- AllllSevens

- Posts

- Daily Newsletter

Daily Newsletter

SPY, IWM ,AFRM, CVNA

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

Preface:

I don’t normally do Daily newsletters,

but today felt like a great time to send one out!

I simply want to go over what I see on the SPY after today’s action, because a candle like today’s can put a lot of people in a state of uncertainty and mistakes can be made.

SPY

If you didn’t read this week’s HTF breakdown, read that here.

Overall, I’m not very interested in adding new longs on SPY,

But I am VERY convicted that this Daily rally is not over…

After an entire month of accumulation,

The SPY has broken out of the range on increasing volume.

Using a .618 Fibonacci off the low of the range and the highest accumulated Dark Pool, I project a rise in price to $489.25 minimum.

Today’s candle shows me a simple pause in the rally.

the low volume tells me while a small pullback COULD occur from this “rejection”, it is not strong enough to invalidate my projection above, and I’m still looking for higher prices.

As you can see, there are no levels to work with here!!!

Let’s see if there was any notable Dark Pool activity today, giving us new levels to use as the SPY enters “price discovery”

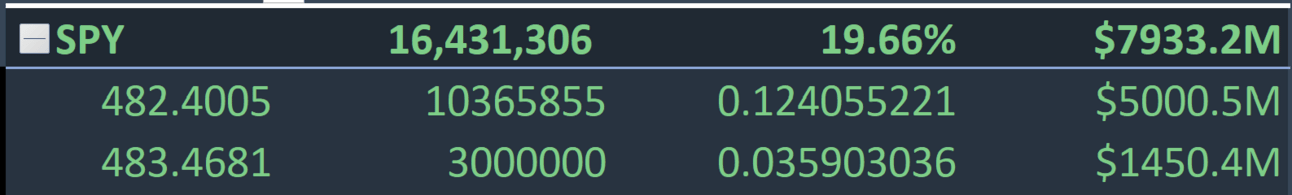

1-22-24 Dark Pool Activity

Overall, $7.9B was transacted on the Dark Pool today,

Two of which are actually notable and will be placed on my chart.

$482.4005 will be marked on the 4HR time frame and below, with a level 2 thickness.

$483.4681 will be marked on the 4RH time frame and below with a level one thickness, dotted line.

Neither of these are extremely notable, but they are still useful for intraday trading and managing current swings.

Let’s take a look at the intraday price action on SPY today:

I saw a LOT of accumulation…

No big money sold out today!

15m

The 15m chart displays accumulation during the morning session and a retail sell-off during the afternoon drop, confirming that accumulation.

2m

The two minute chart displays today’s tape the best.

Purely dominated by buy volumes.

The entire downtrend today was backed by impatient retail participants.

Smart money is long and strong!

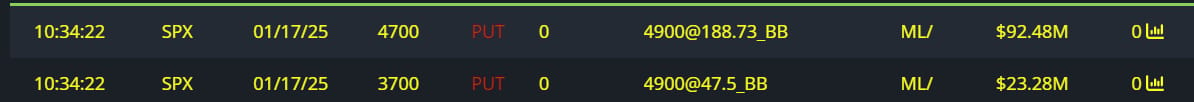

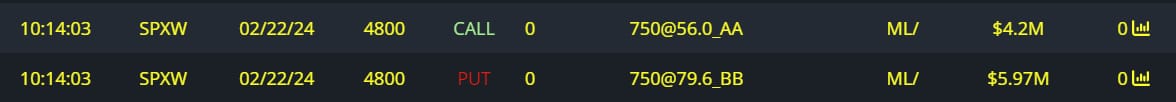

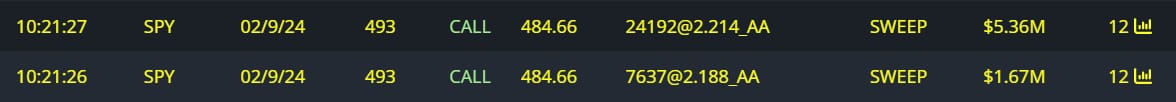

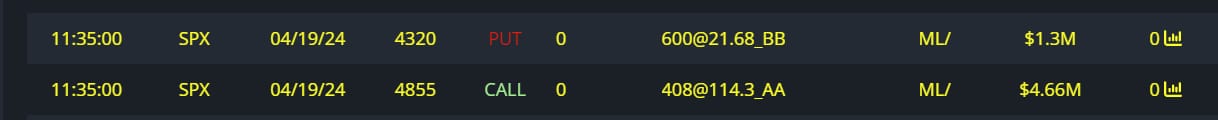

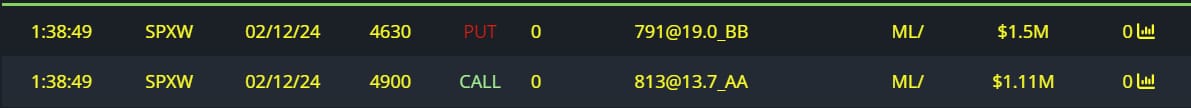

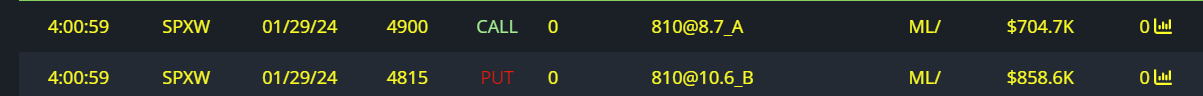

The options flow supports my analysis…

Some extremely notable Unusual Options Flow hit the SPY today.

$115M Puts Written

$32M Calls Bought

$10M Full Risk Bullish Order

$7M Calls Bought

$6M Full Risk Bullish Order

$2.5M Full Risk Bullish Order

$1.5M Full Risk bullish order

Considerably far OTM

I was pleasantly surprised to see so much activity on the flow today.

Conclusion:

I am still projecting SPY to rise to $489.25 on a daily time frame.

Today we saw price “reject” new ATH’s, but on what volume?

Who exactly sold out? Nobody with a brain.

In fact, institutions absorbed all the shares that were sold.

At the same time, whales piled into long positions on the options flow.

I think these people are slightly insane as we are pretty extended from any MAJOR support ($475.15-$476.48) so the R/R is not great anymore-

But I think people loading puts are even more insane.

Overall, I am BULLISH

Swing positions are to be held.

As for new longs-

I opened one into the close today and I’ll be looking to add more tomorrow if an entry presents itself.

$482.40 will be my basis for risk. If this level is not defended, then momentum is beginning to fade and I don’t want to get chopped.

Losing $482.40 would NOT invalidate my $489.25 target, it would just mean theta decay us kicking in and it would be possible, but unlikely for $476.48 to be retested, therefore I wouldn’t want to hold any new longs.

For AllllSevens+ subscribers,

First, I give my trade plan for IWM tomorrow.

Next, I share my long-term outlook on AFRM and CVNA with my plan to potentially catch extremely lucrative short-term moves on these names in 2024. (CVNA is insane- just saying)

In yesterday’s newsletter, I covered my long-term outlook on the IWM and why I think small-caps have extreme potential over the next year.

These are two of the many names I will discuss over the next few weeks.

Reply