- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Short-Term rotation OUT of Semiconductors. Long-Term rotation IN. + $U- Unity Software Inc

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface:

This week, I will go in-depth on an idea I’ve skimmed over in recent newsletters.

There is a more favorable short-term bullish trend in Software and other Tech than there is in semi-conductors at this moment and it doesn’t appear that this will be changing for the foreseeable future.

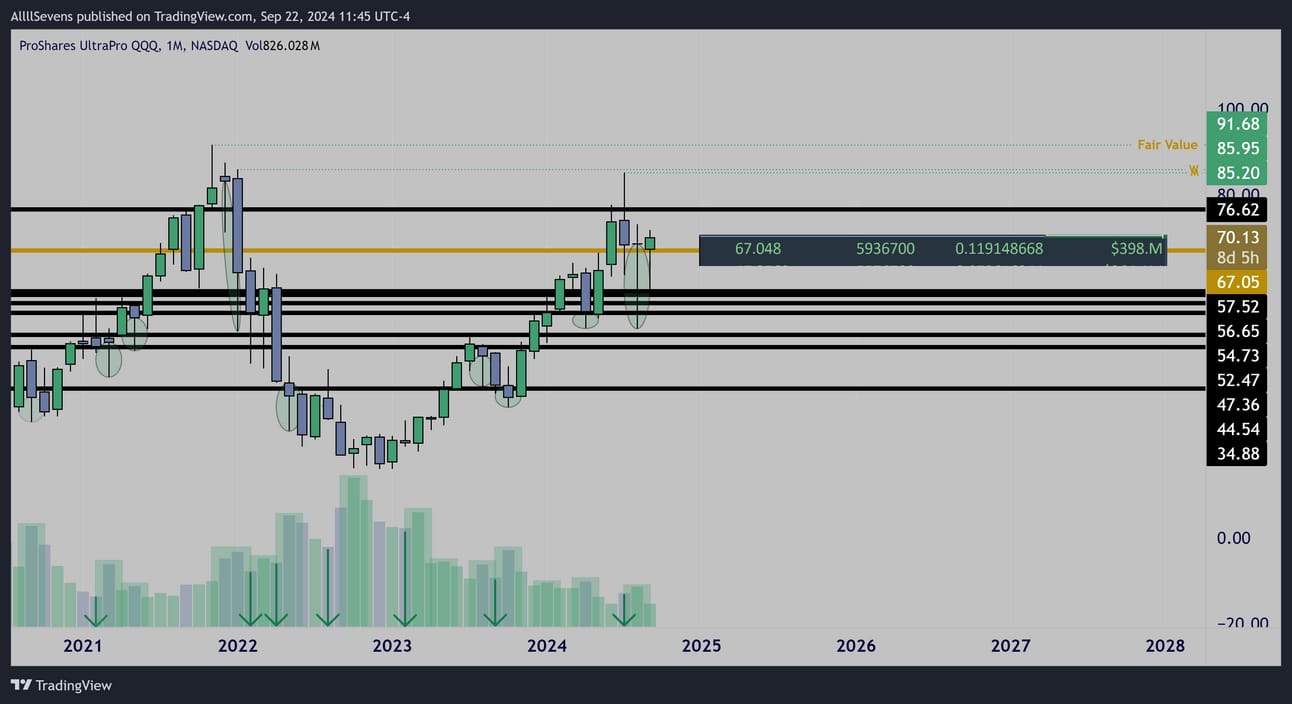

$TQQQ Monthly Interval

I have shared this chart many times now.

The triple leveraged QQQ ETF is pivotal for tech momentum.

Last month, it’s largest Dark Pool in recorded history was transacted @ $67.05

and was clearly accumulated by institutions through the increased volume lower wick that formed. This isn’t the first institutional accumulation that has occurred in this ETF, or specifically in this area. This is extremely notable and very bullish.

As this month’s candle begins to flip green into the end of this month, bulls are in full control. I have repeatedly expressed this idea, and it is coming to fruition.

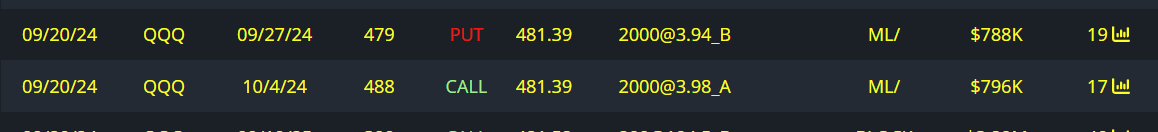

$788K Put Writer for this coming week’s expiration 479p’s

$496K Call buyer into 10/04 488c’s

$679K Call Buyer for 10/11 487.5c’s

$2.2M Call buyer for 10/11 490c’s

Notice that the expirations for this bull flow are all trying to capture the rest of THIS month’s candle. Not a coincidence.

That is the bull thesis here: This month’s TQQQ candle continuing to push higher as it turns $67.05 into clear support with potential range to $76.62

On QQQ, this range is to $496.39. Lines up almost perfectly.

Here’s where something interesting is now occurring though-

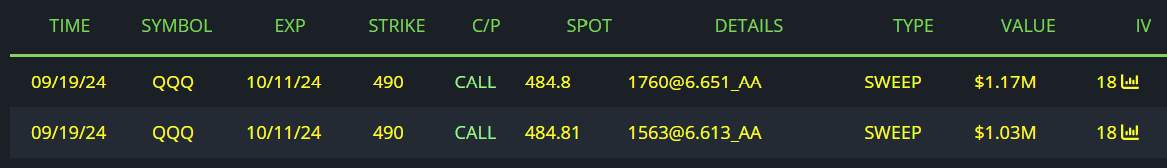

$QQQ Daily Interval

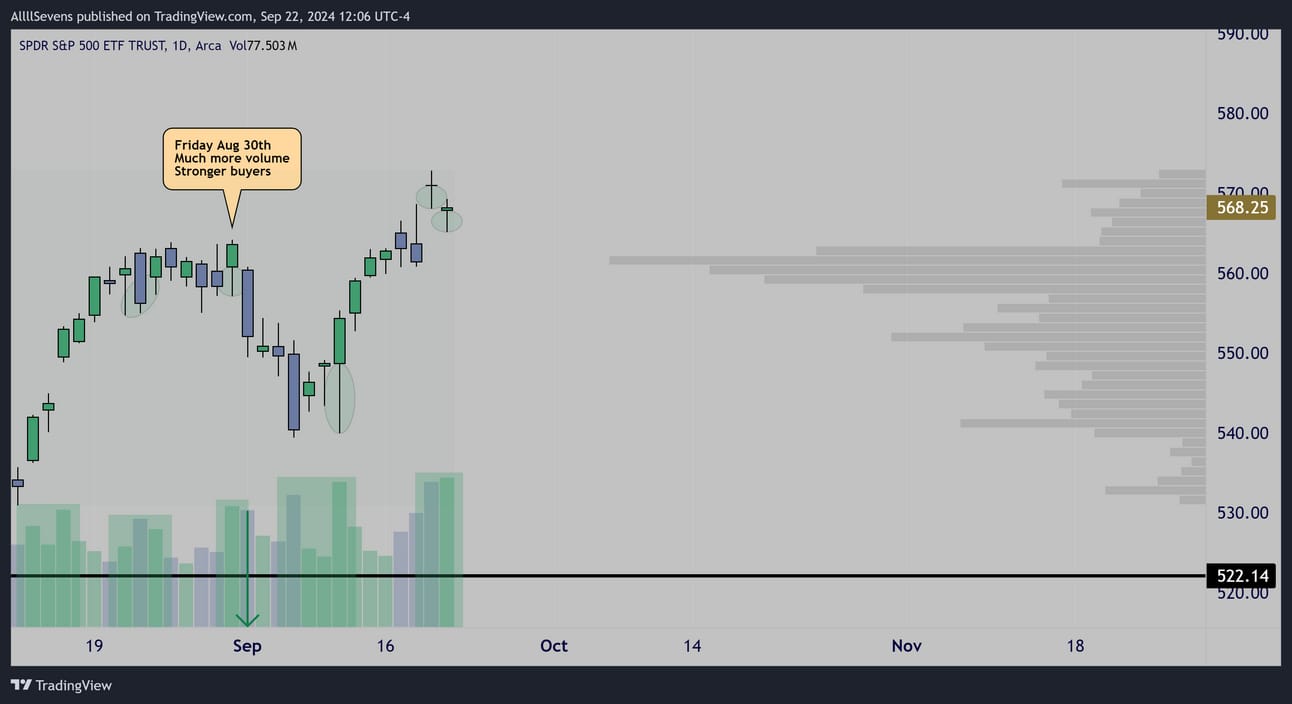

$SPY Daily Interval

As the TQQQ is confirming very strong price momentum, preceded by volume-

There is clear rotation into the SPY occuring…

$SMH Monthly Interval

The #1 culprit

Semi-conductor stocks have been very noticeable laggards over the last month.

I wrote a dedicated newsletter on the Software Sector and why I believe it is much stronger right now. Read that here.

The SMH shows the same Monthly accumulation pattern as the $TQQQ and also similar dark pool activity @ $218.97 & $243.43 confirming institutions are actively building long-term investments.

But, the reason is is currently lagging short-term is because this month’s candle opened BELOW $243.43 and so it has been treated it as resistance, while TQQQ opened ABOVE it’s dark pool and has been able to act as support.

If you truly stay in the loop of my newsletters, my thesis on NVDA from last month should immediately come to mind when reading this about the SMH

Read it here if you have not.

Here’s an update:

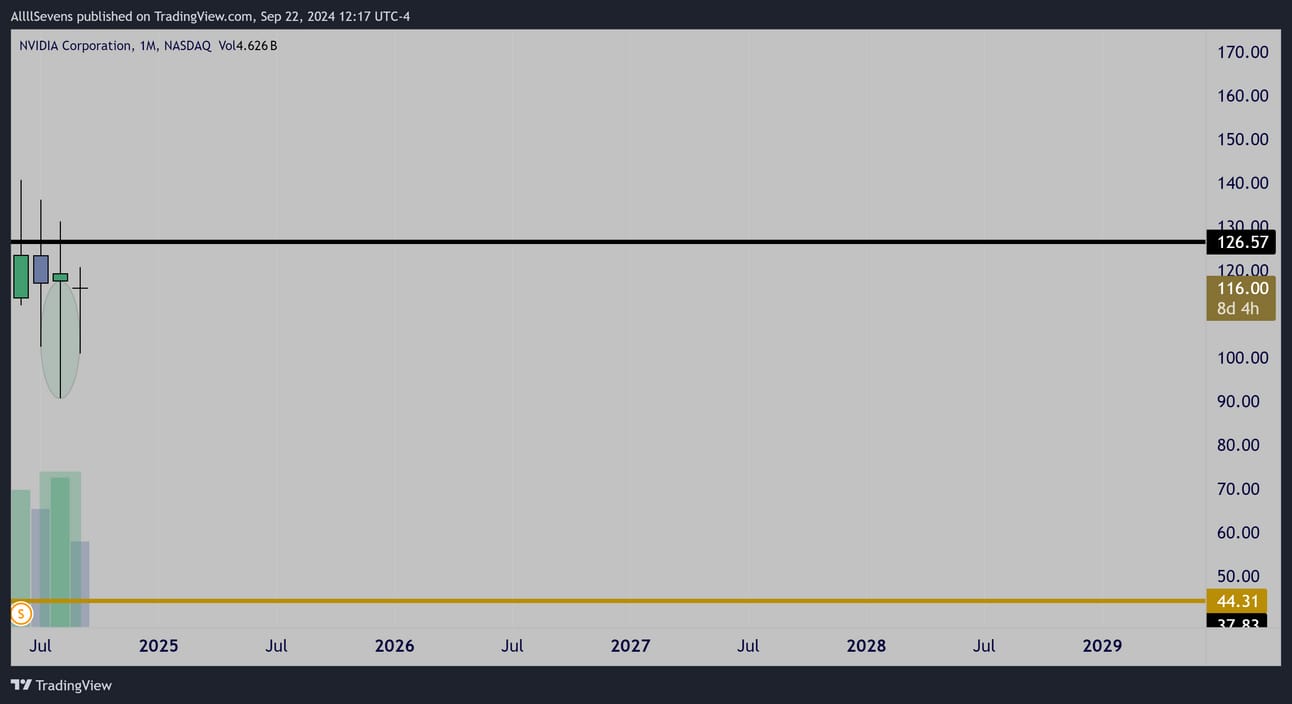

$NVDA Monthly Interval

The accumulation here specifically BELOW dark pool is now visible on the monthly time frame as well. In the newsletter above, it was only seen on the weekly.

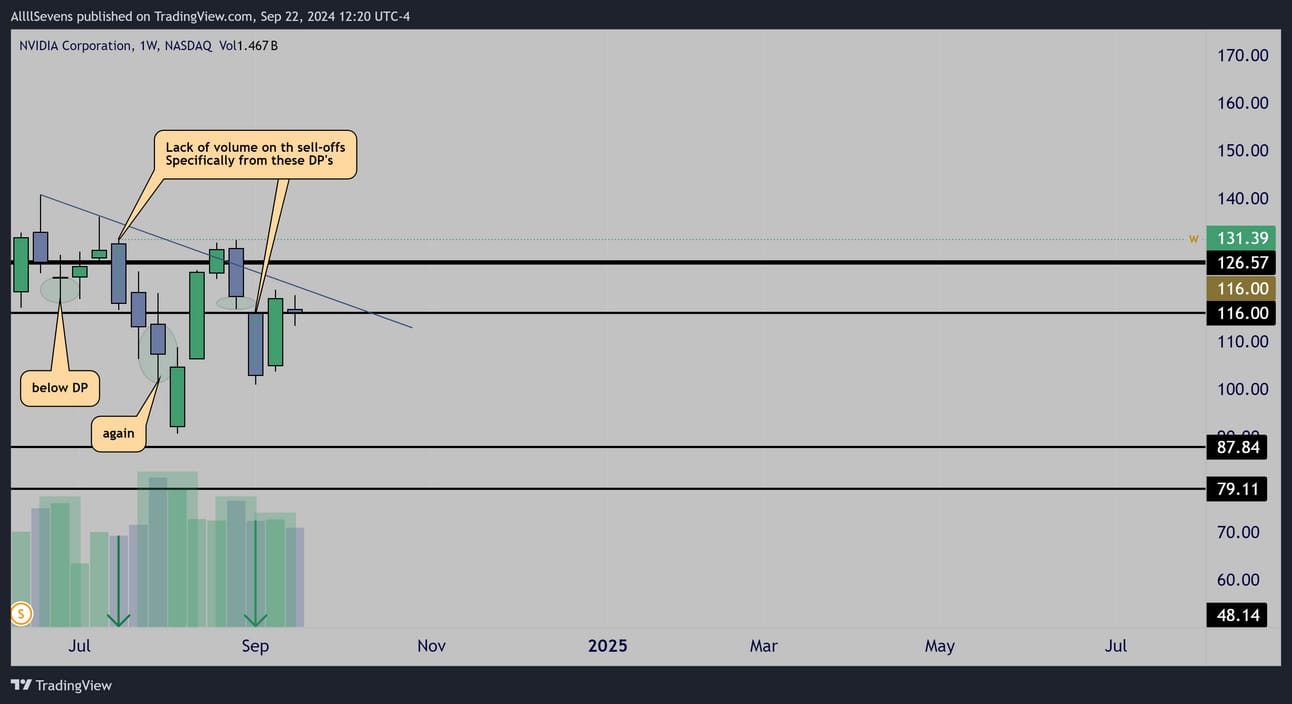

$NVDA Weekly Interval

This chart us truly eye-opening! Make sure you are on the same page as me here. Notice the candle spreads and their respective volumes.

There is CLEARLY a bullish campaign occurring here. Institutions have intentionally placed these large dark pool resistances, so that retail will reject them and they can absorb (accumulate) more shares below. It’s astonishing.

As the largest holding in SMH, this definitely explains the recent lag!

Does this all mean that the TQQQ short-term bullish thesis is failing??

XLK / IGV

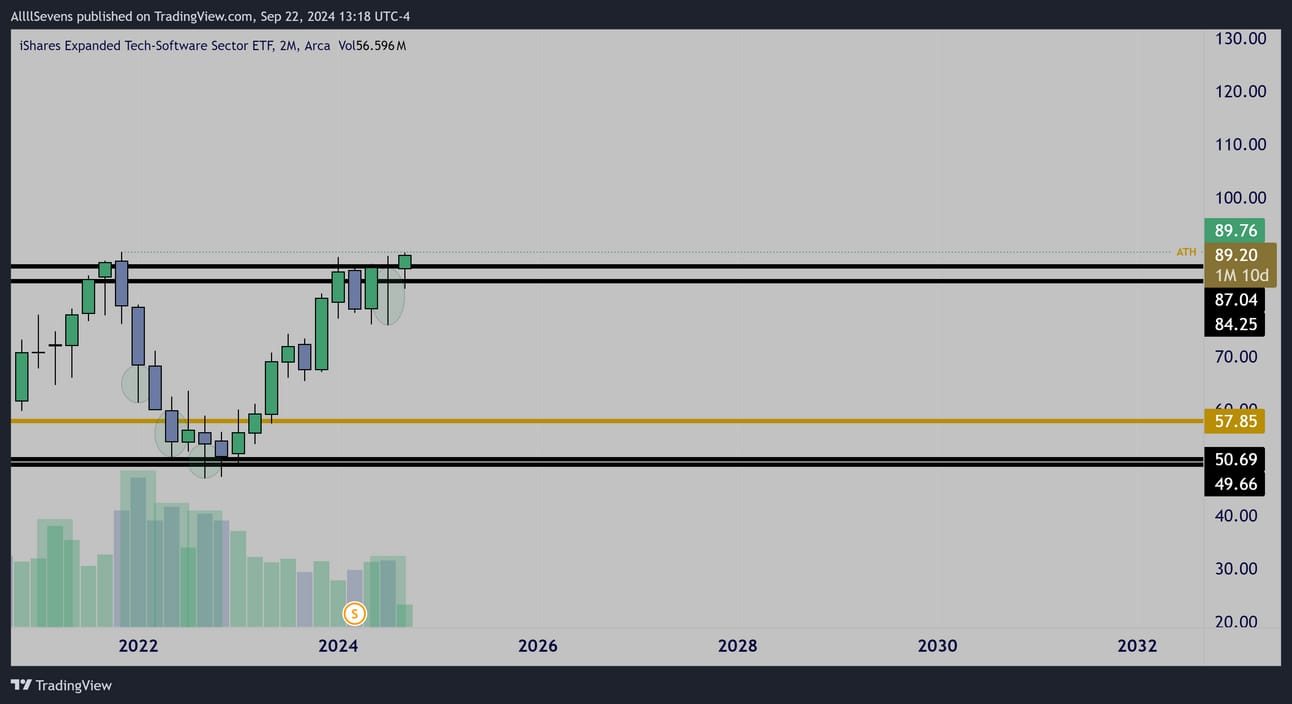

$IGV Two Month Interval

$XLK Weekly Interval

$850K Call Buyer for June 2025 235c’s

While there is clearly institutional rotation into the SPY over the QQQ right now, I absolutely do not think that this means QQQ isn’t about to pump +2.89%

I remain short-term bullish.

The QQQ Daily shows a very notable lack of volume, specifically on Friday’s hammer candle at Dark Pool support- But, it still held support.

+

The monthly pattern in play. This has been a long-time coming and preceded by so much prior accumulations, that we don’t need to see volume on Friday’s candle. Then, you also need to consider the charts above.

Broader Tech (XLK) and specifically Software (IGV) are still insanely strong.

This rotational volume will likely come into play later. Not now.

It should mostly affect semi-conductors, putting them in the passenger seat next to Software and other Tech until the SMH reclaims $243.43

It’s possible this resistance for semi-conductors even gets reclaimed very soon-

Closing the quarter strong, and then pulling back during October or November to retest and see more accumulation prepping for an EOY santa-rally.

Very speculative to guess on how that works out, but that’s my guess.

Overall,

I remain bullish. I think QQQ is ready for a push to next resistance at $496.39.

Once we get there, $NVDA would likely be at $126.46 and $SMH over $243.43

$GOOGL would also likely be back at the $172.50-$180 resistance.

Watch my video update on GOOGL here.

With some big names at resistances, but overall sectors at support, this would put QQQ in an ideal situation to see some indecisive price action and potential congestion for more accumulation. We will see and I will update then.

U

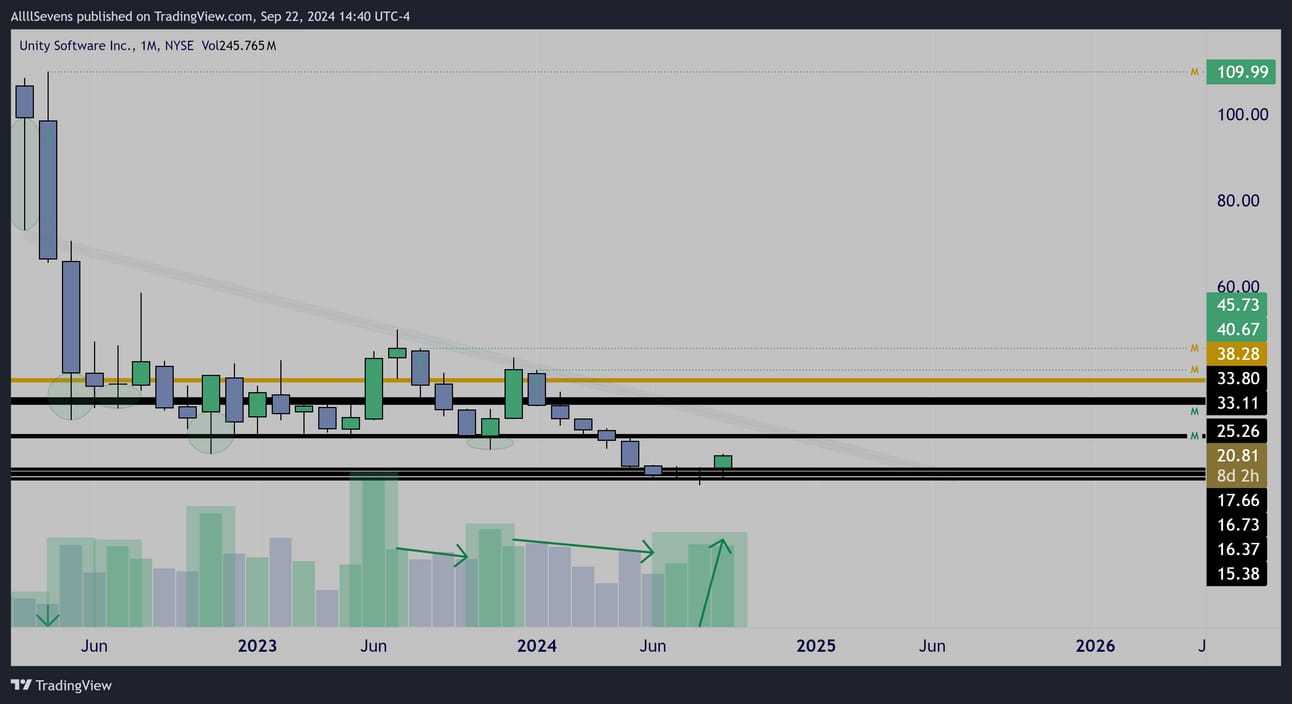

Weekly Interval

$U Weekly is seeing it’s highest GREEN volume since it’s summer 2023 rally…

This leads me to consider the possibility and probability of a similar move now being attempted again.

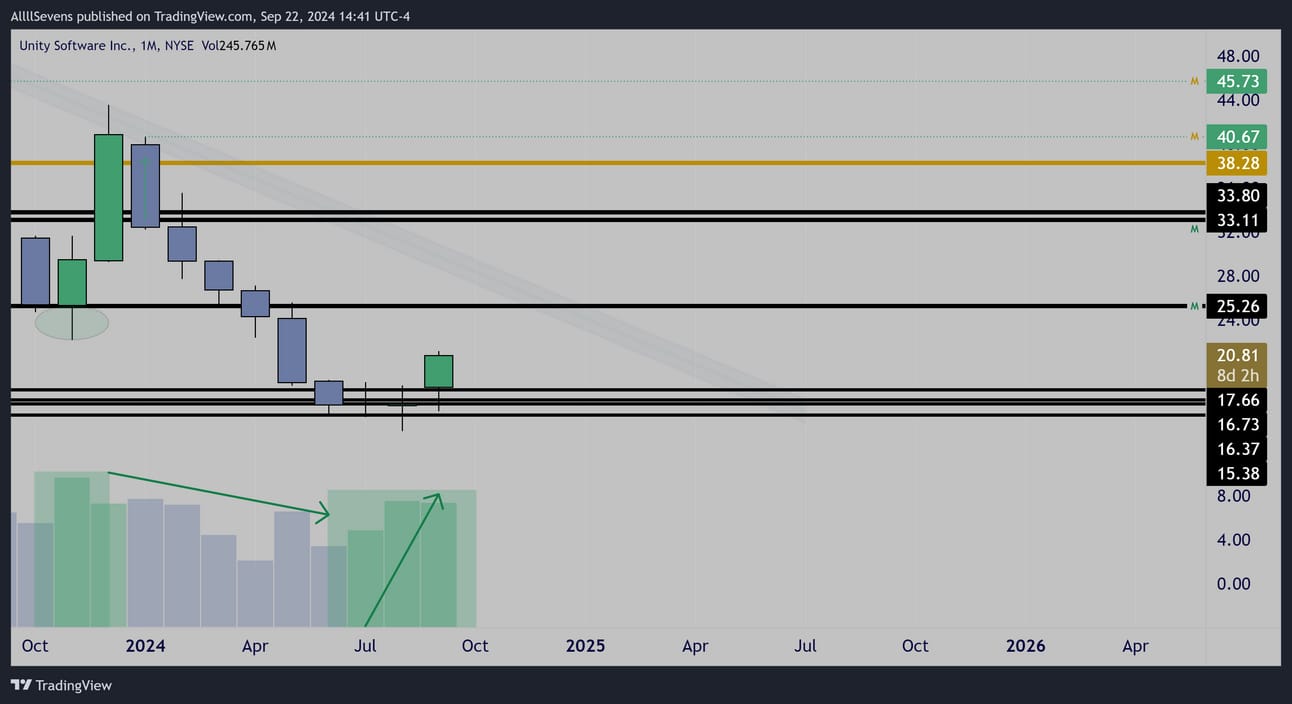

Monthly Interval

Monthly interval

Zooming out, I start to see the true potential behind this multi-year base that has been accumulated mostly above the $25.26-$33.11 Dark Pools.

It’s clear that the breakdown from this support in 2024 was backed by retail volumes. Now, after a new Dark Pool support has been created at $15.38-$17.66 The monthly candle is reversing on it’s third consecutive increase in volume…

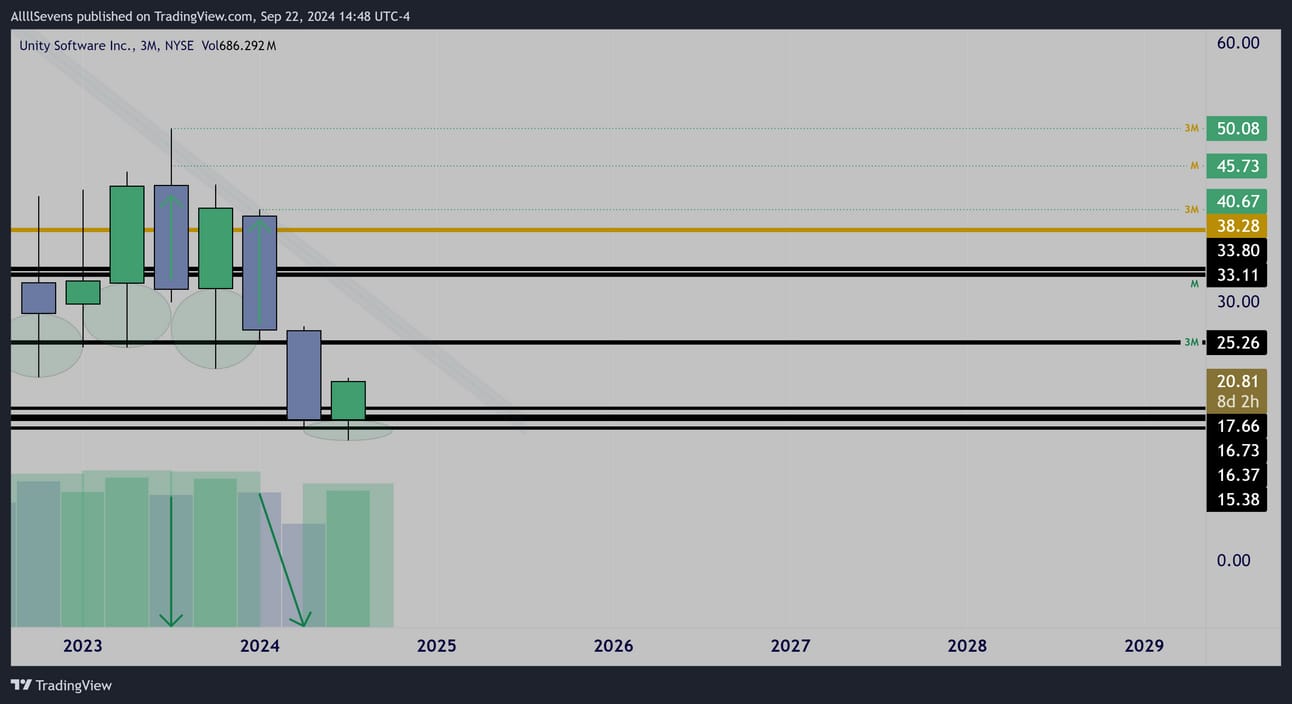

Quarterly Interval

The quarterly chart by far best displays the bull thesis for this stock.

Absolutely textbook institutional accumulations off the $25.26 Dark Pool followed by repeated retail sell-offs.

The volume this quarter defending new DP’s in the $15 range is massive.

Again though, just like every interval so far, it is clear the true point of control for institutional investors is over the $25.25-$33.11 mark.

While they are actively adding risk here, they have much more long exposure over those levels and so it is inherently riskier to be a buy below them.

When/If this demand gets reclaimed, that’s when I become a MAJOR bull on this stock… For now, I am looking at a very risky speculative bottom being set.

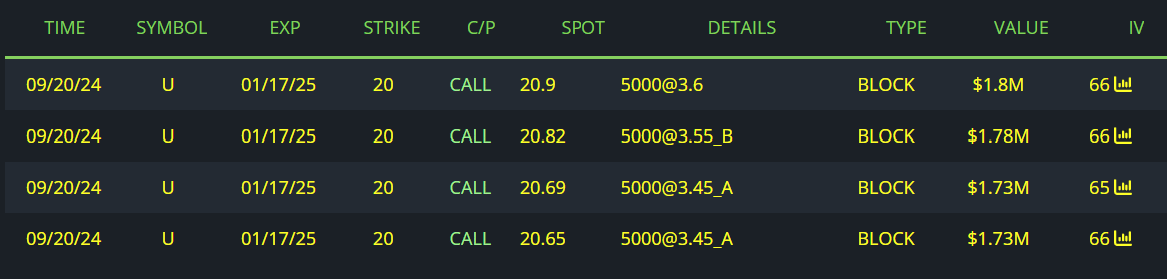

On top of shares being accumulated, it appears some large options flow is betting on this bottom as well.

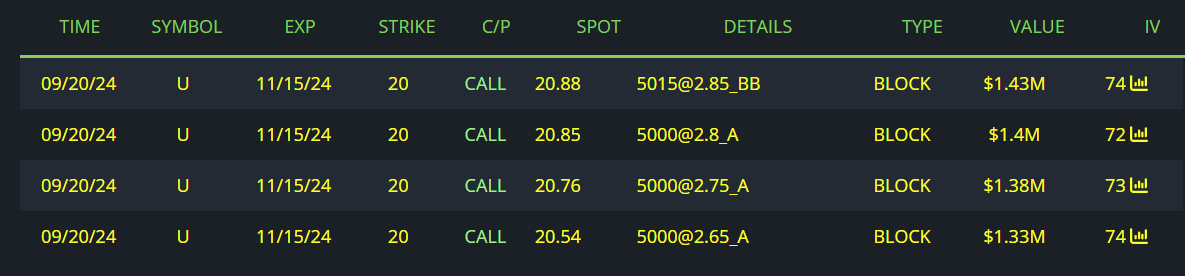

$7.04M Call Buyers

$5.54M Call Buyers

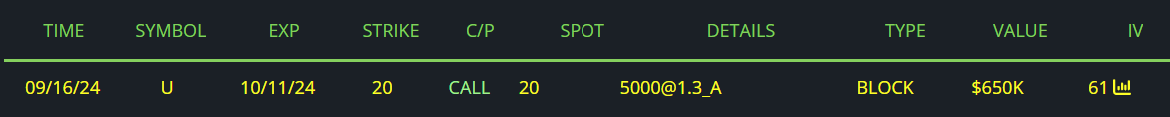

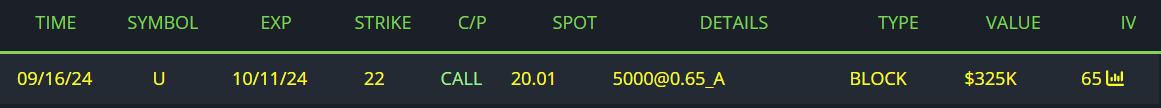

$650K Call Buyer

$325K Call Buyer

This is truly unprecedented flow, and it’s why I feel comfortable making this the single individual stock outlined in this newsletter.

Recalling what I just mentioned above though, about this stock seeing TRUE bullish confirmation if and when it reclaims $25.26-$33.11-

I do not think it’s a coincidence these whales are buying more short dated call options rather than multi-year LEAPS.

An actual bottom here is not confirmed. This is a high-risk short-term bet.

If/when the demand above gets reclaimed, I am sure even crazier flow would come in on this stock. Personally, I am only trading the short-term call options here. I have no interest “investing” in the stock until it truly confirms.

Make sure you are signed up for my newsletters ahead.

In my next one, I plan to cover exactly what sector(s) I think this SPY rotation is going into. Hint: it’s the XLF. I have been tweeting about it here.

Sign up for my next newsletter here.

If you truly find value in my work, please consider upgrading your subscription to AllllSevens+ for just $7.77 per month.

Click here to upgrade.

I will occasionally send a premium newsletter & you will also get access to my Discord where I gather and collect my data throughout the week.

I take chart requests at any time in my Discord.

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply