- AllllSevens

- Posts

- Spotlight Newsletter

Spotlight Newsletter

Microsoft Corp - $MSFT & The Software Sector ( $ADBE / $CRM / $INTU / $NOW )

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

We are seeing something massive here.

MSFT is one of the largest companies in the entire world.

The money behind this setup is not seen anywhere else.

The story behind this is truly exceptional. Please read all of this.

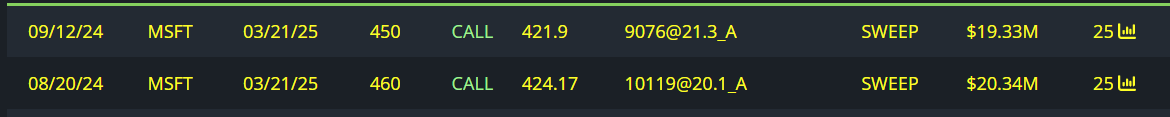

$39.67M March 2025 Call Buyer

MSFT

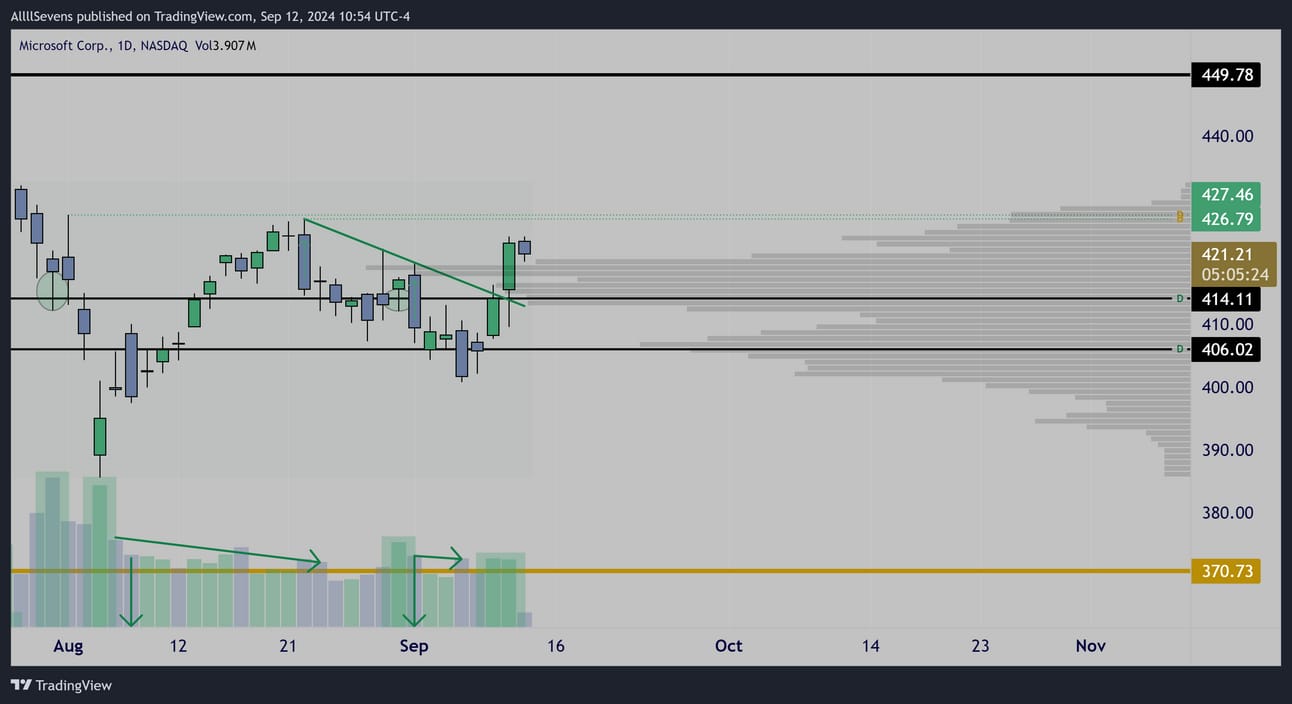

Daily Interval

For a majority of the year, MSFT stock has not moved.

It rallied hard to begin the year, notably off it’s largest Dark Pool on record at $370.73 on high volume, and has consolidated since…

It has been compressing, and showing very blatant institutional accumulation directly at the $406.02 & $414.11 Dark Pools.

These two dark pool levels represent a nearly 11M share support, or rather a potential $4.5B long position being accumulated.

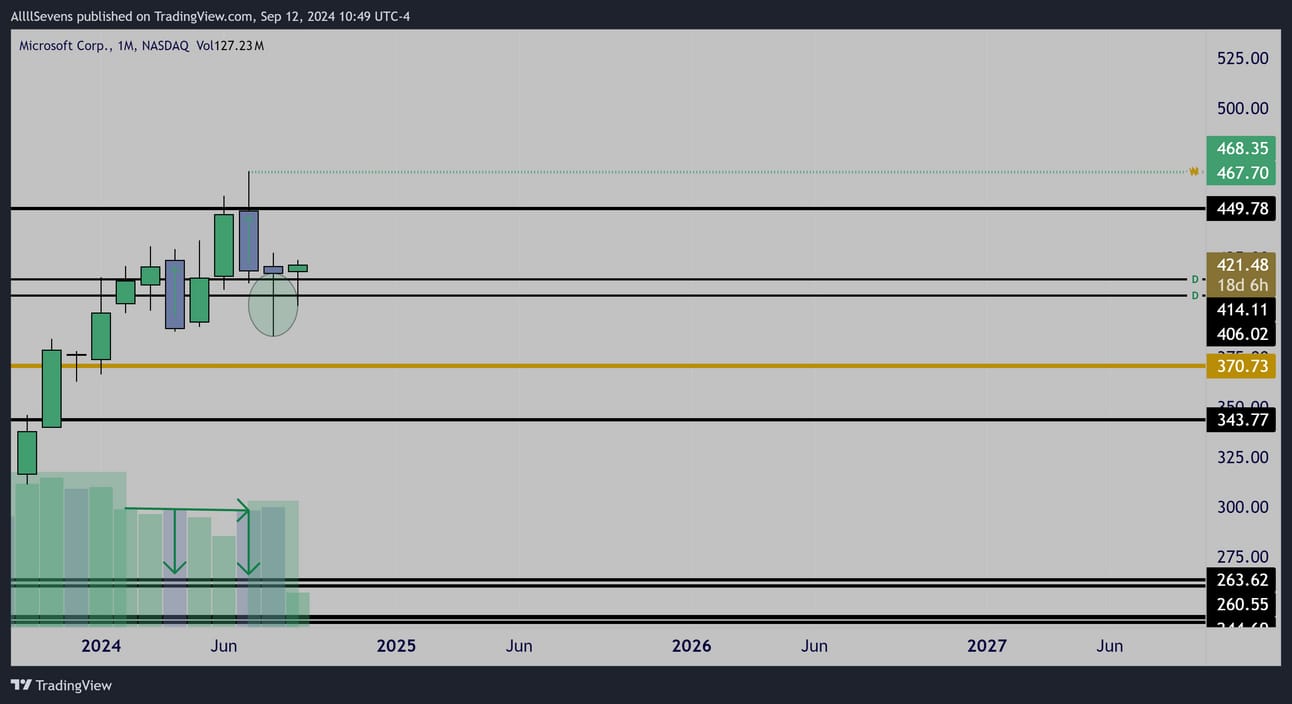

Weekly Interval

This time frame shows the true scale of this compression / accumulation phase. The break here could be huge.

$450 is obviously the first target, but should go much higher eventually.

Monthly Interval

With a hammer formed on the monthly time frame after a blatant retail rejection of highs, this compression could be coming to and end.

Daily Interval

Pair the monthly hammer with this bull flag breakout on the Daily and it becomes clear why these institutions are currently positioning themselves in nearly $40M worth of bi-quarterly call options on top of the billions of dollars worth of shares the have accumulated.

The risk-to-reward here is extraordinary.

Lose $406.01-$414.11 and they are clearly wrong.

Hold and rally to $449.78 they make extraordinary amounts of money, and potentially even more if they trail stop and let the compression break further. All depends on the market environment which is forever changing in real time, so be aware of all possibilities.

These guys could be totally wrong on the short-term breakout right now. They probably aren’t, but they could be and you should aways at least be aware of that- or else when the time comes to potentially stop loss and manage a failed trade, you will hesitate and hold to zero.

Now,

There’s also a bit more confirmation that could occur here-

And it adds even more confluence to how absolutely explosive this could be.

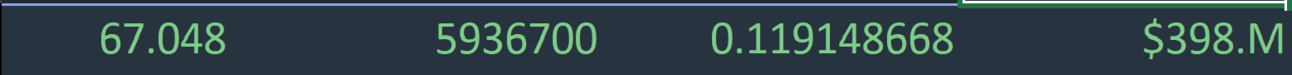

$TQQQ Monthly Interval

Just last month, the 3x leveraged $QQQ was accumulated off it’s largest Dark Pool on record @ $67.05

The timing of this can’t be a coincidence!!

Monthly Interval

If/When this month’s candle reclaims $67.05 and begins to flip green, we could see extreme momentum emerge not just in MSFT but many tech-themed stocks.

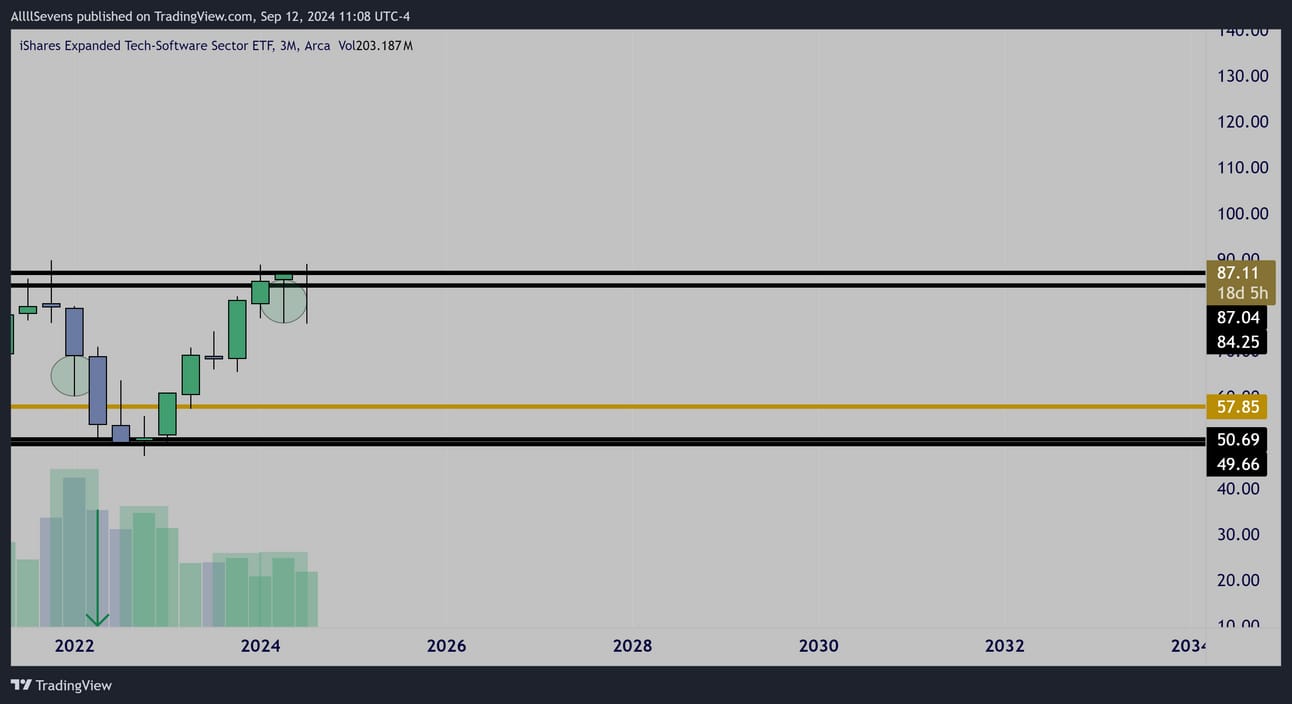

$IGV Quarterly

The software ETF for the stock market

Compressing for most of 2024 just like MSFT

Just below ATH’s, providing explosive potential if/when it breaks.

Clear institutional accumulation has taken place on any rejections of the level, shown by the lower wicks.

Approximate holdings by weight in this ETF:

$ADBE 10%

$CRM 8% Read my in-depth bull thesis on CRM here.

$ORCL 8%

$MSFT 7.5%

$INTU 7%

$NOW 5%

$PANW 4.75%

$SNPS 3.20%

$CDNS 3%

$CRWD 2.5%

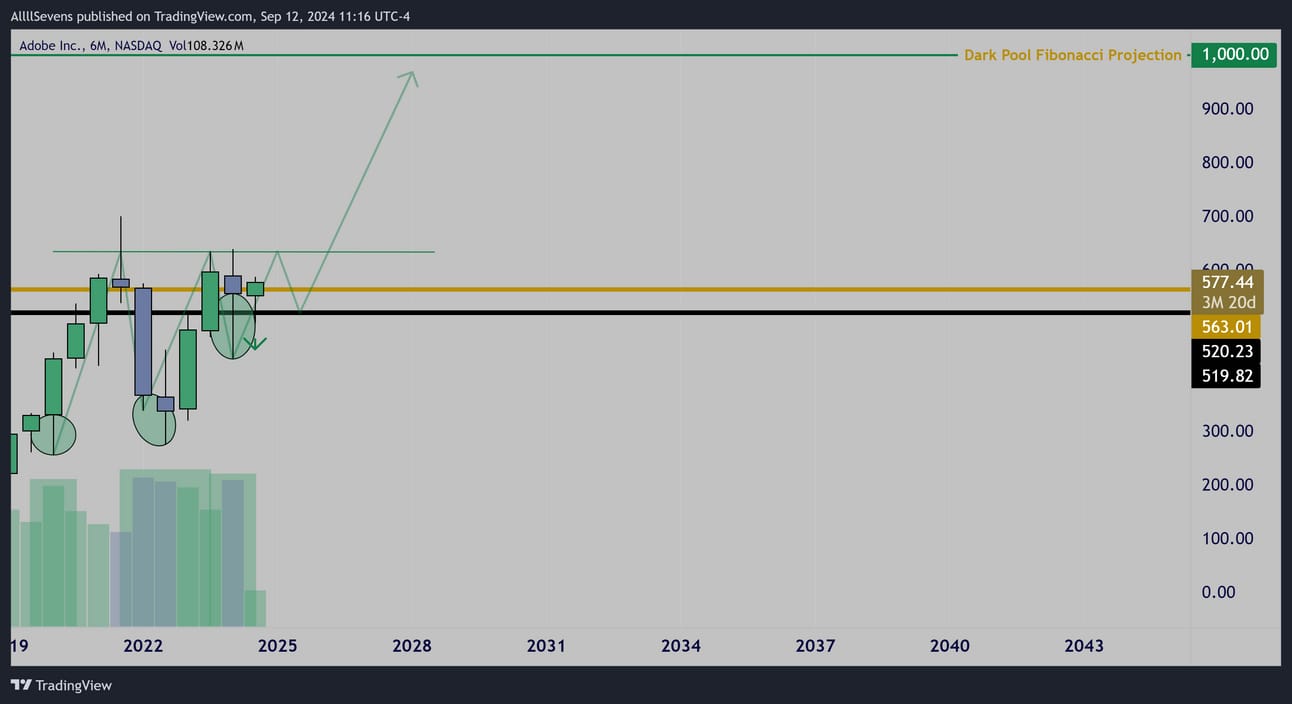

$ADBE 6 Month Interval

Huge long-term ascending triangle.

