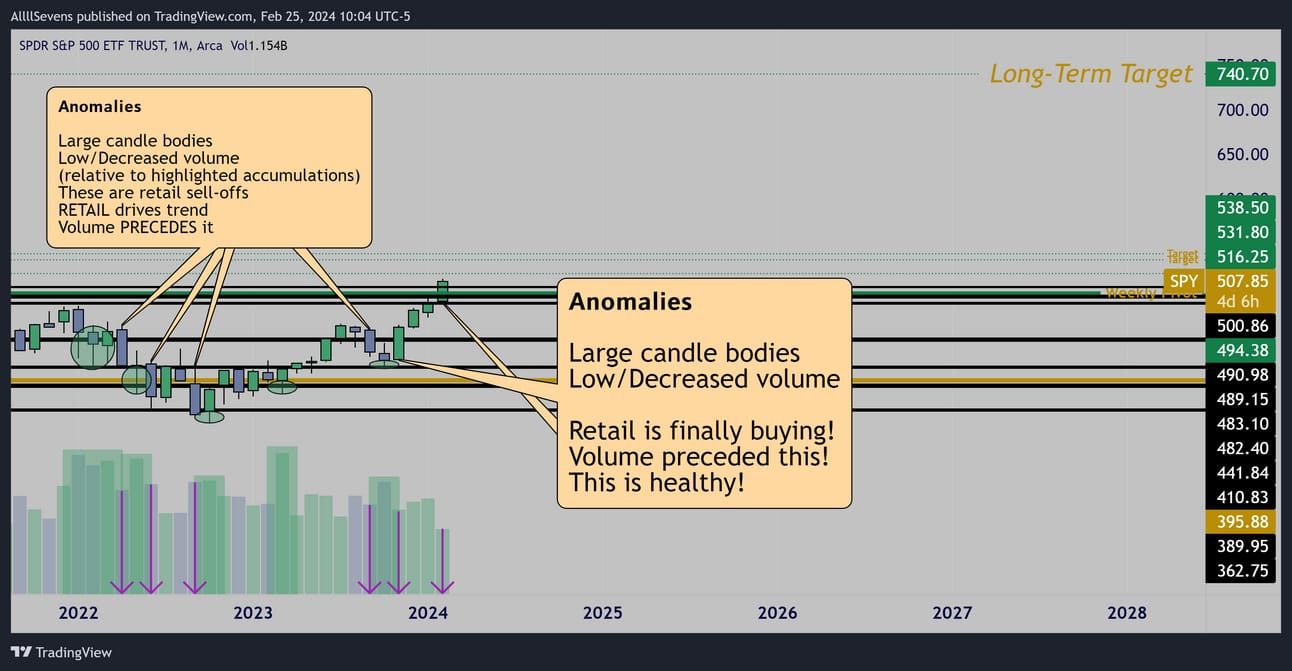

Monthly

The S&P500 has been in an Accumulation Phase for two years…

It’s projected to reach $740 over the next decade. At the least.

But, that’s not what I’m trying to show you here.

I want you to notice that RETAIL PARTICIPANTS (low volume) are the drivers behind short-term trend! They sold the entire wave down in 2022 while institutional volumes were clearly buying dip.

Volume (institutions) PRECEDE price trend.

So, when we see price finally rising on low volume after a two year accumulation phase, it’s actually healthy and very much expected.

It’s not bearish at all. (many people will tell you it is)

It could actually be signaling that the Accumulation Phase is nearing an end and a true “melt-up” Public Participation Phase is beginning…

Headed into next week:

