- AllllSevens

- Posts

- Consumer Defensive Rotation XLP / QQQ

Consumer Defensive Rotation XLP / QQQ

XLP Historic Long Term Opportunity as well as a very intriguing Short-Term setup.

Disclaimer

I am not a legal professional.

The content shared in this newsletter is purely my personal opinion and for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

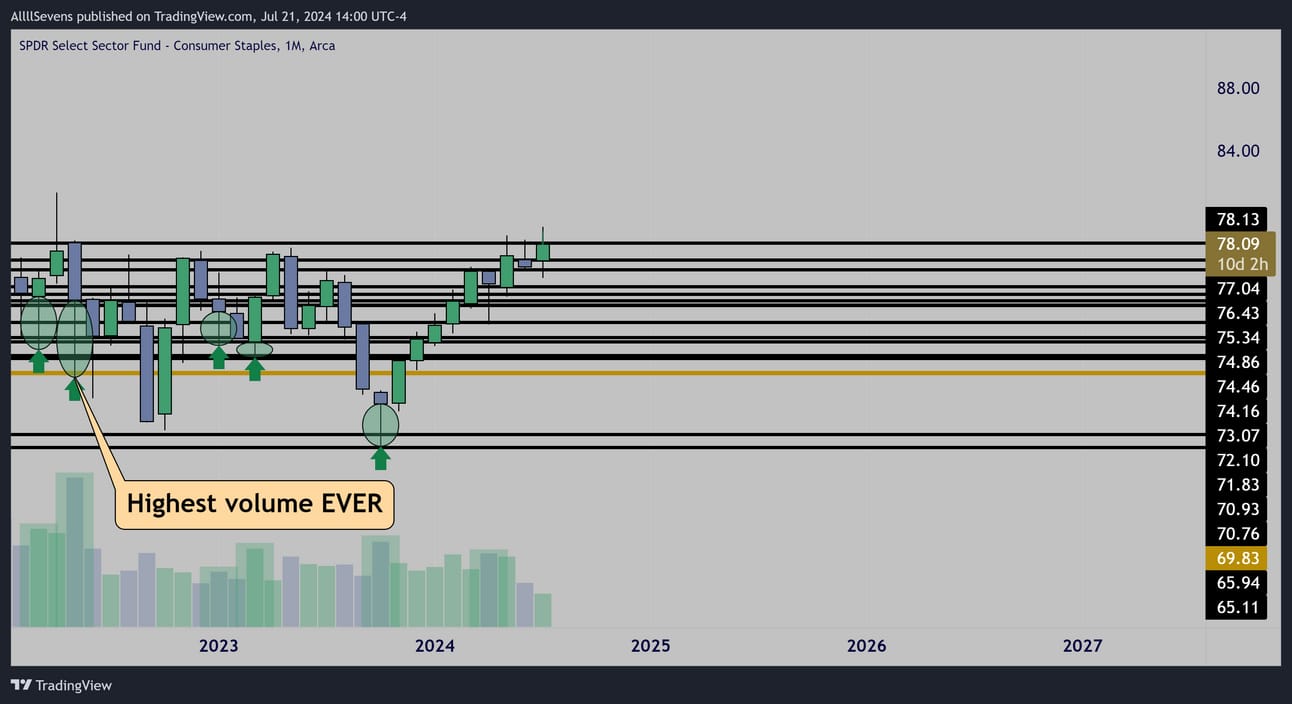

XLP

Monthly Interval

This sector saw it’s largest accumulation EVER during the 2022 “crash”

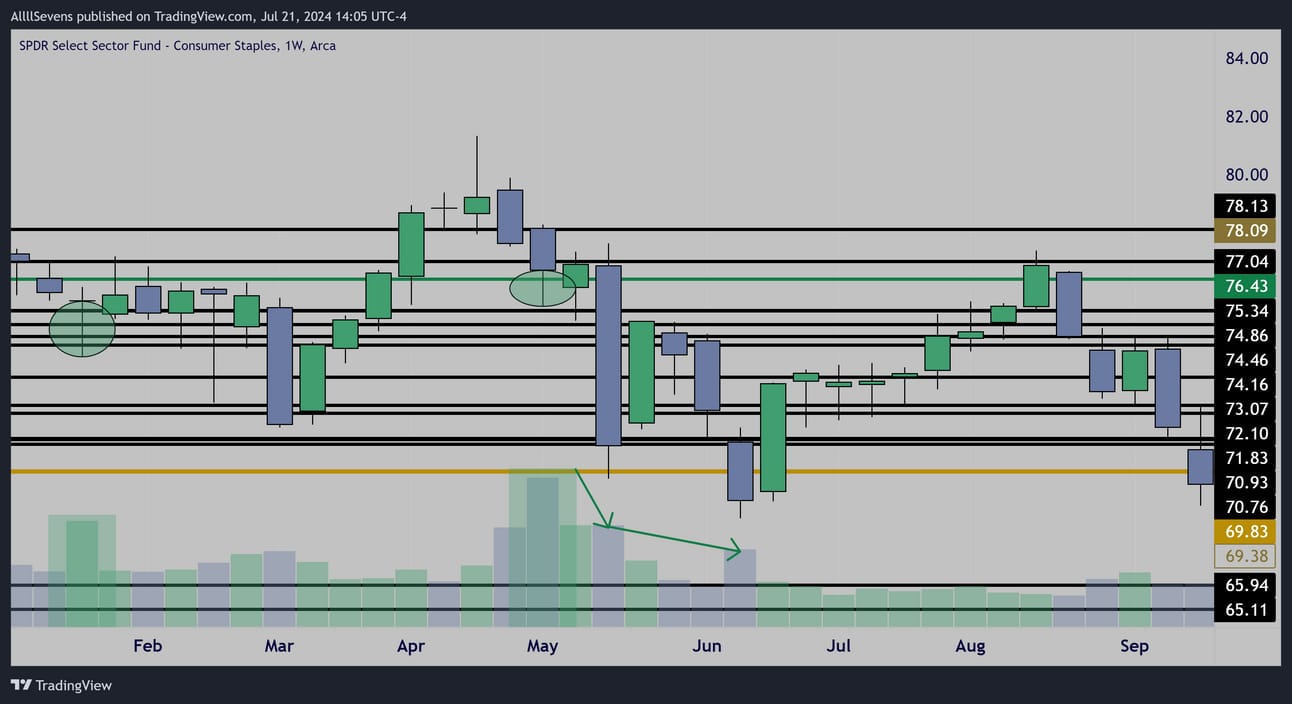

Weekly Interval

Zooming in, I can see exactly which DP this volume came in at. $76.43

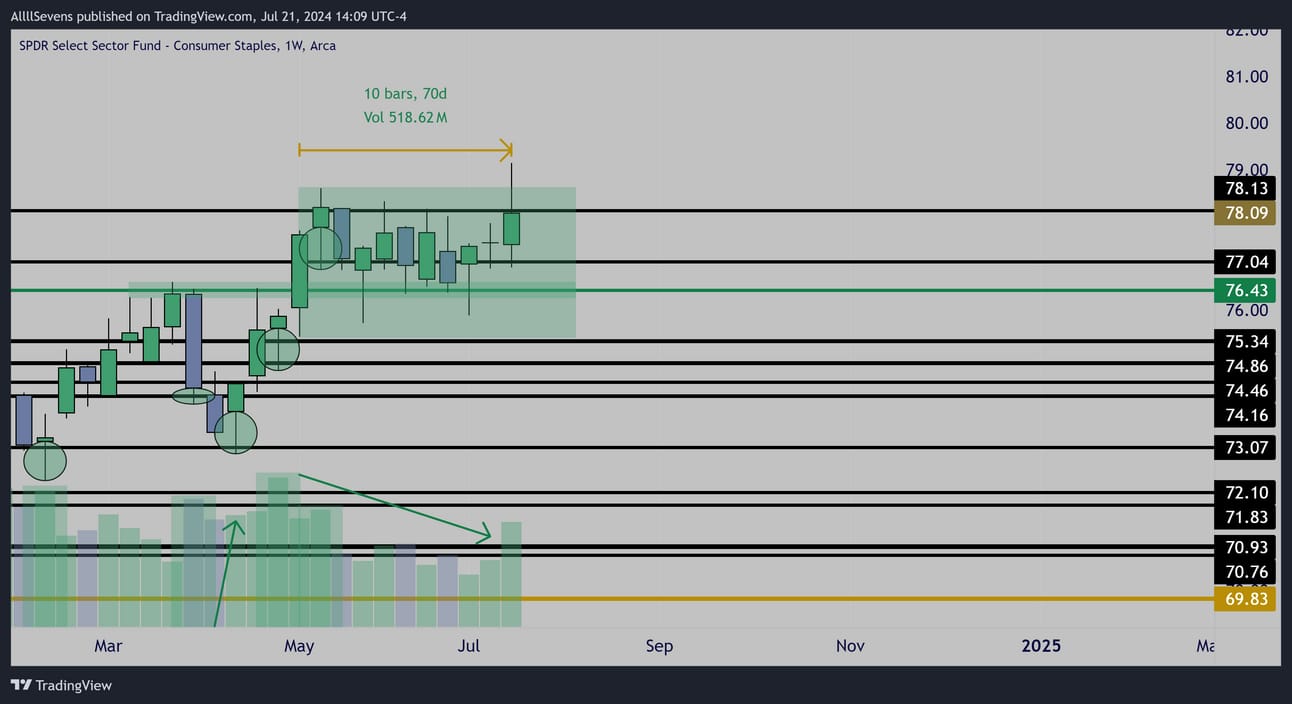

Weekly Interval

Price has been compressing / bull flagging over this dark pool on declining volume for TEN weeks straight…

$78.13 is the sector’s last DP resistance before a major breakout.

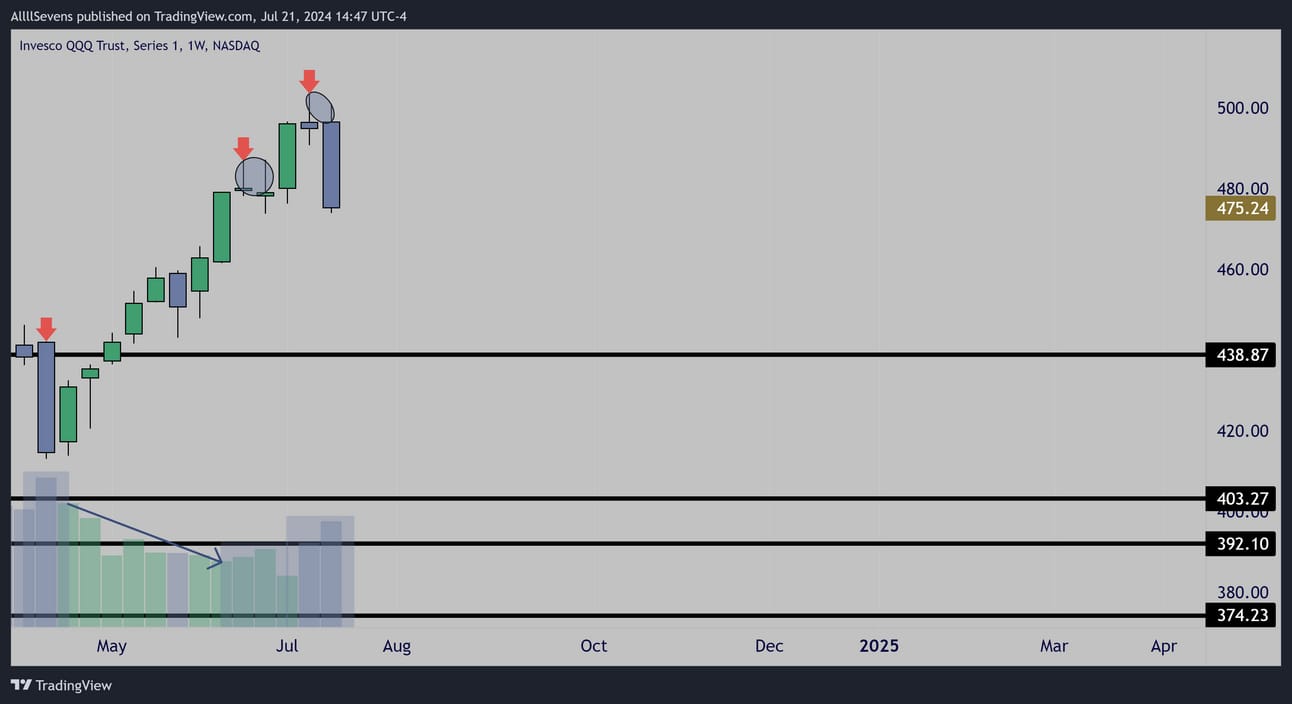

QQQ & SPY

Weekly Interval

It’s really hard to be bullish here.

I’m obviously not shorting though- there’s no resistance.

I’m just pointing out a lack of a strong bullish setup…

I don’t think this is a coincidence. When QQQ begins to stall, it usually causes a rotation into more defensive stocks…

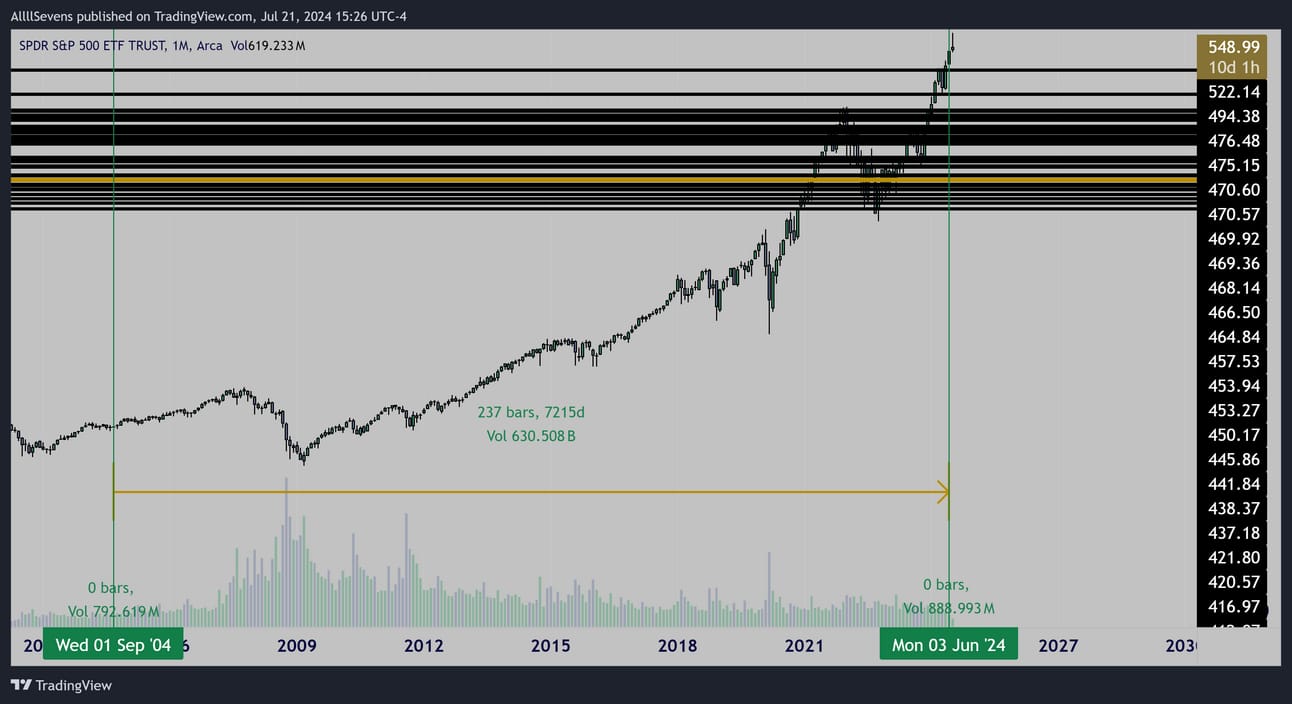

Monthly Interval

In June, SPY traded it’s lowest volume in nearly 20 years…

I find this a bit ominous, especially when you consider my last newsletter on the SPY… claiming that the bullish breakout we were seeing would not last. It’s almost as if everything is slowly falling into place now.

https://allllsevensnewsletter.beehiiv.com/p/weekly-newsletter

Again, I am not calling for shorts on the SPY, just noting a lack of bullish volumes, meanwhile very bullish volumes and compression on a defensive sector ETF…

Conclusion

I’d like to emphasize the potential once in a lifetime Long-Term opportunity in the XLP sector right now.

It truly is an anomaly to see the ETF’s largest volume ever in the form of crystal clear accumulation.

Short-term, things are always uncertain, and for all I know this weekly compression fails and breaks down. But, that would not change the volumes here. VOLUME is screaming this will appreciate over time, potentially at a historic rate in the coming years.

The second emphasis I’d like to make is that I am not necessarily bearish SPY or QQQ, I am simply very bullish the XLP.

The volumes on SPY and QQQ aren’t showing me a bullish setup, which further supports the potential for a defensive rotation into the XLP.

There isn’t a strong overhead resistance SPY or QQQ and that is why I am not calling for any shorts. I’m bullish the XLP.

Follow & engage with me on Twitter/X for updates on this thesis!

https://twitter.com/SevenParr

Reply