- AllllSevens

- Posts

- AllllSevens Newsletter 2024

AllllSevens Newsletter 2024

The S&P500

Disclaimer

All information presented in this newsletter is my personal opinion & for speculation purposes only.

Nothing stated is intended to be interpreted as financial or investment advice.

I am not a financial advisor and I am not giving you financial advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is the Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this tweet below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Reach out if you have questions.

Preface:

First, I will display the almost unbelievable, but very realistic, long-term potential of the S&P500 and it’s indivudal sectors.

Then, I will discuss the current market environment and the criteria that must be met for a short-term breakout in 2024, as well as the potential for a pause in trend / market pullback!

SPY

There are 11 sectors in the S&P500 and they each have their own dedicated ETF:

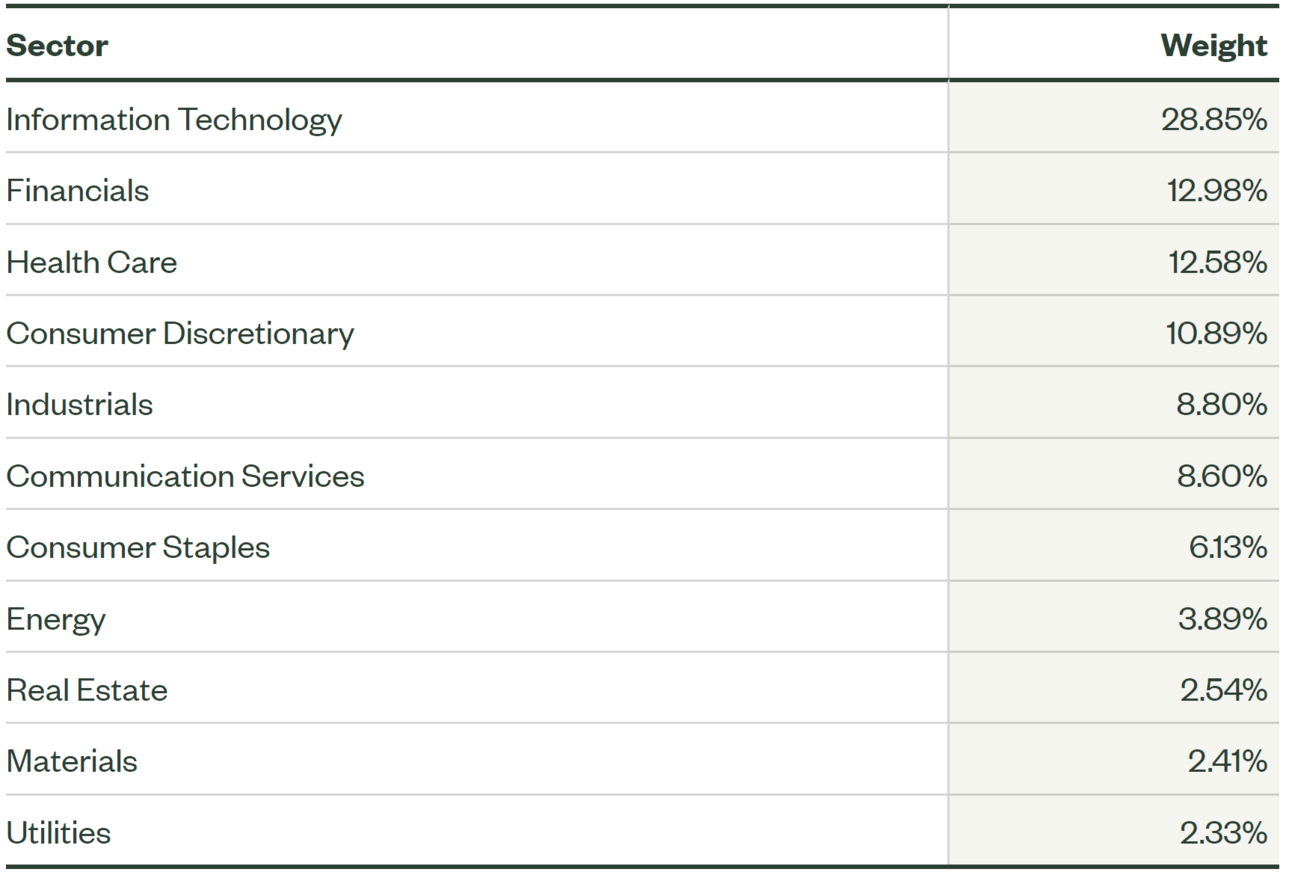

Sector Weightings

XLK XLF XLV XLY XLI XLC XLP XLE XLRE XLB XLU

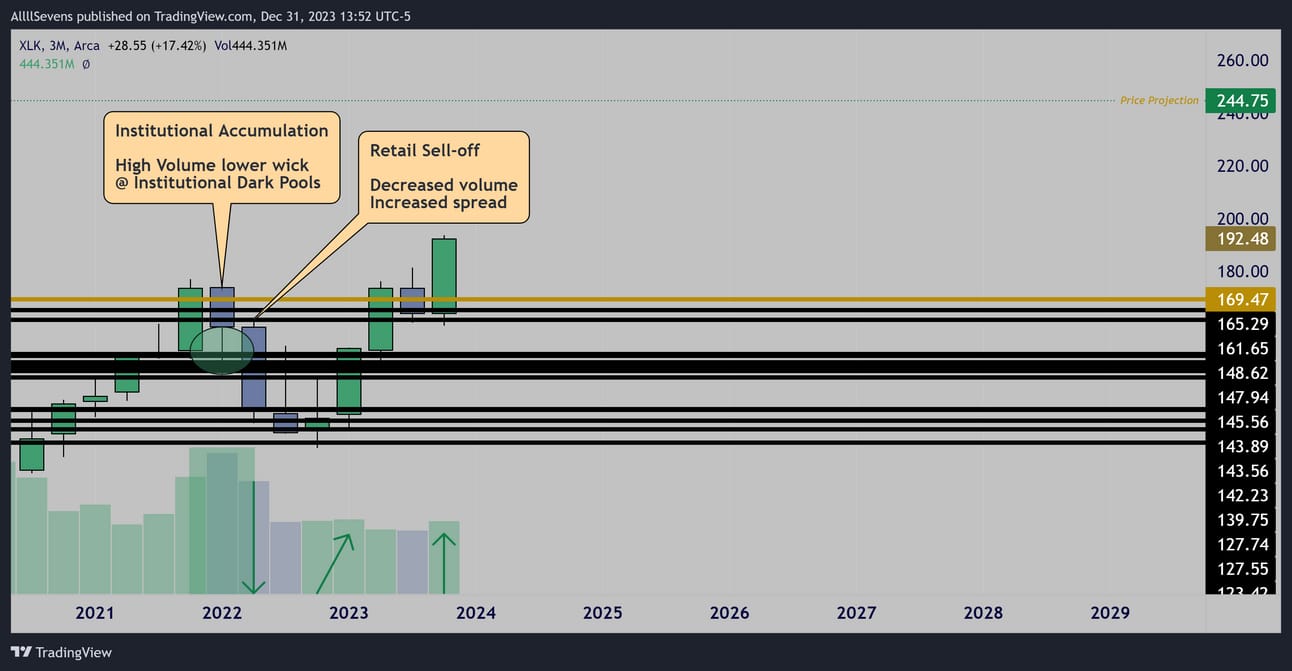

Technology (XLK) :

Quarterly

The XLK shows institutional buy pressure in early 2022 visible through a very high volume lower wick at major Dark Pool levels.

Following this candle was confirmation of the accumulation:

An increased spread sell-off with decreased volume relative to the accumulation… This tells us retail participants drove prices lower and the institutions who accumulated never sold out-

A pattern you will see repeat itself time and time again.

It’s how the market works. It transfers money from the patient to the impatient testing participants with short-term drawdown.

It’s now in clear space with my long-term projection lying at $244.75.

With no levels nearby, this is at the bottom of my short-term focus list. I’m not a buyer or a seller here. I’m somewhere else!

Financials (XLF) :

Monthly

The XLF shows some very aggressive institutional accumulation over the last two years-

Notably, directly off it’s largest Dark Pool on record ($38.01).

This ETF is at the top of my short-term focus list.

Once $38.01 gets broke and turns into support, large long-term upside expansion towards $51.50 can finally begin.

Until the breakout occurs, a short-term rejection wouldn’t be crazy to see.

I’ll speak more on this later.

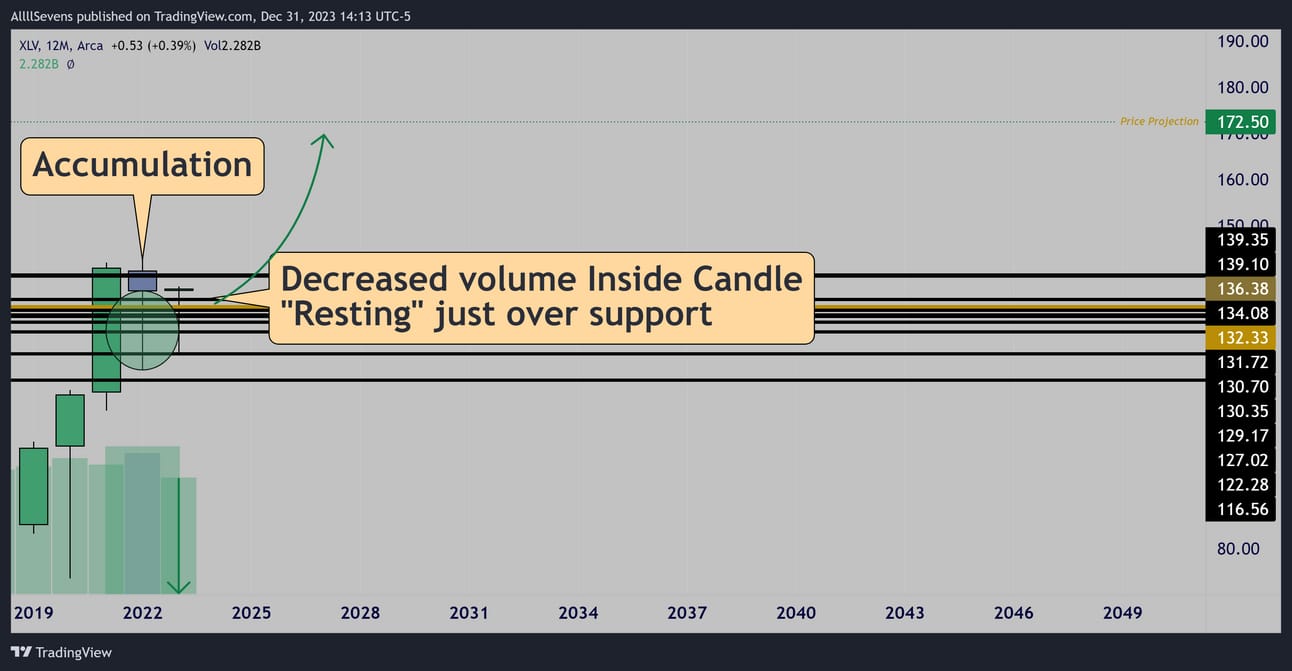

Healthcare (XLV) :

Yearly

The XLV sector… is incredible.

Healthcare should emerge as a major market leader over the next few years.

The yearly candle displays large institutional accumulation directly off the largest Dark Pool on record.

Following this is a decreased volume inside candle,

“Resting” just over the Dark Pool support.

This creates an A+ environment for an explosive move over the next few years, expanding towards $172.50.

I wrote an entire premium newsletter for AllllSevens+ subscribers covering the XLV in much more detail as well as my top 12 individual Healthcare stocks. Some of the individual names in this sector have truly incredible long-term accumulation patterns. Extremely valuable stuff.

I wrote a FREE newsletter on one of those names if you’d like to get an idea on what I’m talking about.

Walgreens Boots Alliance, Inc. $WBA

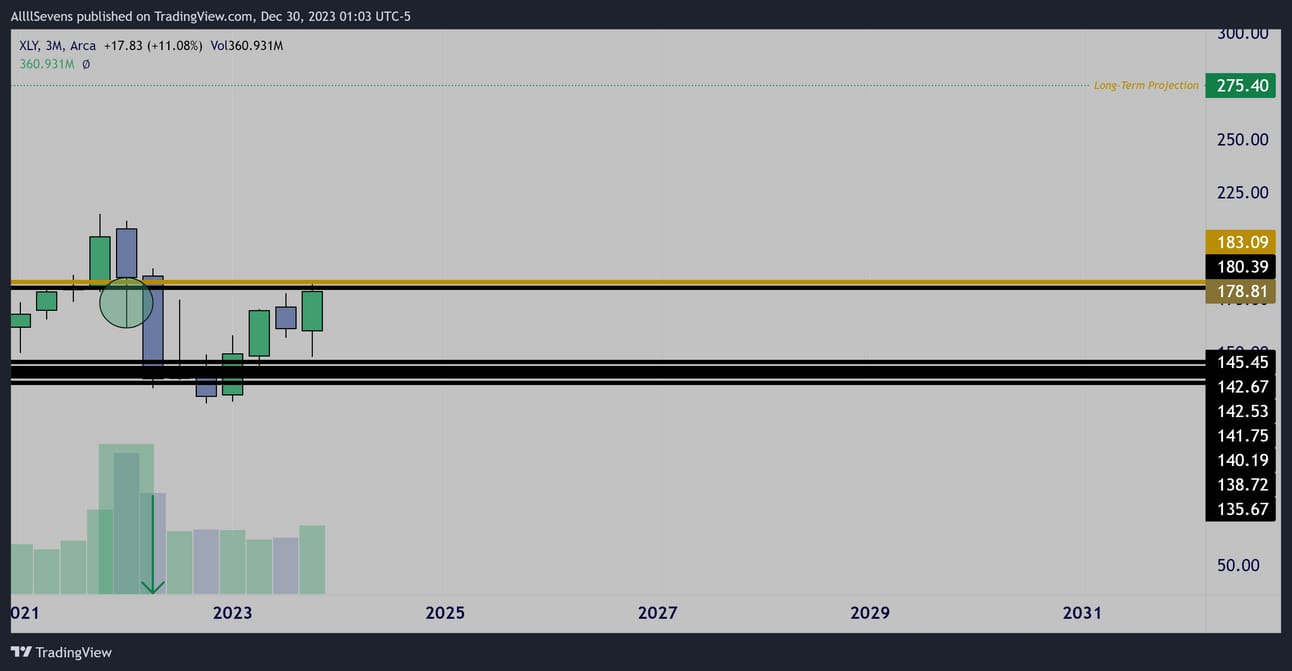

Consumer Discretionary (XLY) :

Quarterly

The XLY shows the same situation as the XLF.