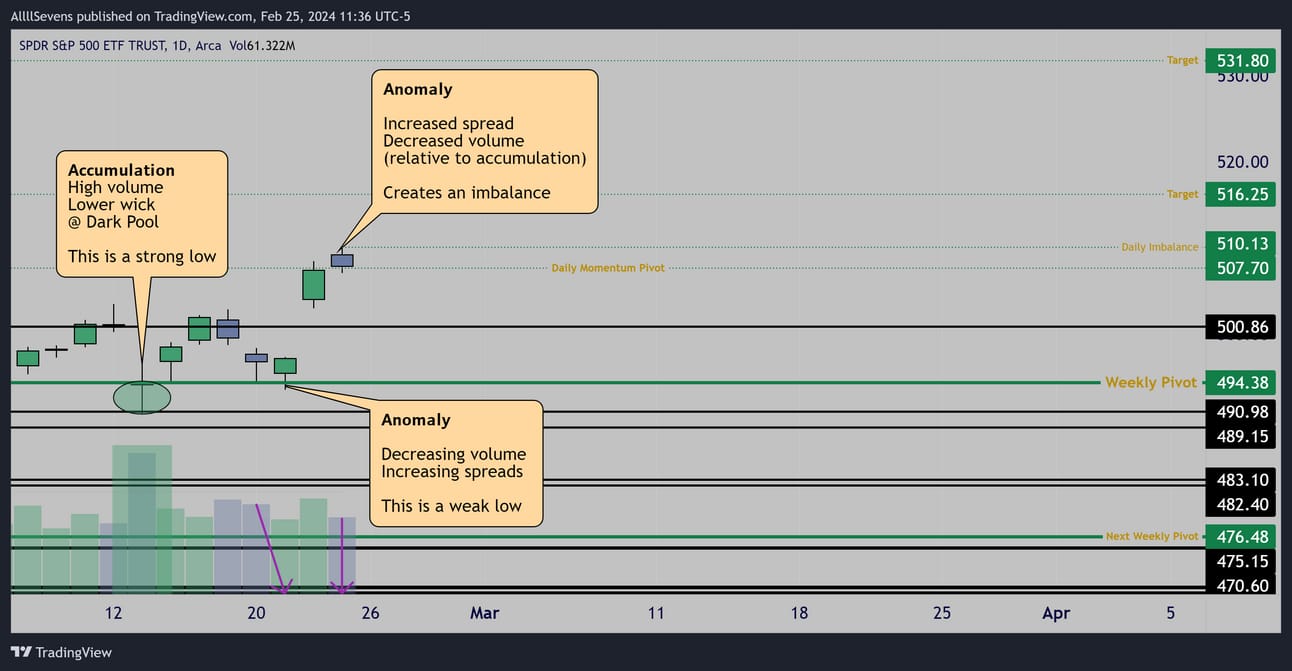

Daily

There is a strong low formed @ $490.98

If long from there or below, it’s likely that price will respect your stop and holding for targets above is safe.

There is a WEAK LOW formed off the top of that range @ $494.38

Price reversed on increasing candle spreads and decreasing volume.

If long from here or higher, there is a higher risk of your stop being hunted and it’s not as safe to be holding for targets above.

There is a weak high formed on Friday’s high @ $510.13

An increased spread (relative to the strong low accumulation candle) rejected price from ATH’s on very low volume. Anomaly. Retail sell-off.

This creates an imbalance between price and volume and it’s very likely this high will be broke at some point. I consider any price below this imbalance to be a discount for the targets shown above.

So, with price likely opening extended from supports this week-

On low volume and with a weak low below the weekly pivot…

The Daily Momentum Pivot @ $507.70 will be crucial in determining the theme for this week.

#1-

Above, hold, and we’re looking at some very strong momentum likely to take us towards target #1 @ $516.25

Here are some intraday imbalances collected from Friday’s price action.

Potential scalp targets / levels to gauge discounted entries if price holds momentum over $507.70 👇

15m

#2-

Below the Daily Momentum Pivot @ $507.70, and we’re looking at potentially choppy price action and/or a potential stop hunt @ the weak low- $494.38 where I’d expect buyers to step back in.

We do have the $500.86 level to watch and it’s possible a strong low develops there, but until that happens, its safer to simply expect the weak low to get swept.

Conclusion

From an investor’s perspective:

Institutions are actively buying here.

Long-Term projection is @ $740 (45%+)

Below Friday’s high, the SPY is technically trading at a discount.

Let’s say despite this, everything falls apart from here in short-term.

Price hunts the weak low and then opens below $494.38 next week, pivoting trend to the downside and potentially starting a correction…

There’s absolutely no reason to question the long-term stability of the S&P500. Short-term drawdowns should be something an investor should look forward to and be ready for. Plan accordingly.

From a trader’s perspective:

$507.70 is the level for strong upside momentum this week.

Below, and $500.86 could be a place to anticipate buyers, but really, I expect the $494.38 low to get swept before very strong buyers step in.

I will update Daily on 𝕏

QQQ

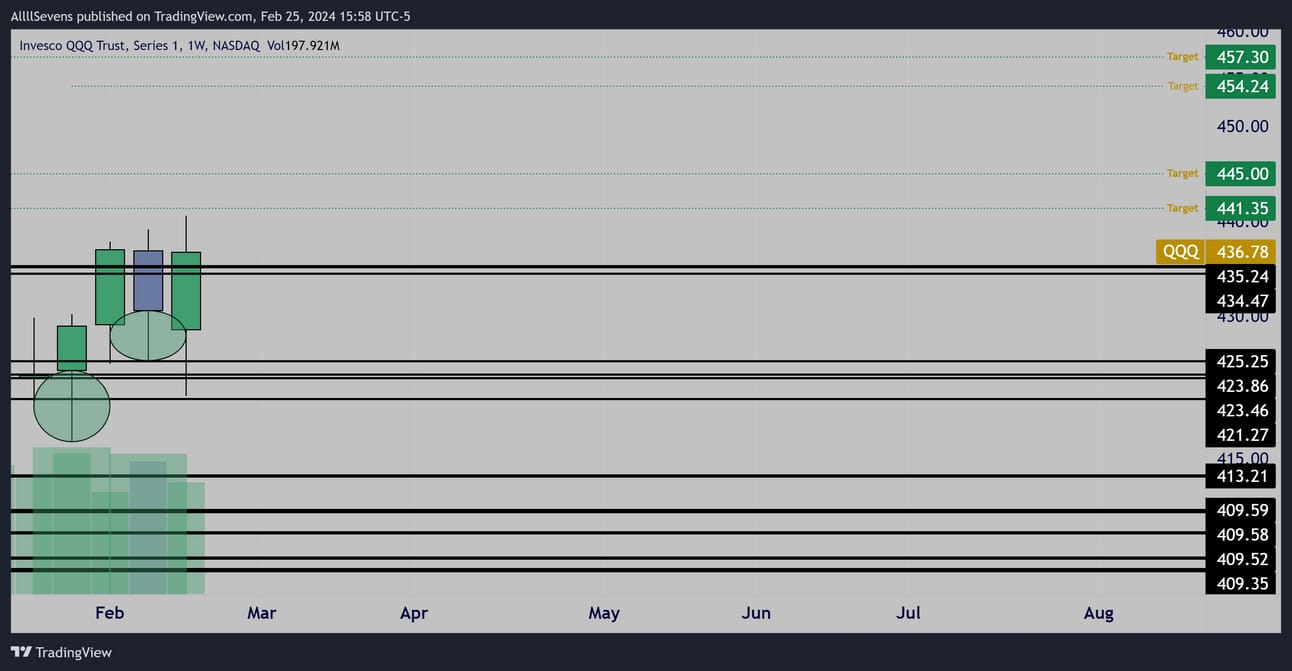

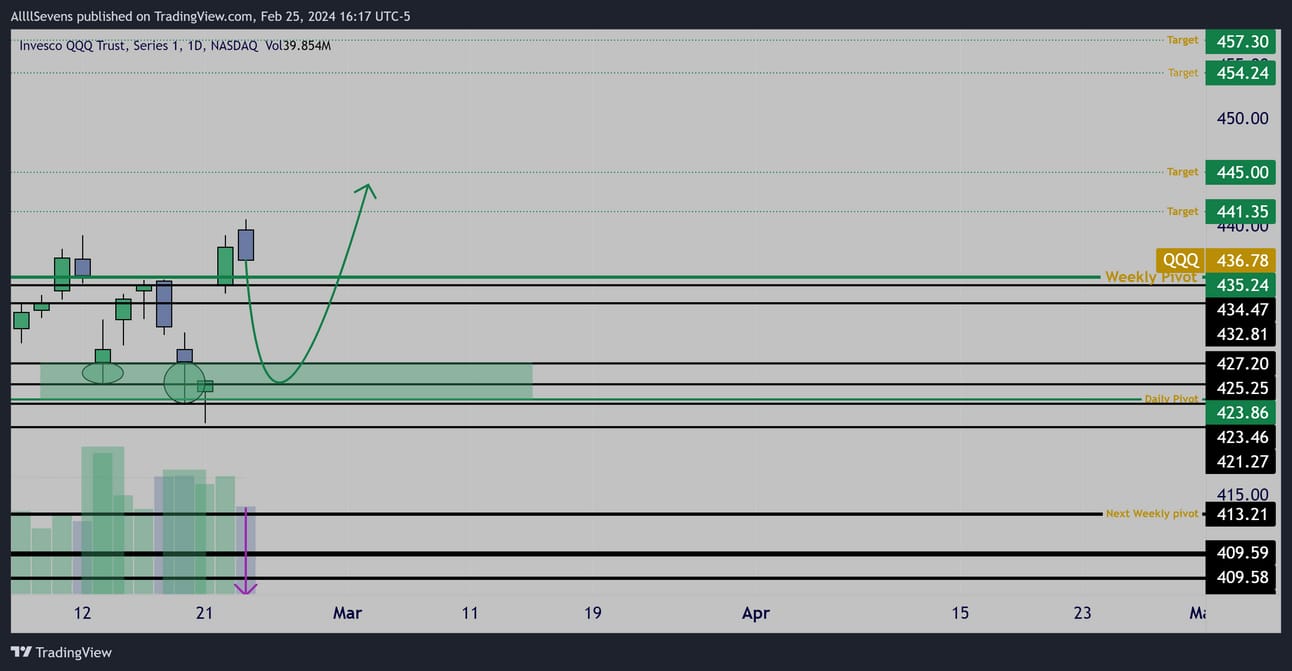

Weekly

Does not display the same extreme anomaly as SPY

There is no weak low on the QQQ either…

I’m extremely interested in the QQQ specifically if there is a pullback this week for the SPY to sweep the weak low it made.

If QQQ opens OVER the weekly pivot @ $435.24 setting us up for a bullish trend, and then it dips alongside SPY I’m seeing strong conviction to expect relative strength here and a higher low to form while spy makes a lower high. This would be a very lucrative time to add longs.

Of course, there could be no dip on either!

Targets are above. Supports shown. Good luck!

Conclusion

From an investor’s perspective:

Same exact story as the SPY

From a trader’s perspective:

Institutional buyers are more aggressive here than they are on SPY

My focus will be here for strength this week, specifically if there is a dip to break lows on the SPY.

AllllSevens+

Upgrade your subscription to gain access to premium newsletter content,

Mostly indivudal stock picks using this same style of analysis.

Which stocks have institutions bought the most of the last two years?

I plan to release a premium newsletter tomorrow at 5:00AM E.T.

Also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

It’s only $7.77 per month. Try it out!

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjPDr

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply