- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Who is selling the stock market right now?

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of March 30, 2025. I am not liable for any losses incurred by others.

Preface:

Before reading this newsletter, it is important to read the intro of one of my prior newsletters HERE.

You must understand the the power that non-institutional participants can have on short-term price action despite clear accumulation taking place.

The S&P500

$SPY Weekly

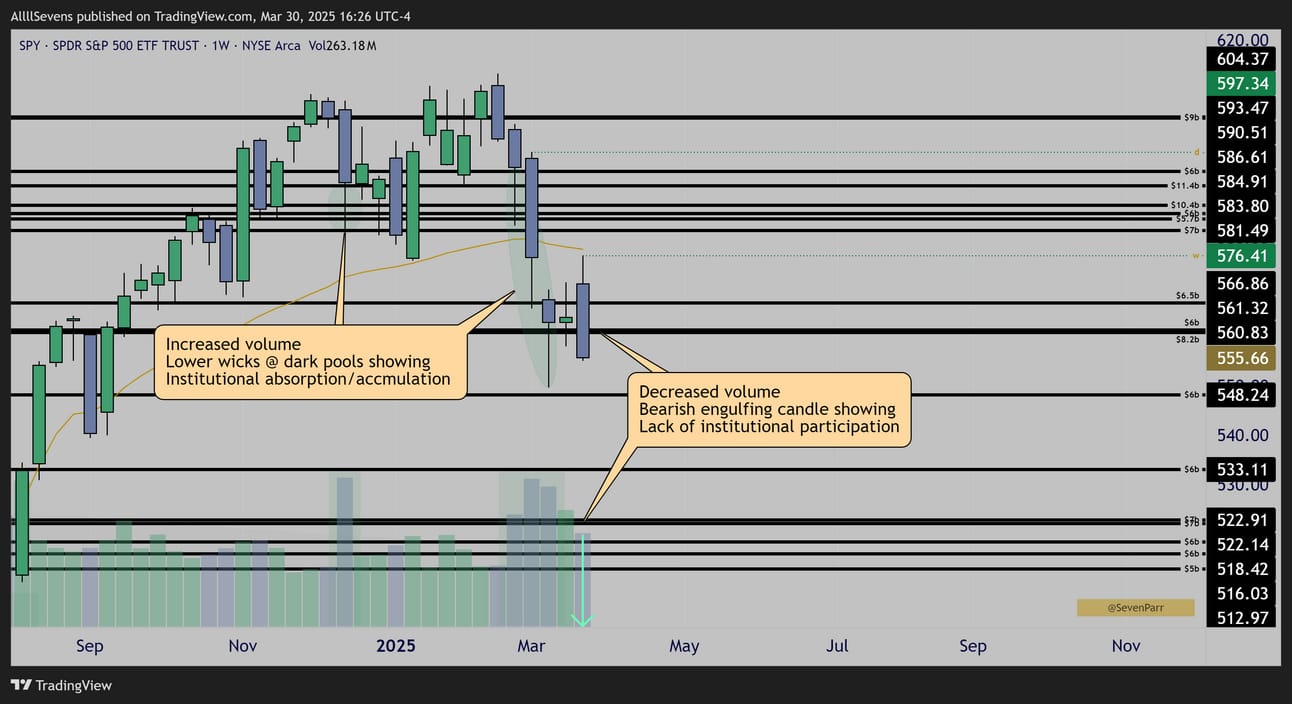

Check out the chart above.

You’ll see I’ve highlighted increased volume lower wicks @ dark pool levels.

These are signs of massive institutional accumulation.

But, last week price smashed through those same dark pools, breaking support and sending price lower. At first glance, this screams that the bull thesis is dead—and short-term, it could be if price does not reclaim support.

But, look closer.

The volume behind last week’s loss of known accumulated dark pools?

It’s decreased— way less than the high volume lower wicks.

This says something.

The institutions who have been buying are NOT dumping.

They’re holding tight.

So while short-term bullish trades may be invalidated until support is reclaimed, the long-term bull case is actually strengthened.

In fact, with price now being below levels that are confirmed accumulated by institutions, it leaves us retail investors with an exploitable “discount”.

Buying into a short-term loss of support goes against our strong desire for short-term gratification, but it is necessary for long-term growth.

These same patterns occurred during 2022 and it lead to the monster 2024 rally.

I missed the 2024 rally because instead of accumulating discounts just like what we’re seeing now, I was naively focused on going “all-in” and timing the start of the next rally. I’m not doing that this time.

I see this as a once in a lifetime long-term buying opportunity even larger than 2022’s because of the size of the dark pools on IVV and VOO highlighted in my previous newsletters (linked in preface)

They’re the largest dark pools EVER recorded for the S&P500 and that suggests a truly historic bull-market will follow - even crazier than 2024’s

How long until prices go up again? We don’t know.

How much lower will price go first? We don’t know.

Are institutions actively making some of their largest investments ever recorded?

Yes.

Will price go up again?

Yes.

Best case scenario would actually be if the market enters a decline similar if not larger than 2022. This would provide us with plenty of time to prepare for when the secular bull market continues, which should be a similar if not stronger move than what was seen in 2024.

As of now, until/unless price reclaims the support it just lost, I am sitting on my hands, saving cash for more accumulation, prepared for more downside.

If price does not reclaim support and continues in a bearish trend, I am sure one of these weeks I will even put on a downside hedge.

For now though, I’m not seeing a great risk to reward for that, I see too much potential for an upside reclaim or a relief bounce sooner rather than later.

I will continue to update this thesis each and ever week.

If $SPY reclaims support, it’s going to be lead by certain sectors & stocks that are currently testing support rather than losing it.

So, in the remainder of this newsletter I will cover some assets that have this characteristic and also saw notable bullish options flow.

This analysis is only accessible to premium subscribers.

It costs $7.77 / month and you also get access to my DISCORD where I do even more extensive research. Organized, real-time data collection on options flow and dark pools before they get compiled into newsletters.

Sign up here, log in, and you can view the information below 👇

Reply