- AllllSevens

- Posts

- SPY Daily Outlook 1/18/24

SPY Daily Outlook 1/18/24

An update on my weekly thesis!

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

My outlook on the market is determined using Volume Price Analysis, specifically at the largest dark pools on record for the ticker in question.

Doing this allows me to present the market through the lens of an institutional trader/investor. Pure data. No personal bias.

I can determine whether or not “smart money” has bought, is buying, has sold, or is selling. This can be extremely valuable information.

This week’s newsletter for reference:

https://allllsevensnewsletter.beehiiv.com/p/weekly-outlook-11624

I called for large upside expansion towards $490 to begin.

I called for new ATH’s by 1/17-1/22

Invalidation being failure to open above $475.15 this week.

This level also to be used in order to manage risk.

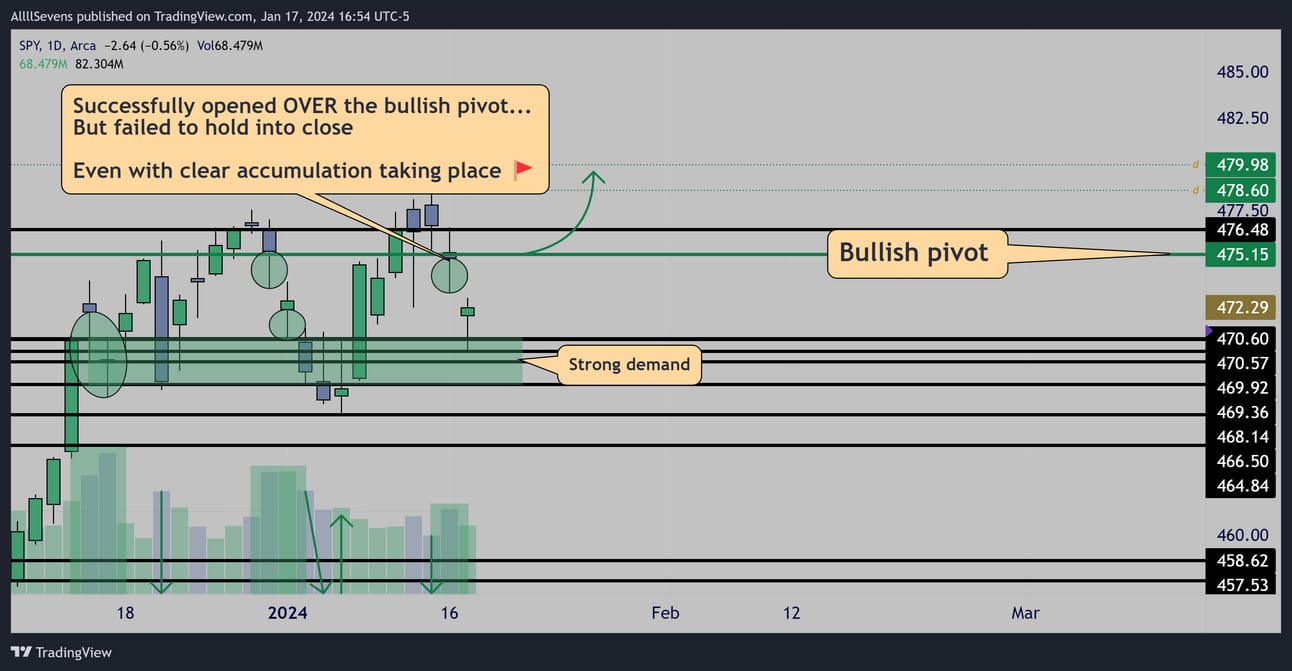

Price opened over this level to begin the week, confirming my thesis.

But, it was not respected into yesterday’s daily close.

This was a major red flag, and good signal to manage risk.

Something was wrong.

After closing below our pivot, a large drop followed-

All the way to the bottom of the accumulation range.

Because of the lack of volume on this today’s bounce I did not re-load my calls.

I am still looking at calls though…

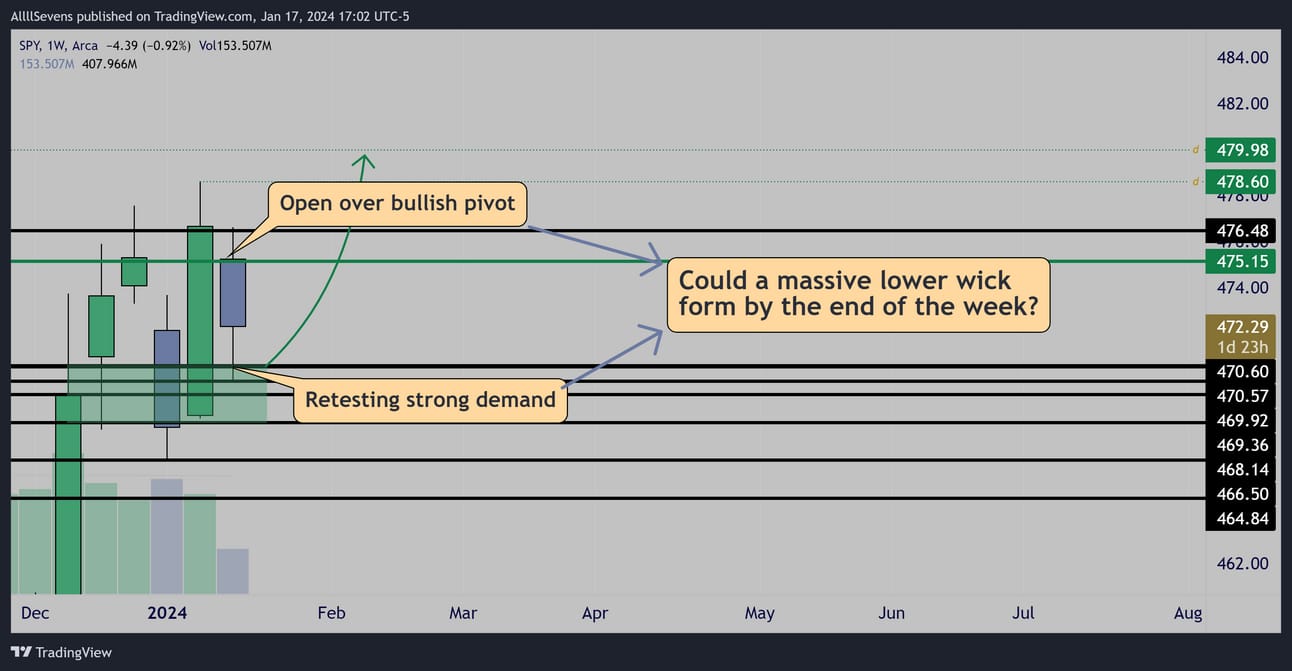

When you look at this from a weekly candle perspective-

Weekly

It would be insane to short this weekly candle!

With an open over our bullish pivot-

This is just a giant re-test of previously accumulated levels.

If price bounces and reclaims $475.15 into the EOW my thesis could begin coming back together!

Like I said, due to the lack of daily volume I did not reposition in new calls. I have taken a loss on my thesis this far.

For me to buy calls again, I need one of two scenarios:

-Another dip into demand tomorrow, with a seriously STRONG entry signal resulting in HIGH daily volume bouncing it up just like today.

An entry signal for me s a high volume hammer, tweezer bottom, inside candle, or engulfing candle.

-A large gap up over the bullish pivot, $475.15

These are two specific conditions that I may or may not get.

There’s one thing that concerns me about all of this, and it’s preventing me from feeling any FOMO from no longer being positioned long:

If last Thursday’s candle was a successful test of supply, then why did price lose $475.15 in the first place? Why has there been MORE sell-pressure? A successful test was supposed to mean no more sell-pressure.

This is definitely a concern of mine, and it’s why I have very demanding conditions I need met for me to add long again tomorrow.

If one of my scenarios above does not confirm my entry, then it’s very possible that Thursday’s candle was a failed test.

If that’s the case, expect a follow up newsletter explaining why I think this happened and how I can learn from this moving forward.

A few more pieces of data I’d like to share supporting the potential for SPY’s weekly candle to make an epic turn-around:

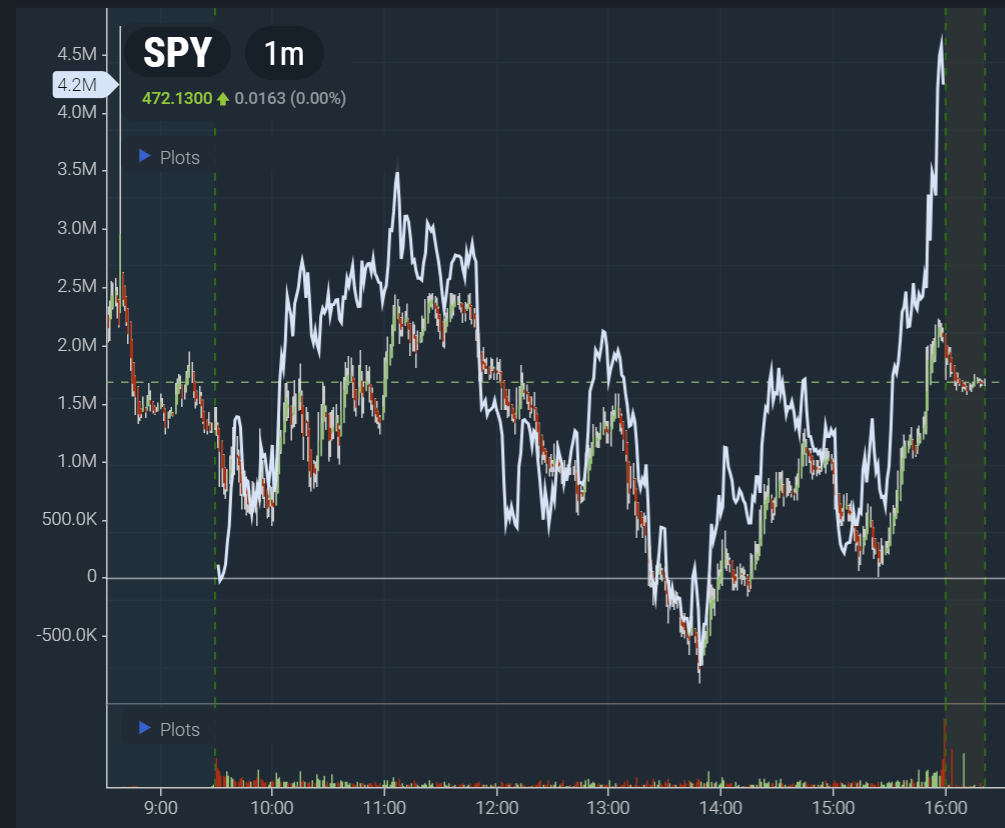

SPY Net Options Delta

This is an indicator from the BlackBoxStocks platform that gives us a cumulative reading on the options flow for the session.

Today, the NOD diverged price to the upside…

Pumping to a new high of day, while price made a lower high into close…

This tells us the overall options flow for SPY is positioned for further upside.

Second,

While the SPY daily bounce lacked in volume, the QQQ did not.

This definitely helps the bull case.

My conditions for taking QQQ calls are the exact same as SPY

A large gap up over the bullish pivot, $409.35,

Or a strong buy signal on a retest of demand below that turns into a second very strong daily long signal.

This week has been tough to say the least!

If you didn’t manage risk like a robot on yesterday’s failure to hold the bullish pivot, you got caught in a brutal gap down that likely forced you to close calls due to the severe drawdown.

I’ll be honest… I’m in that boat!

I was too biased to close my calls on yesterday’s close for a small loss despite the chart clearly telling me something was not right.

Today came, and I was full of emotion.

I cut my position for a larger than necessary loss.

But, I survive to trade another day, and a lesson was learned.

I’m ready to execute again.

Make sure to follow my new twitter!

https://twitter.com/SevenParr

Like & retweet to show your appreciation and help me grow my following it’s former glory! I can’t do it without your help.

And if you really like my style of analysis, you’re going to want to subscribe to my premium newsletters. They’re just like my weekly newsletters, but fewer in between (quality>quantity) and they’re on more than just the main Indices.

Also, get access to my Discord server!

Upgrade for just $7.77

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtjKR2

Reply