- AllllSevens

- Posts

- Weekly Outlook 1/16/24

Weekly Outlook 1/16/24

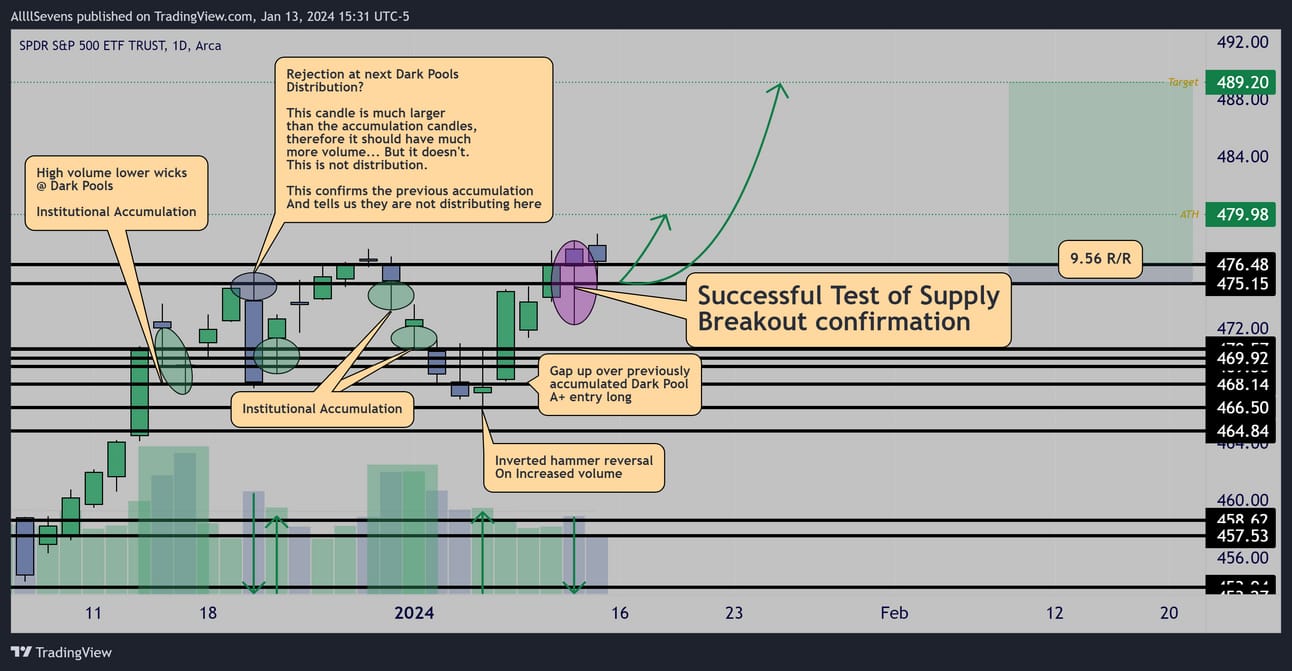

SPY Daily Upside Expansion

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

My outlook on the market is determined using Volume Price Analysis specifically at the largest dark pools on record for the ticker in question.

Doing this allows me to present the market through the lens of an institutional trader/investor. Pure data. No personal bias.

I can determine whether or not “smart money” has bought, is buying, has sold, or is selling. This can be extremely valuable information.

Preface:

Make sure to check out my 2024 outlook for SPY:

https://allllsevensnewsletter.beehiiv.com/p/allllsevens-newsletter-2024

To sum it up-

I’m EXTREMELY bullish the market long-term.

The S&P500 and each indivudal sector inside has seen outstanding institutional accumulation over the last two years and should eventually see major upside towards $650+

When?

Short-term, I have been preaching reason to go “risk-off” as the yearly chart signaled a pause in trend, the market entered extreme greed, and two major sectors, Financials and Consumer Discretionary, are at resistance… This was the “perfect storm” giving bears a window of opportunity during the last few weeks…

They tried. They failed.

This week I have an extremely important update on the SPY.

Price is ready to go up.

SPY

The SPY has been in an accumulation phase for the last month.

Institutions have been absorbing (accumulating) all of the active sell-pressure (supply) in the market, preparing for a rally (mark-up phase).

Before beginning the rally, they need to run a “Test of Supply”

on the market to make sure all sell-pressure has been properly absorbed and an efficient mark-up phase can take place.

How is a Test of Supply ran?

They let price rise into resistance where sellers should already be active if there are any- on top of this, they sometimes drop a negative headline to further entice sellers…

Their goal is to get anyone who wants to sell, to sell.

They are testing how much supply / sell-pressure is still in the market.

During the sell-off, institutions will buy the dip, bringing price back into resistance by close, creating a large lower wick and a small candle body.

The amount of volume required to create this candle tells them how much sell-pressure there is in the market.

If it takes a lot of volume to catch the knife, then their is still too much supply in the market. They need prolong the accumulation phase.

A mark-up attempt would only be met buy more selling.

If it takes little volume to catch the knife, then this signals their accumulation phase has been successful. Supply has been absorbed.

Price is ready to be efficiently marked-up.

Daily

After an entire month of accumulation-

Last Thursday, the market got tested.

Price came into resistance ($475.15-$476.48) and a hot CPI was released, enticing sellers to show their strength.

Institutions bought the dip and created a Test Candle.

The market passed.

They created a massive lower wick back into resistance on hardly any volume (especially for a CPI day) telling us the accumulation phase has been successful and an efficient mark-up phase can now occur.

Using a .618 Fibonacci from the low of the range, to the highest accumulated Dark Pool, I project a rise in price towards $489.20.

Using 475.15 as a level to manage risk, that’s a 9.56 risk-to-reward setup!

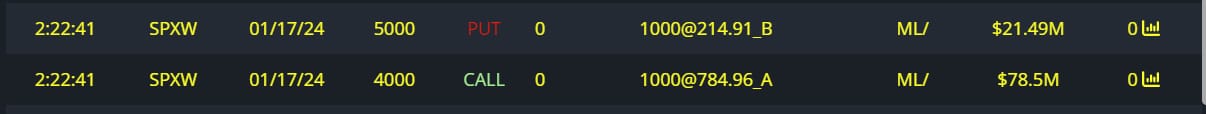

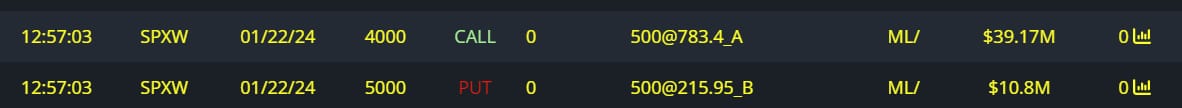

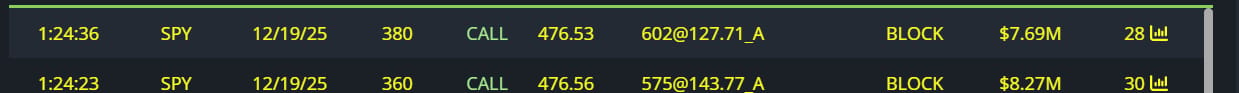

Unusual Options Flow

$100M Full Risk Bullish Order

$50M Full Risk Bullish Order

$16M Calls Bought

Conclusion

I’ve never been more confident in my analysis.

The SPY is ready for a period of Daily expansion.

New ATH’s should come fast. (1/17-1/22)

$489.20 should come in due time.

I wish I had a crystal ball to predict exactly how long that it will take!

If price opens below 475.15 next week, my entire thesis is invalidated for a short-term move. This would be very strange.

If this happens, I’m back to being “risk-off” in the short-term.

Before you go,

Make sure to follow my new twitter account:

https://twitter.com/SevenParr

If you want even more of my market research, sign up for my premium newsletters + Discord access for $7.77 per month

I have some extremely interesting newsletters coming for AllllSevens+

THIS WEEKEND

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtjKR2

Reply