- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Possible short-term bottom & long-term accumulation continues, but will uncertainty persist?

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of April 13th, 2025. I am not liable for any losses incurred by others.

Preface:

With last week’s extremely climatic volumes, a short-term bottom seems very likely, but with uncertainty still in the air, and tons of lost support now going to be re-tested as resistance, the question becomes:

Is this bounce going to be sustainable, or will price reject lost supports, congest, and drop again, providing deeper discounts to accumulate over the next year?

This is what happened in 2022.

The S&P500

SPY Monthly Candles

The S&P500 is undergoing an even larger long-term institutional accumulation than what occurred during the 2022 decline.

Price recently broke down from a 4-month compression following the November gap-up and over the last two weeks we have seen MASSIVE capitulatory volumes - the highest weekly volumes in YEARS.

Institutions are deploying their largest amounts of capital on record through the dark pool, specifically on $IVV & $VOO which I have outlined multiple times in my prior newsletters, read here for more details.

Long-term, it is undeniable what’s happening.

The stock market is a wealth transferring machine, from the impatient risk averse participant, to the patient risk-seeking investor, and through the recent dark pools and volumes, I am certain this is what’s happening right now.

Years from now, I believe this will certainly be reflected in price.

Short-term though, lets look at this from an unbiased lens because as we learned from 2022 patterns, it doesn’t necessarily matter how institutions are positioning themselves if a certain market environment is present.

We are currently experiencing record levels of volatility.

This is not just due to the macro environment like tariffs and recession fears, but I think because of record levels of speculation and degeneracy across the world.

In January of 2022 when institutional accumulation began of the $440’s, we saw the ame accumulatory / capitulatory volumes as the last two weeks. The result was some short-term upside, but really, price congested & accumulated for two more months, February-March, before failing to make new highs and completely collapsing in April of 2022… In fact, the April 2022 candle is the largest candle body by dollar amount in $SPY history.

Could this happen again? Yes.

Is this going to happen again?

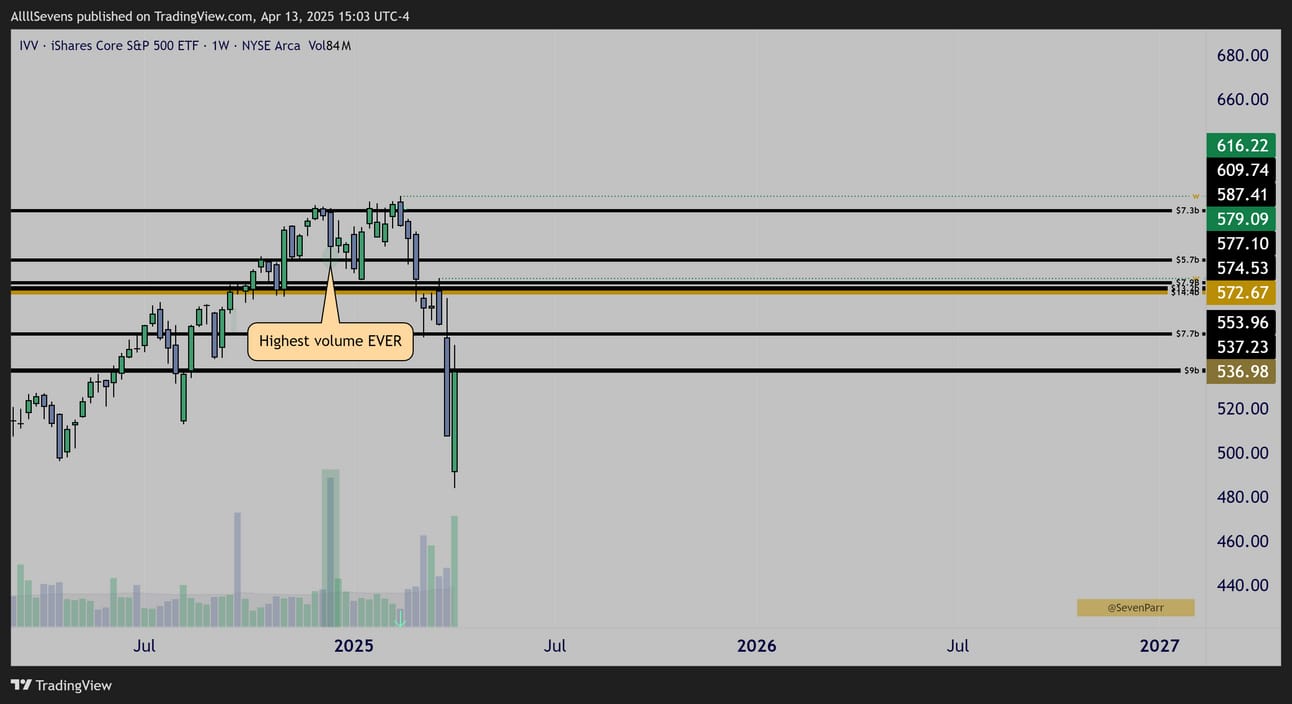

$VOO Weekly Candles

In the previous newsletter I linked above, I outline the $50B+ dark pools on IVV & VOO - the largest prints on record for the S&P500 - much larger than 2022 prints which is why I believe the current accumulation campaign is even larger.

Recent price action / volatility reflects this.

Last week, $VOO just traded its highest volume EVER, again, further confirming the massive institutional accumulation occurring right now. That’s not-to-be ignored long-term institutional buying.

BUT

Look at all the resistance price now has. This is the same dynamic that let the market congest and sell-off even harder when similar accumulation occurred in 2022.

IVV Weekly Candles

$IVV shows the same story.

This dynamic creates the POTENTIAL for price to struggle to reclaim these levels, congest, and make enter a true bear market / accumulation phase even larger and longer than 2022’s.

I’m not saying this is what happens. I am saying it could happen.

Right now, with the volumes we saw last week, it is extremely hard to see the market not moving up towards these resistances. Then, we will see how they react and continue assessing the situation.

I am obviously a long-term buyer, actively contributing every month, and almost every week, but until there is some clarity on this market environment, I’m not buying with increased size - even though institutions are.

Technically, I am trying my luck at timing the market, rather than just having time in the market, because like I’ve said 10x now, institutions are very clearly making their largest investments on record- in a way, there’s no reason I shouldn’t as well. But, I think there is a very real chance that price uses all these overhead dark pools as short-term resistance over next few months and we see another, maybe even more viscous leg down.

For now, this is all speculation - I am just putting the idea out there.

I am not necessarily bearish, I’m just willing to remain mostly cash during this market bounce to see how it plays out inside resistance.

There are though, certain places I feel a bit more confident adding size…

KVUE

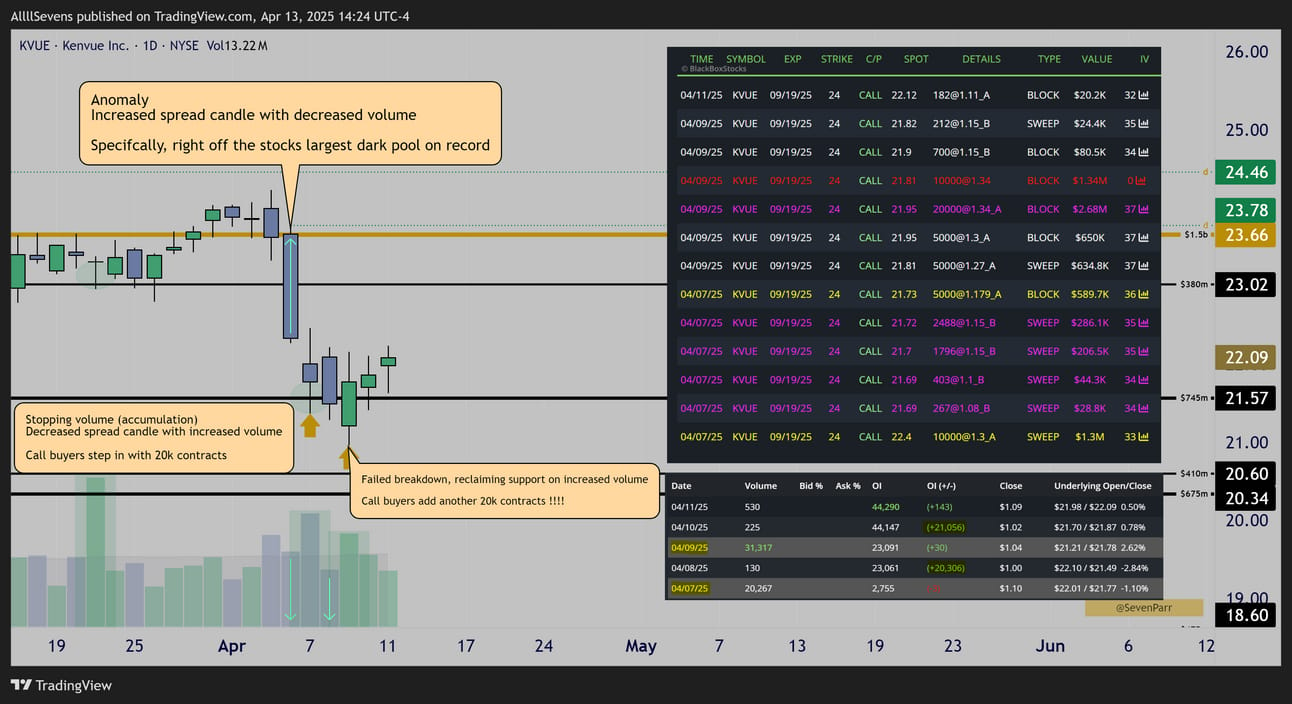

Daily Candles+ Options Flow

On April 4th, price sold off HARD from the stock’s largest dark pool on record, a $1.5B level. This shows that institutions are NOT participating in the selling here.

Side note: $1.5B is a massive dark pool, most stocks do not have this level of institutional interest. To me, this signifies greater long-term potential.

The next session, April 7th, a much smaller candle defended the $745M dark pool @ $21.57 on increased volume, showing not only are institutions not participating in the selling, but they’re building a long position.

On top of this, a trader begins a position in the 9/19 24c’s with roughly $2M

April 8th, price sells below this dark pool on an increased spread, decreased volume candle again showing no institutional participation on the sell-offs.

April 9th, price reclaims support on increased volume, and the trader from April 7th doubles their position with another $2M into the 9/19 24c’s giving them a total of 40k contracts and $4M worth of leveraged upside exposure.

Side note:

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQo

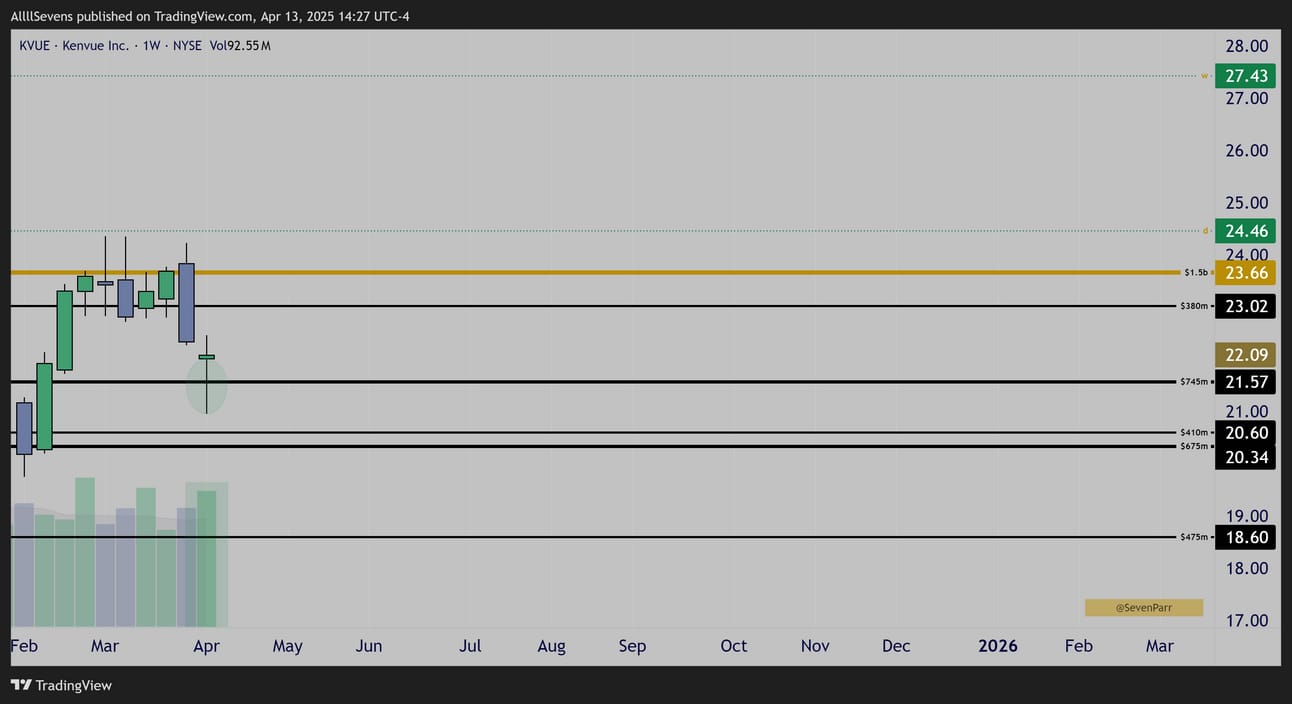

Weekly Candles

Last weeks price action developed into an increased volume hammer, an upside reversal pattern.

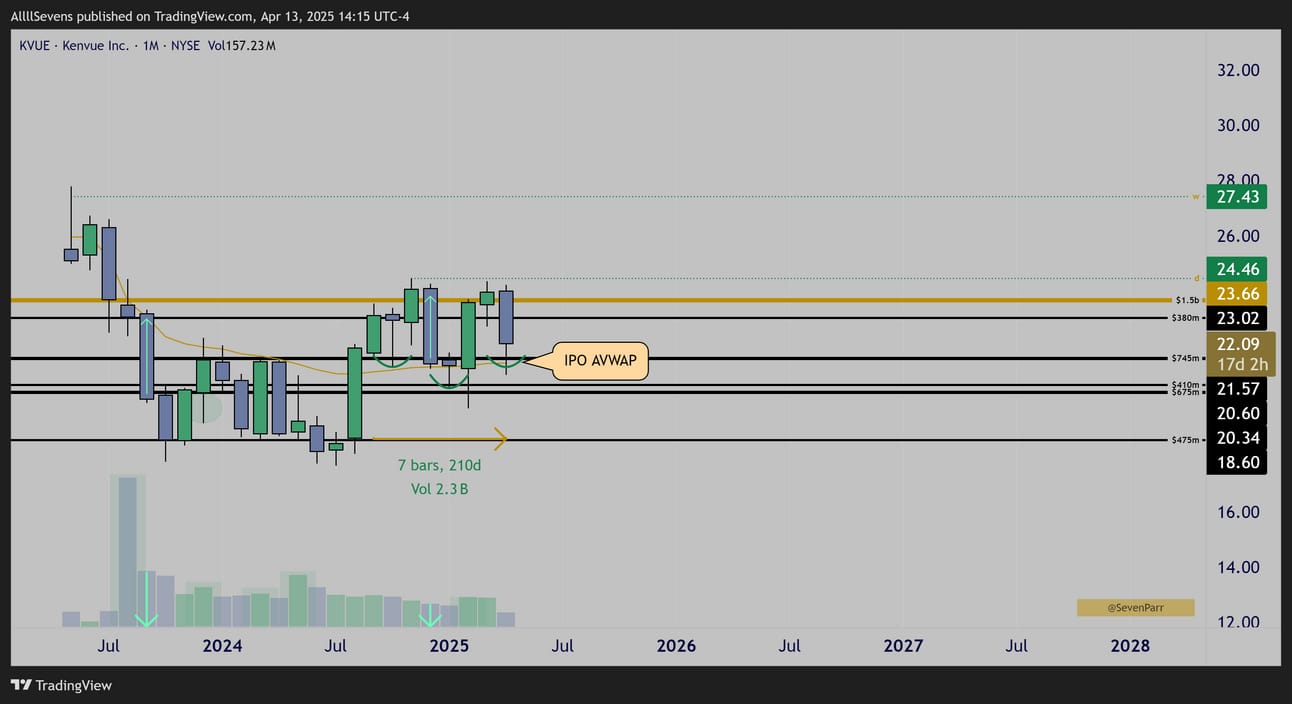

Monthly Candles

Here we can see the same anomaly sell-offs from $23.66 that we see on the daily.

This lack of institutional participation on the sell-side has been occurring for quite some time.

After being in a steep downtrend from IPO, over the last 7 months price has finally stabilized over AVWAP, creating potential for a bullish trend to emerge.

I also notice an inverse head & shoulders, an upside reversal pattern just like the hammer we see on the weekly.

Pair all of this with the flow, and I say there’s a damn good chance price at least pushes back into $23.66, if not a much larger breakout.

I don’t think last week’s low should be broke again. If that happens, this thesis may be wrong, and I’d be watching to see if the whales on the flow manage short-term risk with that leverage.

KVUE is a defensive consumer staple stock, and considering the POTENTIAL for the broader market to face resistance over the coming months, it lines up perfectly with the XLP being in the complete opposite environment.

XLP

Monthly Candles

Unlike the S&P500 having all this overhead resistance yet to be reclaimed-

$XLP, after being accumulated off its largest dark pool on record on its highest volume ever in 2022, is consolidating over SUPPORT.

For 7 months just like KVUE

Weekly Candles

Last week was the highest volume since the 2022 accumulation.

Short-term, price needs to hold prior ATH’s

Just like KVUE, I don’t see why last weeks low would be broke if this is going to push higher over the coming months.

Price also has a big resistance above still, just like KVUE @ $23.66 even though clearly being accumulated.

This is just to keep in mind that short-term things CAN and often do fail.

If price rejects resistance and breaks last week’s low, short-term strength becomes very questionable and risk should be controlled.

Oddly enough there have been some put hedges place here, so KVUE is definitely the vehicle of choice for me.

The remainder of this newsletter is accessible only to premium subscribers for $7.77 / month. I have one A+ setup I’m sharing and a LOT more shared in discord over the weekend.

Sign up here, log in, and join with the link below 👇

Reply