Propped just over it’s largest Dark Pool on record headed into an earnings report after today’s close. Crucial for the sector.

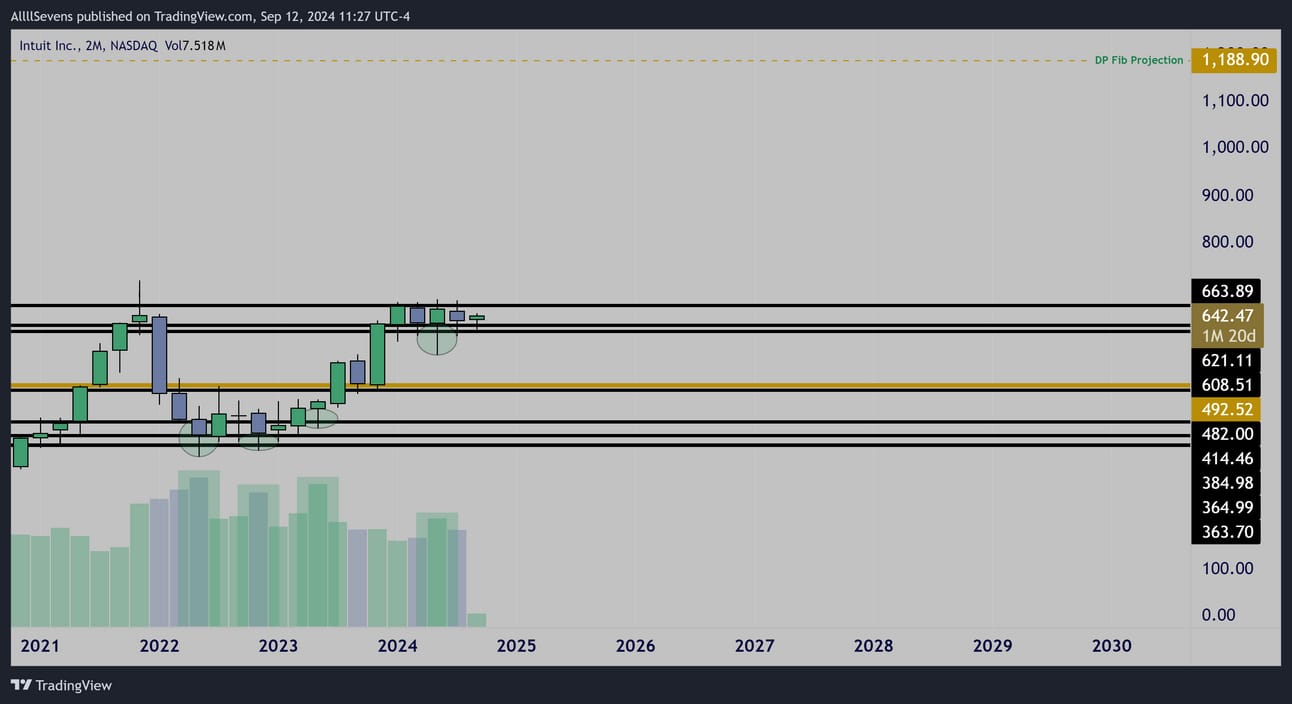

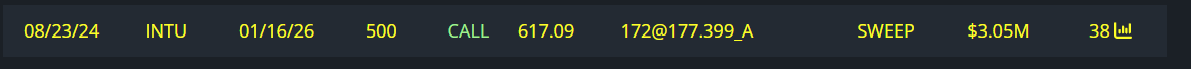

$INTU Two-Month Interval

Arguably the cleanest chart in the sector.

Truly incredible. This stock has so much potential behind it.

The compression and continued accumulation just below prior ATH’s is truly unprecedented. I should be writing a newsletter solely for this stock. I probably will.

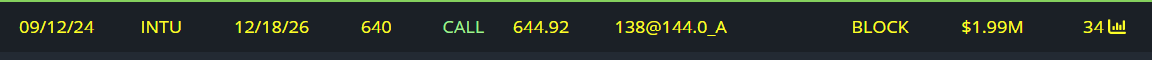

$2M Call Buyer for December 2026

$3.7M Call Buyer for June 2025

$3M Call Buyer for January 2026

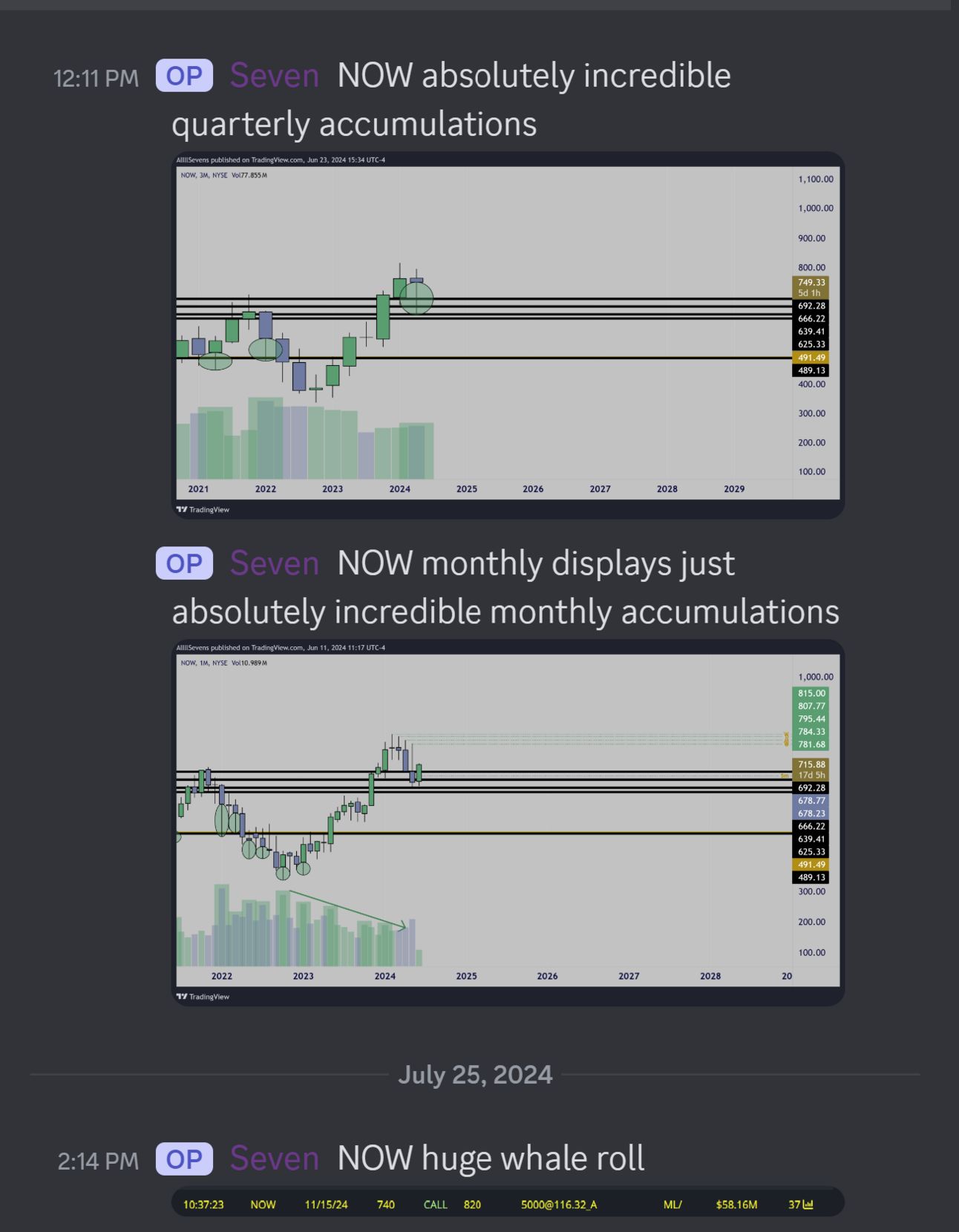

$NOW Quarterly Interval

Miles ahead of the entire sector.

I covered this extensively in my Discord months ago.

Not something I’m interested in at the moment. Looks like a hold and would surely continue to benefit from a sector-wide breakout.

Data shared exclusively in Discord

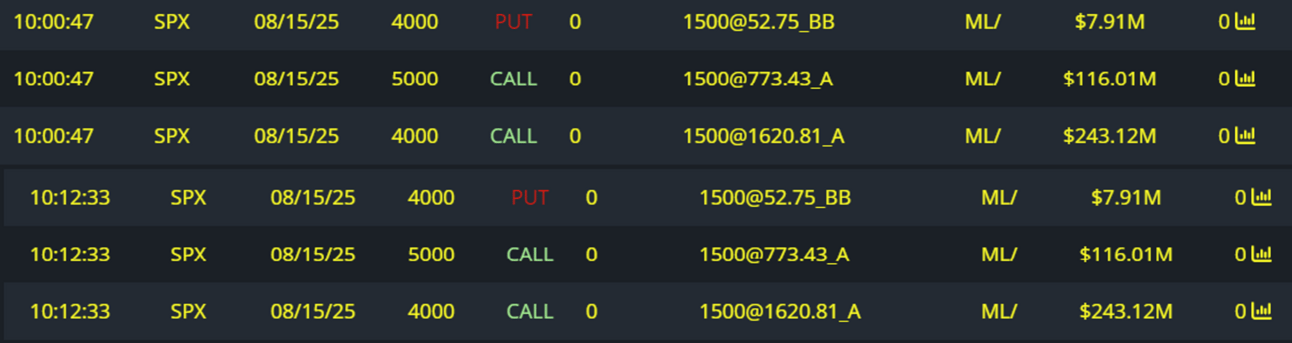

Before ending this newsletter, perhaps I should share some broader market flows that have been coming in.

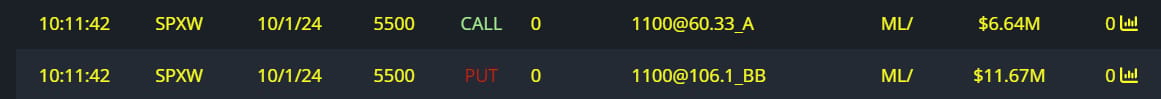

$600M+ Full Risk Bull on LEAPS executed at lows yesterday

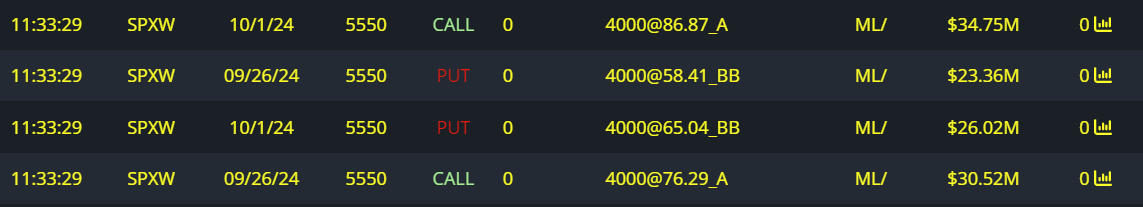

$100M+ Full Risk Bull into 9/26-10/01

This was executed today

$18M Full Risk Bull for 10/01 executed yesterday near lows

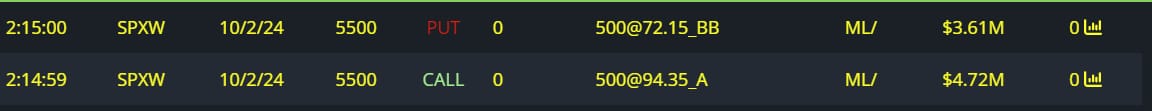

$8M+ Full Risk Bull for 10/02

Executed Yesterday

$8M Bullish Debit Spread for Dec

Executed Yesterday

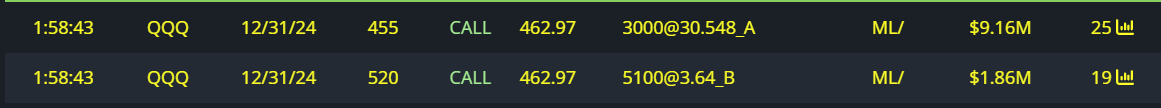

$15M Full Risk Bull for November

We’re seeing some unpresented amount of leveraged bullish positioning. Not just option trades being executed, but the very notable largest DP on record for TQQQ being accumulated.

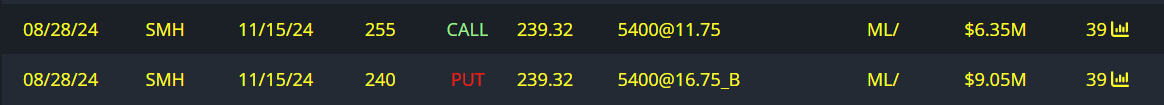

I have also been continuously sharing micro-accumulations occurring on the SOXL and the SPXL over the last two weeks.

Perhaps this is all for a reason.

Maybe the entire market is about to explode to the upside.

I have said it before and I will say it again-

There is no large DP support nearby for SPY

No resistance to reclaim for entry either… I just know there’s a better chance of an upside drift than a correction right now.

For semi-conductors, the SOXL and the SMH, there are levels just above that if reclaimed can spark big moves. More confirmation needed.

Very similar to the TQQQ, which i think is the best vehicle to use for bullish broader bullish confirmation right now.

The QQQ itself also has levels above to execute from unlike SPY

Overall, the software sector is by far the most attractive from a short-term m traders view, because we are directly inside dark pools, giving us clear levels to manage risk from. This is where my focus will be-

And if/when TQQQ reclaims support and goes green on the month, with semi’s potentially doing the same, I can begin to shift that way as well. For now,

MSFT is THE focus for me

ADBE ER will be important for the IGV sector

CRM is a major LT focus. After a poor reaction to ER, it could greatly benefit from broader confirmation on the TQQQ

INTU is also a really great focus right now

Best of luck.

Remember, this is the stock market and no idea or predictions shared above are for certain, no matter how convincing they are-

Especially in the short-term, anything can happen.

We can only find probabilistic scenarios and defined risk, which I believe is what I have laid out here.

As always, I truly hope you found value in this newsletter.

Make sure you’re subscribed for my next one!

Subscribe here.

Make sure you’re following me on 𝕏/Twitter for updates.

@SevenParr

If you are finding immense value in my analysis-

Please Upgrade your subscription to AllllSevens+ for just $7.77 per month and compensate me for the time I put into my work.

Also get access to my Discord where I share even more data, gathering and collecting information before I write newsletters and make posts to 𝕏/Twitter. “behind the scenes access” if you will.

$NOW is a great example of something I just never got around to sharing on twitter or writing a newsletter about. Unfortunate for people not in the Discord.

You can also ask me questions anytime in Discord, and always get a response. I often do not respond to twitter DM’s or chart requests.

I will always make time to respond in Discord.

There is a great community of like-minded individuals coming together here. I would love to see it grow. The link is above to upgrade!

Only $7.77 per month. Cancel at any time. )

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply