- AllllSevens

- Posts

- Weekly Outlook 1/29/24

Weekly Outlook 1/29/24

SPY & QQQ Headed Into FOMC & Big Tech Earnings!

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

Hey everyone! We have a big week ahead, let’s dive into it!

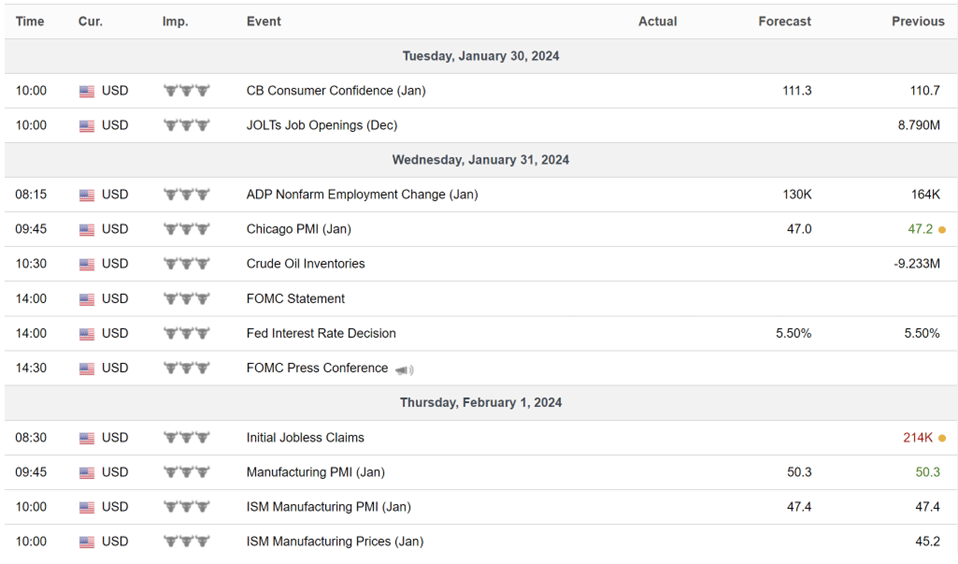

This Wednesday at 2:00pm (E.T.) and again at 2:30pm, the market will see a large influx of volume and volatility as the Federal Open Market Committee (FOMC) announces further direction of US monetary policy.

This will create a high risk and high reward price fluctuation across many stocks in the market, most notably the indices themselves.

SPY QQQ IWM DIA etc.

High Impact Economic Data

On top of extremely important economic data being released this week,

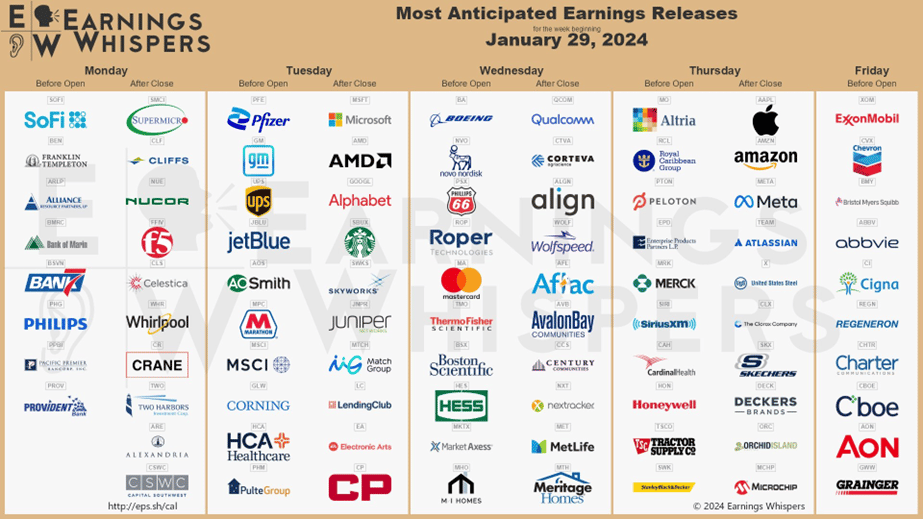

There are some MAJOR stocks reporting earnings.

By the end of this week, it’s likely that the market will give us good conviction for market sentiment and trend into the end of the quarter.

Is the recent breakout going to hold and continue?

Or is it going to be a giant head fake?

My outlook on the market heading into this week will be determined by implementing Volume Price Analysis at the largest Dark Pools on record for the index or stock in question.

The goal is to present the market through the lens of an institutional trader/investor. Pure data. No personal bias.

What are the big players positioned for?

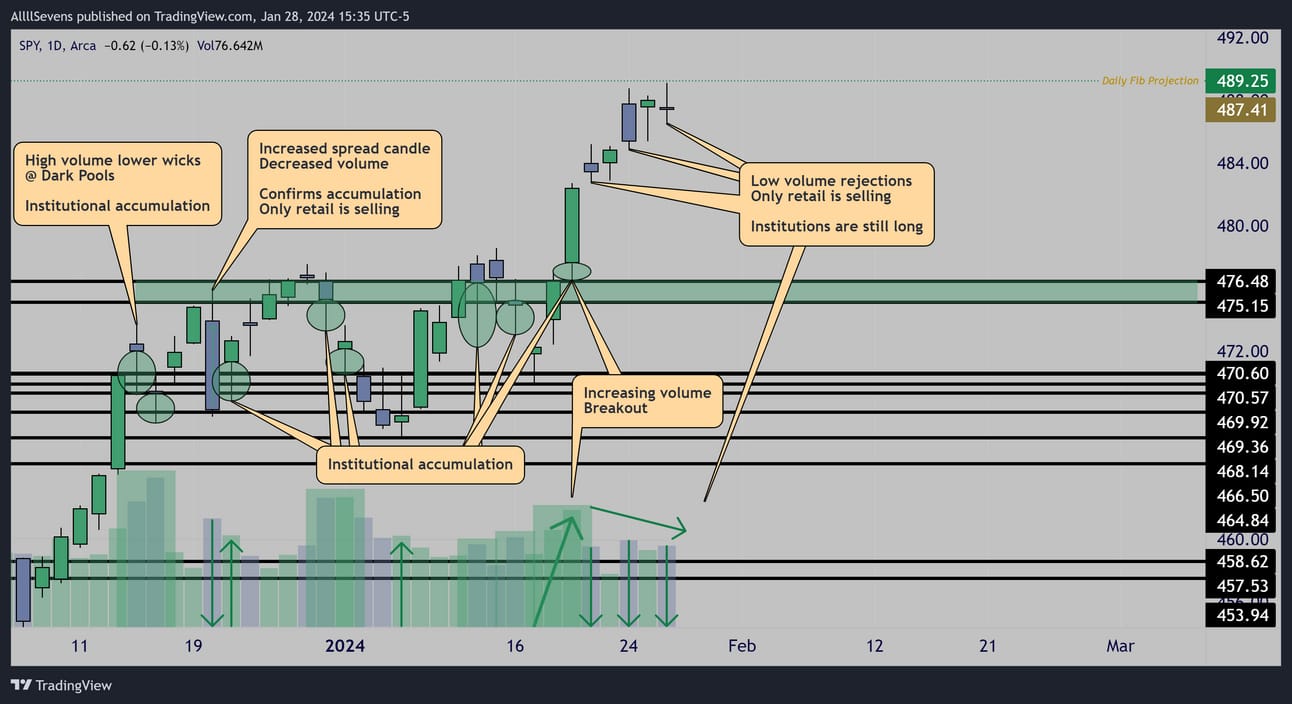

SPY

Short-Term Outlook:

Following a month-long period of institutional accumulation, price has finally broke out from resistance ($475.15-$476.48) and currently has a strong upwards trajectory until proven otherwise.

Looking at last week’s daily candles we can see that institutions are not yet selling out of their long positions accumulated below $476.40

At the same time, they’re not continuing to aggressively add long…

From their perspective, there’s nothing to do here but hold longs accumulated from below $476.48!

Now, I’m not going to just end the newsletter here, because I know some of us are much more focused on the lower time frames.

What is my plan as a short-term focused trader heading into this week?

First off, let’s gauge current market sentiment.

I notice each time price made a new ATH last week, a larger upper wick was formed on the Daily candle. This tells me that public participants (not institutions) are eager to de-risk headed into a very volatile and uncertain week of earnings and economic data.

I have three trade plans I’m looking at for this week:

#1-Trend holds.

1HR

I am VERY BULLISH over $487.51-.85

There are no signs of institutional selling on the daily chart, so if price maintains an uptrend this week, the retail profit takers we saw last week will be forced to participate. “Panic buy” if you will, after they just spent the week taking profits and continue to watch it rally into the events… This could create quite an aggressive and euphoric upside move.

#2- Trend breaks.

Given that there is a clear sense of retail sell-pressure in the market headed into this week, and no signs of strong institutional buyers yet-

A small breakdown in trend is very possible and if this happens, I do not want to be forcing longs UNTIL I see institutions begin to buy.

Between $485.30 and $487.51 there’s no direction.

My plan here is to trade breakdowns from support, not short highs, and not to predict a breakdown.

The way I approach this is from the perspective of a bullish trader…

When support gets tested, and I don’t see A+ volume and price pattern for a long entry, then I’m looking to trade the breakdown of this level to the next support.

I’ll keep doing this until I finally see institutional buyers step in.

#3- Dip Buy

If plan #2 plays out, leading to retail profit takers take control of trend, I want to be very very patient in timing a new buy. As I said, institutions are showing a major lack of interest on the daily chart up here.

For all I know, they’d let it fade all the way down to the breakout zone ($475.15-$476.48) before showing strong daily accumulation again.

These plans are slightly subjective and nuanced, so make sure you’re staying up-to-date with me on 𝕏 as well as joining my Discord if you’re interested.

Conclusion

If long from below $476.48, there’s no reason to be selling out yet, nor is there reason to put on a meaningful short position.

In fact, if $487.51-.85 acts as support, I will be anticipating rather aggressive upside continuation.

If not in a long from below $476.40, here’s my plan:

#1

Over $487.51-.85, I’m looking for continued upside.

Below this zone, I am seeing range-bound, choppy PA which does not interest me at all.

#2

If price tests the bottom of the range, $484.88-$485.30 and fails to see an A+ bullish reversal pattern on HIGH VOLUME then I will be looking to trade a breakdown to the next support.

I’ll watch for the same setup at the next support.

#3

If plan #2 plays out, I expect that eventually large buyers will step in.

I want to keep in mind that until clear buyers are visible on the daily chart, intraday accumulation patterns could begin a day or two early, so if I’m going to go long intraday, I need to be very meticulous and it needs to be on some extremely large volume that shows high potential to translate to the daily chart. I have to assume FOMC day would be the day for this to happen, IF it’s going to happen.

If plan #2 plays out, I will not be forcing a bullish bias-

I know that smart money is PATIENT and if retail wants to drop price all the way back to the Daily breakout zone, I’ll let them.

If I miss a mid-week reversal after price broke trend and faded down for a while, that’s fine because the real aggressive move will be over $487.51-.85 anyways.

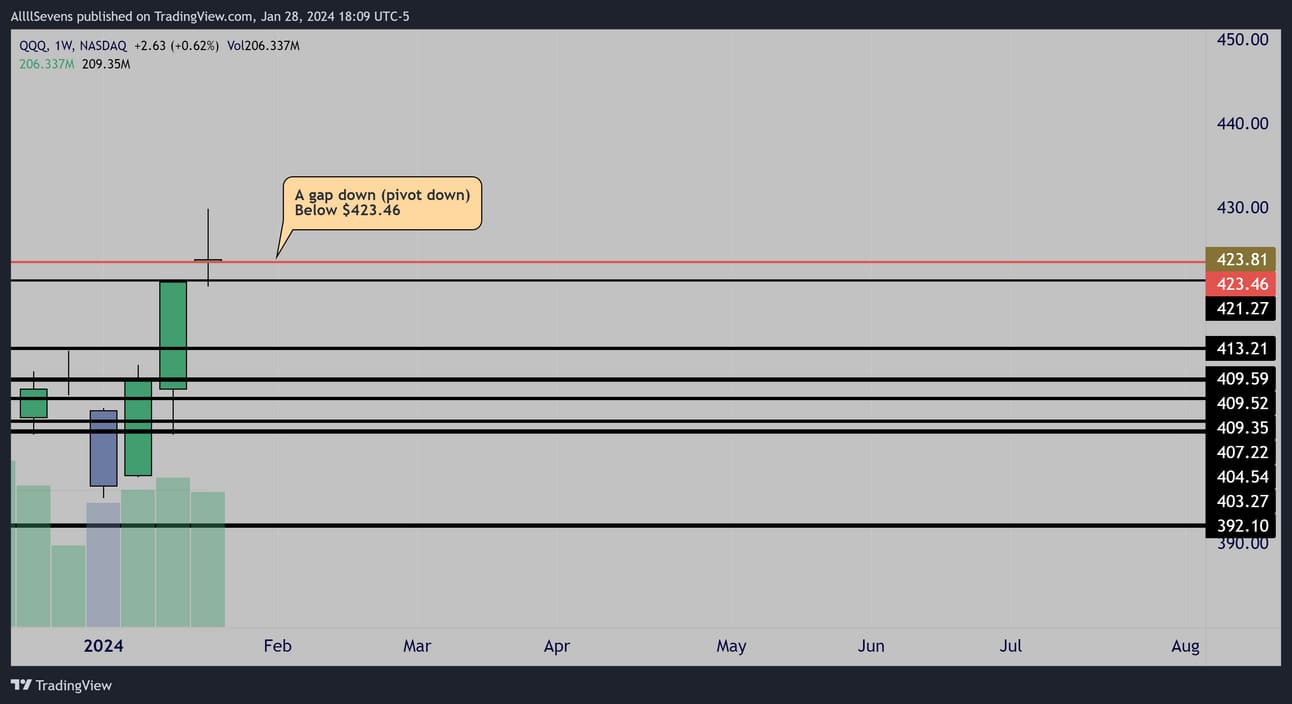

QQQ

I am focused on the QQQ for relative weakness if SPY trade plan #2 goes into effect. I have been mentioning since two weeks ago that I soon expect the SPY to show relative strength to the QQQ

If price pulls back this week, I believe the QQQ will pull back more.

Weekly

If price opens below $423.46 we could be looking at a very notable shift in short-term trend. This weakness is ONLY confirmed when/if SPY trade plan #2 is confirmed. A simple open below $423.46 is not enough.

Otherwise, this level could easily be reclaimed and the QQQ could continue to show it’s strength.

AllllSevens+

I’m very active in my Discord everyday, updating charts, sharing unusual options flow, and sometimes trading on live voice.

I’ll also be very active this week sending a newsletter each day discussing the notable earnings reports coming out.

Once all of this data is out of the way and the market has clear sentiment for where it wants to go the rest of the quarter, you can expect these newsletters to be fewer in-between and focused on one or two stocks at a time with immediate actionable setups.

These earnings newsletters are a great time to get a long-term institutional perspective on a stock as well as it’s current monthly and quarterly trend to determine where good buy levels might be.

I’ll also share any notable options flow headed into the events.

Tomorrow, a newsletter will be sent covering Tuesday’s earnings reports, $GM $PFE $UPS $JBLU $GLW $MSFT $AMD $GOOGL $SBUX $SWKS $JNPR $MTCH & $CP

Tuesday, a newsletter will be sent covering Wednesday’s earnings reports, $BA $MA $TMO $QCOM $CTVA $WOLF & $AVB

Wednesday, a newsletter will be sent covering Thursday’s earnings reports, $MO $PTON $EPD $SIRI $HON $TSCO $SWK $AAPL $AMZN $META $TEAM $CLX $ORC $MCHP

Thursday, a newsletter will be sent out covering Friday’s earnings reports, $XOM $CVX $BMY $CHTR

These newsletters take me hours to complete.

This is my full-time job.

All I ask for is $7.77!

Please, try it out and feel free to cancel at any time.

Upgrade here 👇

https://allllsevensnewsletter.beehiiv.com/upgrade

Reply