- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

CI / BKNG / BABA / PFE / CORZ / HASI / SCHW

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

My apologies for getting this out so late.

But, here it is-

After scanning my 400+ stock watchlist, the flow, and the dark pool transactions all of last week, here are 7 of my favorite stocks headed into the week of 8/25/2024

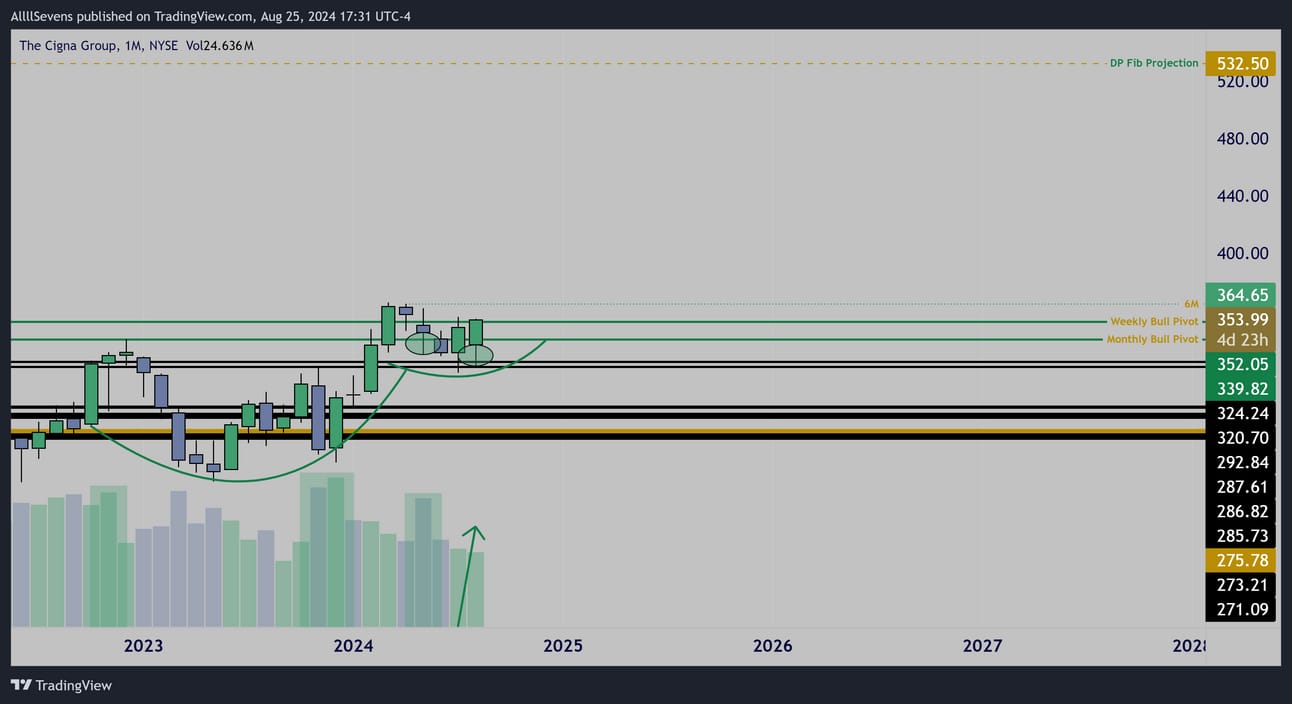

CI

Monthly Interval

Beautiful accumulation patterns.

Cup & handle formation over prior ATH’s.

Increasing volume on this month’s candle.

My long-term projection here is $530 per share.

Please keep in mind that would likely take many years.

I expect the $339.82 dark pool to hold if my timing here is correct.

Weekly Interval

Very intense accumulation patterns over the last 6 months.

For short-term momentum, $352.05 is the DP to hold.

Daily Interval

Continuity on each time frame.

Just tons and tons of bullish volumes visible here.

Notable Options Flow

$645K OTM Call Buyer for January 2026

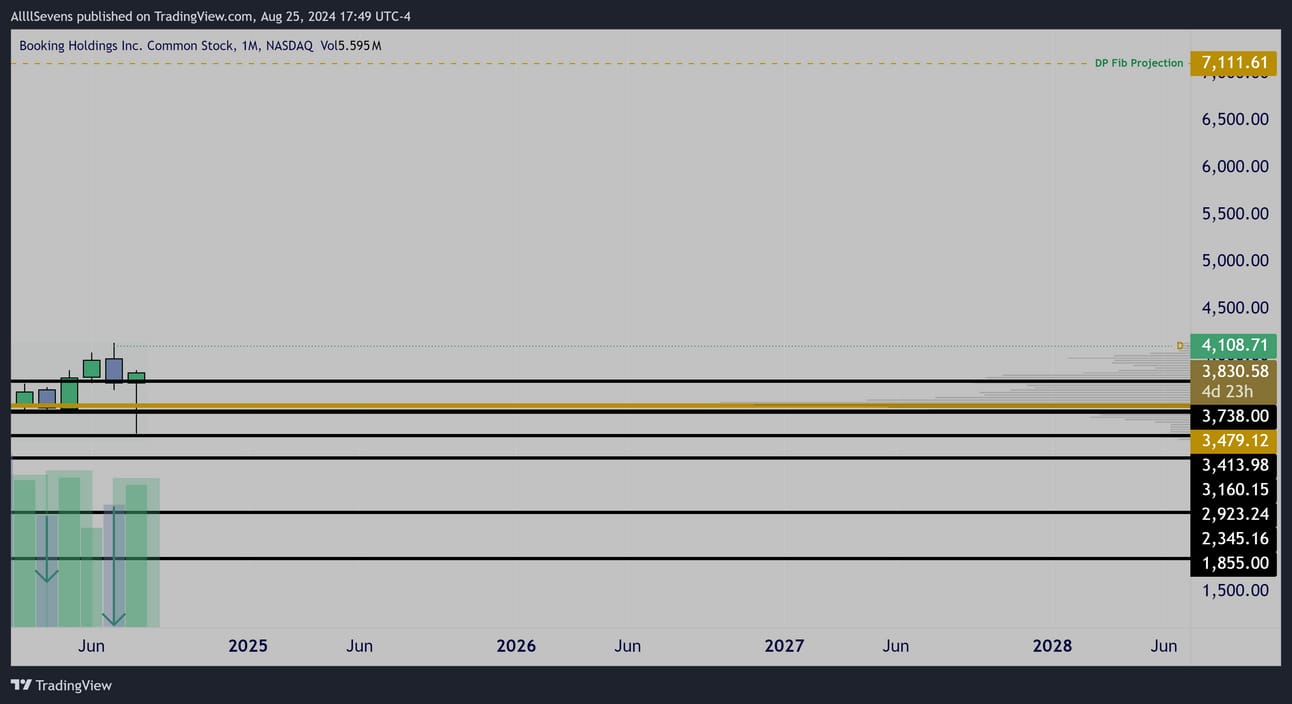

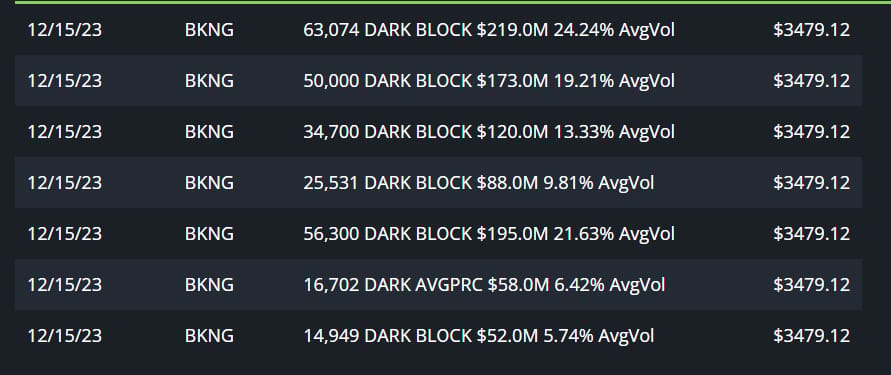

BKNG

Monthly Interval

Largest Dark Pool On Record

$900M+

Strong monthly hammer forming off the stock’s recently transacted largest DP on record.

I think we’re seeing a very clear institutional interest in this stock for the long-term.

Obviously my projection of $7,000 per share would take years.

Weekly Interval

$BKNG has been sideways for the entirety of 2024

Major price & volume compression like this typically leads to a large expansion move when it breaks.

I love the recent sweep of lows leading to a very fast recovery on volume and of course, the monthly candle.

This is the X factor for me.

It really sets the tone and further confirms the volume patterns I’ve been watching here all year. I think “smart money” is very long.

The $3,500 area s obviously the primary level for risk here.

For short-term momentum, the recently transacted DP @ $3738 would be great to see held and strong bullish volumes off of it.

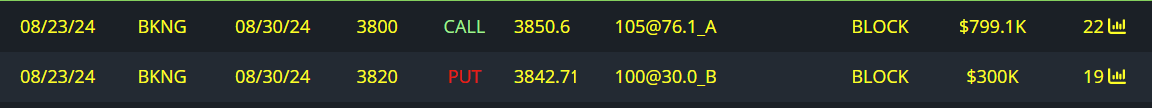

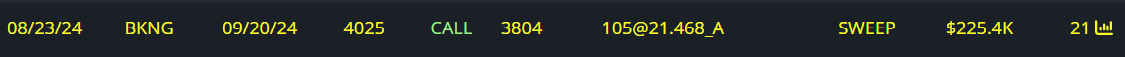

Notable Options Flow

$799K Call Buyer for This Week

$300K Put Writer for This Week

$225K Call Buyer For September OPEX

$44M Call Roll for January 2025

BABA

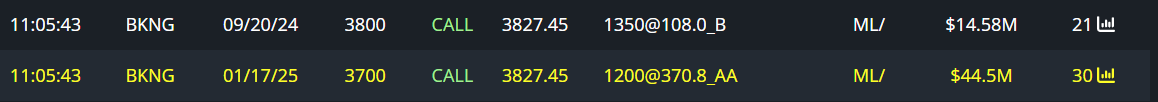

Weekly Interval

I really love the recent bullish volumes off the $82.51 dark pool.

The reason I am choosing to write about it NO, is last week’s decreased volume “resting candle” over support and into the $90 range.

$82.51 is the level to hold here.

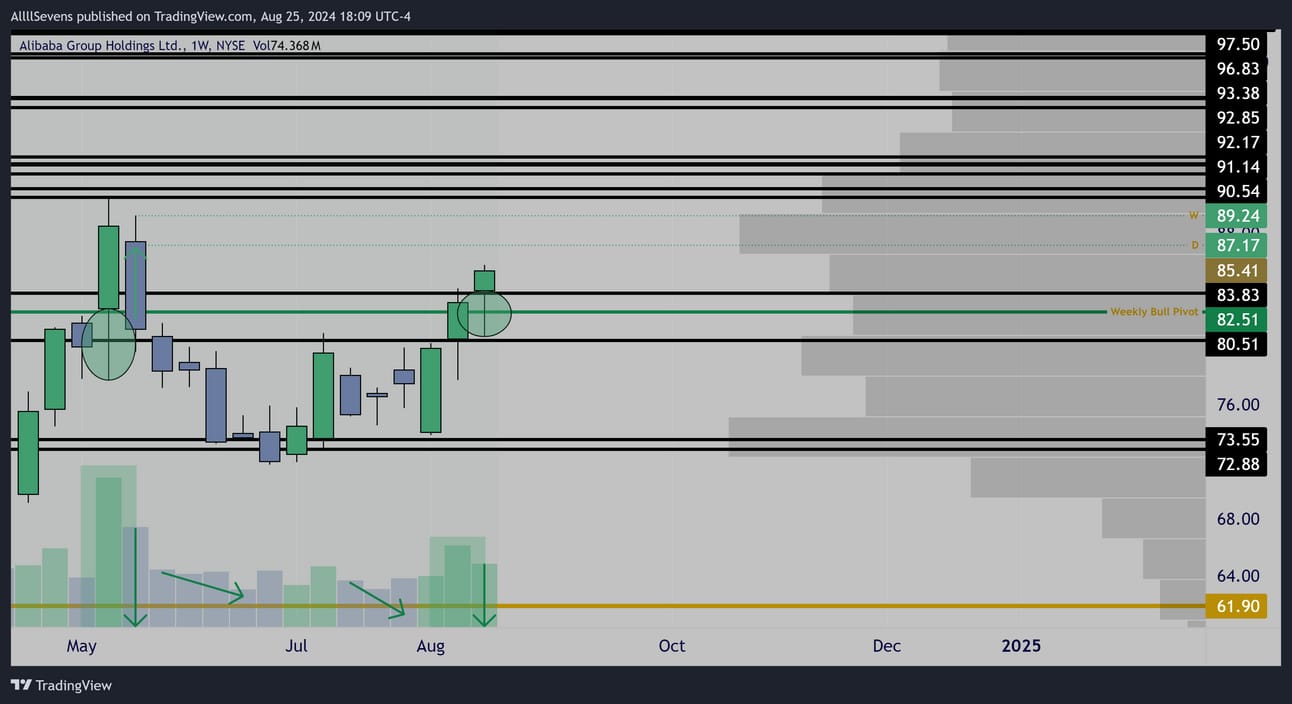

Monthly Interval

I am a MAJOR long-term believer in BABA stock.

The accumulation patterns we see here are truly textbook.

So, is this bottom? Is this the start of a long-awaited bull run??

That, I am not sure of. It could be. It could not be.

I think taking on the short-term risk of this weekly setup primarily for the push to $90 is THE setup here. Whether or not this turns into a much much larger rally, we will have to find out.

I’d personally like to see some of the levels above get broke reclaimed and an uptrend fully develop before I am confident enough to make the claim that BABA is fully bottomed.

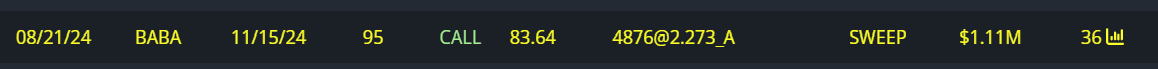

Unusual Options Flow

$1M OTM Call Buyer for November

$1M ITM Call Buyer for December

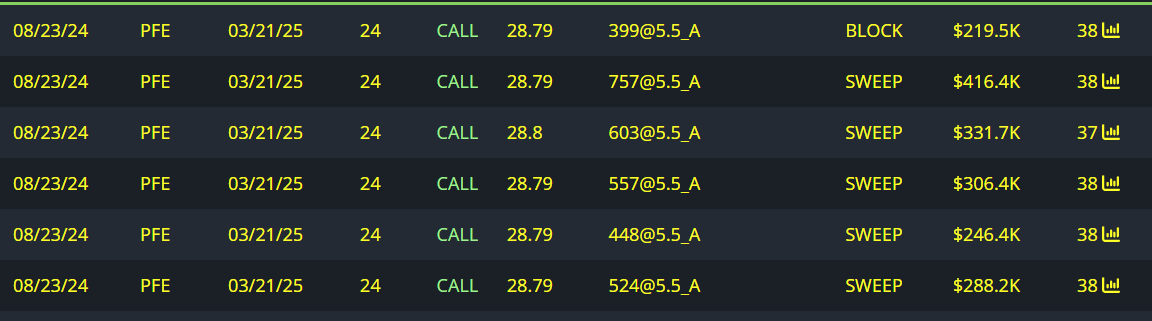

PFE

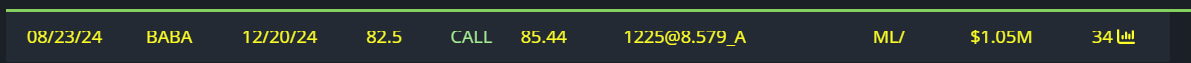

Daily Interval

PEG formation

Decreasing volume pull-back

Buyers beginning to step in off $28.66

If $PFE is going to see an immediate reversal, this level gets defended.

If it fails, further accumulation will be needed as this is at it’s core, a much higher time frame setup.

Monthly Interval

Last December, a hammer formed on the stock’s highest volume in over 7 years.

Since then, price has been progressively making higher highs backed by increased bullish volumes, followed by decreased volume pullbacks.

We are in the process of one of those decreased volume pullbacks…

Will increased volume buyers push this higher in the coming months?

That is the core thesis here.

$26.63 is the primary bullish pivot. There COULD be a deeper bull-back here which is why I stress the DAILY pivot is key. If the daily pivot is lost, it opens the door to the largest DP on record @ $27.70 or potentially the lower pivot @ $26.63.

I’d rather take a loss and re-enter if that’s what happens.

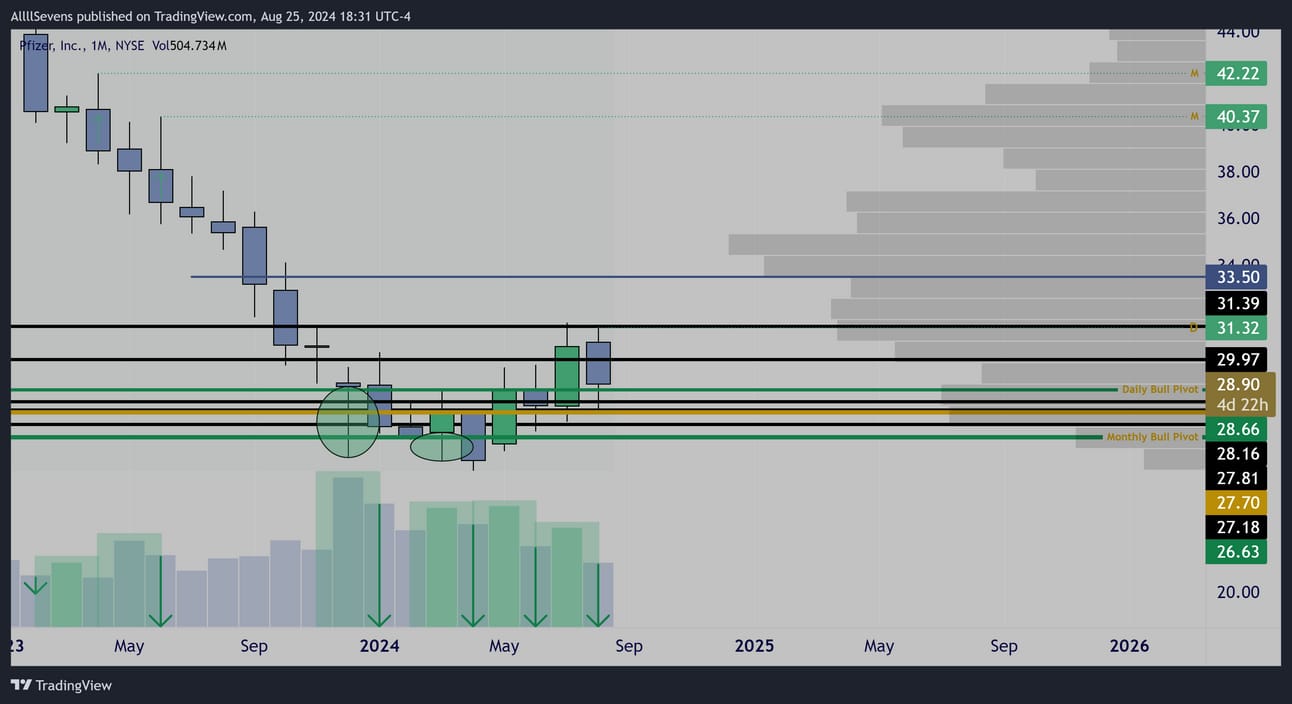

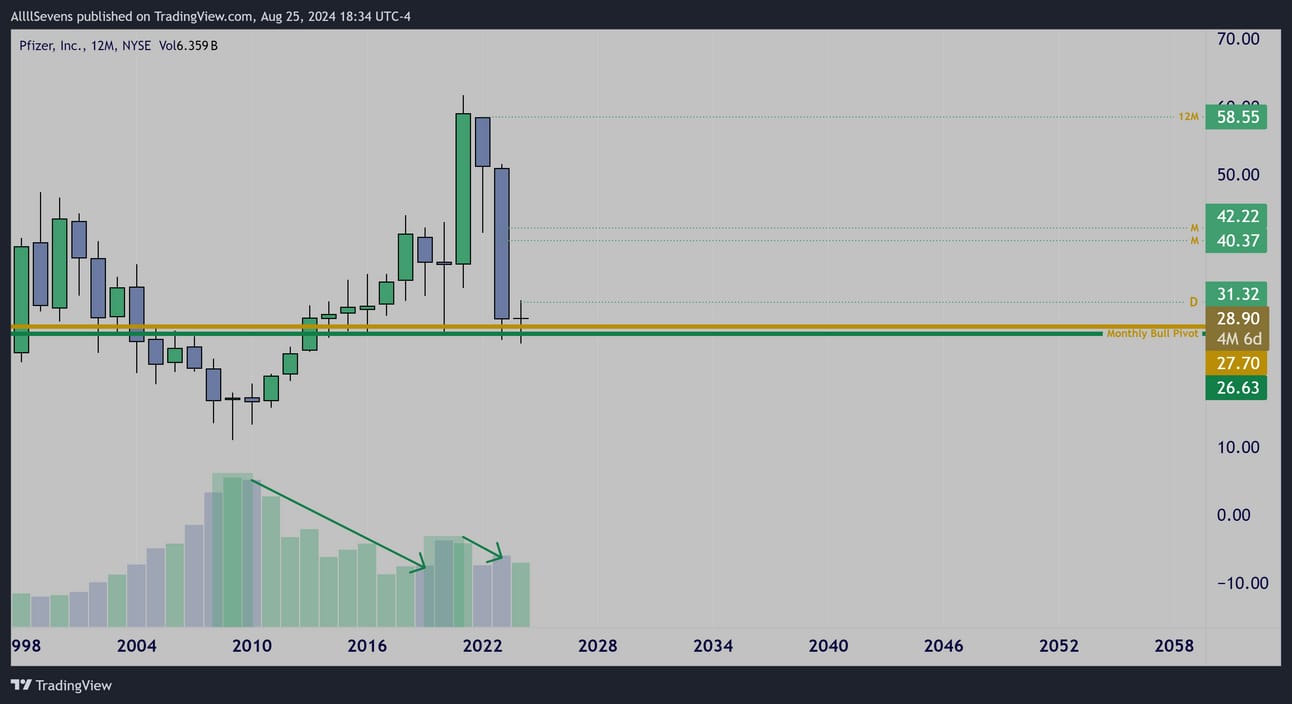

Yearly Interval

$PFE is at a major inflection point on a longer time frame.

No wonder we just saw the highest volume in over 7 years attempting to defend this area.

Notable Options Flow

$180K Call Buyer for This Week

$1.8M Call Buyer for March 2025

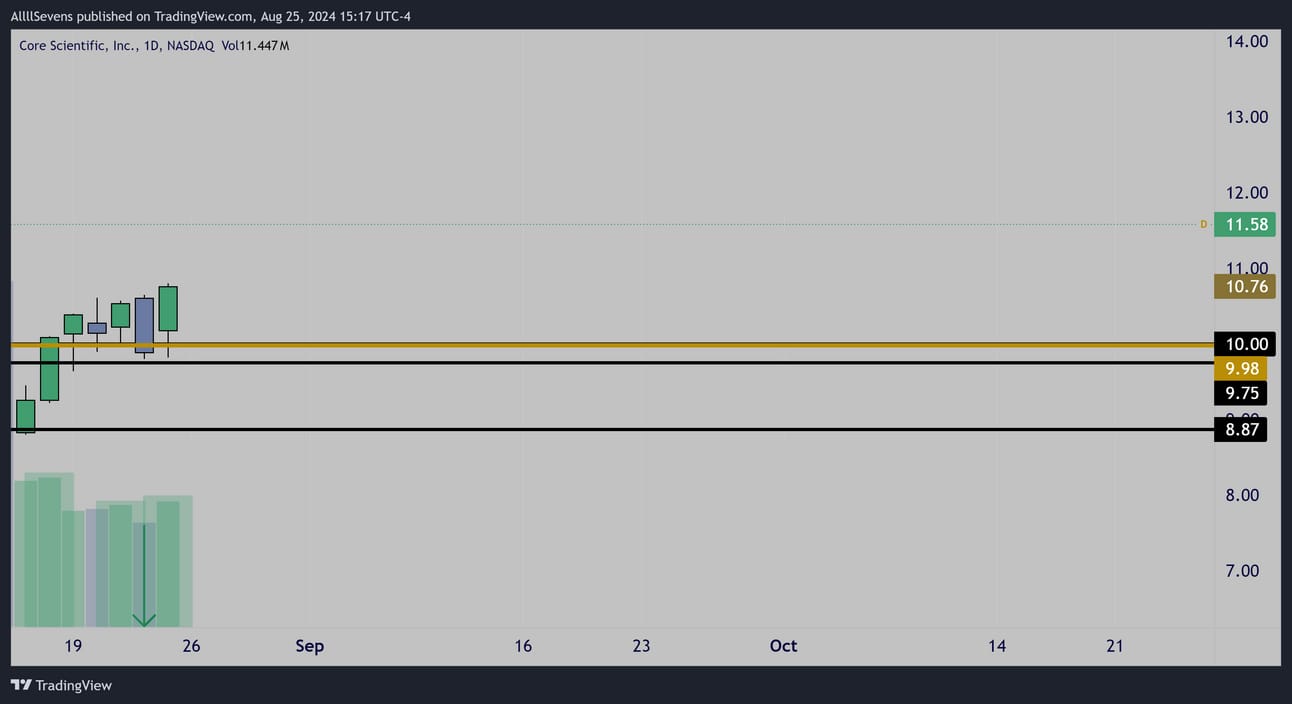

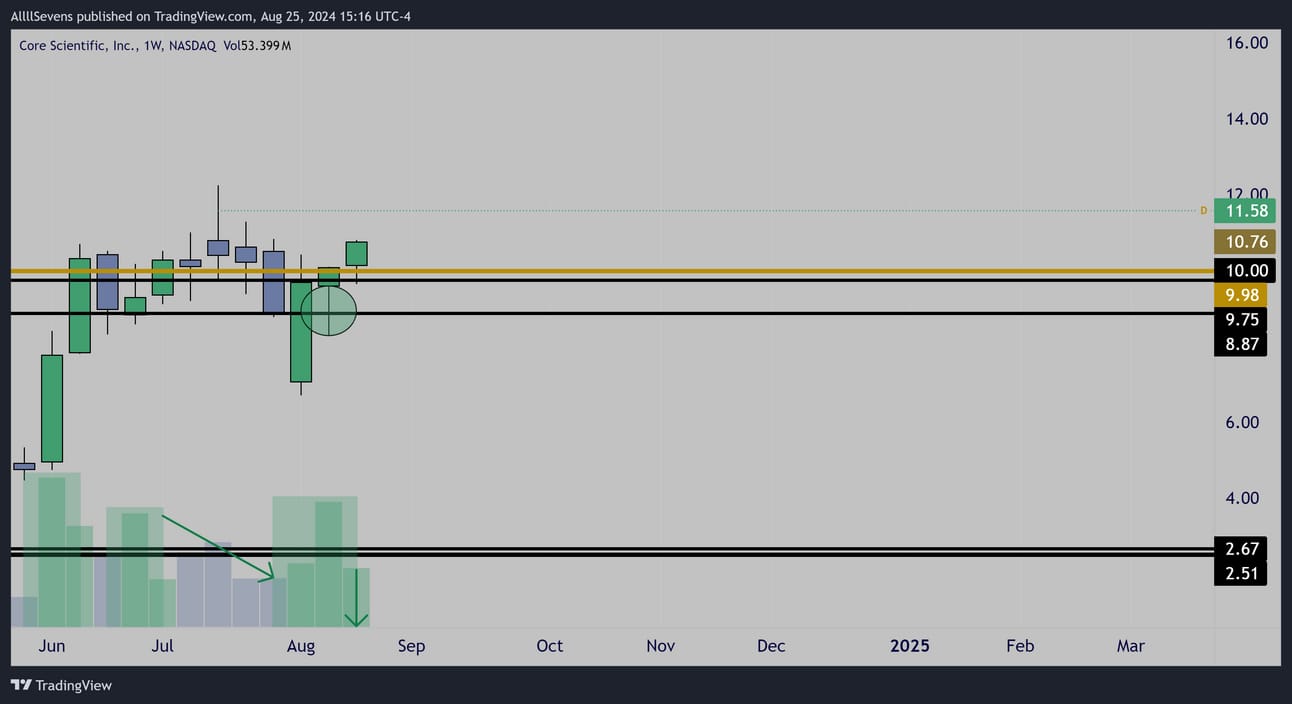

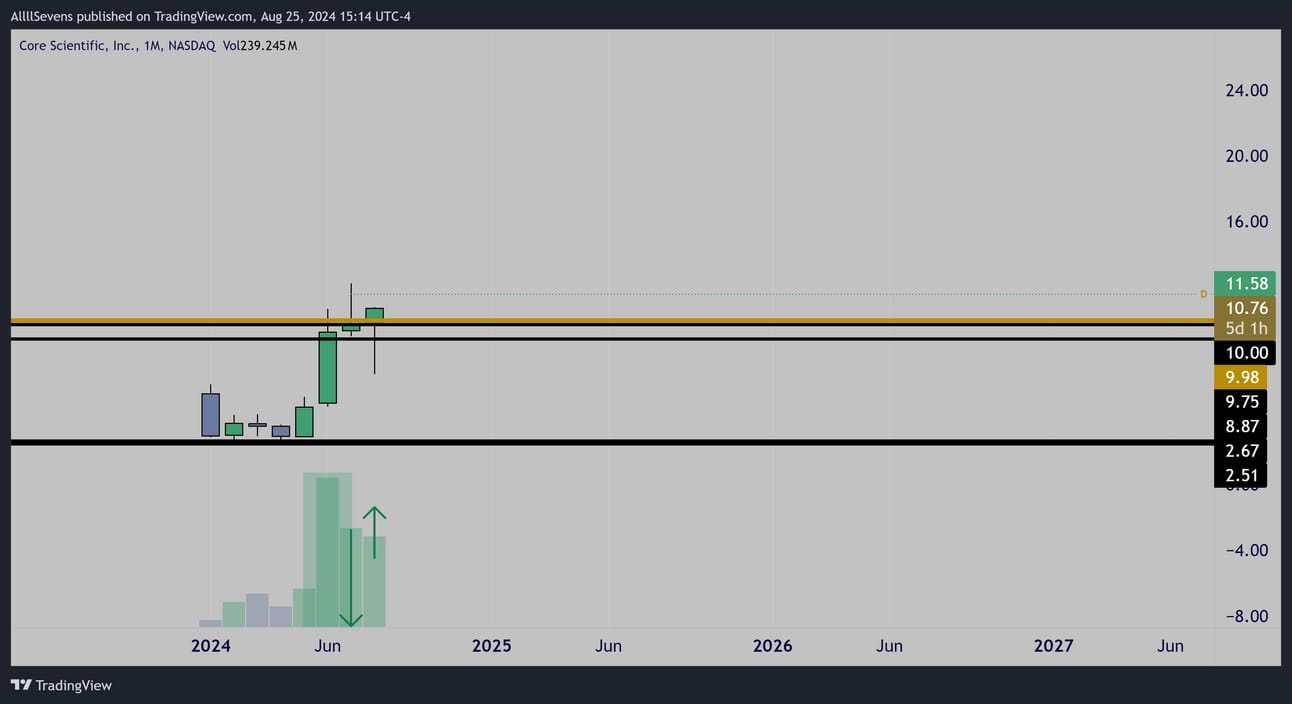

CORZ

Daily Interval

Bullish volumes off largest DP on record @ $9.98

Weekly Interval

About ten weeks of volume + price compression here.

Last week, price formed a narrow spread “resting candle” over support following a high volume hammer right off our primary DP level.

This favors continuation of the high volume.

I don’t want to see price lose $9.75 for this to play out.

Monthly Interval

This month’s candle is about to have increasing volume and is attempting to engulf July’s candle.

Similar to THIS week’s formation, price has been consolidating on decreased volume over support after a large bullish impulse on the monthly time frame as well.

Two time frames favoring upside continuation right now.

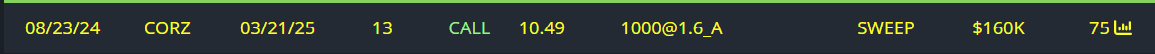

Notable Options Flow

$160K Call Buyer for March 2025

$500K Insider Buy

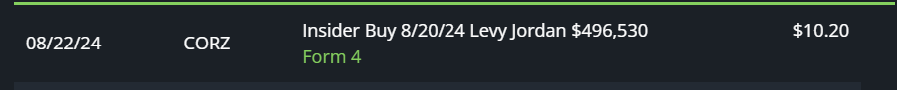

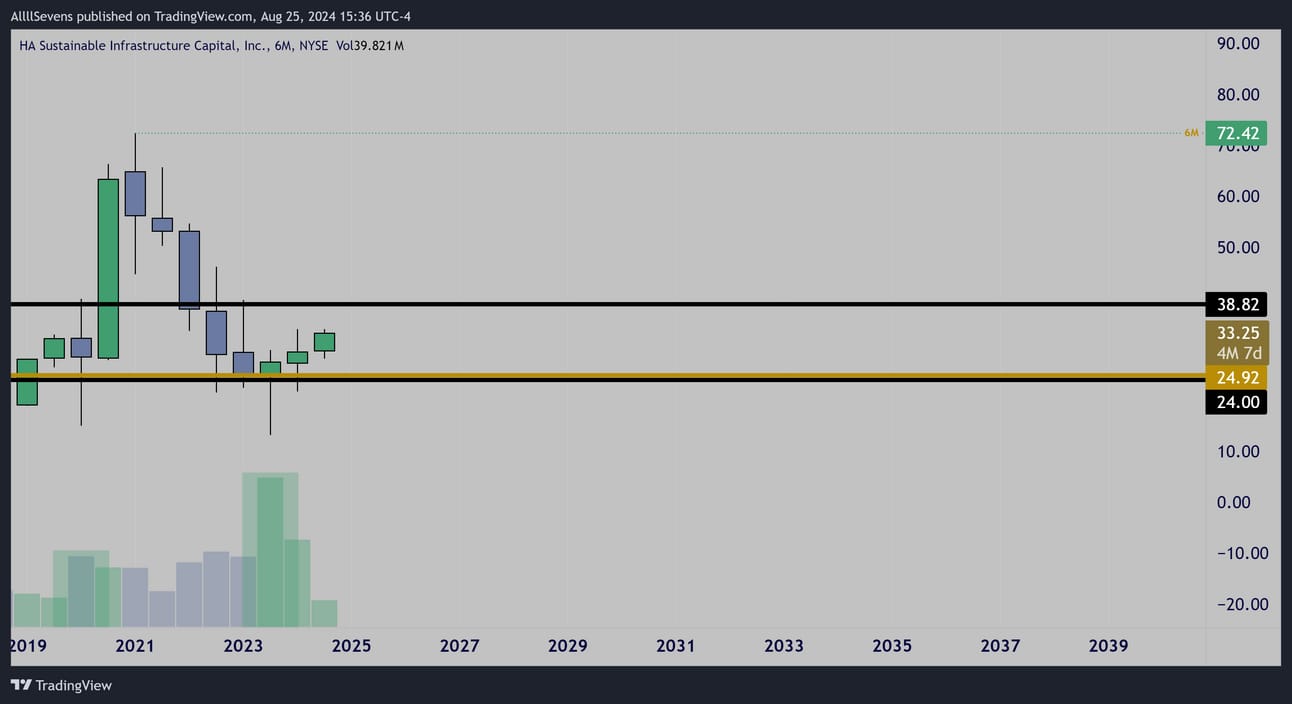

HASI

Monthly Interval

Bull-flag formation over $30 cluster of DP’s

$31.45-$32.15 is the level to defend for this to work.

6 Month Interval

This monthly pattern is coming off a 6 month hammer on the stock’s highest volume ever.

Yearly Interval

Same story on the yearly.

This demand lead to the massive 2020 rally.

Price just swept the low of the previous accumulated candle an formed a massive “spinning bottom” / hammer reversal candle formation.

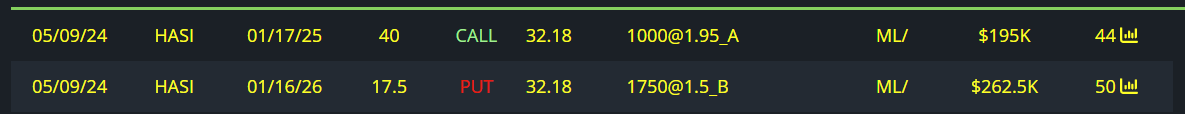

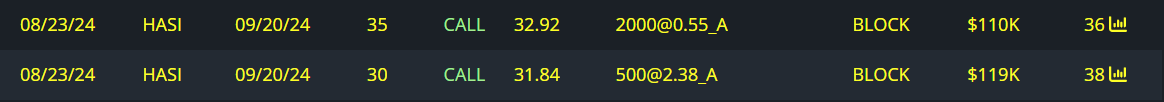

Unusual Options Flow

$195K Call Buyer for January 2025

$260K Put Writer for January 2026

$229K Call Buyer for September

SCHW

Daily Interval

Clearly some accumulation taking place here.

I love Friday’s low volume “resting candle” over the $64.43 dark pool after a very high volume recovery from the gap down Thursday.

If this level ca hold, this bull-flag can break to the upside.

If $64.43 fails, risk needs managed asap.

This isn’t a very lengthy period compression, and I find a lot more success with longer consolidations than this. Need to pop fast or could get caught in further pullback or sideways accumulation.

Weekly Interval

This dark pool was the previous accumulation level for the last rally.

On the massive daily hammer that formed here after ER, it would make sense for buyers to capture control of short-term trend again.

Yearly Interval

Weekly Interval

$SCHW yearly is insanely interesting…

Upon breaking and retesting prior ATH’s in 2023, the largest volume EVER came in as clear accumulation, easier seen on the Weekly.

I believe a very bullish long-term trend could be developing here.

Side note-

$MS is in a very similar situation.

It’s very likely you’ll see me write about that stock at some point as well.

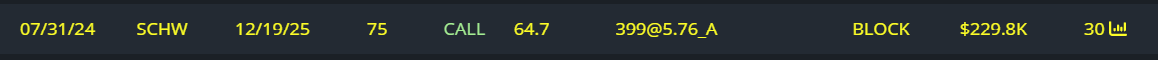

Unusual Options Flow

$240K Call Buyer for March

$230K Call buyer for December 2025

THANK YOU if you have gotten this far, and read my entire newsletter.

It was terribly difficult picking this week’s 7 stocks-

There is so much opportunity out there right now.

There will be many “spotlight” newsletters dedicated to specific stocks, ETF’s, or sectors incoming, likely THIS week, so make sure you are signed up for future emails.

Sign up here.

Follow me on 𝕏/Twitter @SevenParr

It takes me hours and hours to collect this data and form coherent thesis’s on these stocks.

If you find value in my work, please consider upgrading your subscription to AllllSevens+ for just $7.77 per month.

Click here to upgrade.

I will occasionally send a premium newsletter & you will also get access to my Discord where I gather and collect my data throughout the week.

Sneak peaks to newsletters ;)

And honestly, sometimes I simply never get around to writing a full fledge newsletter and only Discord members see the data.

I also take chart requests at any time in my Discord.

Overall though, premium is just a way to show your support.

It’s cheap for a reason. Most of the value I provide is for free.

This is just a way to give back!

So, if you think my work is worth $7.77, make sure to upgrade.

I thank you in advance.

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply