- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Long-Term Buy Opportunity In Tech?

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

I previously wrote a newsletter detailing why I believe we are only at the early stages of the current bull market. You can read it here.

I also highlighted a bullish setup forming just below prior ATH’s on the weekly time frame. Unfortunately, it did not play out.

This wasn’t a huge shock, as I highlighted the importance of price maintaining momentum early in the week, since there were no Dark Pool supports nearby.

When price gapped down to begin the week, it became very clear that it was time to stand aside and let price either pullback to our next DP support, or consolidate further before making another attempt at new ATH’s.

This is the situation we are in now.

SPY

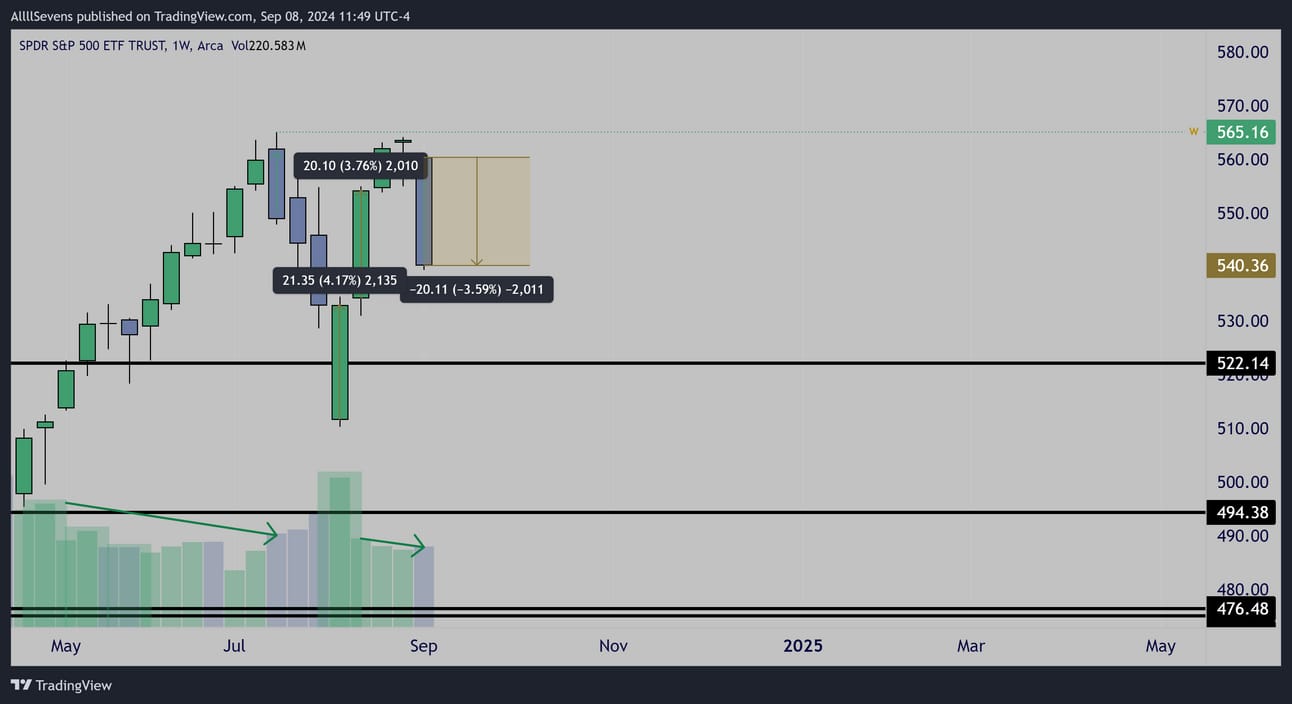

$SPY Weekly Interval

Last week, the market dropped about the same amount as it rallied each week in early August.

However, this decline was supported notably lower volume.

It is clear institutions are not participating in this short-term sell off.

Retail participants simply became too impatient with the congestion and pushed prices lower.

We know the power of retail participants, as laid out in my tweet below.

https://x.com/SevenParr/status/1831075042522009999

It’s key to note that just because last weeks sell-off was backed by dumb money, it does not necessarily mean price must reverse immediately- especially when you consider we still haven’t hit a DP support.

In reality, and don’t take this the wrong way, I’m not bearish but if/when price does test DP support below, we even have to be open to the possibility of retail participants not respecting it, and continuing to sell. I’m not saying this happens, it’s just something to accept as a possibility. It is not something to fear.

Matter of fact, it is only something you fear if you don’t believe it’s possible… Just something to be aware of.

This is the stock market. You cannot hold short-term biases.

Long-term it is clear what’s happening, I am only wanting to make you aware that risk should be controlled if short-term trading.

QQQ

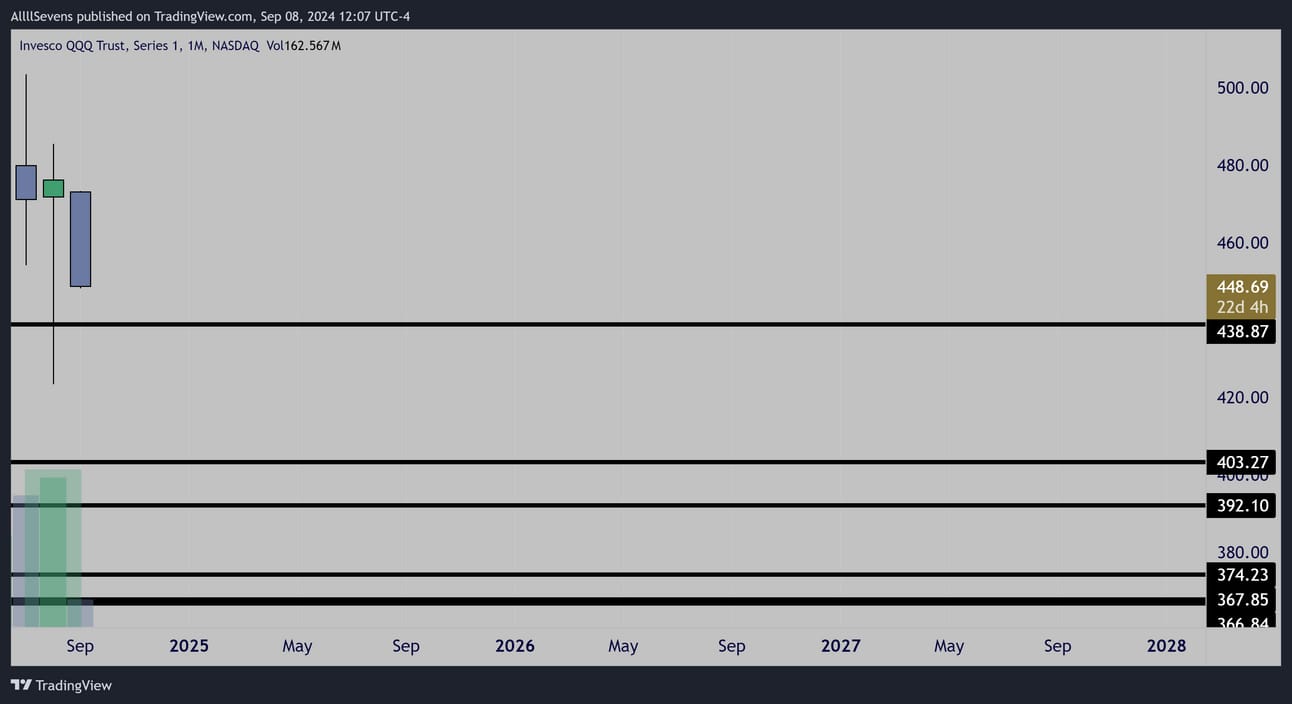

$QQQ Monthly Interval

Clear institutional accumulation has already began during last month’s pullback on the Nasdaq.

$TQQQ Monthly Interval

Not only did the QQQ experience notable long-term accumulation last month, but the leveraged ETF, the TQQQ saw it’s largest Dark Pool on record at $67.05, which was clearly accumulated.

$67.05

5.9367 Million Shares

11.9148668% of Avg. 30 Day Volume

$398M

This isn’t necessarily indicative of what’s to happen next week, but rather what’s to happen over the coming years. Very notable.

SMH

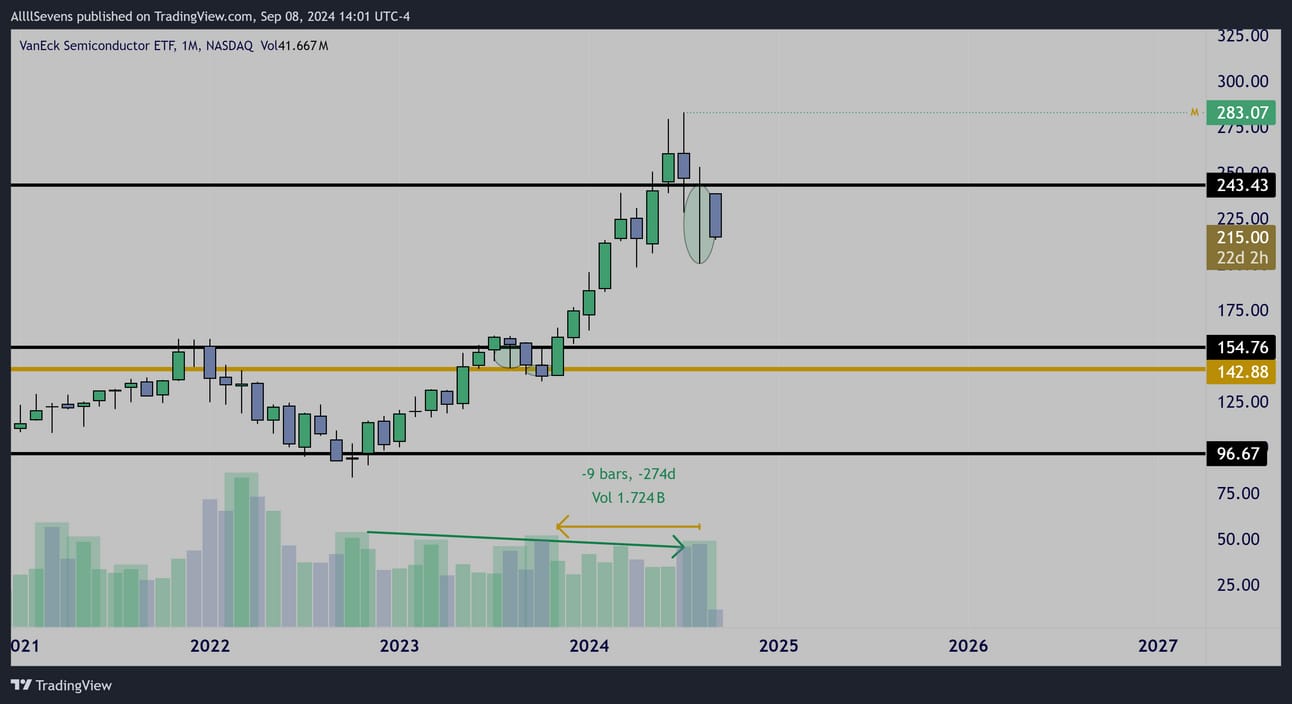

$SMH Monthly Interval

When discussing a Tech-Focused index such as the QQQ, you must mention the leading industry, semi-conductors.

The SMH is the largest market cap semi-conductor ETF-

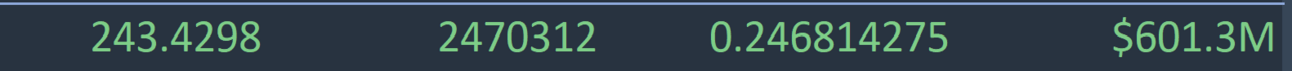

Also seeing blatant institutional accumulation last month.

Highest volume in nine months, accumulating it’s largest post-split Dark Pool on record. (fourth largest ever)

$SOXL Monthly Interval

This is a leveraged semi-conductor ETF, also showing the same monthly accumulation pattern. This one is extremely notable because it’s the largest volume in twenty-one months, when the ETF bottomed on it’s highest volume ever.

This accumulation is off the largest DP on record @ $27.37, which is also an area used for accumulation in the first half of 2021 that lead to the ETF’s current ATH which hasn’t been seen since.

NVDA

A month ago, I wrote a newsletter discussing a very interesting manipulation occurring on NVDA, the semi-conductor, and arguably overall market leader.

You can read this here.

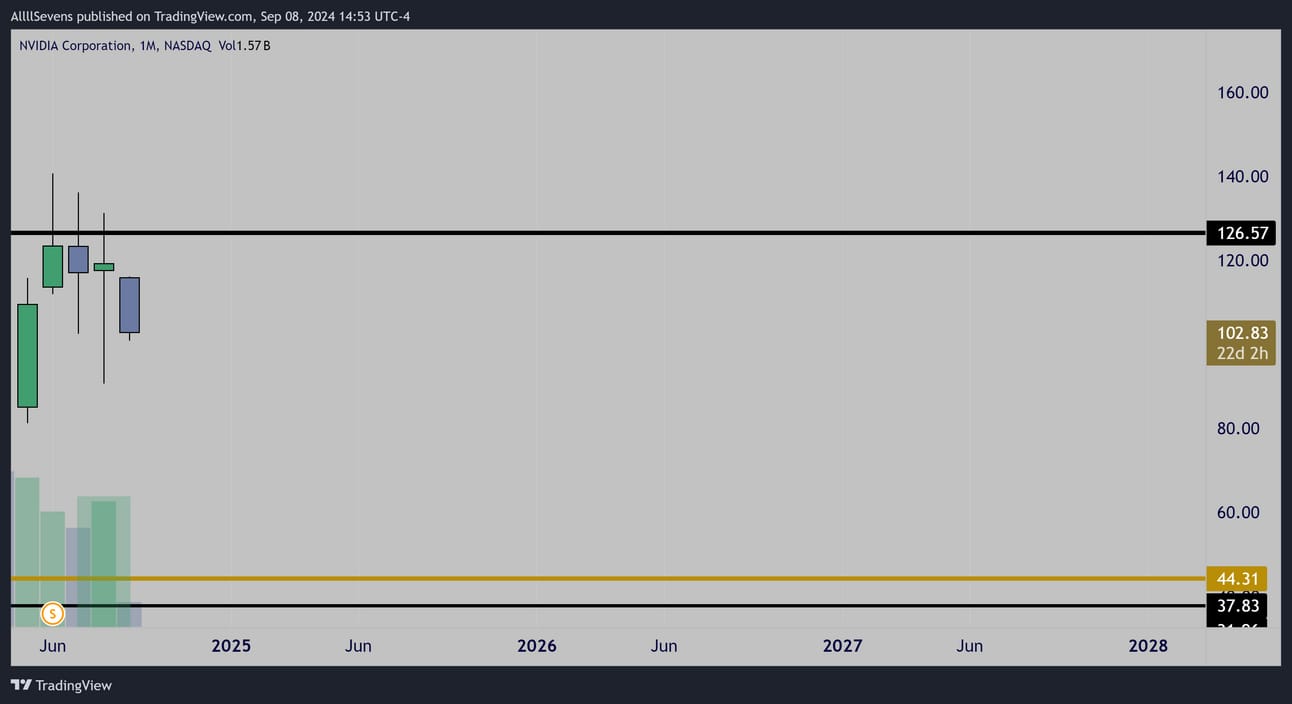

$NVDA Monthly Interval

Not only is the controlled re-accumulation visible on the weekly and daily time frames, but now also on the monthly.

NVDA remains in a “manipulated” short-term bearish environment below $126.57 fueled by retail sellers. Institutions are accumulating.

I must mention GOOGL as well-

Conclusion

Today’s newsletter may seem bland, and not as engaging-

That’s because it is.

I just don’t see much that’s extremely actionable NOW.

I believe last week’s sell-off was blatantly driven by retail investors, and in due time the bull market will continue as scheduled.

Short-term, I am just not necessarily seeing what I want in order to call for a bounce from Friday’s close.

I am an observer, planning for long-term buys across the market which I will continue writing about in coming newsletters.

Thank you for reading.

I’m looking forward to the future, as always!

Make sure you are signed up for my newsletters ahead.

Sign up here.

Follow me on 𝕏/Twitter @SevenParr

If you truly find value in my work, please consider upgrading your subscription to AllllSevens+ for just $7.77 per month.

Click here to upgrade.

I will occasionally send a premium newsletter & you will also get access to my Discord where I gather and collect my data throughout the week.

Sneak peaks to newsletters pretty much.

Sometimes I simply never get around to writing a full fledge newsletter and only Discord members see certain data that I collect.

I also take chart requests at any time in my Discord.

Overall, premium is just a way to show your support.

It’s cheap for a reason. Most of the value I provide is for free.

This is just a way to give back!

So, if you think my work is worth $7.77, make sure to upgrade.

I thank you in advance.

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply