- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Short-term uncertainty within long-term accumulation

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of March 23, 2025. I am not liable for any losses incurred by others.

Past performance is not indicative of future results.

Preface:

Recently, I highlighted a historic dark pool accumulation on the S&P500—bigger than 2022’s—a $50B+ campaign initiated on IVV & VOO, signaling a massive long-term opportunity is taking shape. I also presented the eye-opening reality of short-term market fluctuations and the power that non-institutional participants can have on near-term price action.

Please read that newsletter HERE to fully understand this week’s analysis.

For four months, price held steady within this accumulation and I’ve been predicting further short-term upside. Then, price broke down.

We’re currently below the $50B IVV & VOO dark pool support.

This does not mean the accumulation patterns are invalid.

Recall the newsletter linked above. The largest down candle in SPY history took place right in the middle of an institutional accumulation.

Are we looking at a similar situation?

Today, uncertainty is reigns. Trumps tariffs as well as recession fears have the market rattled—price reflects this— losing major dark pool support despite clear institutional accumulation, short-term bullish trend lost, breaking down from a four-month price compression, and the Fear & Greed Index reading “extreme fear.”

While short-term uncertainties grip the market, patient long-term institutional investors are utilizing the dark pool to execute their largest buy campaign in recent history. But, 2022 taught us, that doesn’t rule out massive short-term curveballs. Historic volatility could strike again in 2025.

Is this just a quick shakeout before price reclaims support and rockets to all-time highs, or is this the start of a deeper sell-off?

That’s what we’ll unpack today.

The S&P500

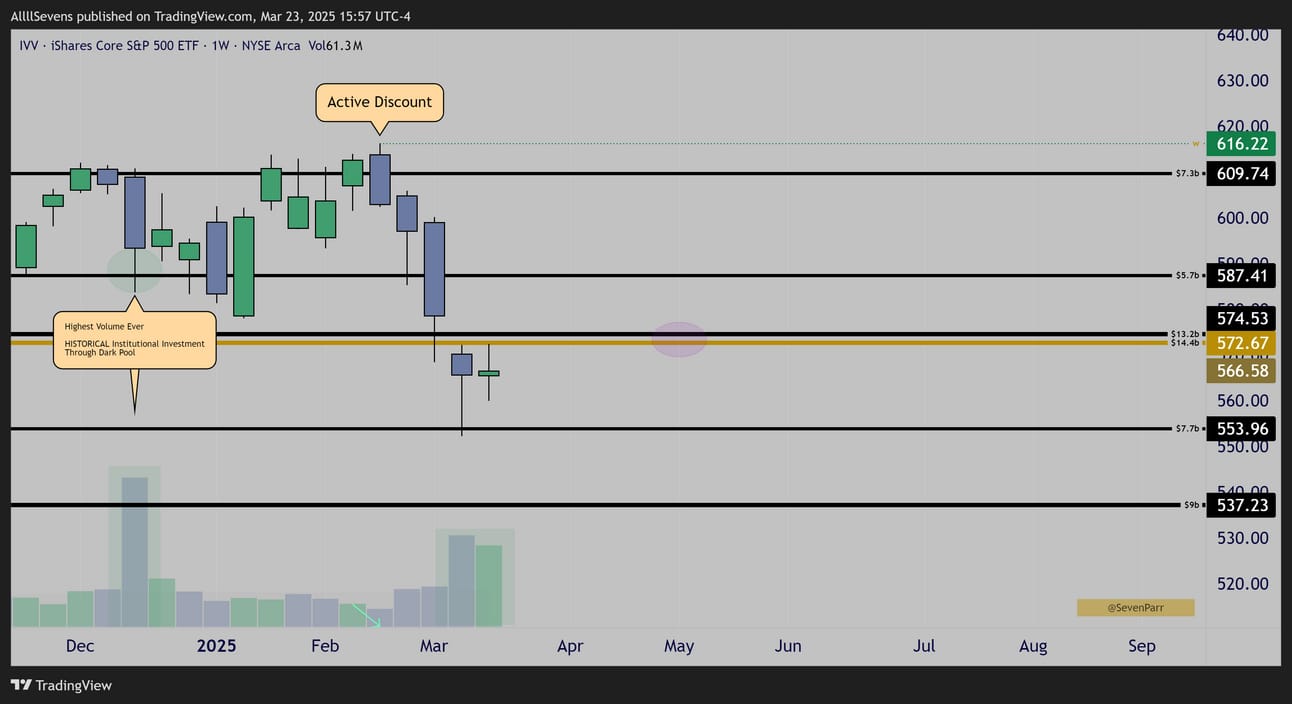

IVV Weekly

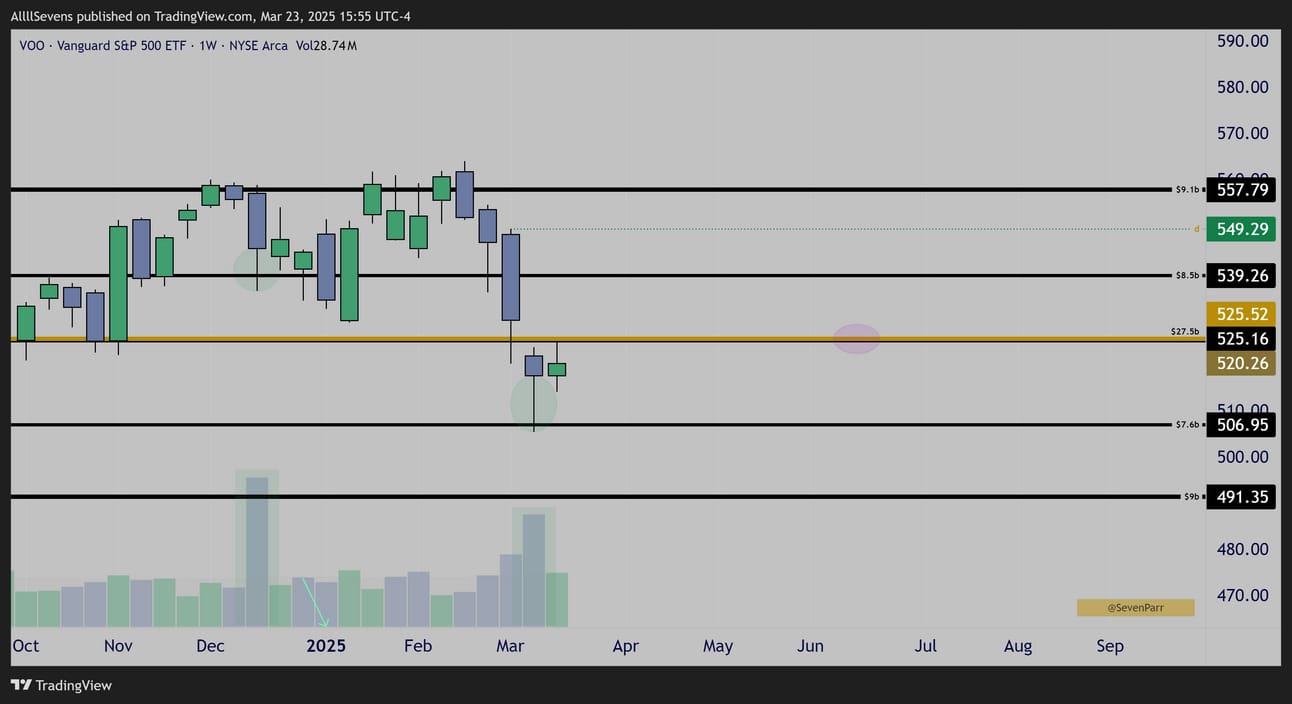

VOO Weekly

Here’s a visual of the $50B+ level that price has fallen below on IVV and VOO.

For a short-term upside reversal, it is absolutely crucial to reclaim.

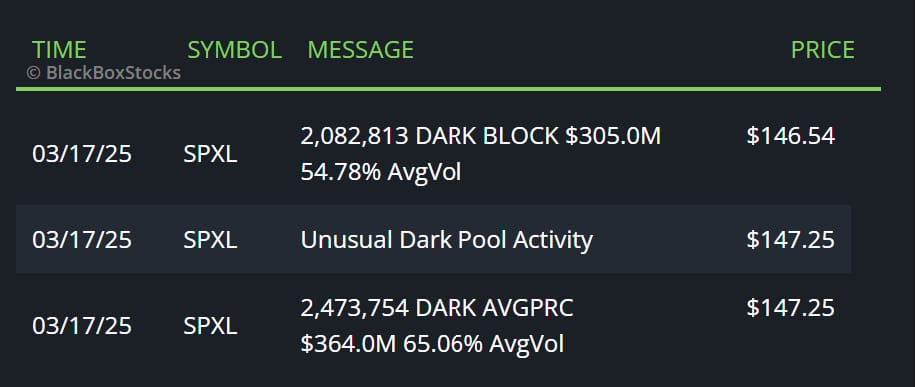

SPXL Daily

Another chart I am watching is the 3x leveraged SPY.

This saw some notable dark pool last week, adding to a historically large cluster, making it a $2.7B+ zone.

This asset shows the same long-term accumulation as IVV, VOO, and SPY.

You can see on this chart a textbook discount candle created on March 3rd.

This confirms the idea that the recent loss of support / bullish trend is not institutionally driven. The accumulations I have shared are valid.

With this said, the timing of this recent DP is a bit strange.

It came in while price was retesting lost support, creating potential for more short-term resistance, to allow further discounted selling to take place.

For short-term upside, this zone must be reclaimed.

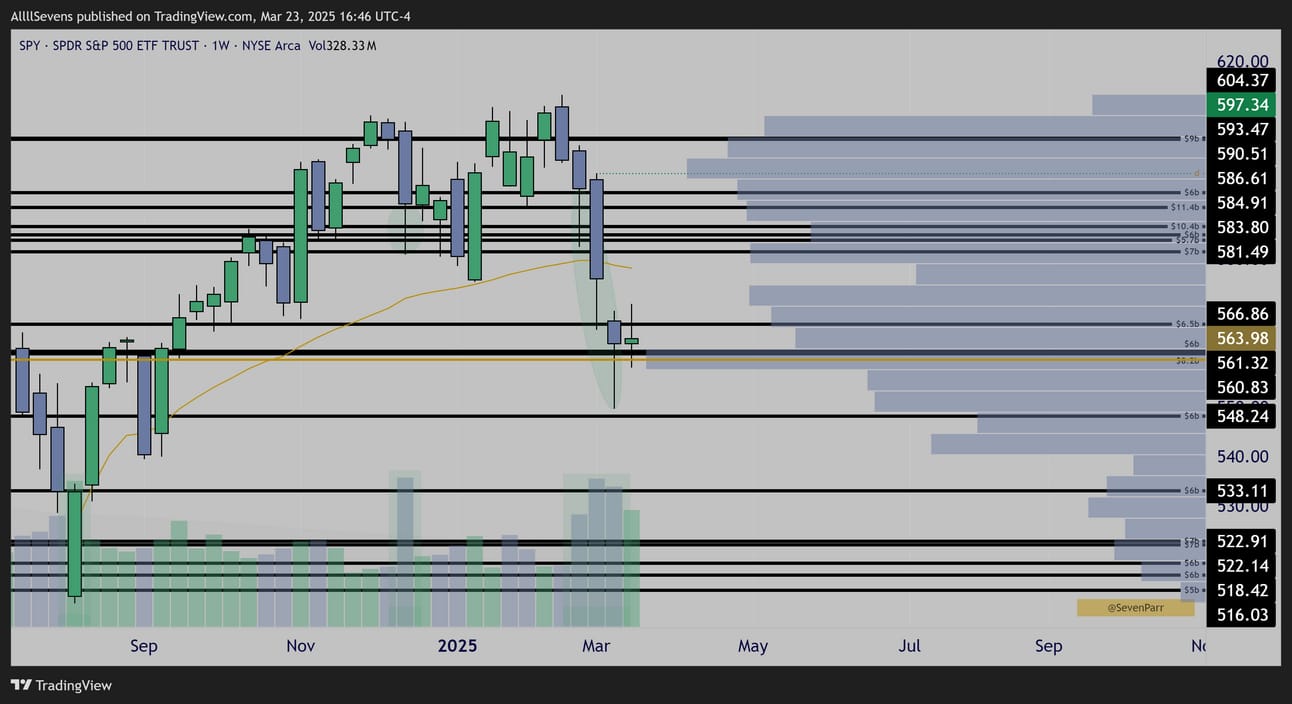

SPY Weekly

Just like every other S&P500 asset, the lower wicks @ dark pools during the recent sell-offs display crystal clear institutional absorption / accumulation.

We are witnessing a massive transfer of wealth from impatient short-term focused participants to the very patient and long-term focused investors.

How long will this transfer of wealth take? When can price just go up again?

The IVV, VOO, and SPXL charts are what I am watching for upside confirmation.

The SPY chart above, is what I am watching for a potential breakdown.

You can see price has fallen below bullish trend (gold moving average) and it is even slopping downwards at this time. However, A short is not valid yet because price is still holding a major volume shelf support @ $560.83-$561.32

Last week traded within the previous weeks range showing some indecision on where exactly price wants to head next.

As a long-term investor, I obviously think the market is a great buy right now. However, I accumulated a substantial amount ABOVE the IVV, VOO, and SPXL dark pools that I have highlighted…

So, with price below these levels and needing confirmation of a reclaim, I am in no rush to continue deploying capital. I am waiting for the market to tell me what it wants to do next. A successful reclaim of these levels and I go back into buy-mode. Until then, I am open to the possibility of a breakdown if price loses then $561.32-$560.83 dark pool support.

Next I’d like to cover a that sector I think has potential to be a very important leader from here IF things confirm to the upside.

The remainder of this newsletter will only be accessible to premium subscribers.

It costs $7.77 / month and you also get access to my DISCORD where I do even more extensive research. Organized, real-time data collection on options flow and dark pools before they get compiled into newsletters.

Many times, a newsletter never gets wrote.

I like to think of my Discord as just a massive data-base. Very useful info there.

Sign up here, log in, and you can view the information below.

Reply