Institutional accumulation off it’s largest Dark Pool on record ($183.09)

Followed by a large retail driven sell-off.

Once price can break over $183.09 and turn it into support, long-term expansion towards $275.40 can begin.

The XLF and XLY sectors will be critical for short-term continuation of the current SPY rally. I’ll speak on this more in a moment.

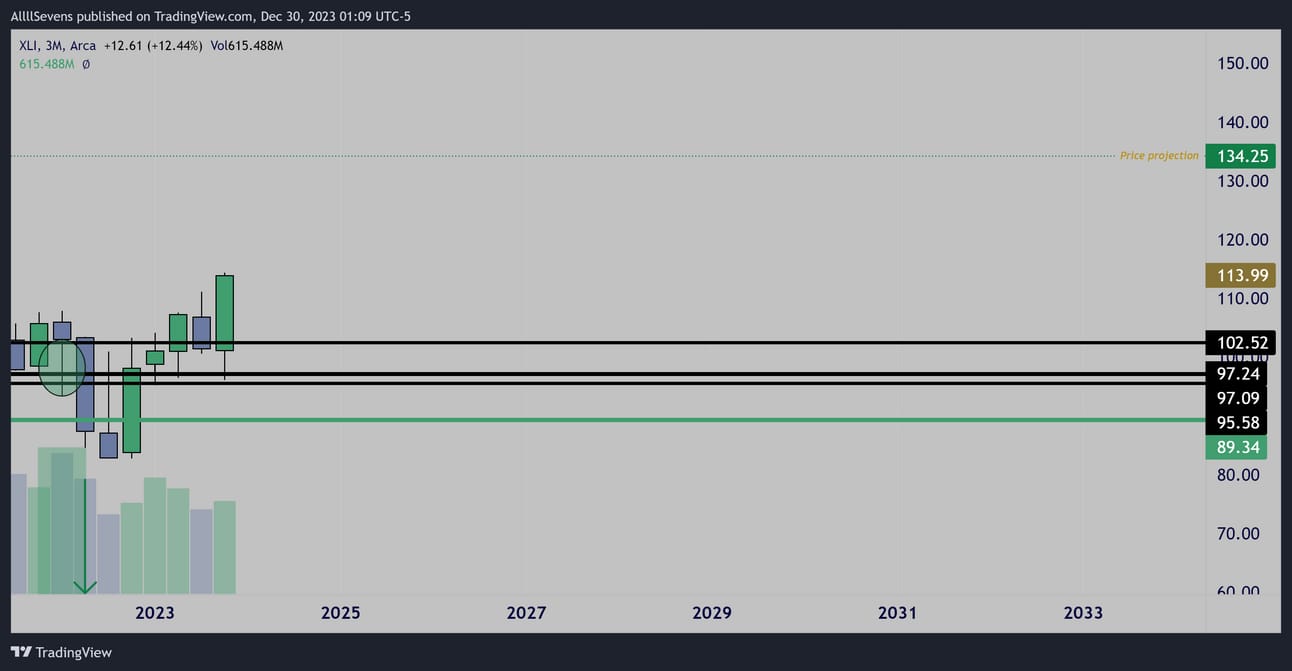

Industrials (XLI) :

Quarterly

The XLI was heavily accumulated in 2022 and is in clear space to it’s long-term projection at $134.25.

With no levels nearby, this sector is at the bottom of my short-term focus list.

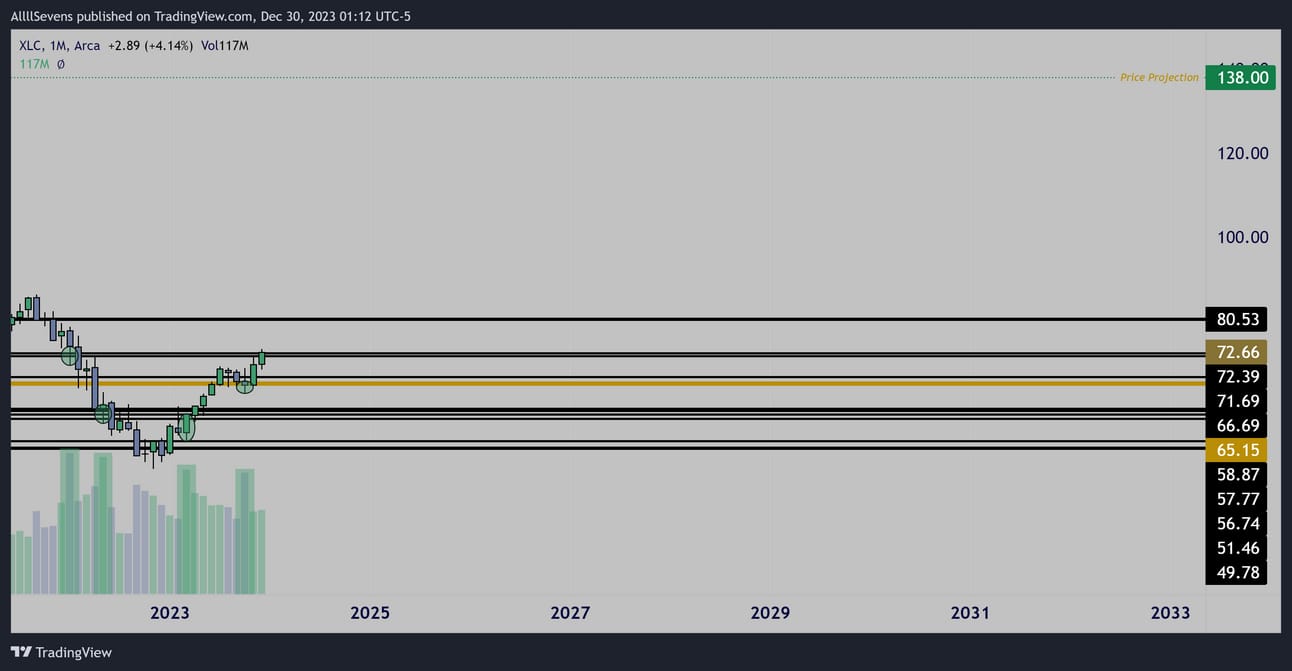

Communication Services (XLC) :

Monthly

The XLC displays incredible institutional accumulation.

I project $138 will come long-term.

Right now, as long as $71.69-$72.39 remains support, there is a large short-term range towards $80.53.

If support is lost, I’d expect the largest DP on record, $65.15 to be a magnet.

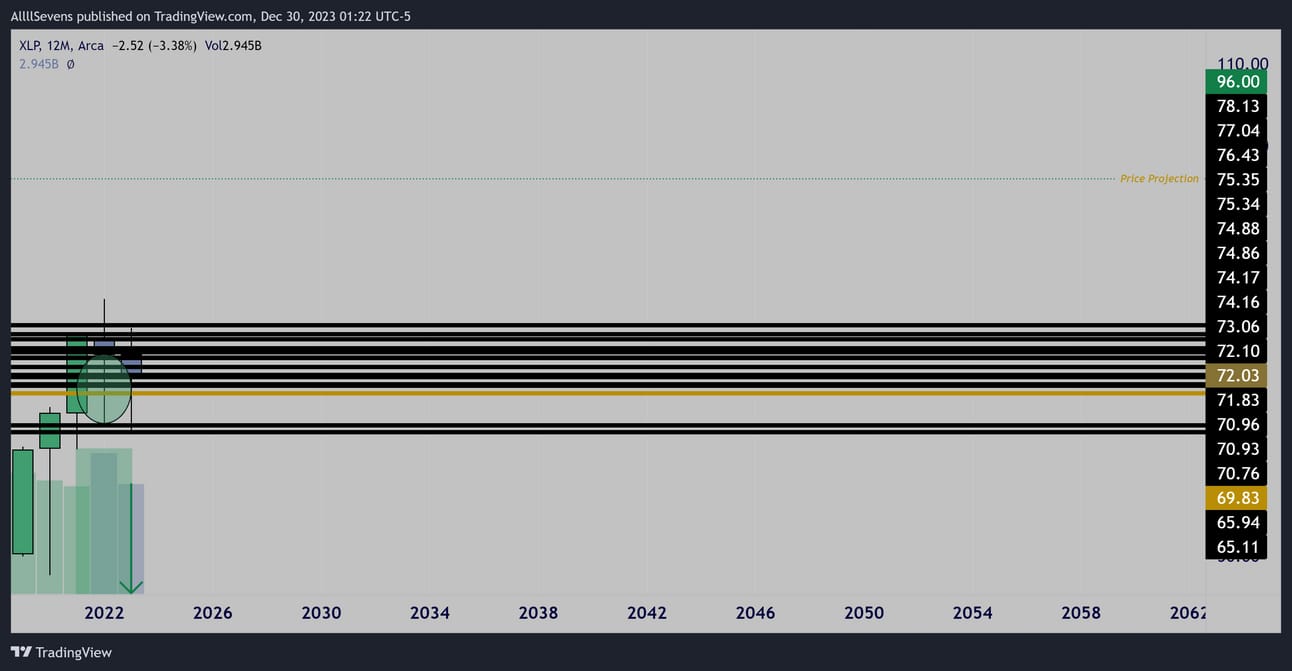

Consumer Staples (XLP) :

Yearly

The XLP shows large accumulation off it’s largest DP on record, with a projected price target of $96.00 long-term.

The setup here is similar to the XLV, but not as perfect due to the massive amount of levels above.

I like a few indivudal names in this sector MUCH more than the ETF itself.

They’re setting up very nicely on the quarterly time frame for potential short-term expansion in 2024.

My favorite is PepsiCo, Inc. $PEP

I wrote a premium newsletter on this a few weeks back.

It’s an amazing defensive stock on a deep discount for the long-term that I’d love to own at current prices.

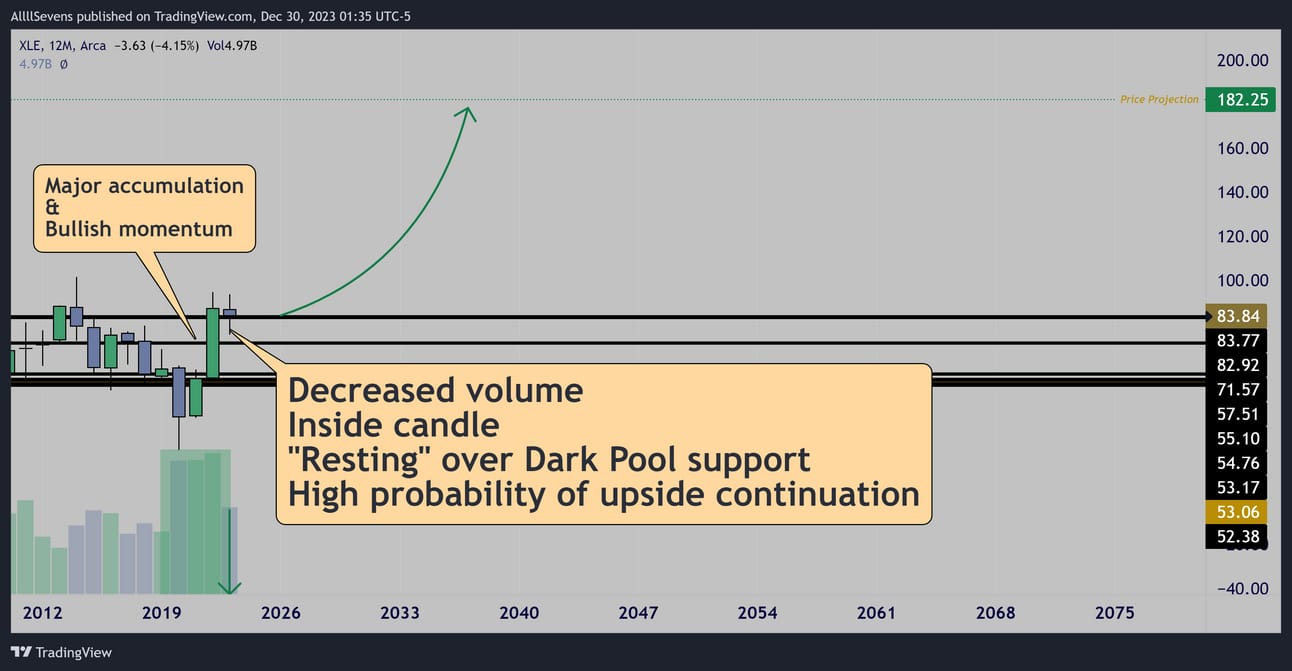

Energy (XLE) :

Yearly

An absolutely outstanding setup here on the XLE.

A large bullish impulse over the last two years followed by a decreased volume inside candle, “resting” just over Dark Pool support…

This creates the perfect environment for a “melt-up” type move towards $182.35 over the next few years as long as the yearly chart holds $82.92.

As a short-term trader it’s important this level is defended over the next few quarters because this sector is known to easily fall into LONG durations of chop-

Not invalidating the fact that it’s very bullish long-term for $182.25,

but totally destroying any short-term focused traders who can’t wait multiple years.

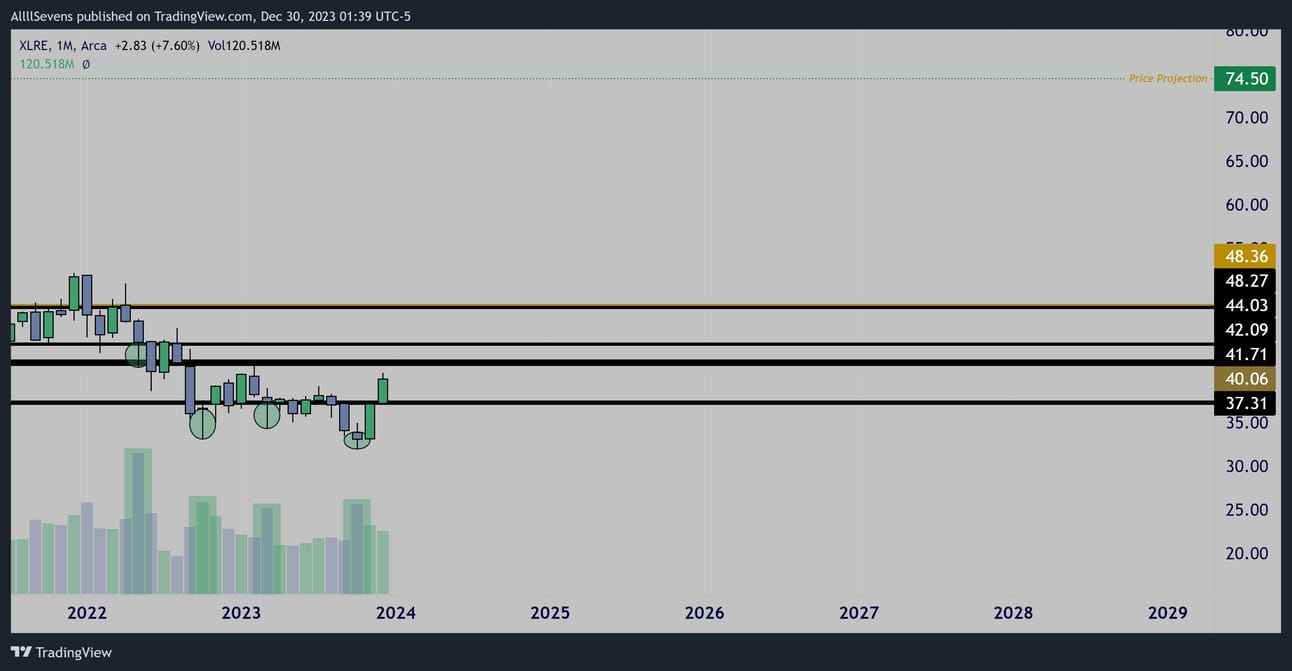

Real Estate (XLRE) :

Monthly

The XLRE has seen some serious accumulation over the last two years.

One of the best.

My long-term projection is $74.50.

As of right now, it’s not near any levels to be executing a short-term trade

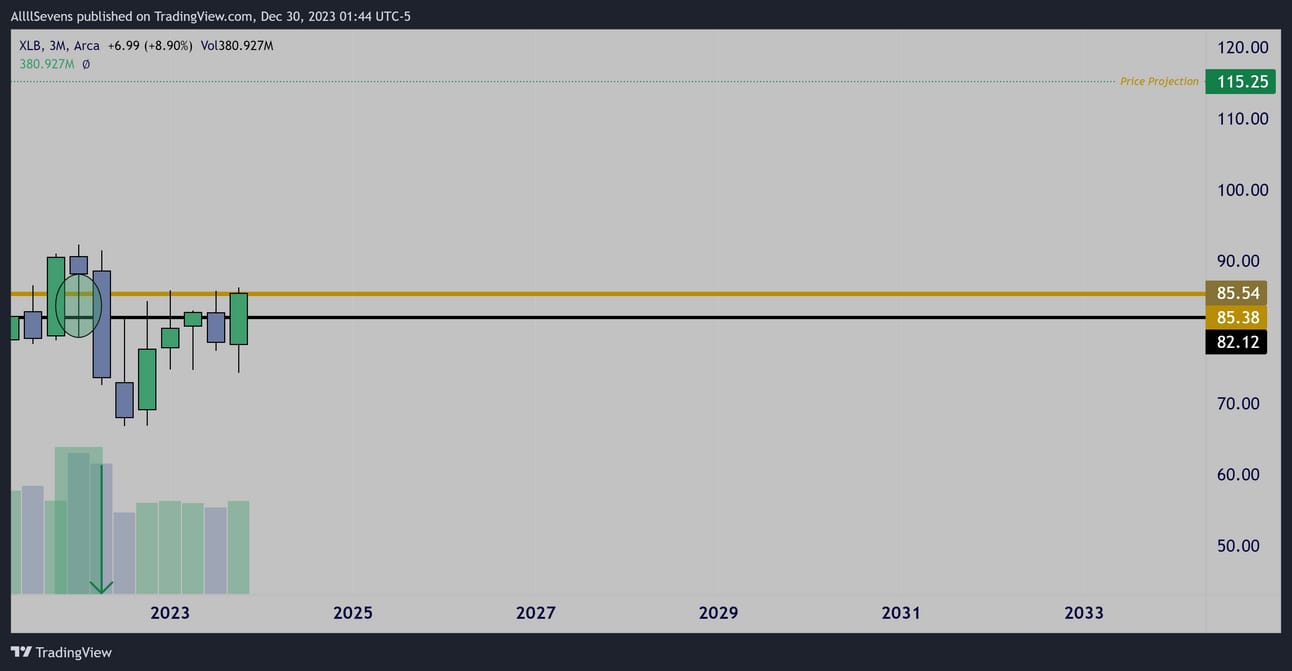

Materials (XLB) :

Quarterly

The XLB shows the same outstanding quarterly accumulation as a few of the other sectors display, directly off it’s largest Dark Pool on record.

Once this level gets broke and turned into support, long-term expansion towards $115.25 can begin.

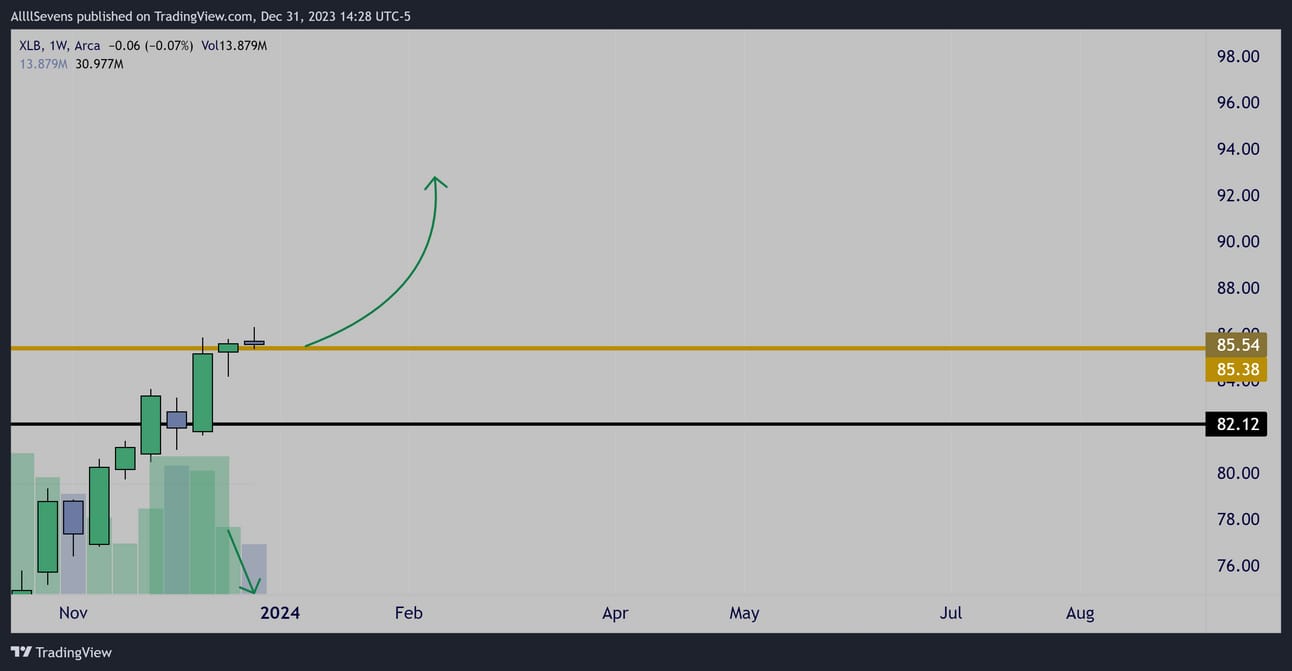

Weekly

High volume bullish impulse leading to a break of $85.38

Followed by two decreased volume “resting candles” over support.

Creates a perfect environment for potential upside expansion.

I have an extreme gut feeling that this short-term setup will NOT work due to the short-term environment of the market which I am about to explain… But the setup is there.

90% of the time, environment tis more important than the setup,

So, I won’t be looking to trade this.

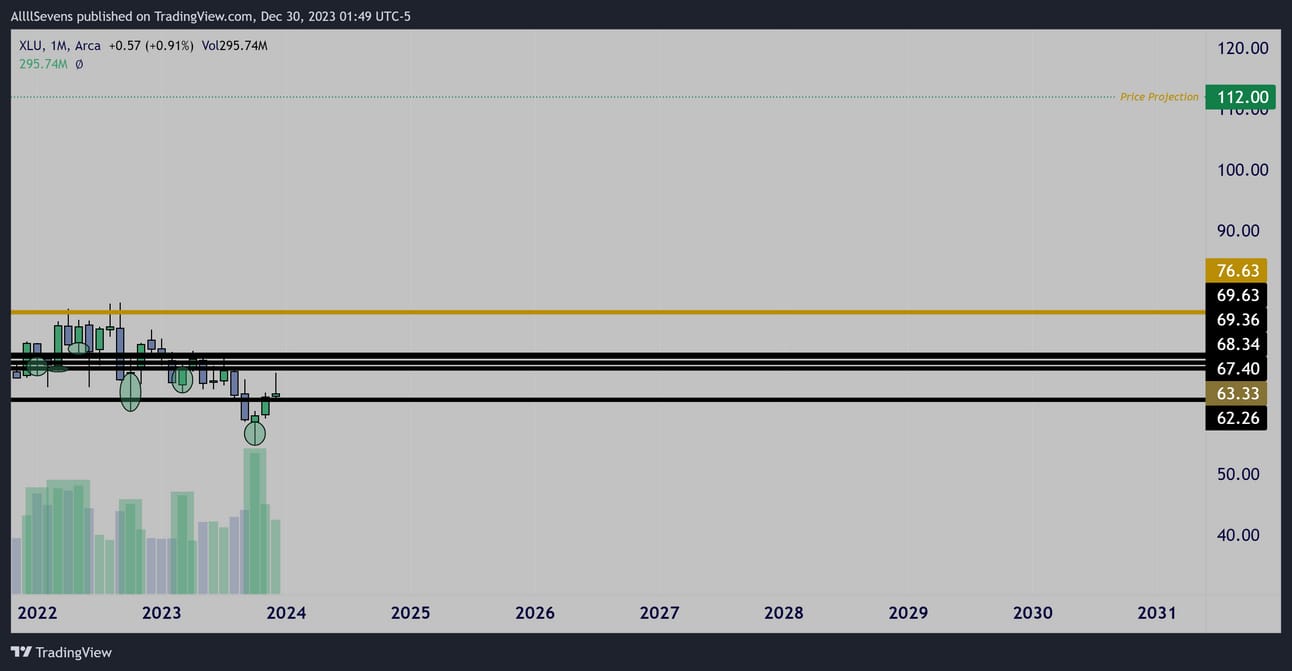

Utilities (XLU) :

Monthly

The XLU displays some of the best accumulation patterns I’ve ever seen.

Long-term I project $112.00

Short-term I’m actually not interested until the current downtrend gets broke and the 67.40-69.43 area gets reclaimed.

That, or a massive volume hammer directly off 62.26

Let’s talk about the SPY itself now.

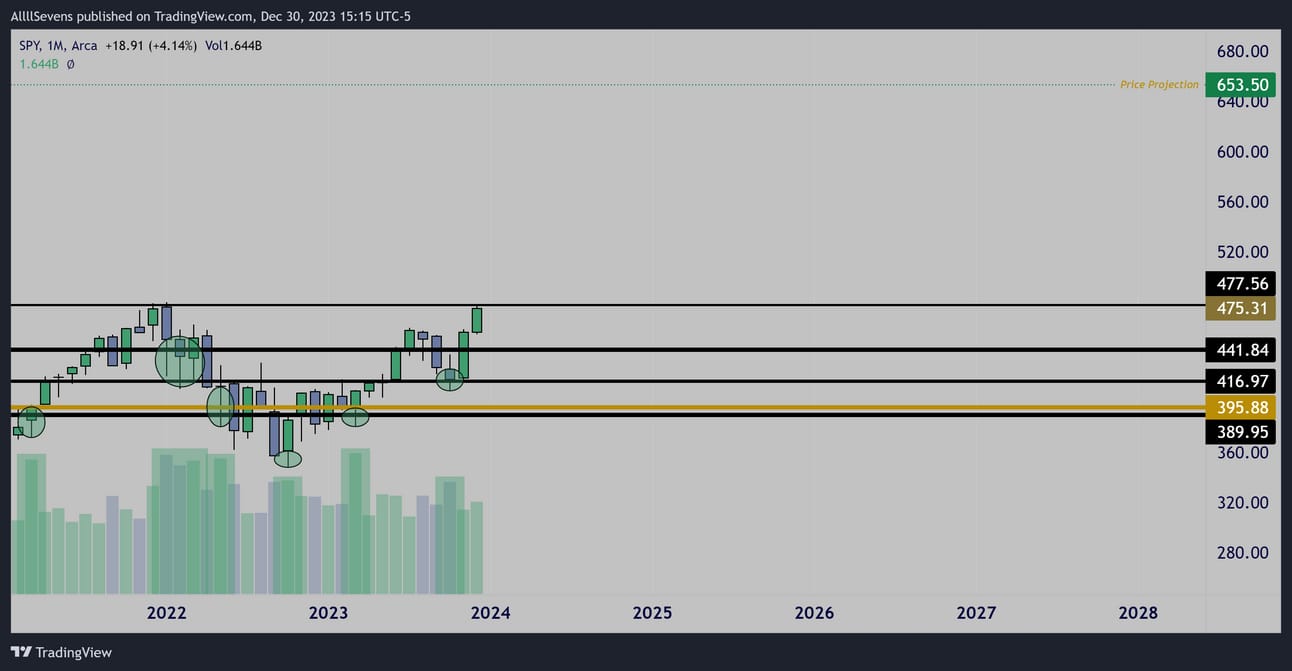

Monthly

The S&P500 has been HEAVILY accumulated over the past two years.

Long-term I project $653.50 as my target.

Let’s bring this all together-

Understand the analysis I just shared is geared towards the

LONG-TERM INVESTOR.

The opportunity in front of us for large upside expansion over the next decade, or however long it takes, is outstanding. Life changing.

If the indices look like this…

Imagine the potential of some individual names…

Below are some recent FREE newsletters I’ve wrote.

$HOOD & $M

$T

$ZM

$CHWY

$CZR

$ETSY & $BYND

Moving forward, I will be mostly writing about indivudal stocks exclusively for AllllSevens+ Subscribers

Here are some names I’ve covered already…

And I’ve only scratched the surface.

$PTON & $KSS $SNOW & $ETSY $JD $MDT $ZS

In my FREE newsletters I will continue to update the sectors and indices with individual stock picks far and few between. The stock picks are where the most value is and I think they’re worth at least $7.77!

Back to the SPY discussion-

While the volumes clearly point up long-term on every single sector I just displayed, short-term fluctuations in price are much more complex and “random”

There are many other factors to consider, like trend, support & resistance, as well as overall market sentiment.

So,

How likely is it that the entire market is ready to continue up NOW?

A lot of us are experiencing a major fear of missing out on this rally…

I’m here to eliminate that.

The market moves mechanically,

And it’s currently “pausing” for the next move, allowing us time to prepare. There is no rush. Let me explain-

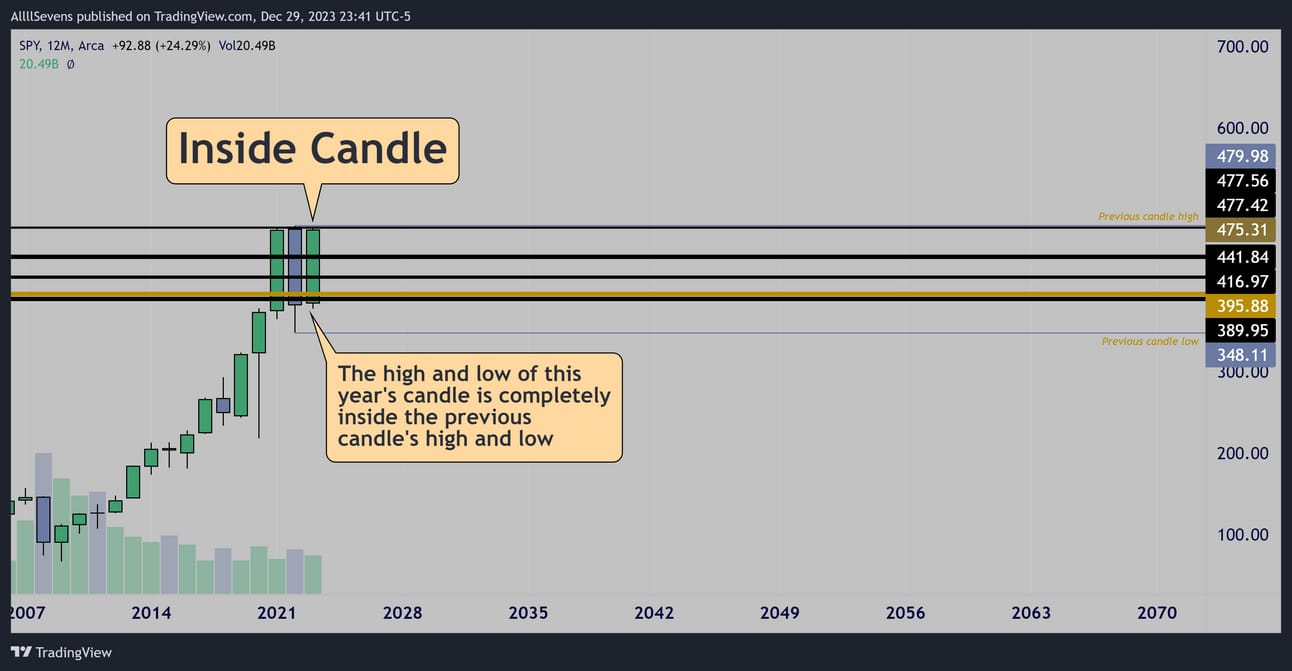

Yearly

2023 has formed an Inside Candle,

This signals a period of “indecision” in the market.

A “pause” in trend.

This is great for traders-

It’s giving us time to prepare and anticipate what’s to come next!

I am seeing two scenarios:

Breakout scenario:

For the SPY to break upwards from this inside candle and ignite a massive multi-year rally to the $650’s,

It is up to two of the sectors I displayed above.

The XLF and the XLY

Financials and Consumer Discretionary stocks are at an extremely pivotal price. A breakout over their largest Dark Pools on record which have been previously accumulated would spark a major move across the markets, and surely carry the SPY through the 2022 high and begin the multi-tear expansion towards $650

Now,

Until this breakout occurs…

Consolidation / Correction scenario:

The SPY yearly candle signals a state of indecision.

Two of its largest sector ETF’s are sitting below major resistances.

+

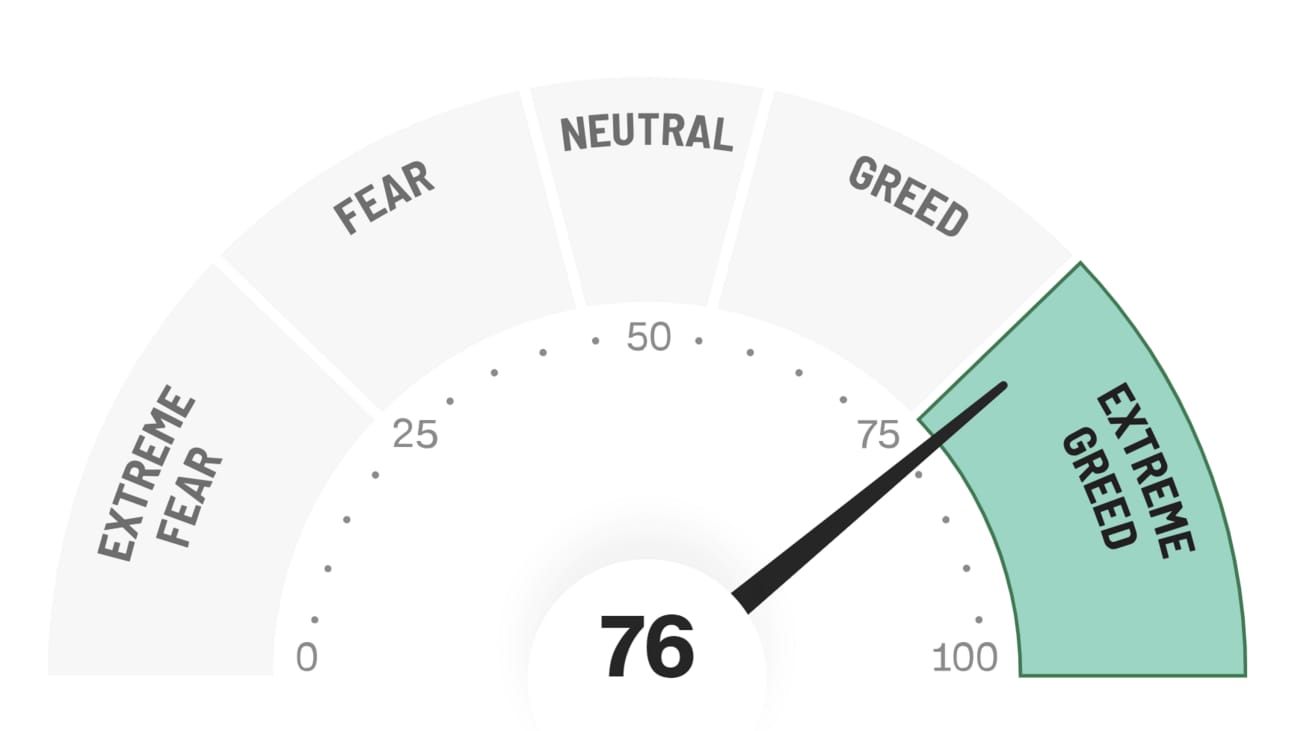

The market is in a state of “Extreme Greed”…

It’s the perfect environment to ignite a potential short-term correction.

“The perfect storm”

CNN Extreme Fear & Greed Index

If the market cannot maintain strong momentum leading the XLF and XLY to breakouts by the end of the first quarter-

I believe short-term focused retail participants will become impatient due to being in a state of extreme greed and aggressively begin taking profits, sparking a pullback or even a correction, delaying the breakout substantially.

Short-term focused traders/investors would get shook out,

And long-term focused trades/investors will be well prepared and extremely thankful for the opportunity to generate more capital for the inevitable upwards expansion.

Conclusion

I am EXTREMELY bullish on the market long-term.

As an investor, a short-term pause in trend means nothing.

I always want to be conservatively adding long-term exposure,

and always have excess capital on deck-

Ready to buy in the case of any LARGE drops.

As a short-term trader-

The market is “paused”

There is nothing to do at this time.

Calling a top here could easily backfire despite the “perfect storm”, simply due to the extremely bullish long-term views I’ve shared.

Every sector has explosive long-term potential.

Plus, many quarterly candles, including the XLF’s and XLY’s as they hit resistance are bullish engulfing candles.

At the same time, aggressively looking for a breakout could backfire,

due to the current market environment-

Extreme greed. Yearly inside candle. XLF and XLY at resistance.

Remember this guys,

The initial market breakout is NOT where the real money is going to be made… It’s going to be in the multi-week/month/year upward expansion.

On the other hand, the market is still aggressively trending up.

If it rejects, it will take some time.

Being a bit late, waiting for a confirmed shift in trend would greatly heighten probabilities of success for short-term downside trades.

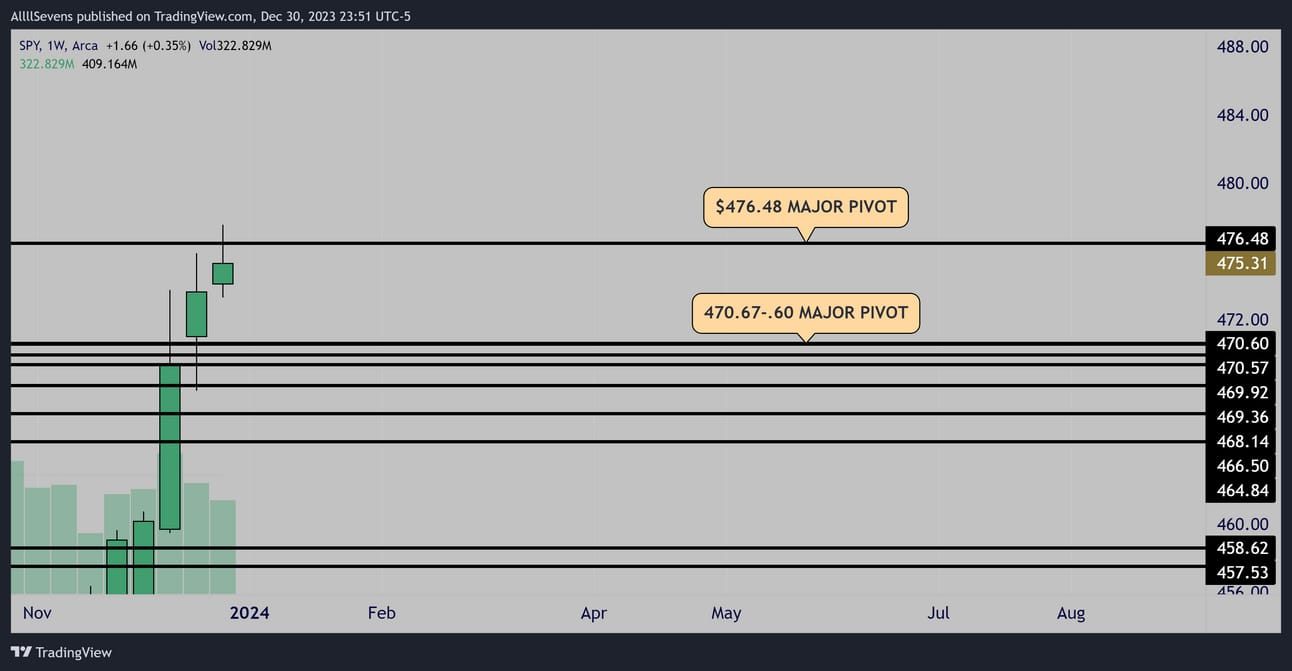

Let’s talk about my plan specifically for NEXT WEEK-

I’m ready to day trade.

I will not be opening ANY swing trades next week.

Weekly

Over the last 3 weeks we have seen two extremely notable Dark Pool transactions come in, creating the pivots displayed above.

Between these levels is a major range of CHOPPY price action.

My plan is to buy supports and sell resistances, never expecting breakouts.

For me to open swings, price needs to “pivot” off one of these levels in the coming weeks,

For upside, an open over $476.48

For downside, an open below $470.57

Until either of those scenarios occur, I’m expecting major chop.

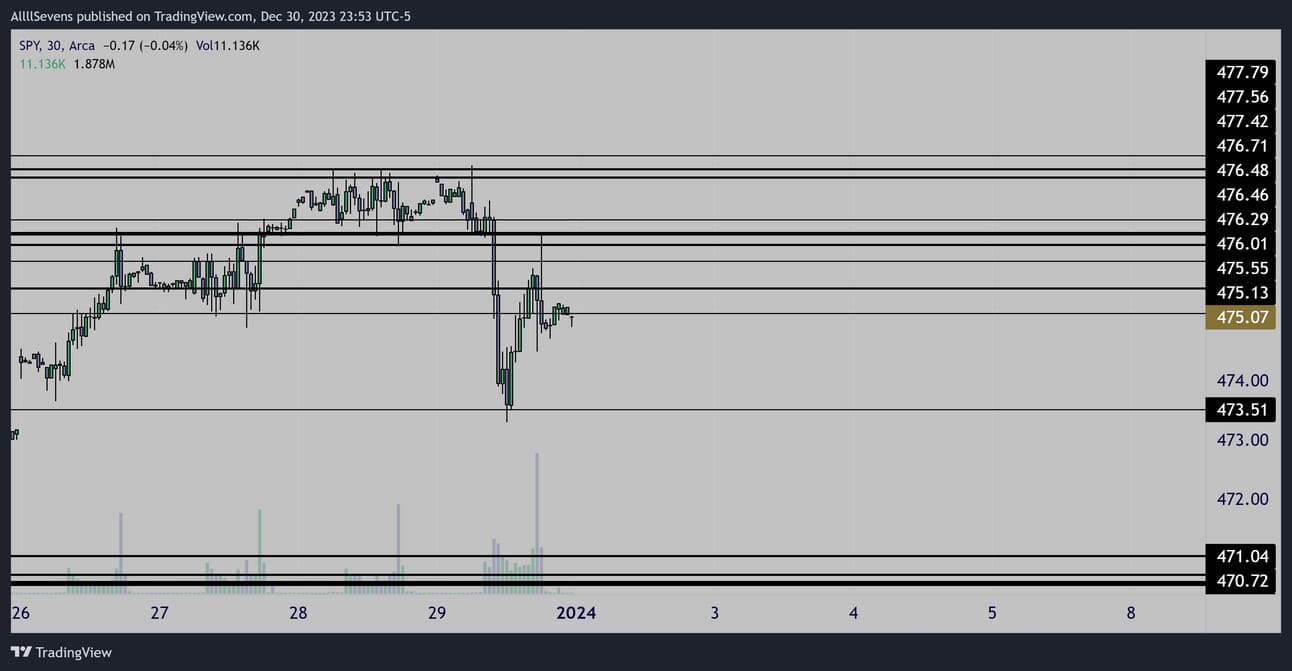

30m

Here is my scalping chart, with less notable Dark Pools marked, useful for day trading and observing intraday accumulation/distribution but not very useful for any higher time frame analysis.

My plan this week is to be completed unbiased and scalp!

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjrgd

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply