- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

The Utilities Sector

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of May 18th, 2025. I am not liable for any losses incurred by others.

Preface:

The S&P500’s Utilities sector is on the verge of a massive multi-year breakout.

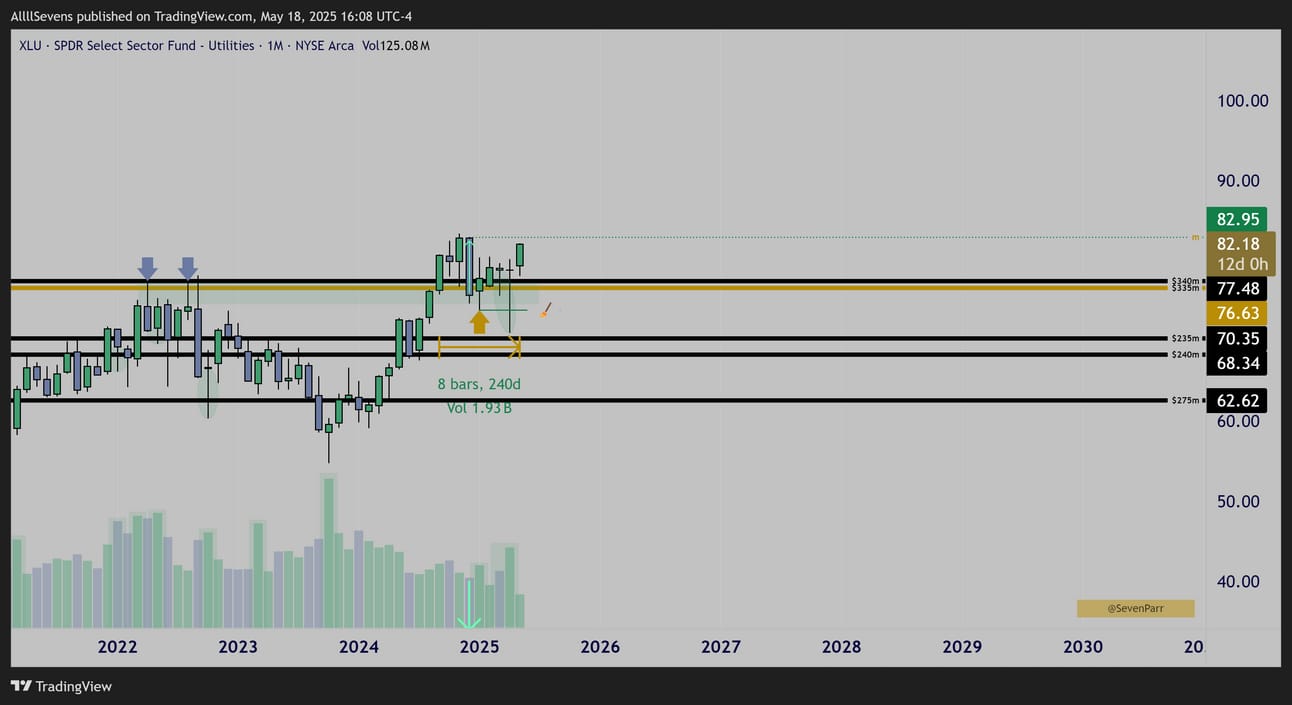

XLU

Monthly

After being accumulated by institutions all throughout 2022-2024, shown by the high volume lower wicks highlighted on my chart, price has finally broken into new ATH’s, forming a base over prior resistance for 8 months now.

This is an extremely healthy “price-compression” that favors upside continuation, using all of 2022-2024’s accumulation volumes as FUEL.

I mention this TODAY, because of what happened last month.

THe entire 8-month range was broke to the downside…

But institutions stepped in, with volume, and created a massive lower wick.

With short-term speculators shook-out, this is now primed for a breakout.

But this isn’t just a short-term setup.

Notable is the December candle.

A massive sell-off occurred that month… On abnormally decreased volume.

The institutions who have accumulated this the last 2 years did not participate

This creates what I view as an exploitable long-term “discount” from $82.95

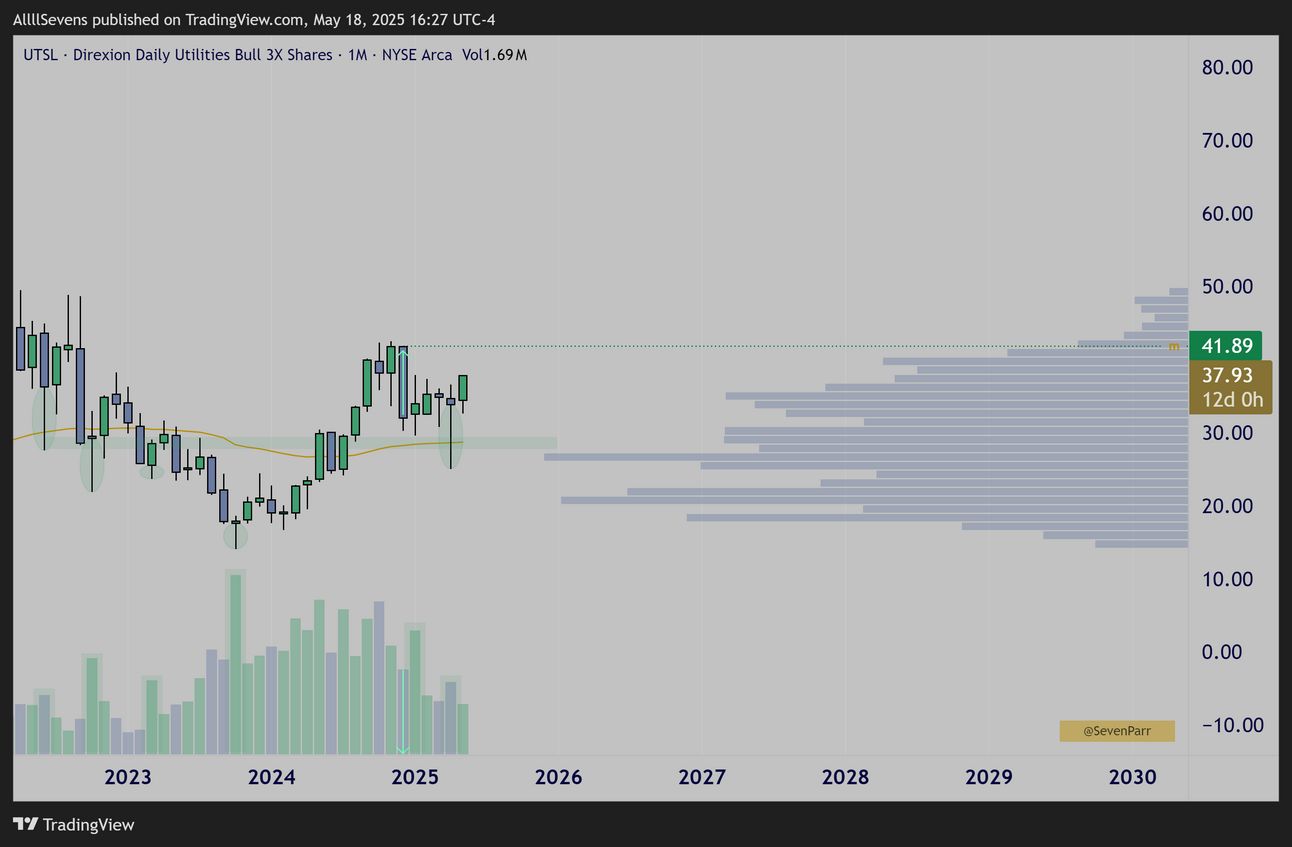

UTSL Monthly

UTSL Monthly

This is the Direxion 3x leveraged Utilities ETF

It share’s the same discount creation in December and last month’s candle not only swept the lows of the last 8 months, but it defended the all-time AVWAP + VPOC volume shelf support which creates high probabilities for a bullish trend to finally emerge here.

This is compressed for over 7 years within this downtrend resistance…

I think this leveraged ETF REALLY highlights the explosive potential of the sector.

Speculators are going to flock to Utilities stocks like we’ve never seen in recent history. We are early.

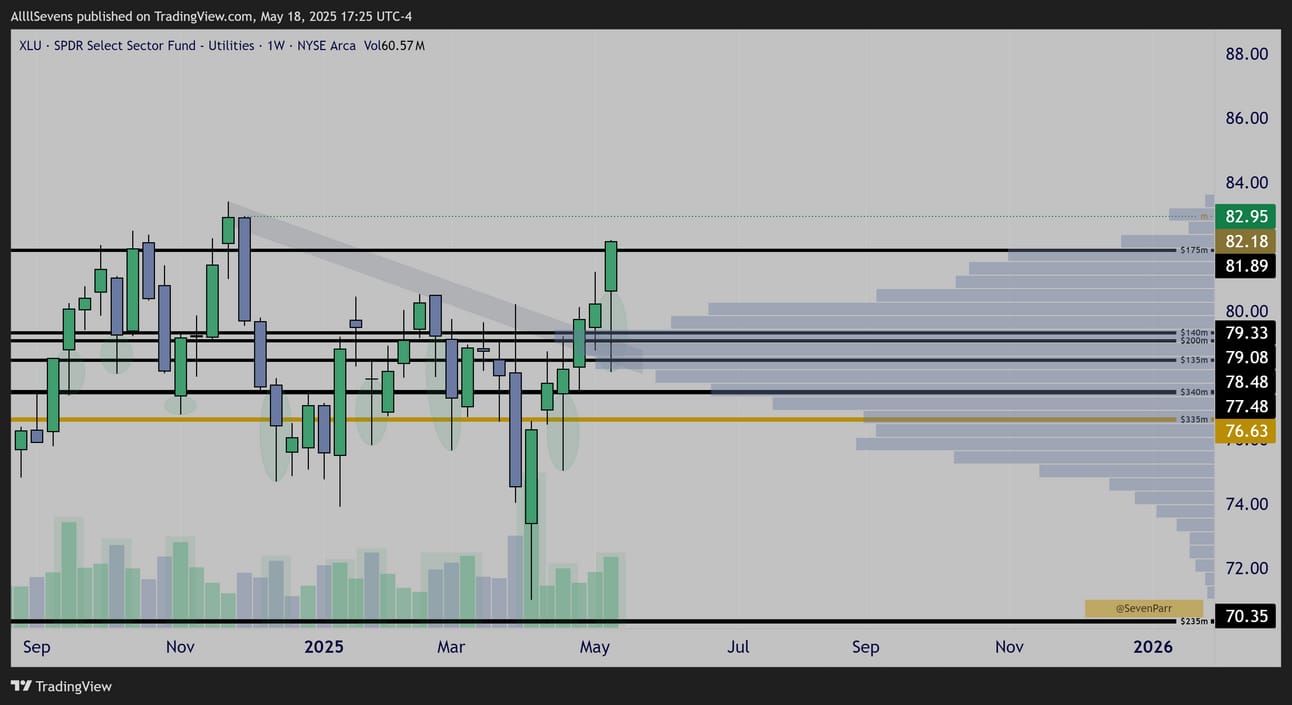

XLU Weekly

I just want to point out how extremely clean the accumulation patterns have been on $XLU throughout this entire 8-month base. Last month’s sweep of lows, on MAJOR weekly volume is the cherry on top.

This is ready.

I love long-term shares.

I love UTSL for the medium-long-term trade.

Next, I will share research on my #1 individual stock pick within this sector ETF.

Insane institutional activity on this stock. Even larger than the ETF.

This research is exclusive to premium subscribers for $7.77 / month.

Upgrade here, and once you log in, you should be able to scroll down and read the rest of this letter!

Again, if hesitant, please check out one of my recent premium newsletters with this FREE access link: Click Here.

I’ve also spent the weekend covering a multitude of individual stocks inside my Discord including $SHOP, $COIN, $U, $TTD, $UPST, $ARKK, $AAPL, & $META, just to name a few. Join!!!!

Reply