- AllllSevens

- Posts

- 2/26/25 Market Scan

2/26/25 Market Scan

Notable Options Flow + Dark Pool Analysis

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of February 26, 2025. I am not liable for any losses incurred by others.

Past performance is not indicative of future results.

Preface:

Make sure to read my broad market update if you have not already:

https://allllsevensnewsletter.beehiiv.com/p/weekly-newsletter-e749

Today’s newsletter is a something new.

I am seeing if I have the audience for a DAILY newsletter.

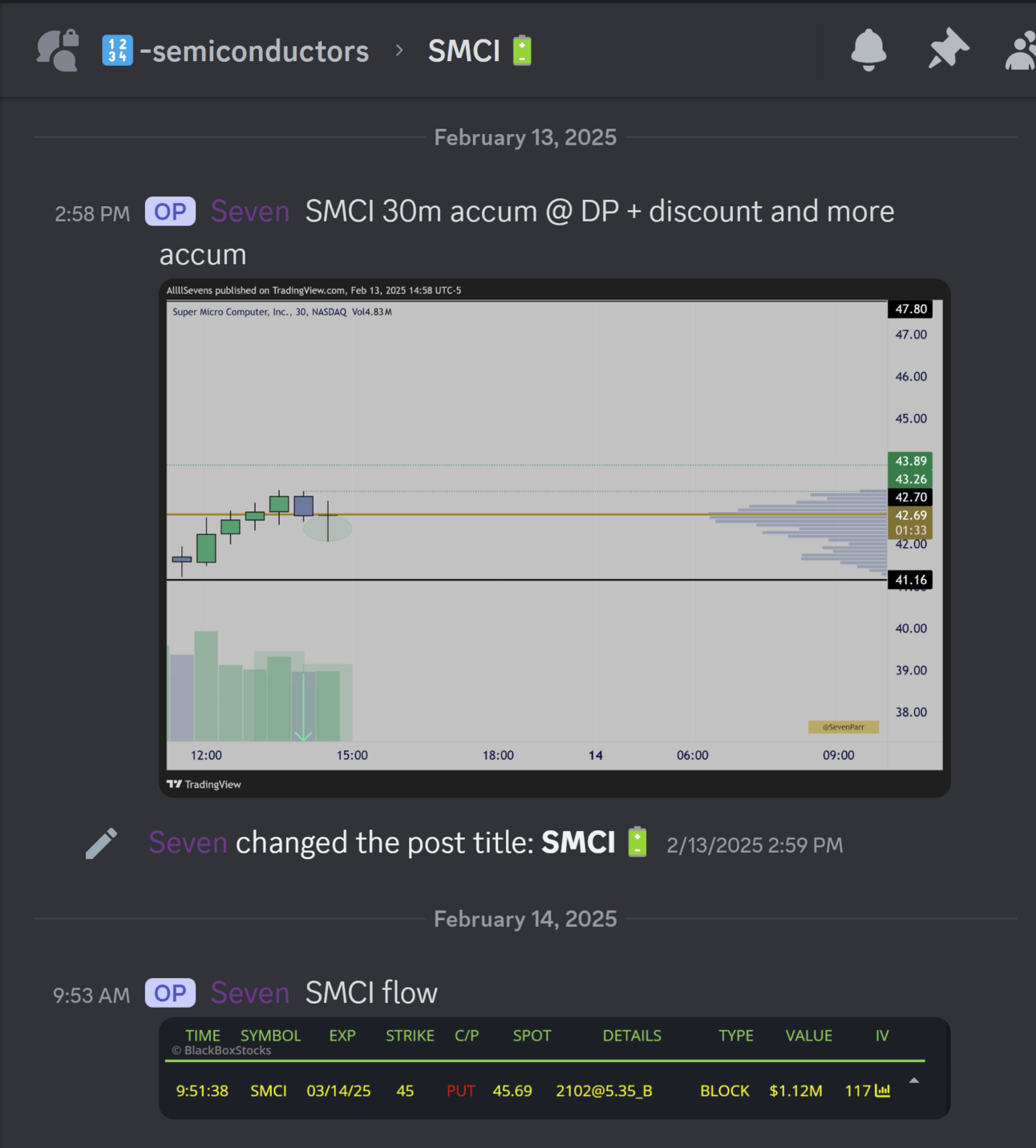

SMCI

SMCI Weekly

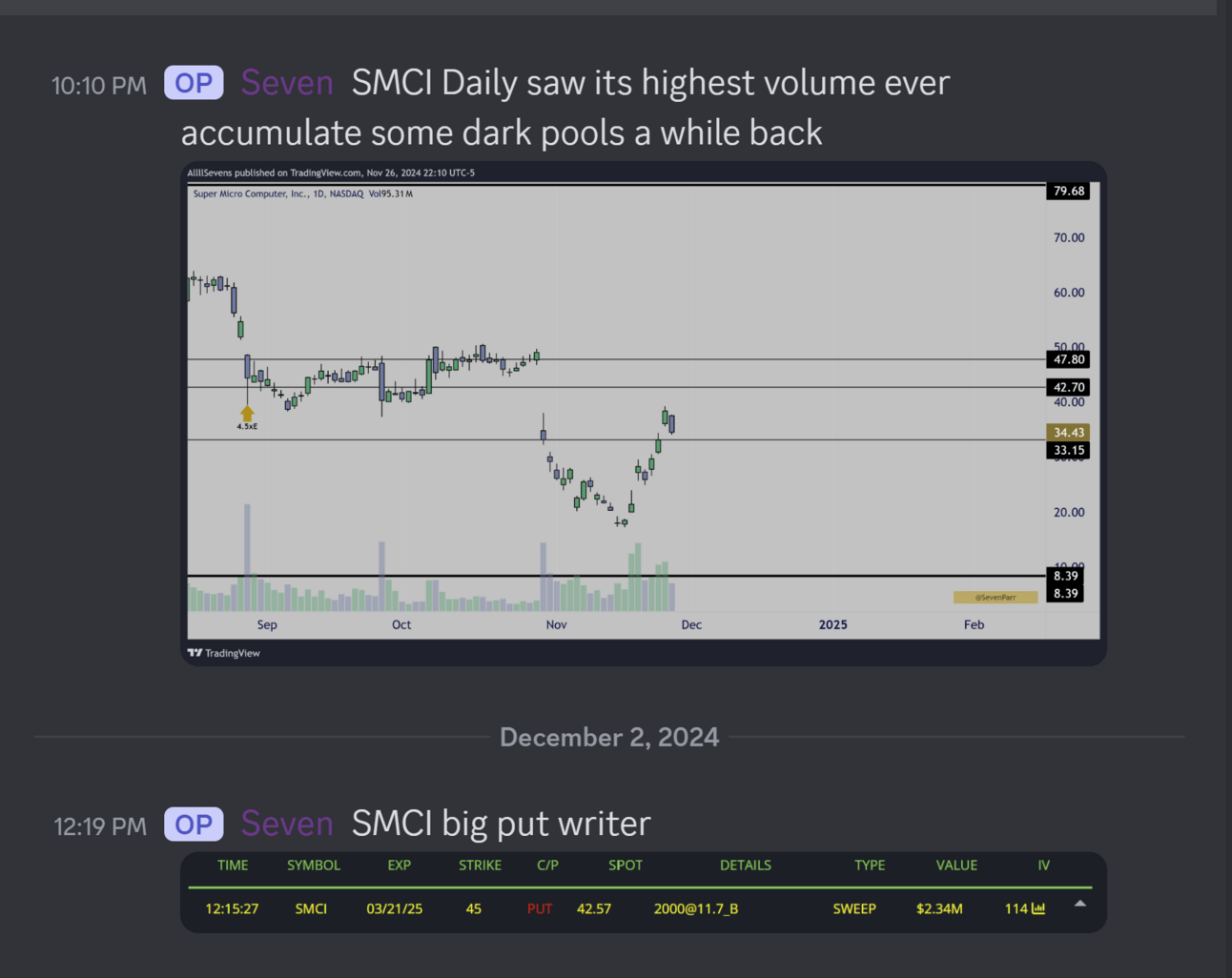

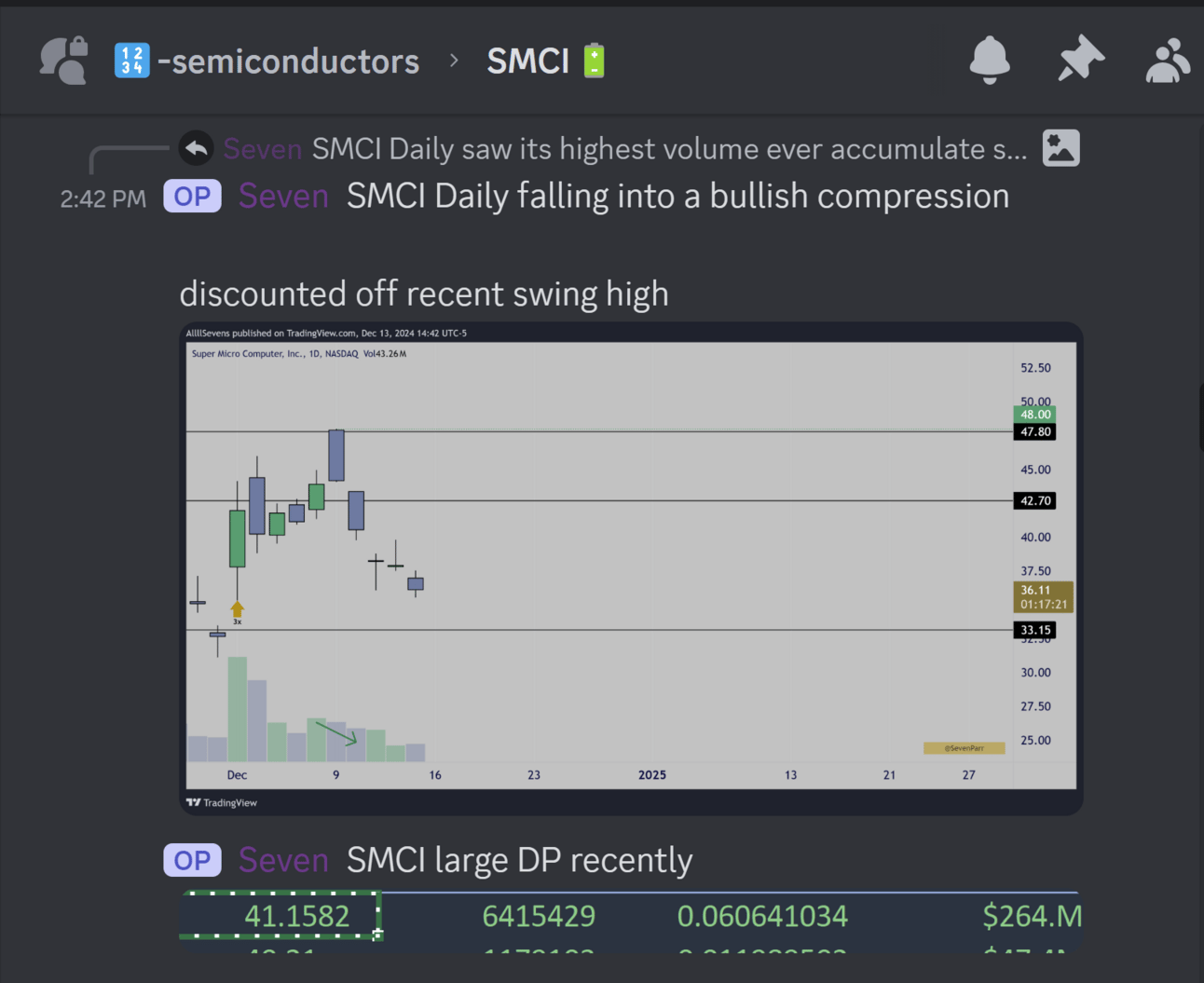

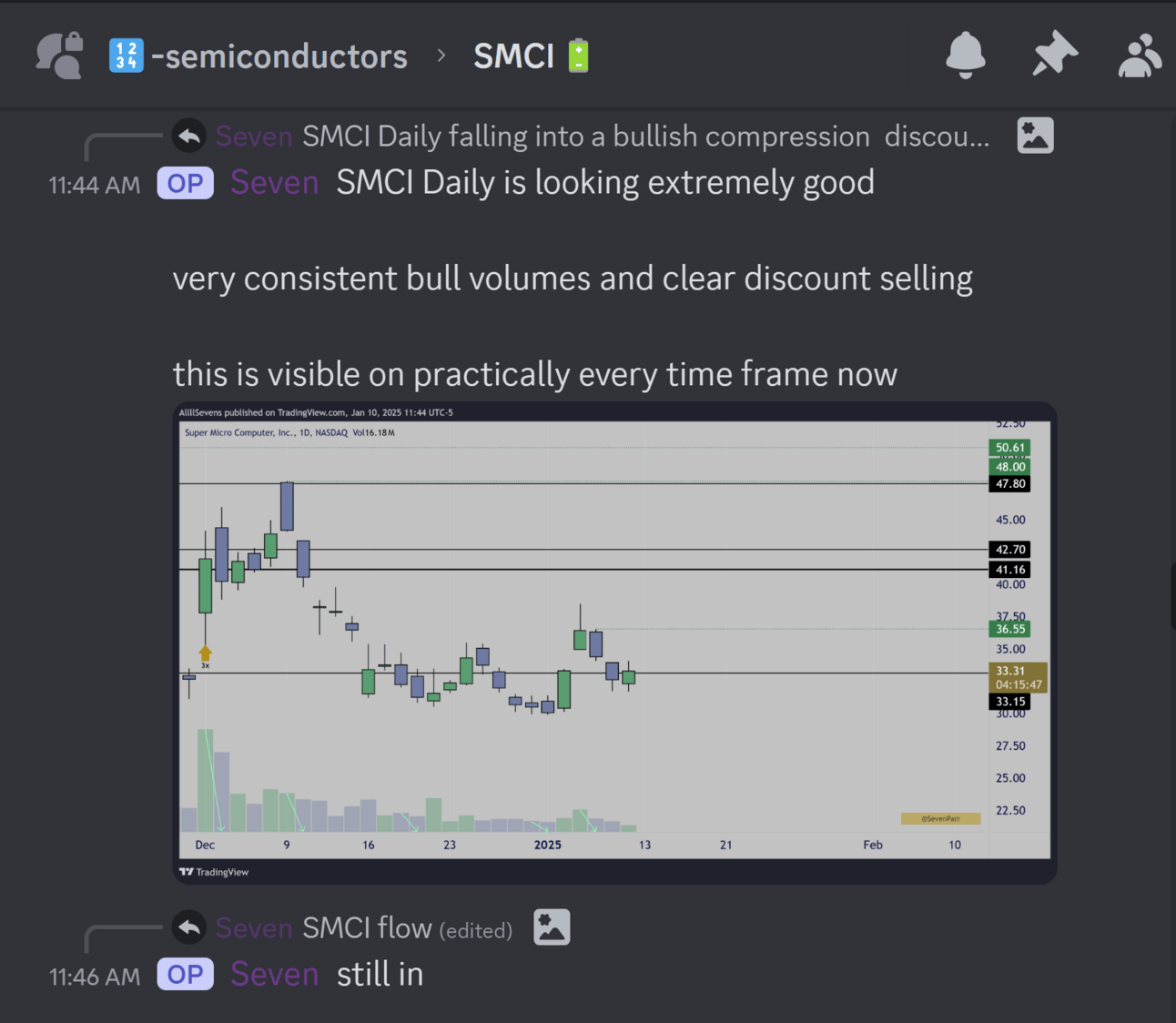

After pulling back on decreased volume over the last year, price is finally retesting it’s prior base that lead to a near 300% rally, and volume has began picking up again, showing signs of re-accumulation. Plus, a nice shake-out below support has occurred.

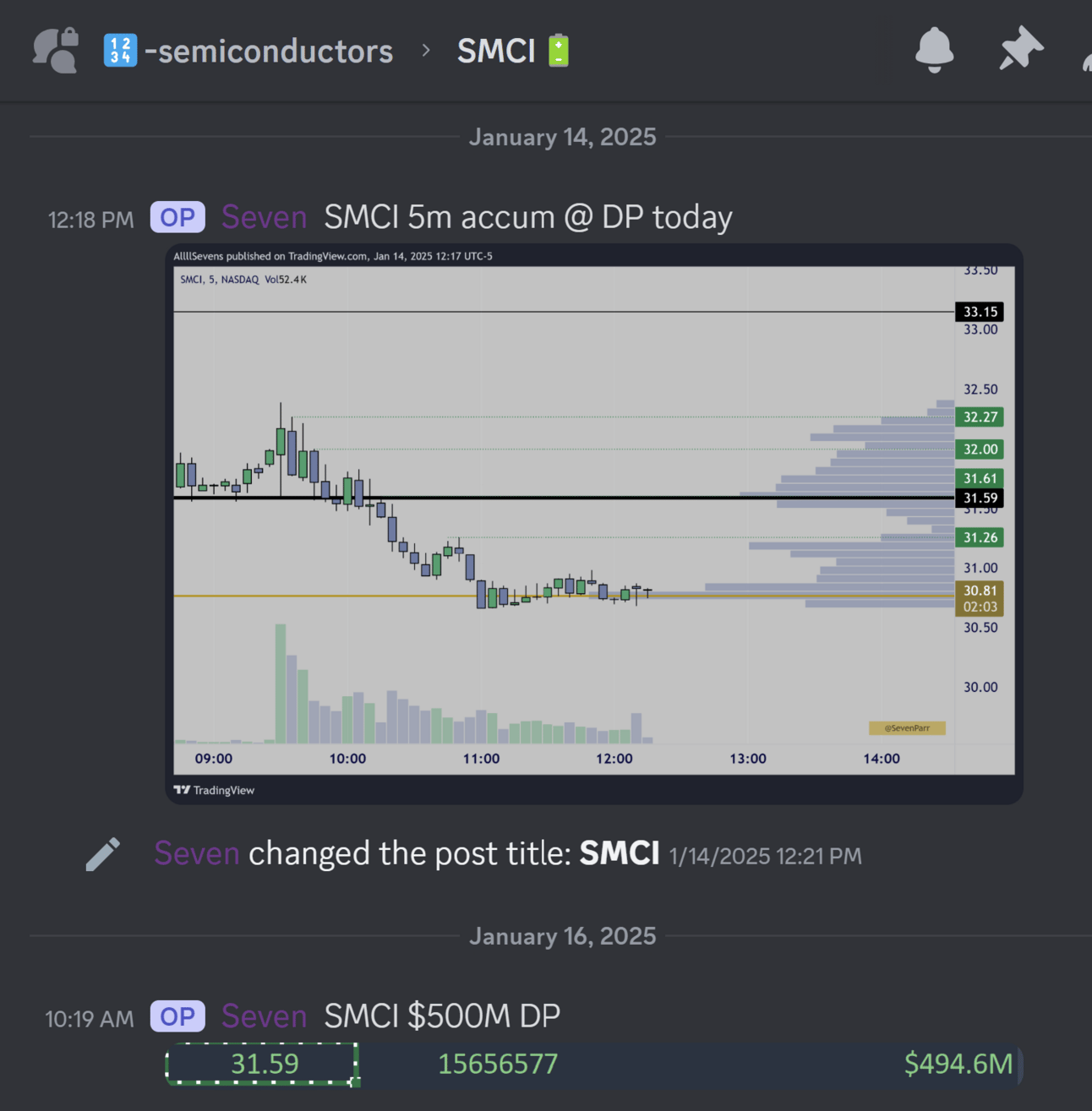

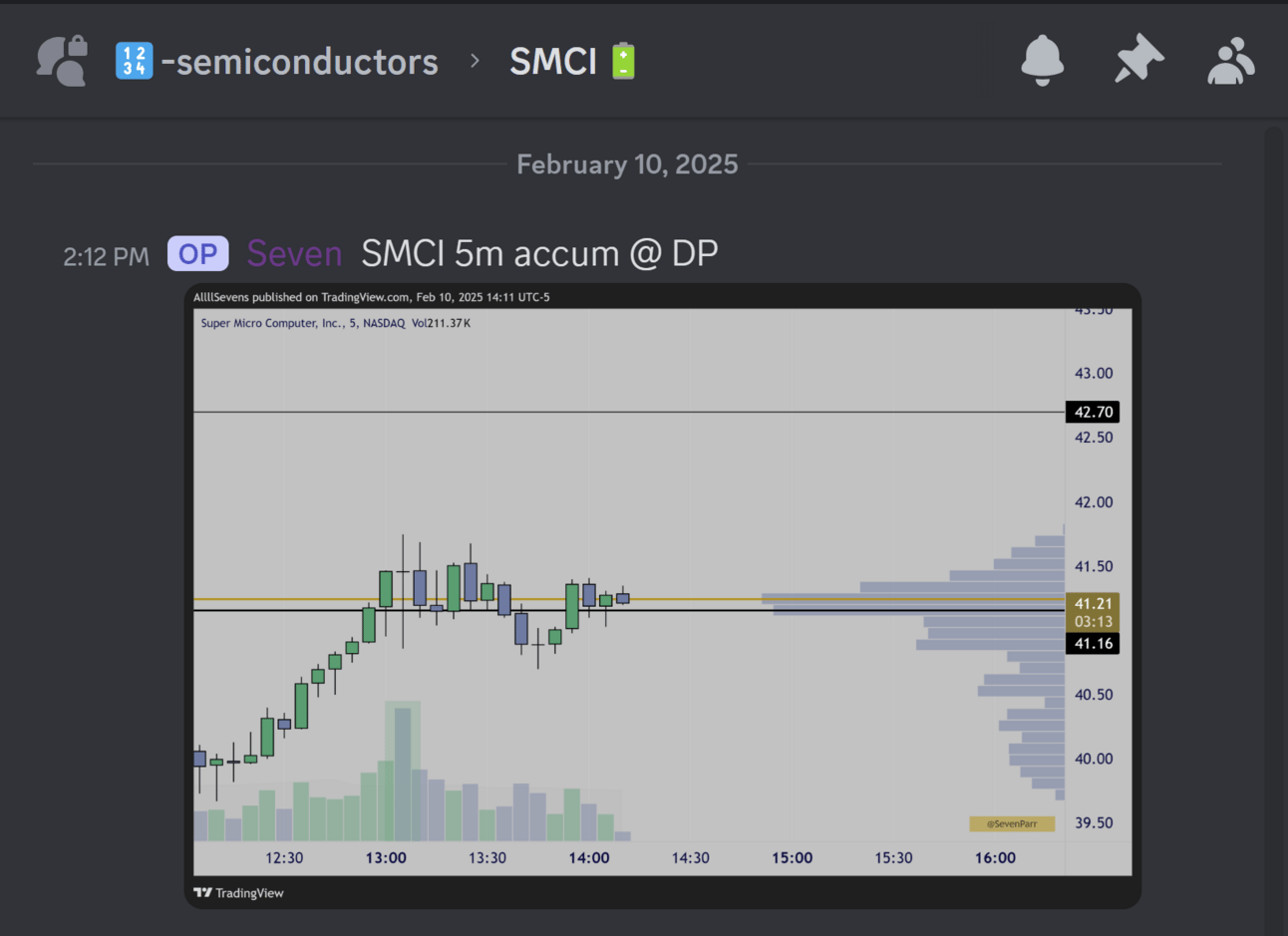

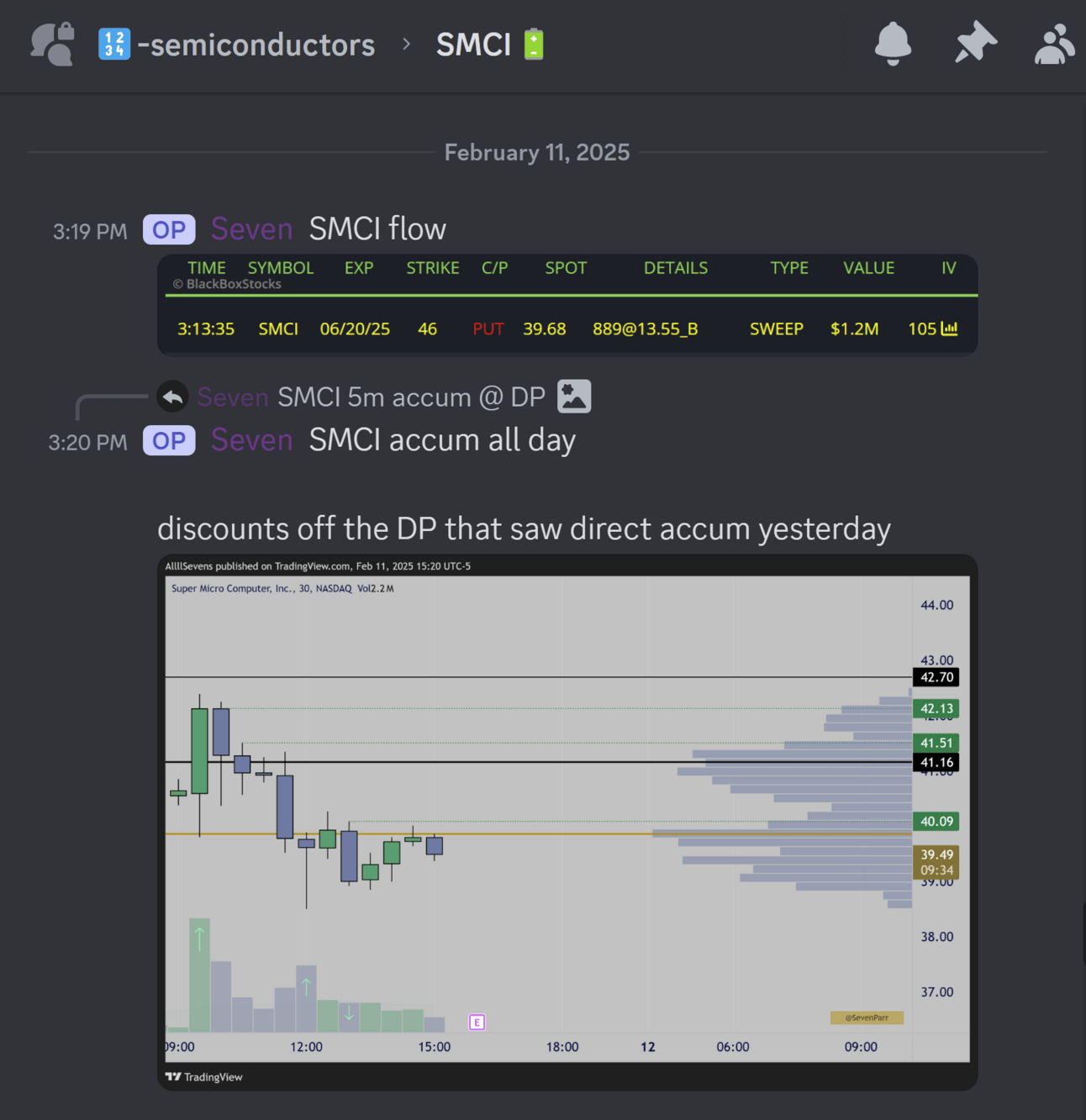

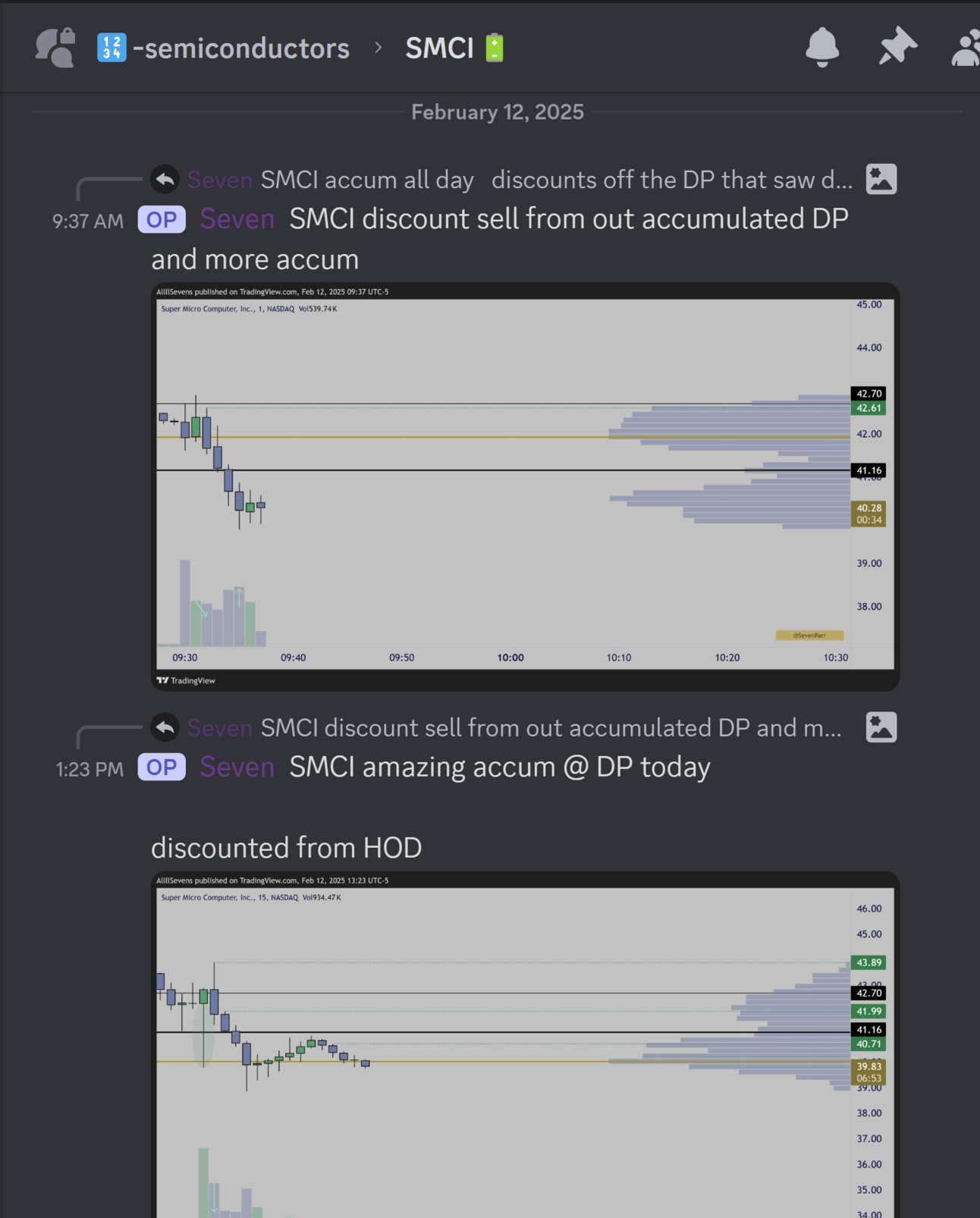

My entry long was after the shakeout when price rallied back up, then formed a discount selling off from the high $40’s back intot he $30 Dark Pool

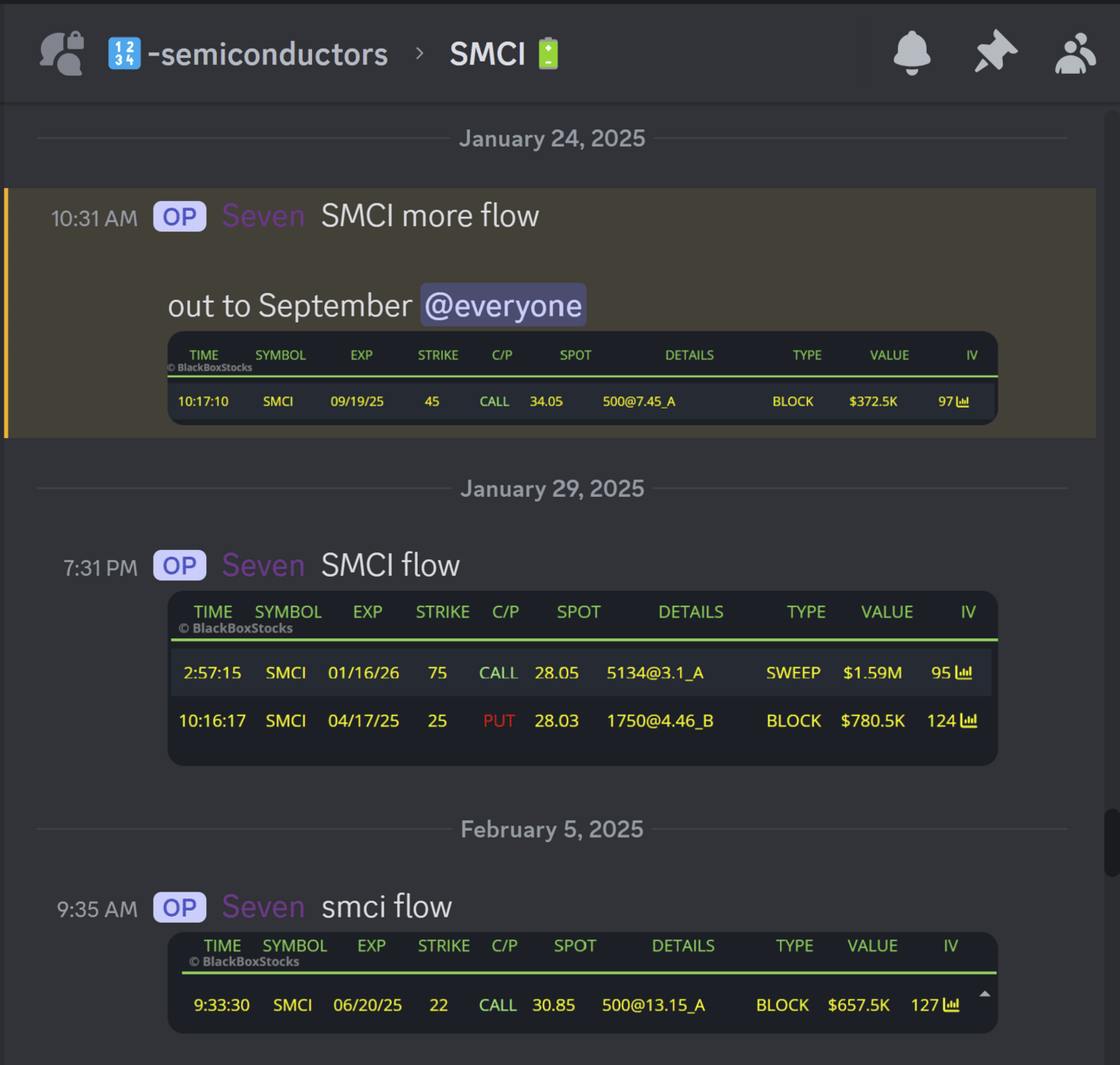

Bear with me a moment as I share what kind of data I was collecting in my Discord to convict me on this trade.

This is a great example of the type of research & data collection I do.

Please join my team if interested- It is just $7.77 / month : AllllSevens+

Hopefully this provides some insight as to the style of my Discord and the type of work I’m doing. Again, if you’re interested, sign up here.

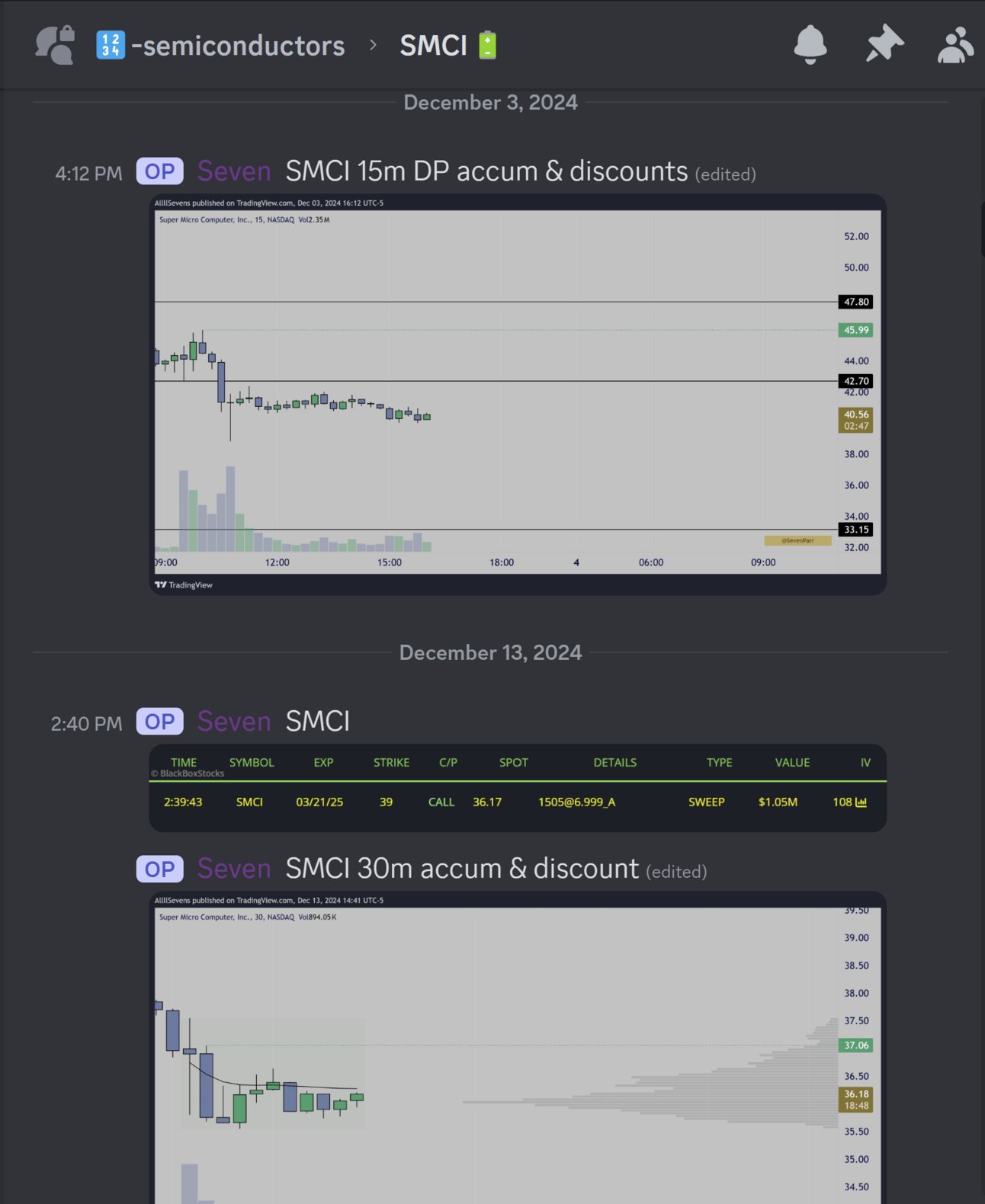

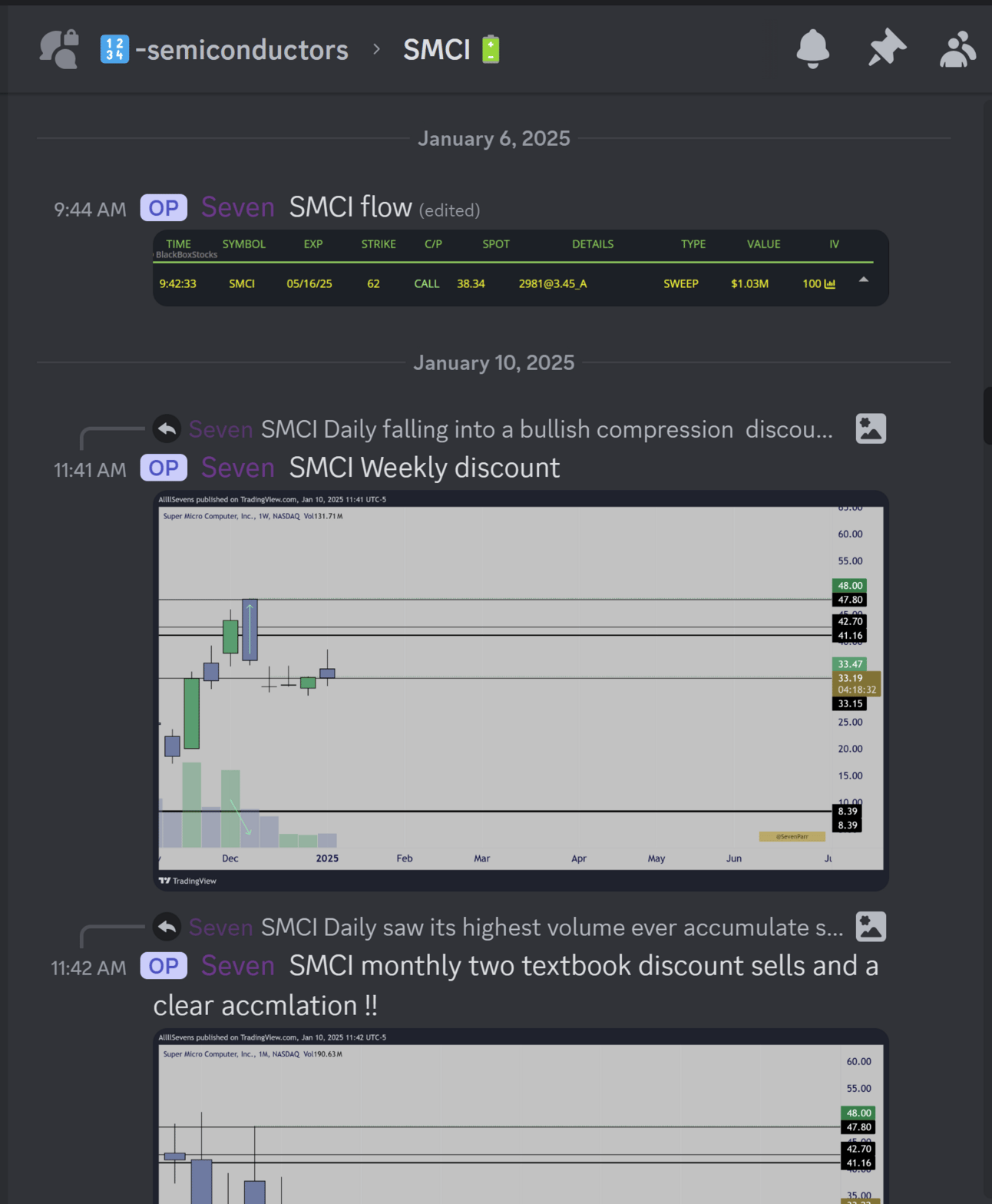

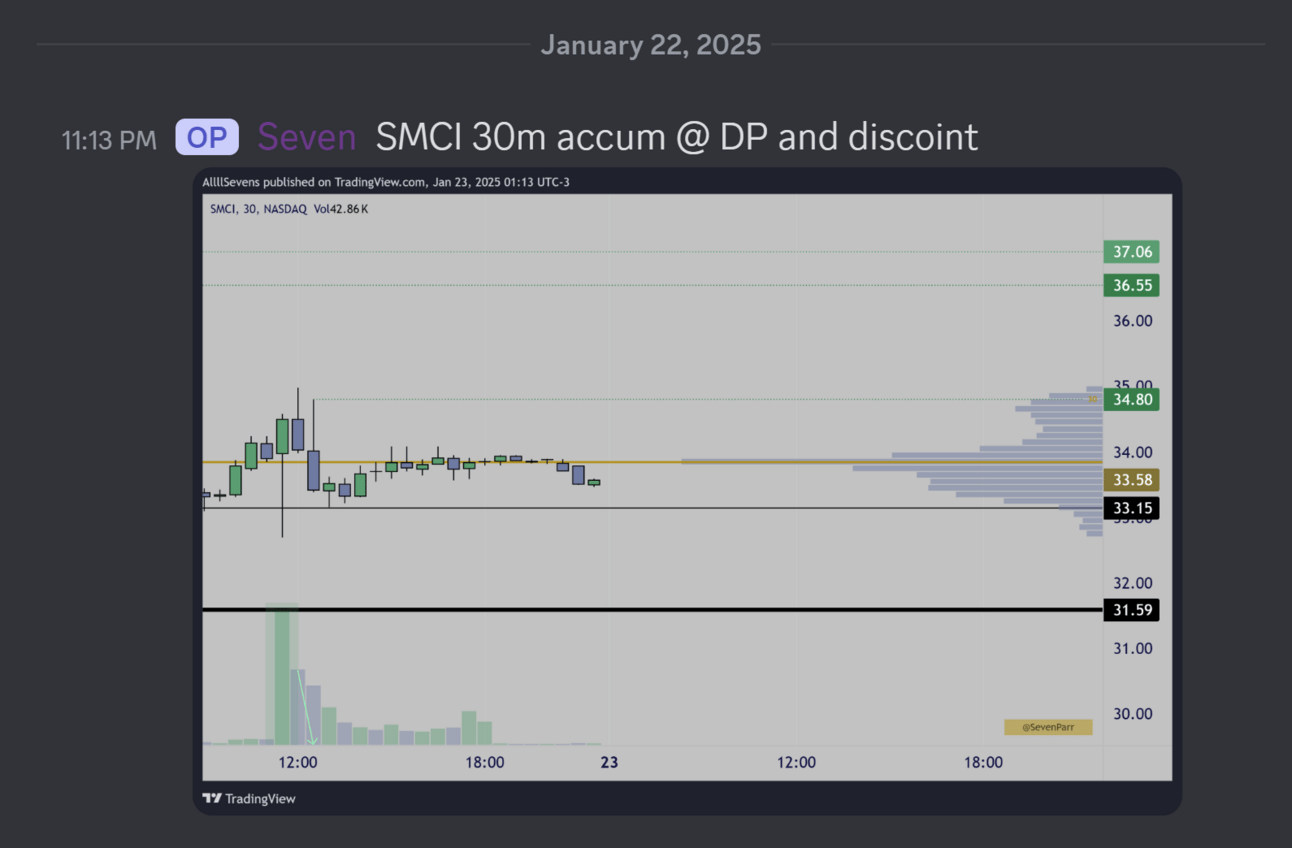

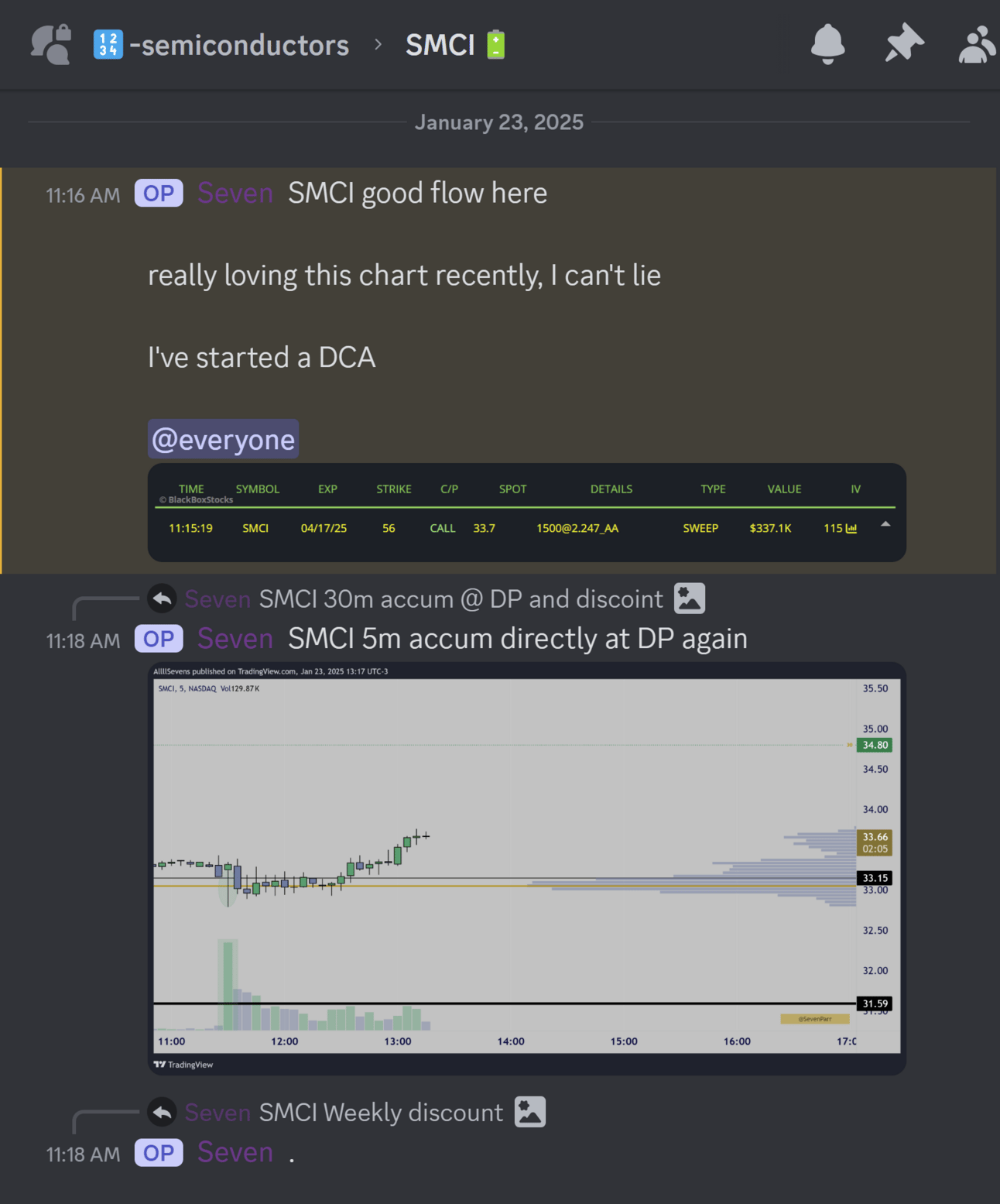

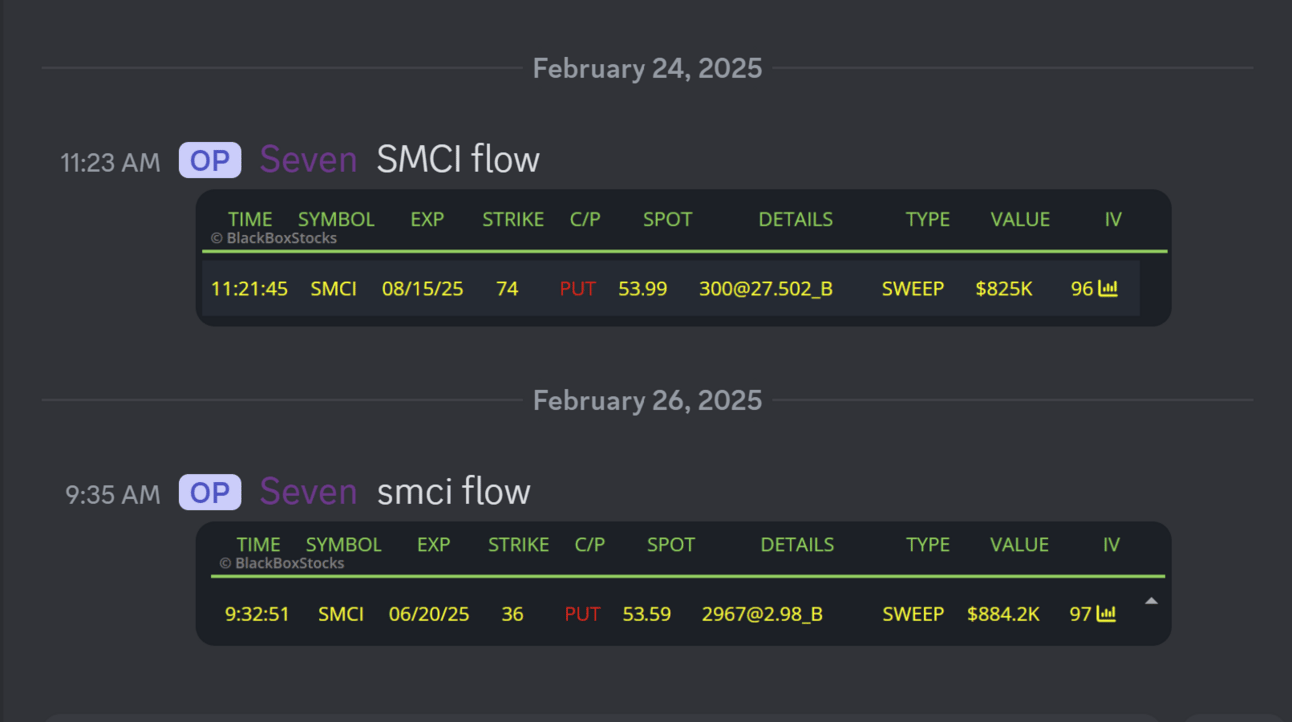

The reason I am writing about this today is I think there’s still a larger move brewing. The weekly chart shows some serious re-accumulation taking place and on the last few days of pullback from the mid $60’s flow has remained extremely as active as seen in the images above.

June-August put sellers.

Freakishly large April call buyer rolled up from 40’s to 57’s

Great size on 2027 59c’s

SMCI Daily

Discount created on Friday’s bearish engulfing candle which supports all the flow that has been coming in. I’d also like to do a double take on od ne piece of info shared in Discord that first got me interest in this stock:

SMCI Daily

These Dark Pools prices trying to turn into support and develop an uptrend over were accumulated the stocks highest volume EVER. Extremely significant.

Unfortunately, I can’t tell you I am adding more stock YET-

I am just laying out what I see. I am holding for now, looking for range into the $80’s and I want to add more if we can someone consolidate further over these accumulated Dark Pool and remain at a discount while doing so.

If I add more, I will notify that in Discord, likely not in a free newsletter or on X, just saying. Again, $7.77 to join here.

KVUE

Kenvue Inc. is a recent IPO, having been spun off from Johnson & Johnson

( $JNJ) in 2023 as a standalone consumer health company.

Kenvue sells brand names like Tylenol, Band-Aid, Listerine, and Neutrogena among many others. This stock is in the Consumer Staple Sector ( $XLP )

The company aims to transform from a cash-generative entity under $JNJ to one that also emphasizes growth, potentially through innovation and expanding its market share in categories like self-care, skin health/beauty, and other essential health products. I find this very compelling. It’s sounds to me like there’s growth potential relatable to a stock like $HIMS, but with the added security of already well established brand loyalty and revenues from other products.

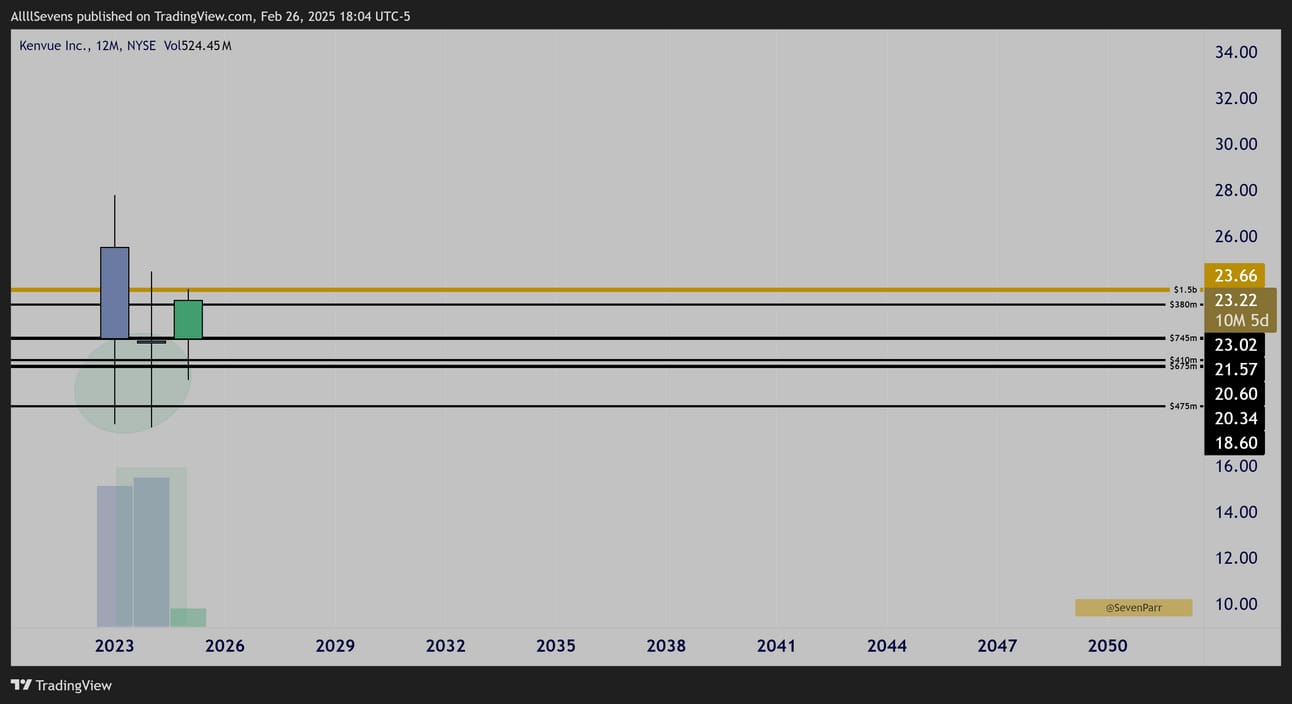

KVUE Yearly

Increased volume sweep of IPO lows forming a tweezer bottom into 2025

Notice how large the Dark Pools are on this stock.

There’s some serious money behind this company.

After all, it is a spin-off from $JNJ, one of the largest companies in the world.

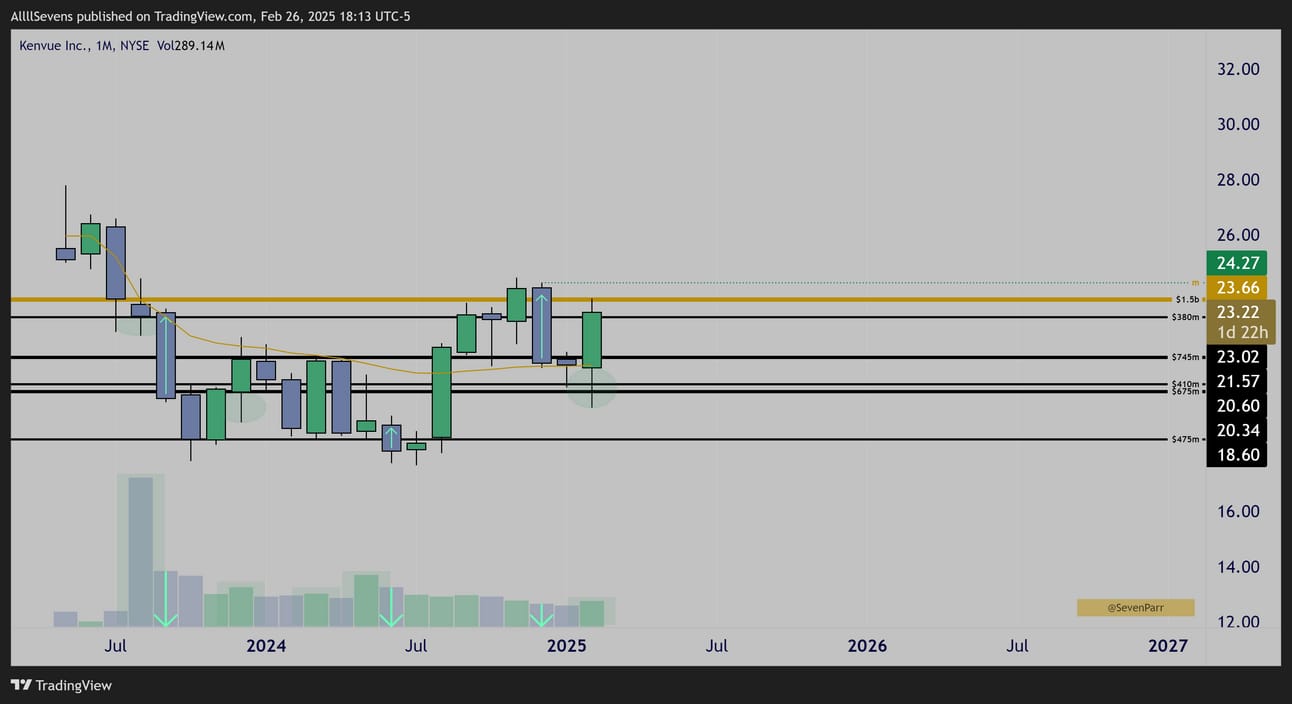

KVUE Monthly

Currently trading at a discount after Decembers sell-off.

This isn’t the first time a large discount has been created from this level.

Great to see considering $23.66 is the stocks largest DP on record.

Institutions are clearly NOT selling off this Dark Pool.

I like how price is trying to turn the ATH AVWAP into a bullish trend support.

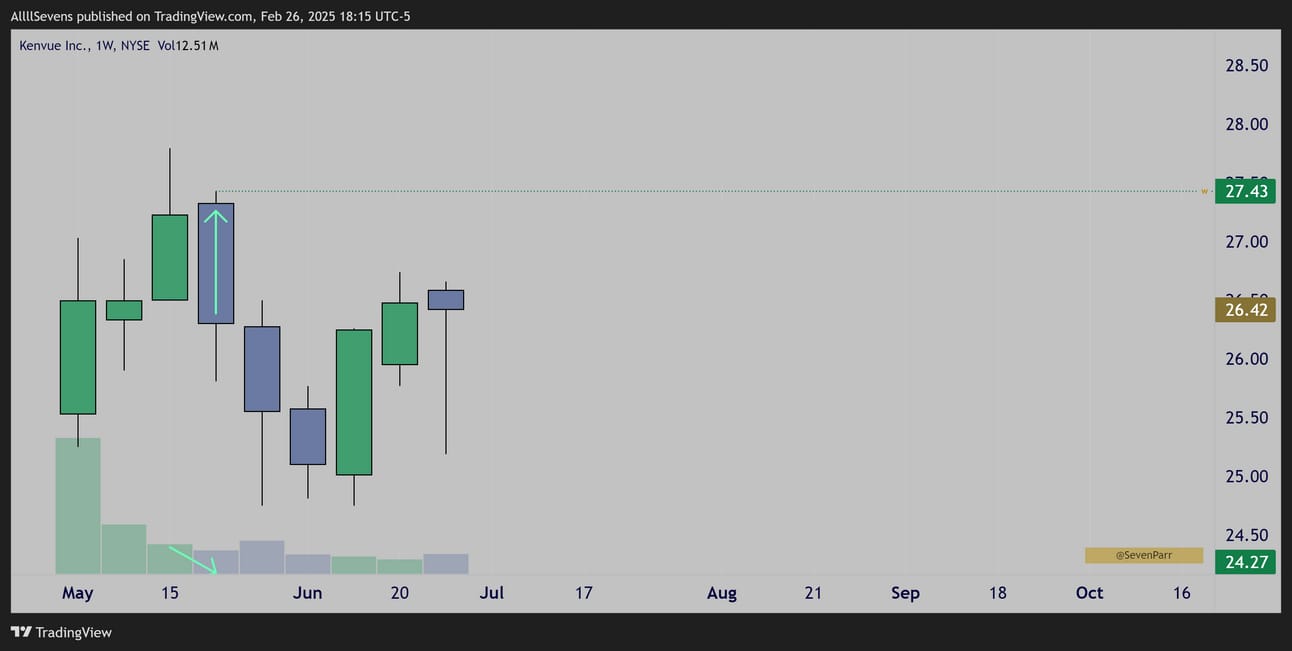

KVUE Weekly

Discount left behind in the upper $20’s from a few weeks after IPO

KVUE Weekly

Clear Dark Pool accumulations, specifically off this $380m $23.02 DP back in September.

KVUE

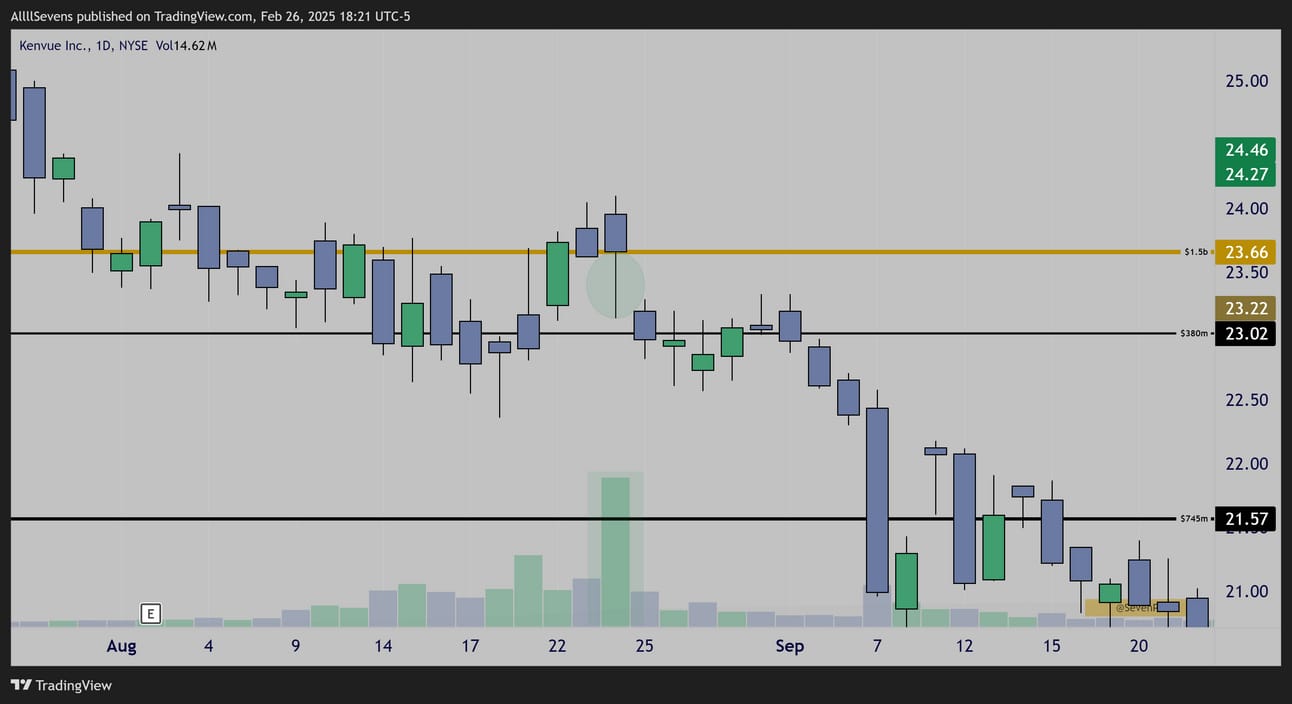

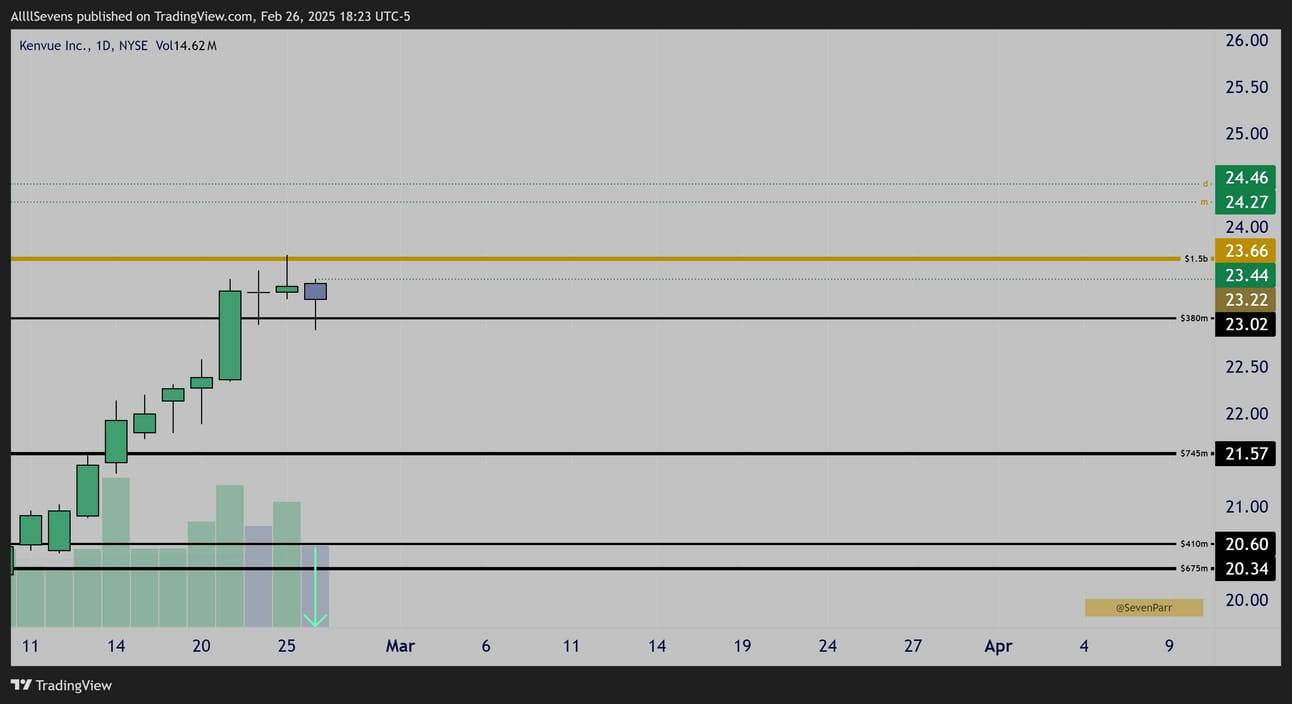

KVUE Daily

Daily

I can see very clearly how aggressive they have been accumulating these Dark Pools price is currently sitting at.

KVUE Daily

Today’s action actually created a discount.

I bring this chart to your attention today because of this…

$3M Buyer into September 25c’s

A wild short-term breakout bet. To me, it feels like a coinflip as to how soon this can actually breakout, but the YEARLY tweezer candle pattern IS amazing.

It’s only a matter of time before retail stops selling off these DP’s since institutions are clearly accumulating them. I’m personally just buying stock here.

No flow on this next stock, but it’s in the healthcare sector and KVUE reminded me of it, so I may as well share it with you.

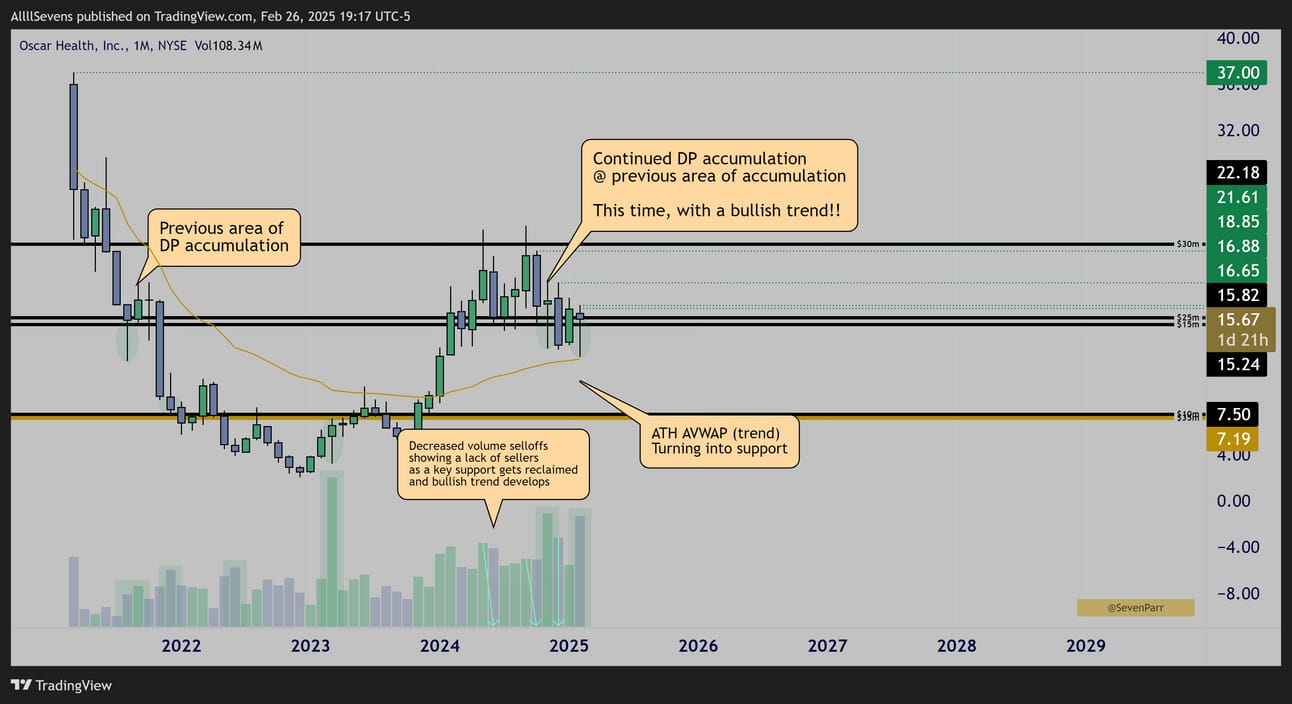

OSCR

OSCR Monthly

This is an absolutely beautiful chart.

Reclaiming an area of prior accumulation, seeing continued accumulation, two discount candles, and development of a bullish trend over ATH AVWAP.

I want to note how SMALL this stock is. Extremely high risk. Know this.

With that said, I am in love with this setup. Just not going to be a massive position for me, bc if I am right, gains will be huge. If wrong, stock has no support until $7 where it would be split in half from current prices.

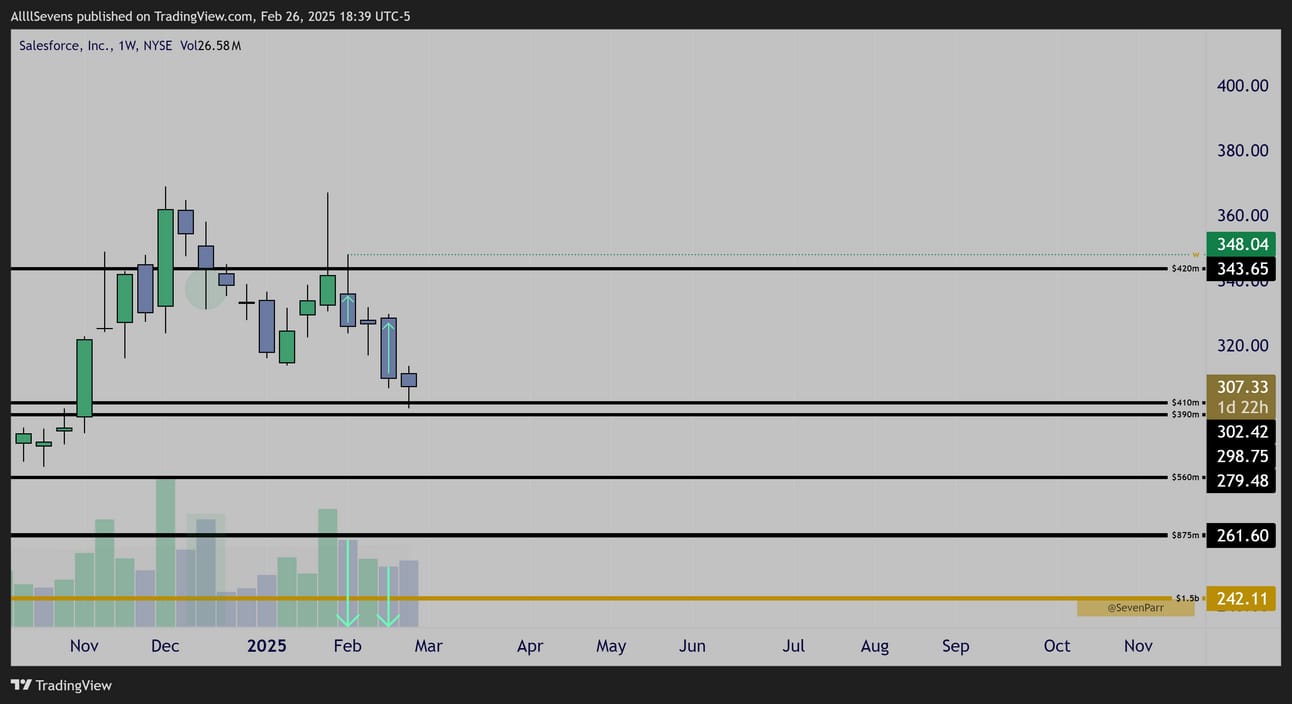

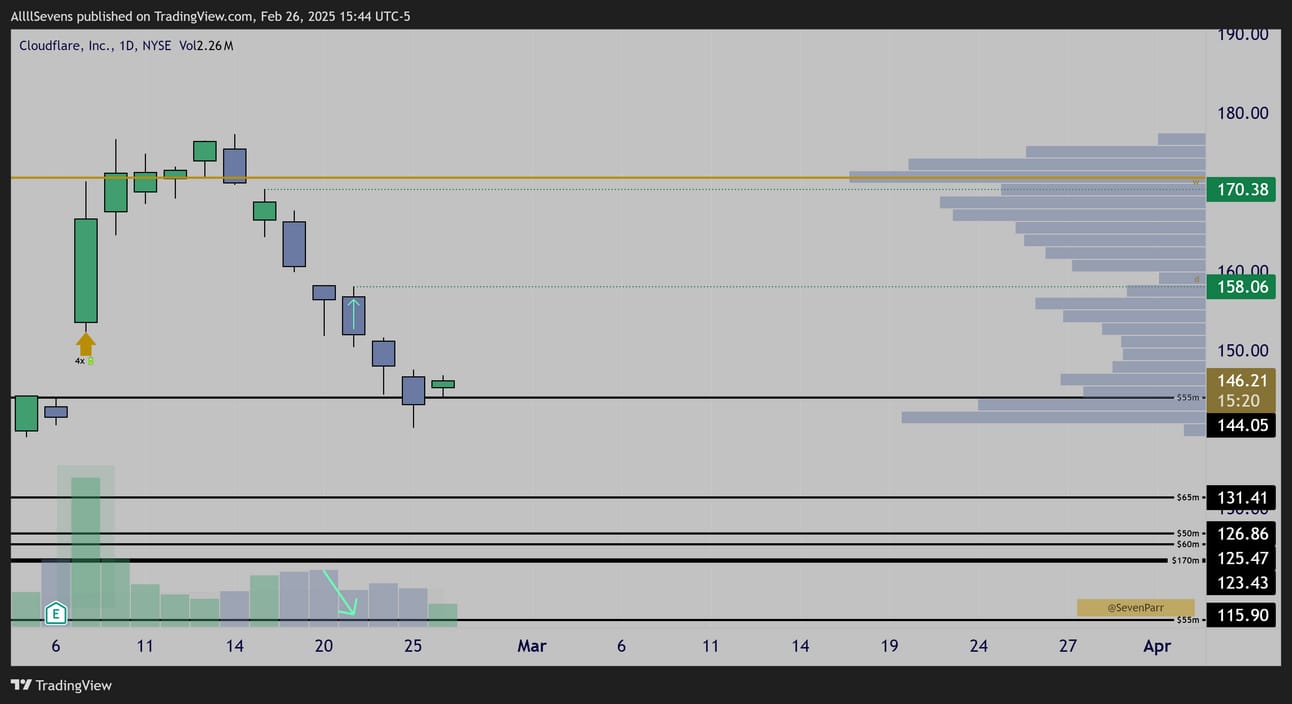

CRM

CRM Weekly

Dark Pool accumulation & discounts from $343.65, a $420m level.

$2M Call Buyer into June 2026

This is a recurring theme. I last wrote about CRM in August and there was an insane amount of leap calls active. It looks like they’re continuing to build their position. Check out that newsletter here. I give a much higher time frame outlook there.

The stock is trading lower this evening following ER, but I think the dip will get bought. I have already been accumulating this pullback since last ER.

On the topic of software stocks, I’d like to cover $IGV

Then, I will cover $NET, $SNOW, and $INTU

IGV

IGV Daily

I have been watching an absolutely INSANE Dark Pool accumulation sequence take place here for months now. FINALLY, a discount formed the other day and I have began buying the dip. That’s all. I have time here. I know what I see.

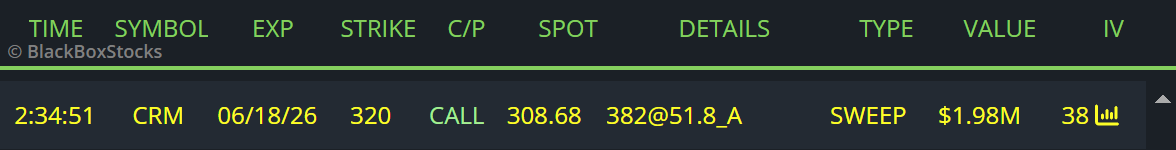

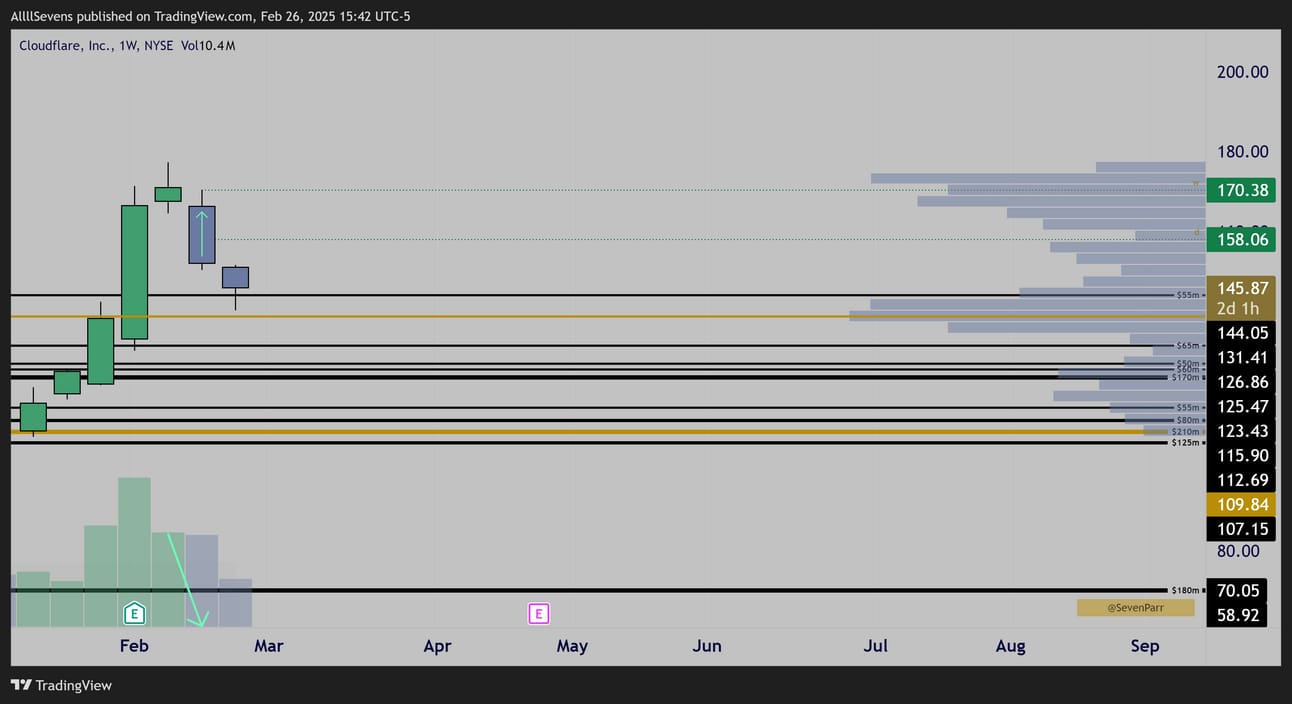

NET

NET Weekly

Discount visible.

NET Daily

4x above average volume PEG formed early this month.

Another discount visible. Finally retesting a $55m Dark Pool today where I have began accumulating.

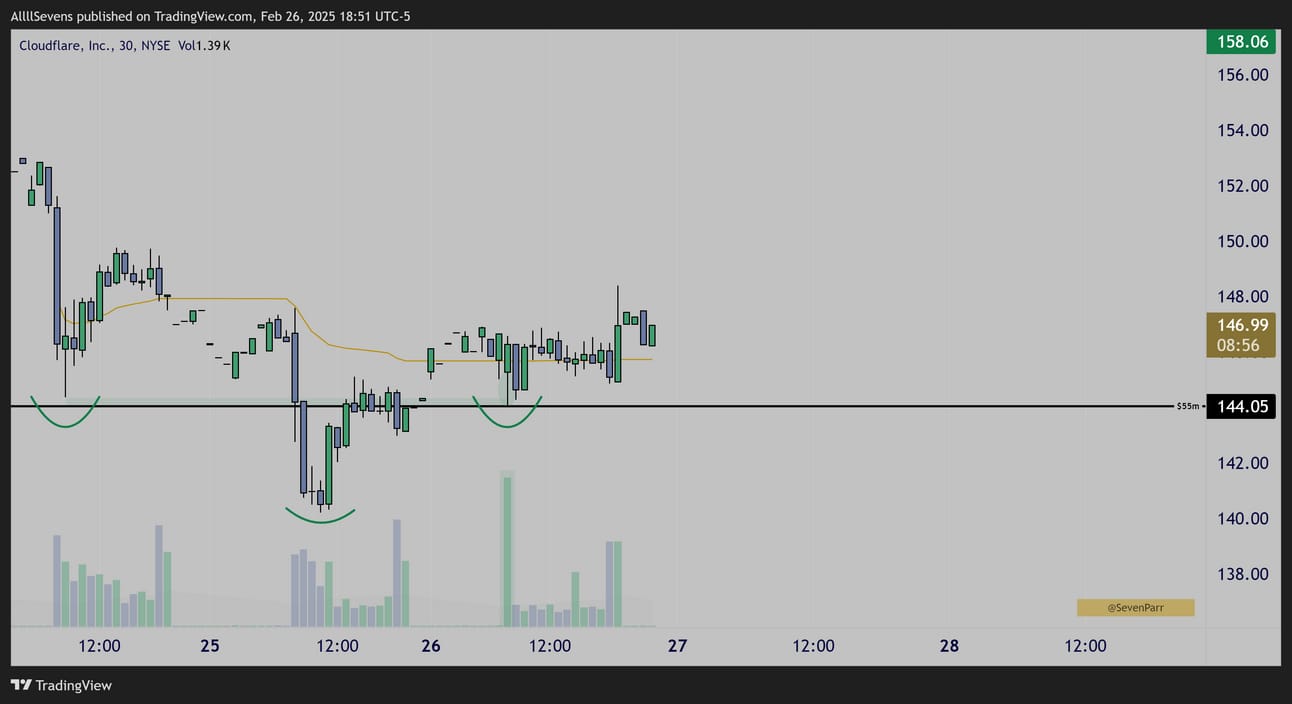

NET 30m

Clear Dark Pool accumulation off today’s open.

POSSIBLE inverse H&S upside reversal pattern in play. We’ll see.

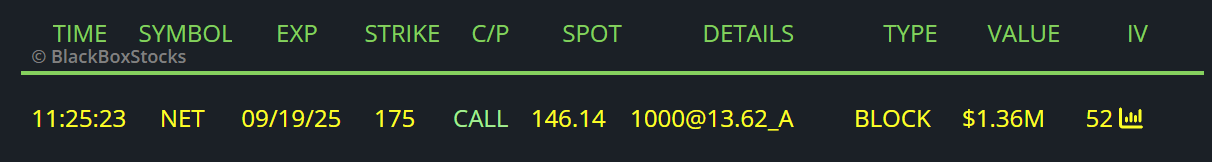

$1.3M Call Buyer (Today)

$2.3M Call Buyer into 2027

Still holding from recent highs

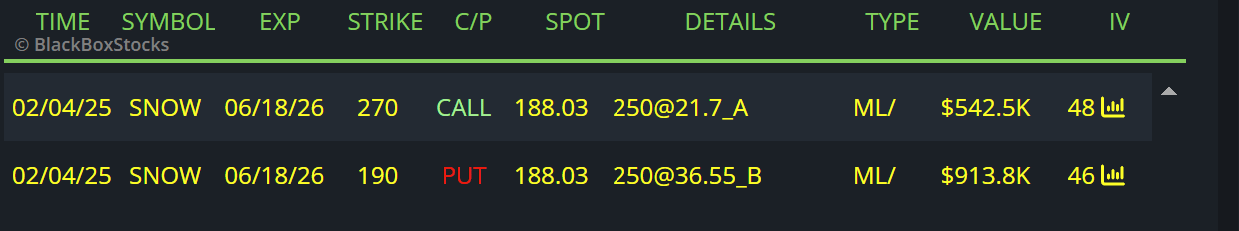

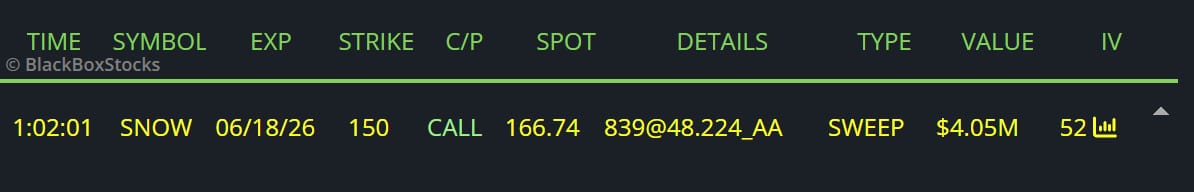

SNOW

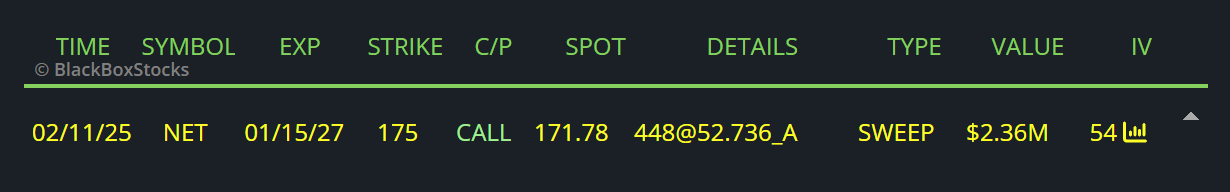

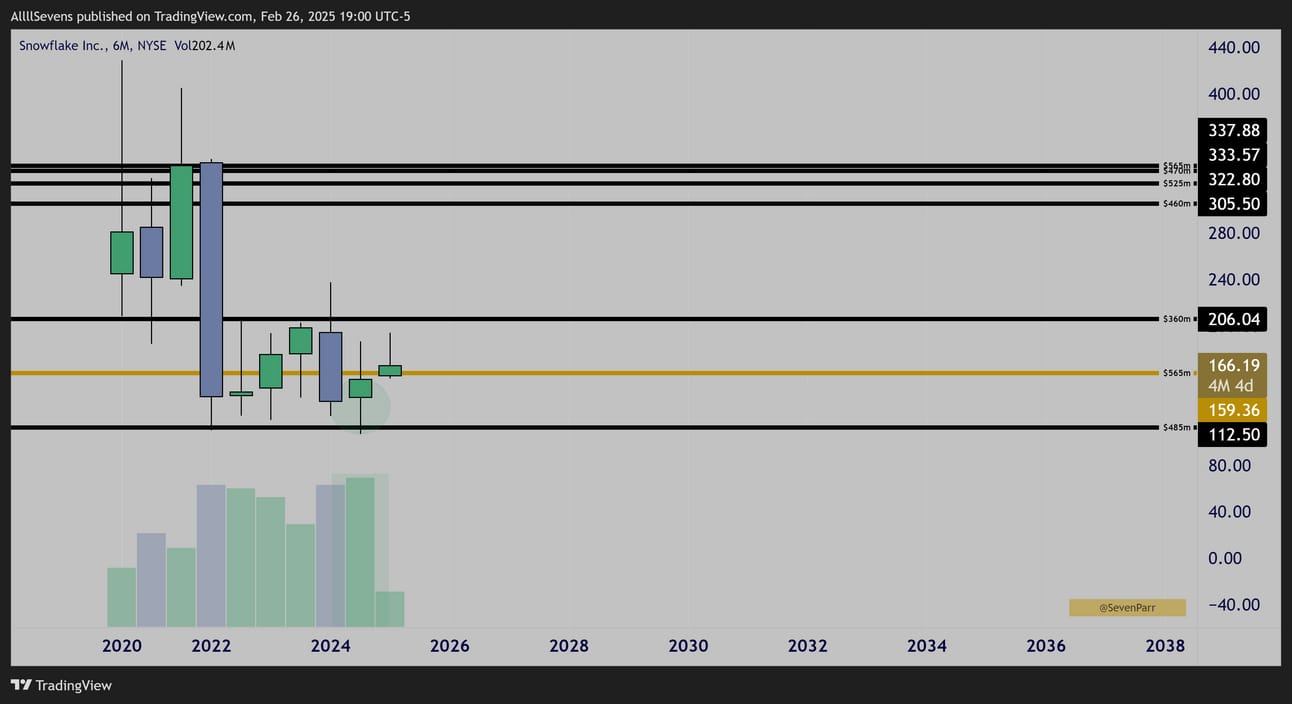

SNOW Yearly

Last year was the stocks highest volume ever, forming a hammer off Dark Pool and a sweep of prior lows. Textbook institutional accumulation.

I’ll also note that last year’s candle was the second perfect INSIDE candle following the 2022 sell-off, which also has a lower wick off this Dark Pool showing stopping volume.

This could be primed for an extremely aggressive upside reversal.

SNOW 6 Month

Same pattern. Highest volume ever, inside candle, hammer off Dark Pool.

Could be THE bottom for this stock.

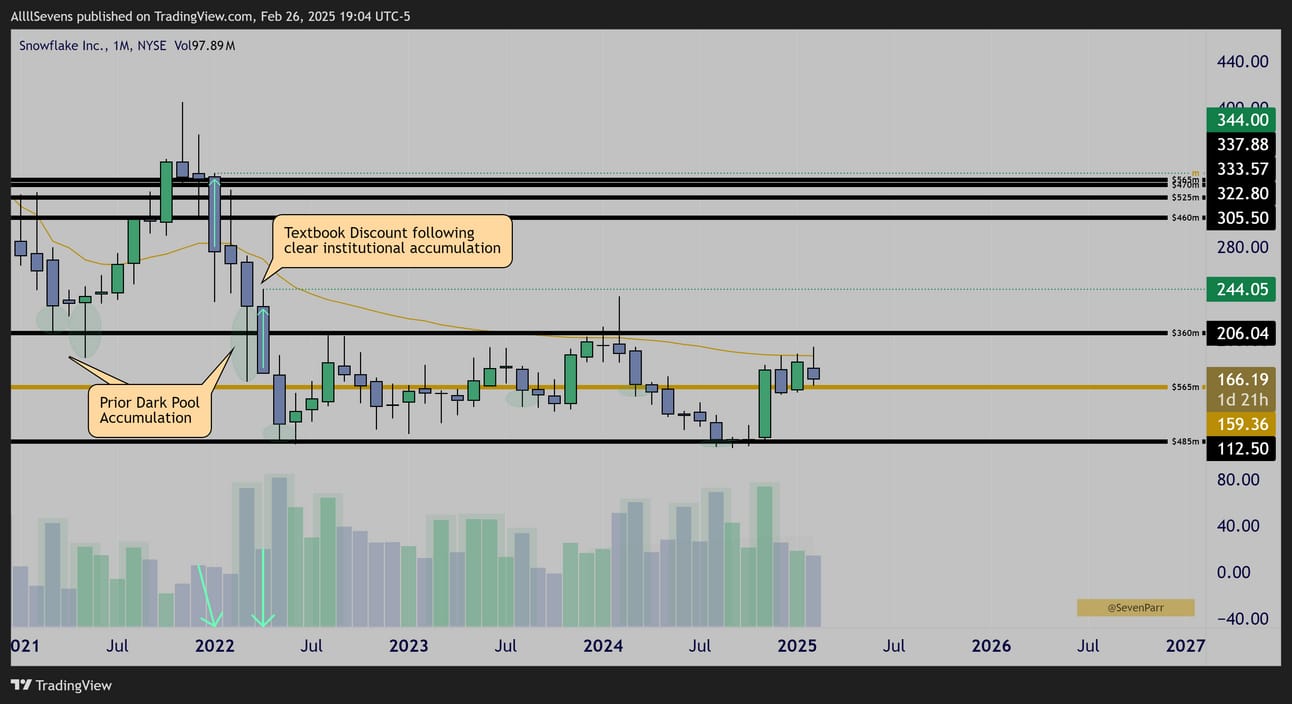

SNOW Monthly

These are some seriously amazing Dark Pool accumulation patterns.

Pair this with the double IB’s / upside reversal pattern and clear accumulation also visible on the YEARLY time frame…

Breaking over this ATH AVWAP resistance and reclaiming the previously accumulated $206.04 level will be very bullish signals.

Price tried to do this in February of last year…

It failed, swept lows to stop everyone out, and formed this insane yearly pattern… I have a feeling the FOMO back into this stock on a true break over trend resistance + $206.05 will quite literally send this stock straight to $300 which would bea 50% gain.

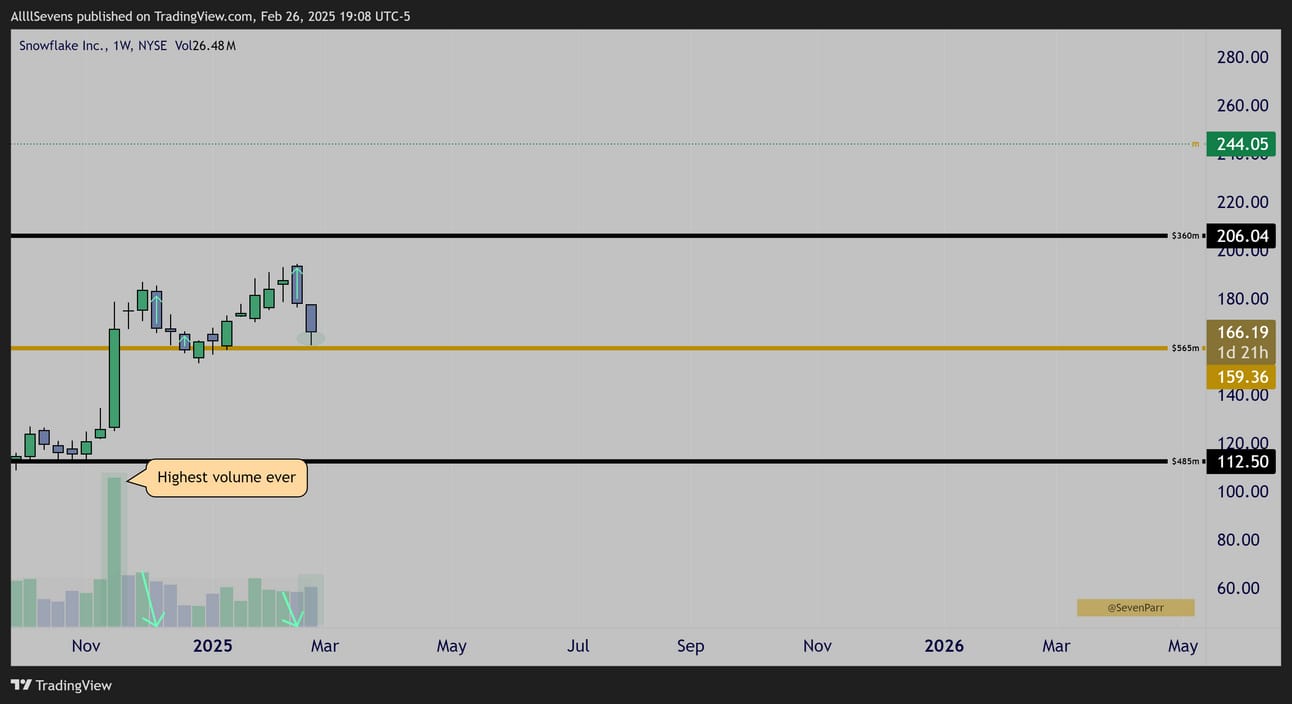

SNOW Weekly

SNOW Daily

Last ER gapped this up on the stocks highest volume ever, reclaiming the largest Dark Pool on record…

The recent pullback to this DP shows textbook discounts.

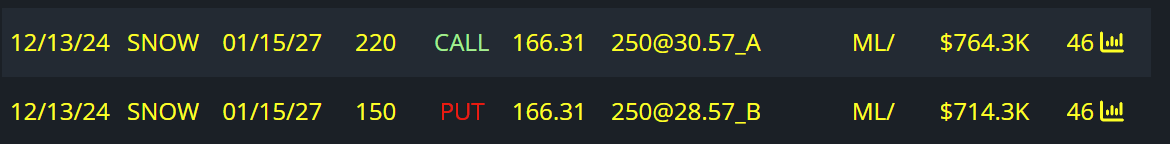

$700K Call Buyer

$700K Put Seller

$500K Call Buyer

$900K Put Seller

$4M Call Buyer (Today)

This stock looks absolutely amazing.

The precision of the double inside candles on the yearly is… amazing.

Add that to the SWEEP OF LOWS on the hammer…

So many market participants are ITCHING to push this higher, and rapidly.r

Breakout over $206.04 will be massive. All eyes.

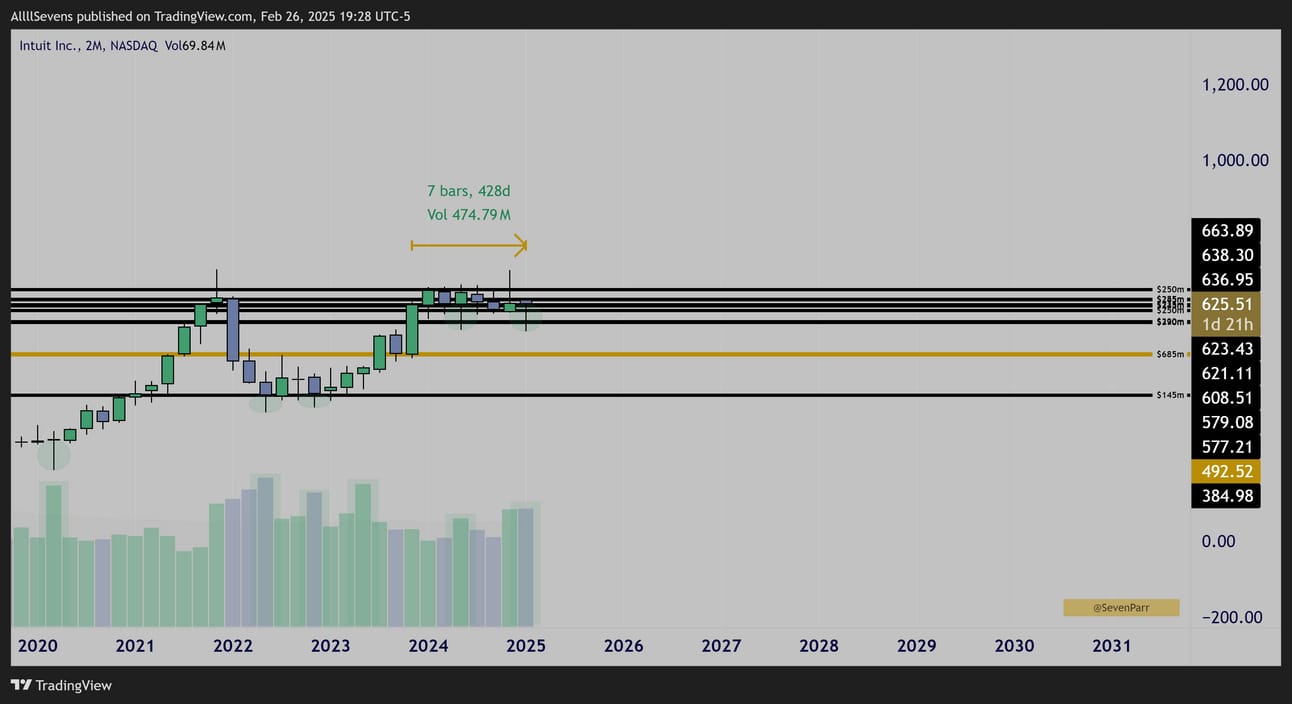

INTU

INTU 2 Month

Amazing Dark Pool accumulation patterns during the 2022 dip.

Continued Dark Pool accumulation over the last 14 months as price compresses below current ATH’s… Crazy explosive setup.

INTU Daily

Today, a Power Earnings Gap has formed on the highest Daily volume in a year.

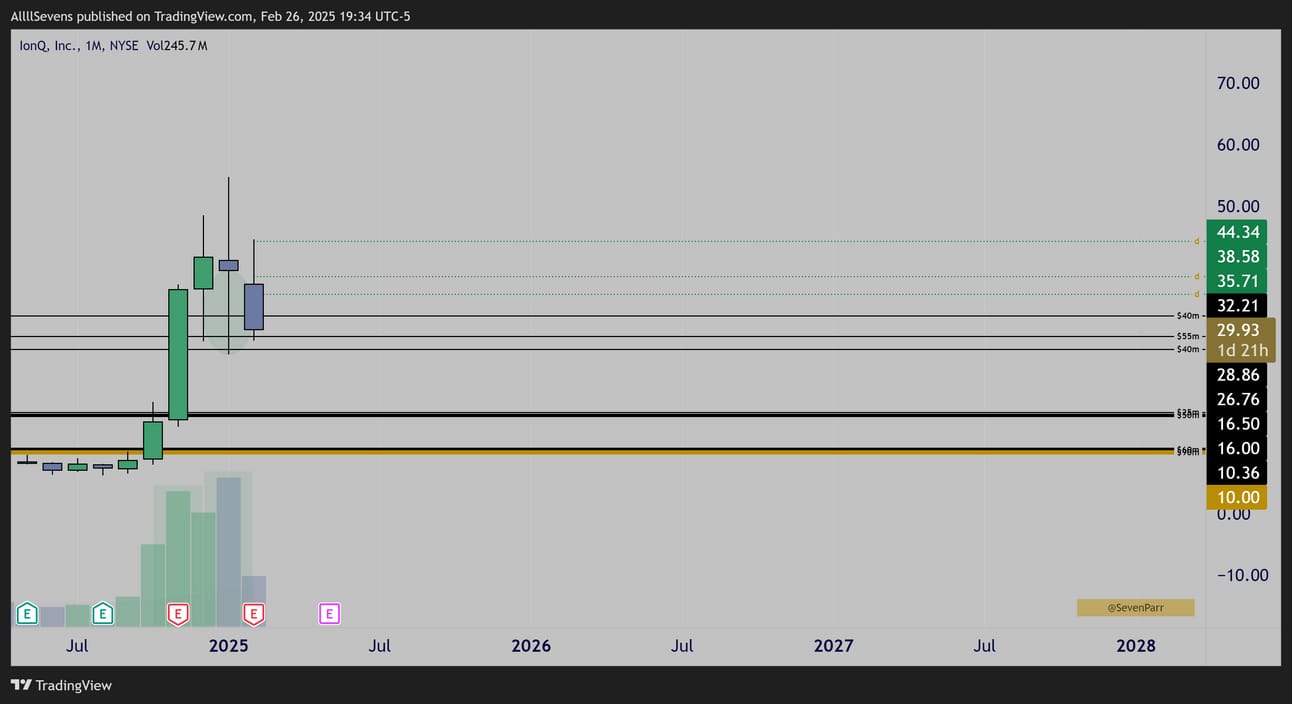

IONQ

IONQ Monthly

Highest volume ever showing Dark Pool accumulation.

IONQ Daily

Considering the Dark Pool accumulation and active discounts visible here, this is definitely on my watchlist.

$800K Put Seller

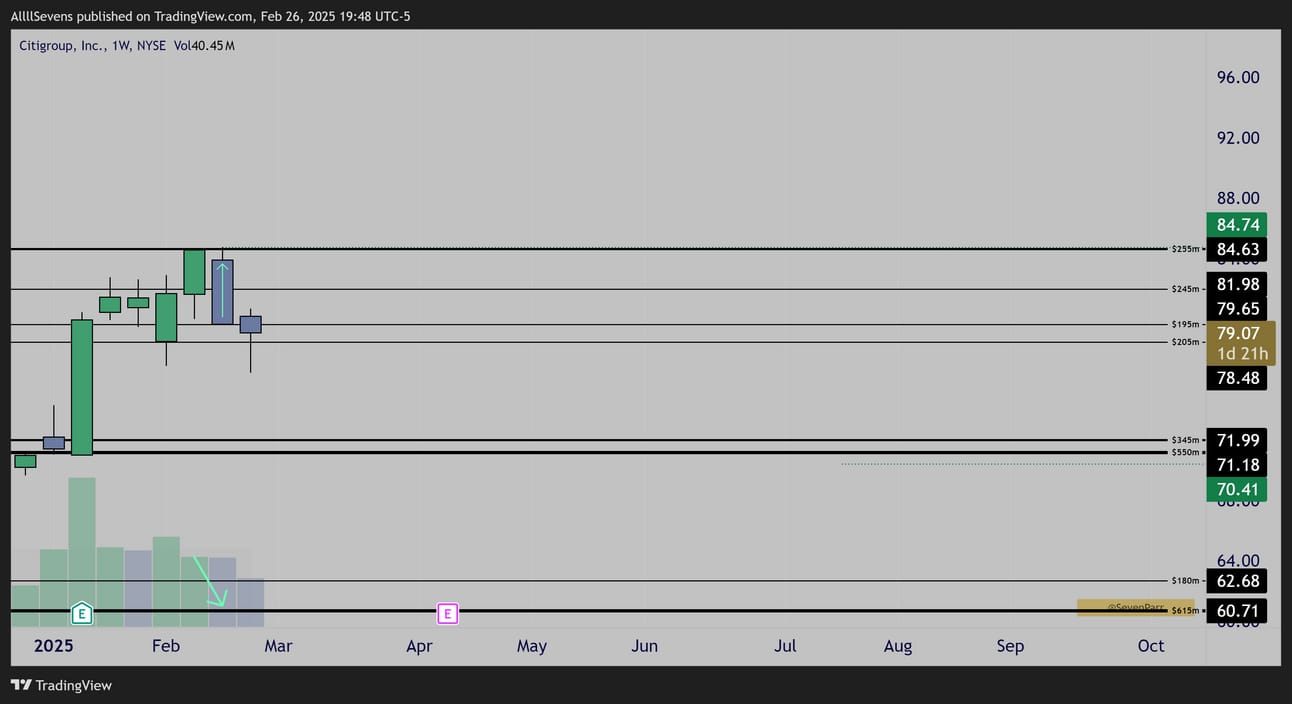

C

C Weekly

Solid discount off Dark Pool last week. Lines up with sector ( XLF )

C Daily

PEG formation on highest volume in over a year.

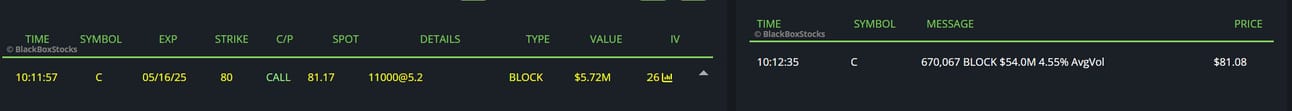

Executed January 21st

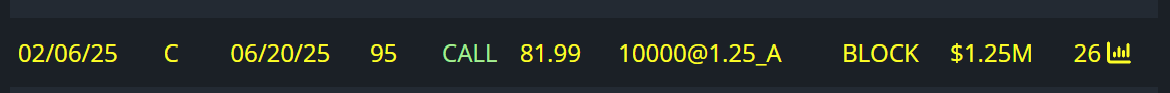

Can’t be certain that this is a call buyer, but the chart makes me think it is

$5M Call Buyer into May + $50M DP

(Executed on January 29th)

$2.8M Call Buyer + $9M DP

$1M Put Seller

$600K Put Buer (hedge)

$1M Call Buyer

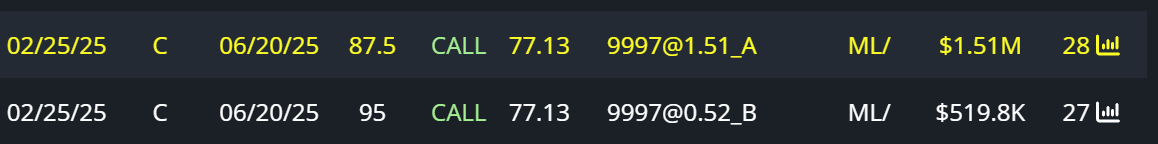

$1.5M Call Roll

$700K Put Seller

$900K Call Buyer

XLF sector remains the strongest momentum Sector in SPY imo

AVGO

AVGO Weekly

Accumulation @ largest Dark Pool on record, an $8B area.

Clear discount created last week.

$3M Call Buyer

I am simply holding this stock from my last mention. See here.

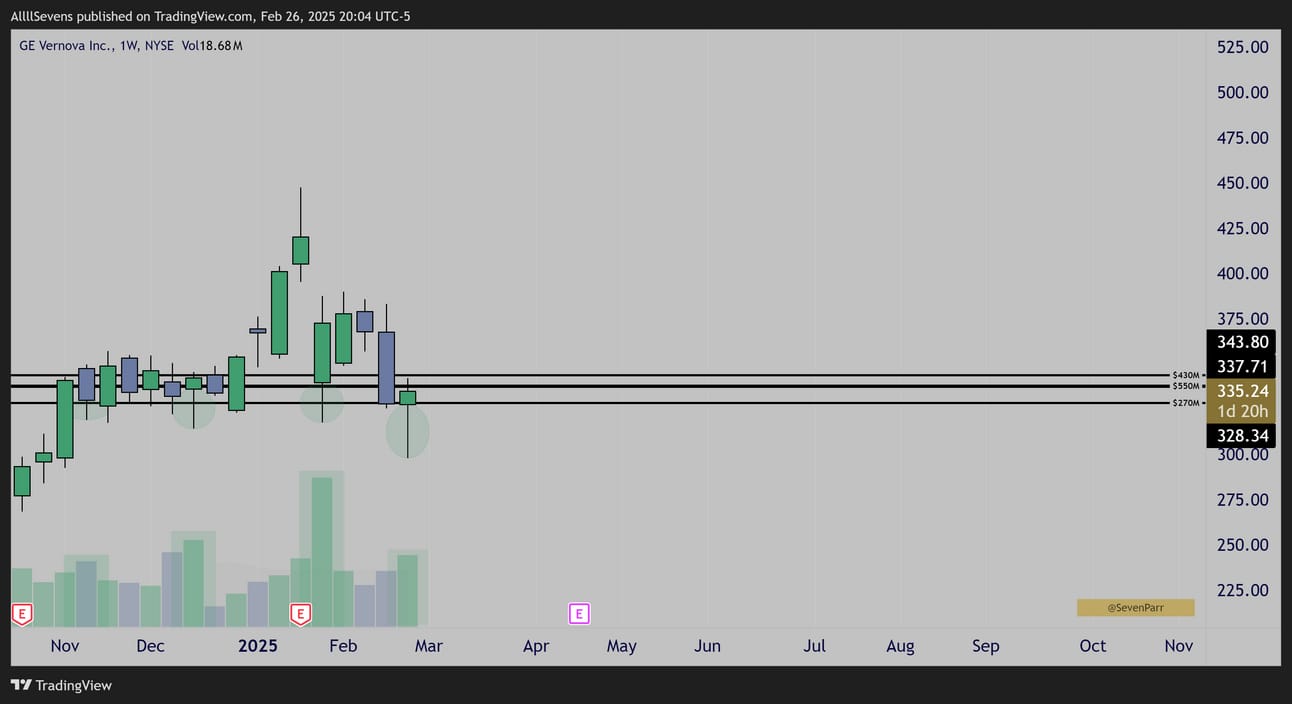

GEV

GEV Weekly

Crystal clear Dark Pool accumulation.

$2M Call Buyer

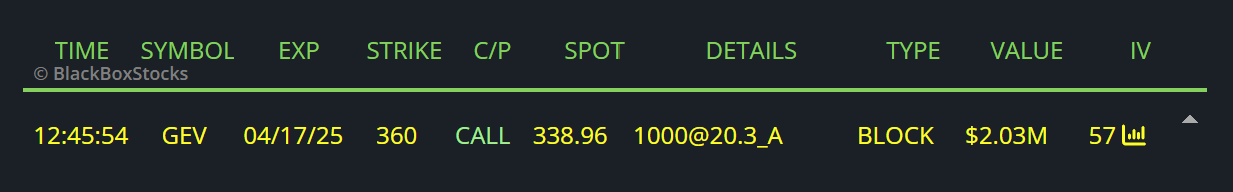

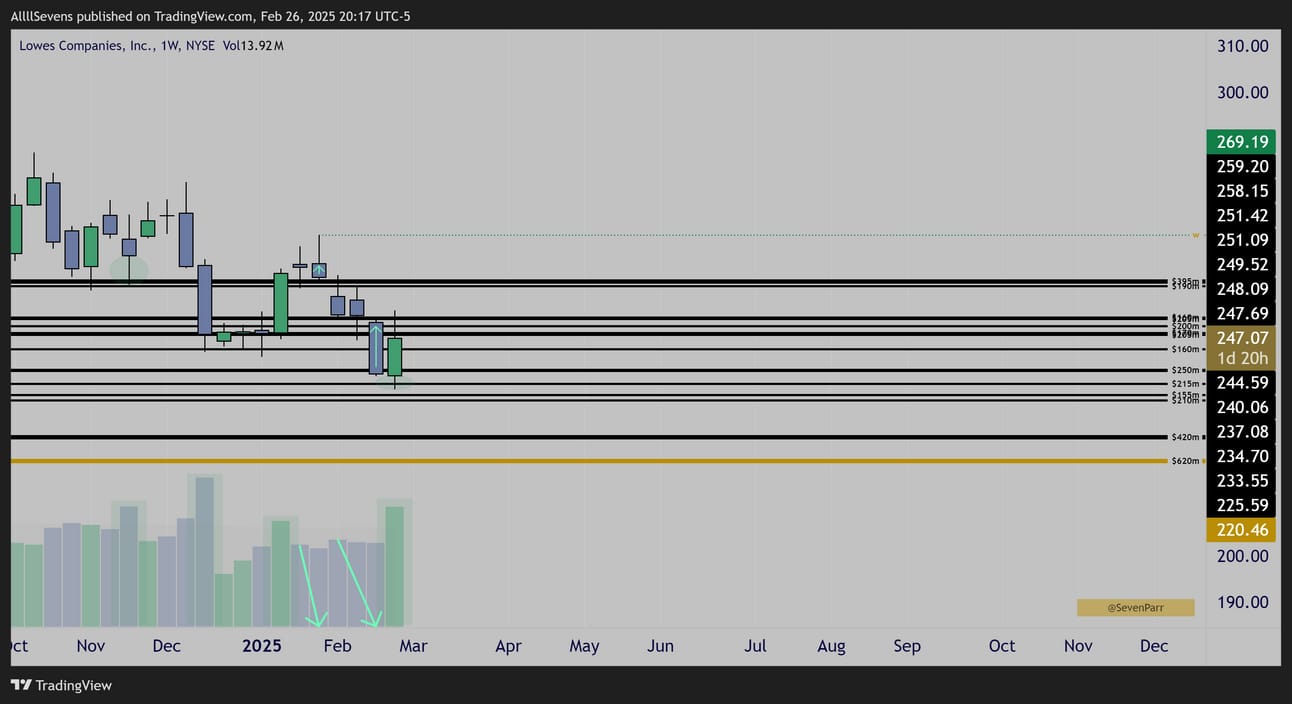

LOW

LOW Monthly

I love the relatively low volume behind the recent sell-off within a clear uptrend.

This months candle is about to show Dark Pool accumulation off $240.06

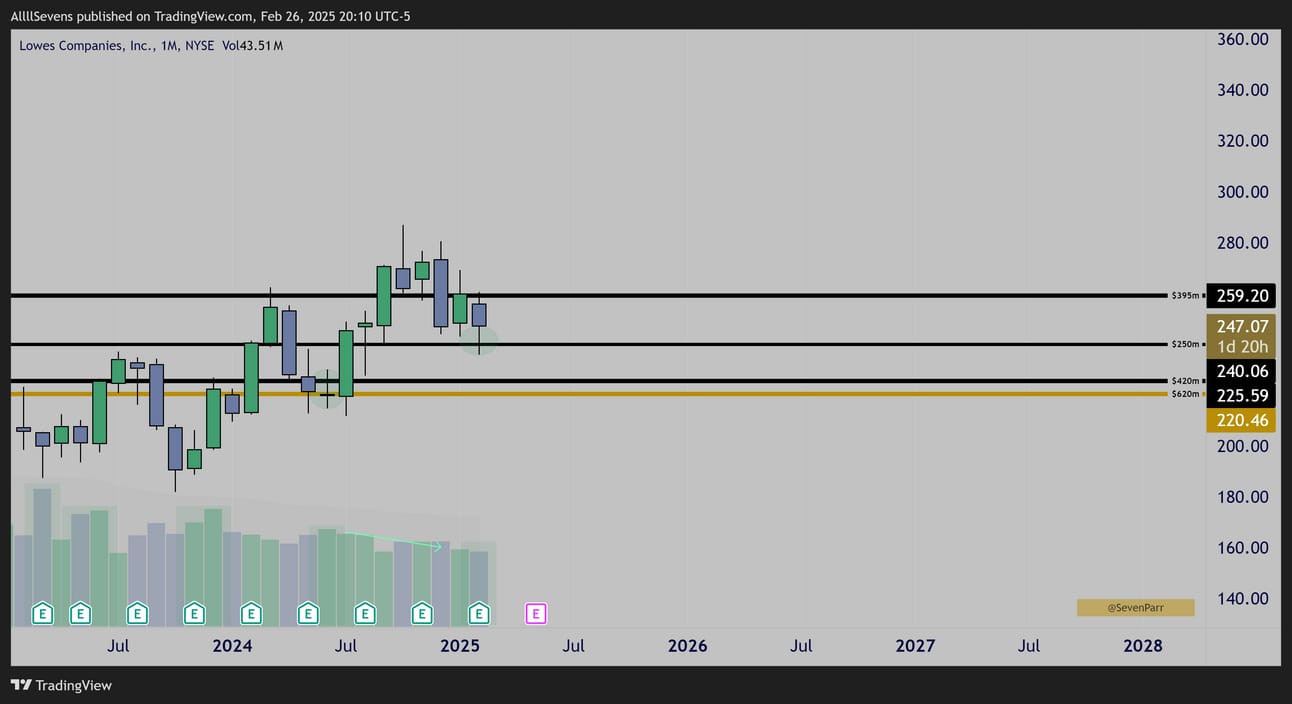

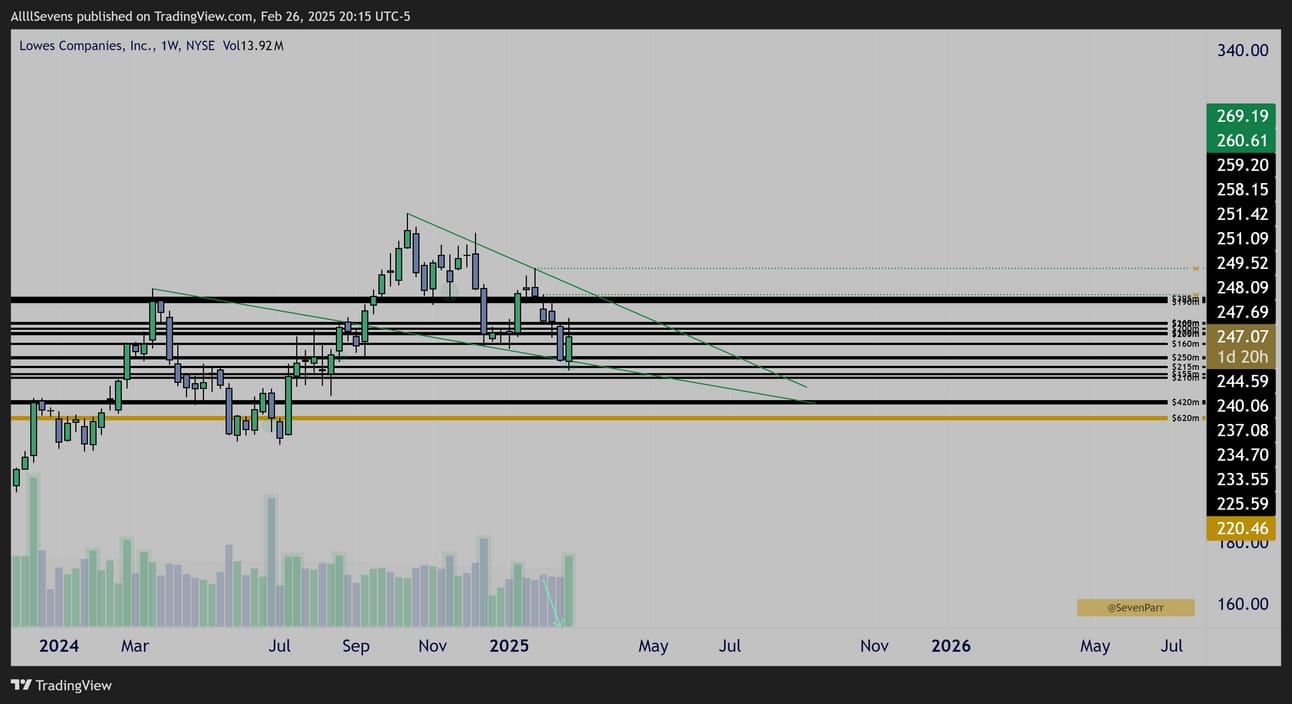

LOW Weekly

STELLAR Dark Pool accumulations off largest DP on record @ $220.46

Nice falling wedge upside reversal pattern as this is in a very healthy pullback as seen on the monthly chart.

LOW Weekly

In the last few weeks specifically, the discount selling has been crystal clear.

Peak retail pessimism perhaps.

LOW Daily

High volume capitulation off the recent low, leading to today’s PEG and attempted downtrend breakout. Note the large buyer in this area back in December as well. This looks great. I’m going to be buying inside these weekly and daily discounts.

Keep in mind the entire XLY sector shows these patterns right now!!

I explain that in the broader newsletter linked at the top of this one. Please read.

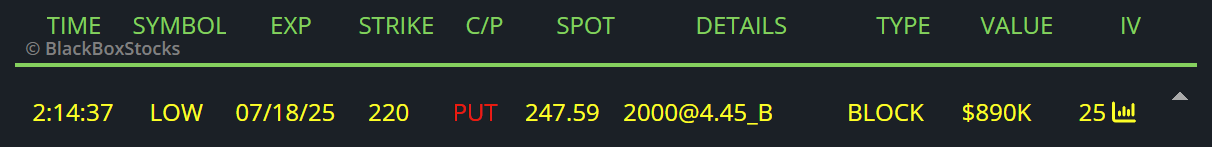

$900K Put Seller

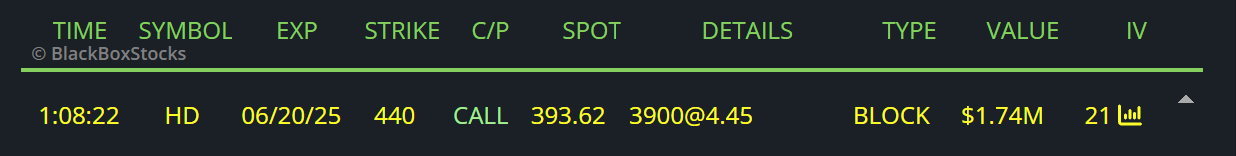

HD

HD Monthly

First off, you should check out the dedicated newsletter I wrote for this stock.

I am EXTREMELY bullish this stock long-term. It is easily one of my favorite picks, especially because it is so slept on.

Read here

Within an extremely bullish YEARLY uptrend, price has tested ATH’s and fell into a bullish compression at its largest Dark Pool on record. Textbook discount candle formed in December, giving me the go-ahead to buy this for the long-term. On top of that, the falling wedge pattern here is arguable even cleaner than the one on LOW

HD Weekly

Same extremely aggressive accumulation patterns.

Very clear relative strength to LOW being displayed here.

HD Daily

Also with a PEG formation and again, notice the repeat buyers in this zone every time it’s here. The accumulation is absolutely undeniable.

Whether or not the short-term falling wedge truly works, I cannot be certain-

For whatever reason, price is struggling to get back over $400- for now.

When / if it does, this thing can go crazy into new ATH’s

EIther way, I am definitely continuing my DCA’ing on this stock right now.

Technically I don’t know if this is a buy or sell, but have to assume it is a buy.

I hope you found value here!!! I put in some serious work here.

I will not be doing these for free very often.

Upgrade your subscription to AllllSevens+ for $7.77 / month to show your support and get more of these newsletters +

-Discord Access

I collect and analyze all of this data in Discord before posting it to X or writing a newsletter. The Discord is an absolute gold mine. See for yourself.

Dark Pools & Options Flow on a Daily basis. Always open for discussion.

Building a community of like-minded folk.

I believe we are witnessing history. Let’s work.

Click here to join AllllSevens+

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQo

I also have a referral link for TradingView, the charting software I use https://www.tradingview.com/pricing/?share_your_love=sevenparr

Reply