- AllllSevens

- Posts

- Weekly Outlook 1/8/24

Weekly Outlook 1/8/24

SPY

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

My outlook on indices and individual stocks is determined by using Volume Price Analysis specifically paired with the largest dark pools on record for the ticker in question.

Doing this allows me to present the market through the lens of an institutional trader/investor.

I can determine whether or not “smart money” has bought, is buying, has sold, or is selling. Extremely valuable information when used correctly

Preface:

Last week, I presented my YEARLY outlook for the S&P500

This is a very important read. Check it out below.

https://allllsevensnewsletter.beehiiv.com/p/allllsevens-newsletter-2024

To sum it up-

I am extremely bullish the market long-term…

However,

Short-term, I am seeing reasons to go “risk-off” for the likelihood of consolidation or even a correction before prices can continue higher.

I don’t see the point in remaining aggressively bullish until some very critical levels are broken to the upside.

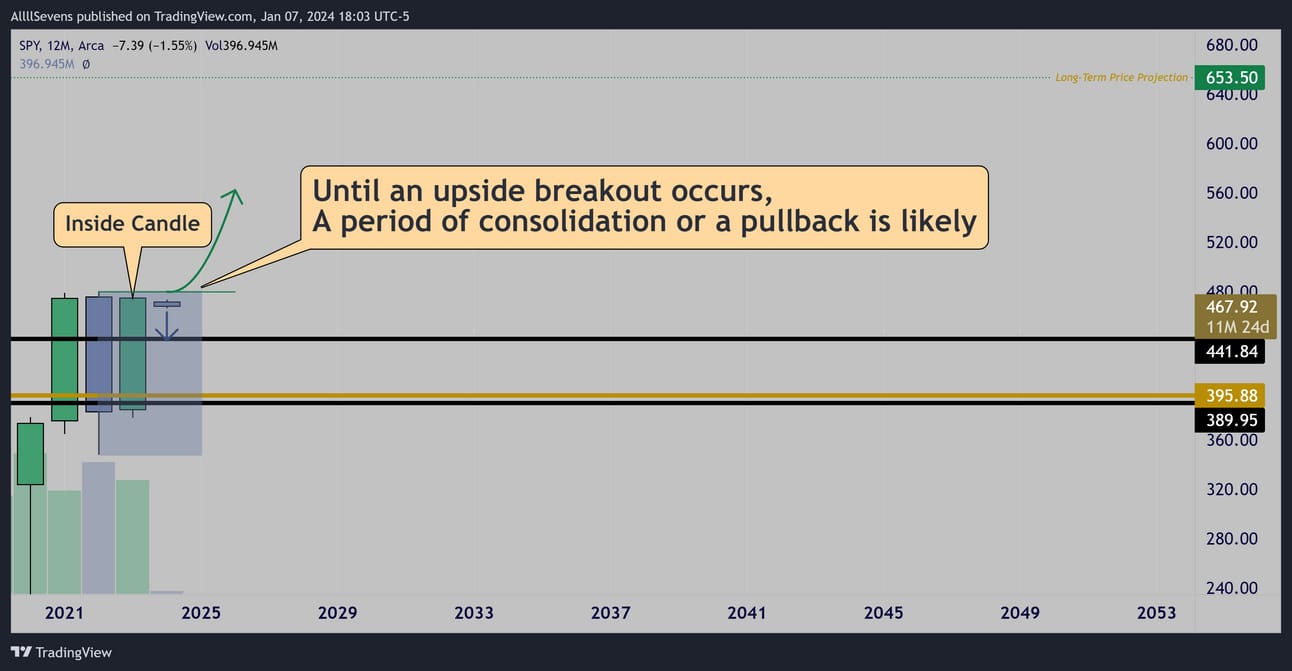

SPY Yearly

2023 closed as an inside candle, signaling a period of indecision.

A “pause” in trend giving short-term focused traders an opportunity to relax and prepare for the next move.

Until an upside break occurs, a period of consolidation or even a market correction is likely. Here’s some added confluence to this thesis:

XLF Monthly

The Financial sector (XLF) is facing it’s largest dark pool on record, $38.01 which has been heavily accumulated for the long-term…

BUT,

Short-term, until this area is turned into support it could act as a major resistance.

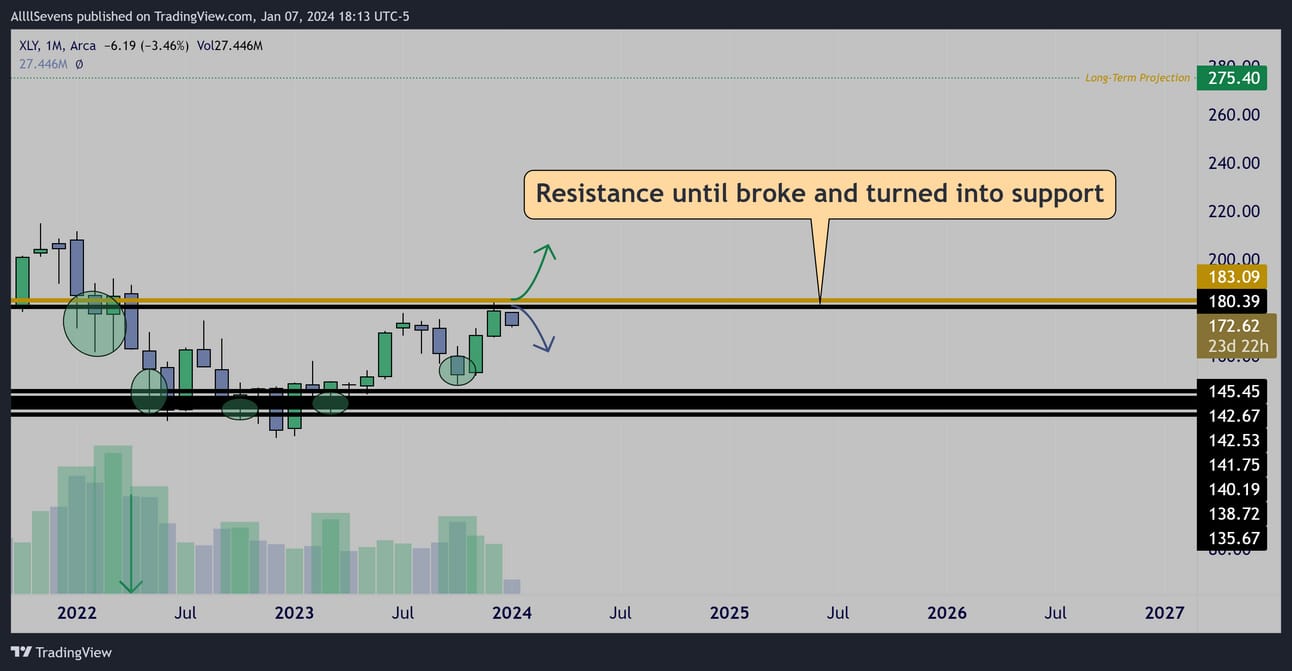

XLY Monthly

The Consumer Discretionary sector (XLY) is the same exact situation.

These are two of the largest sectors in the SPY, facing major resistances that once broke will lead to massive upwards expansion…

Just like the SPY itself is facing an upside barrier (inside candle consolidation) that once broke will lead to massive upwards expansion.

So why am I not screaming breakout? Why am I warranting caution?

Well… It’s the current market environment.

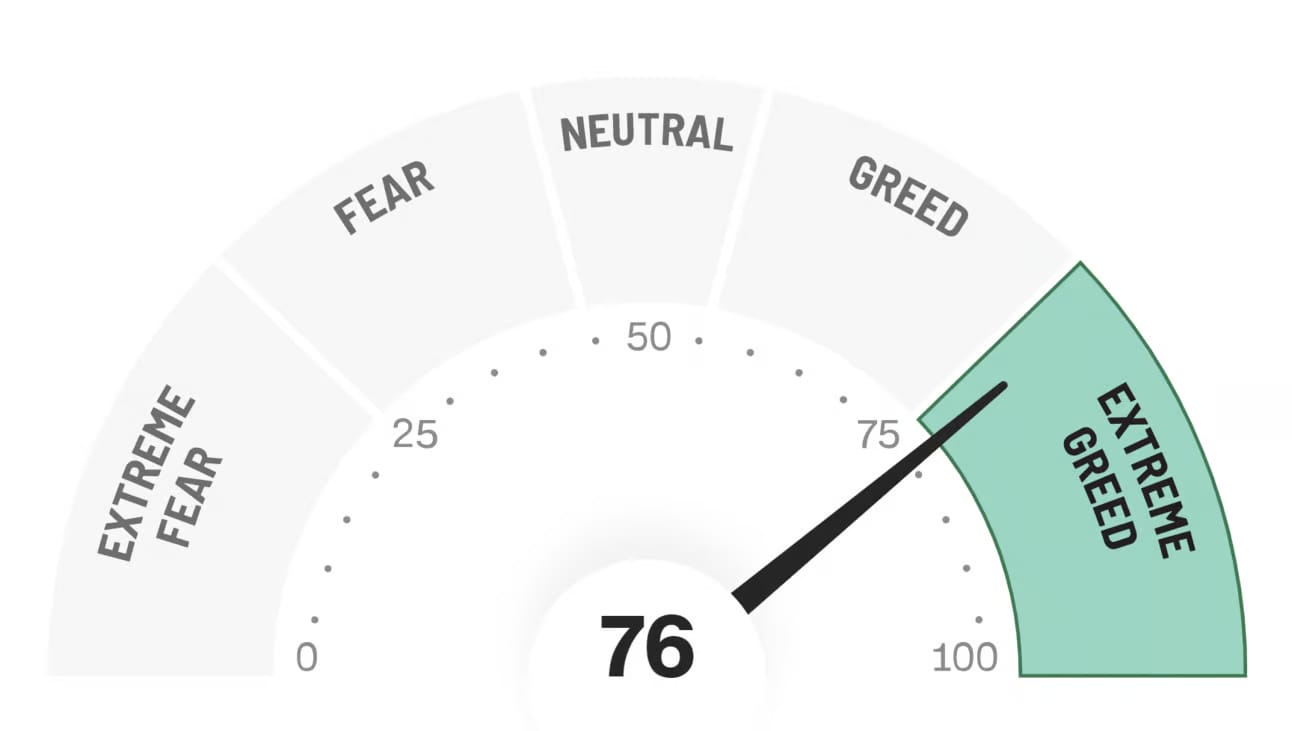

CNN Fear & Greed Index

The market hit “extreme greed” last week.

An “extended/overbought” environment isn’t exactly what you want to see as price approaches a breakout level.

This increases the chance of a rejection significantly.

Could a breakout still happen?

Absolutely. But guess what…

The initial breakout is NOT where the money will be made.

The real money will be made on the multiple months possibly even years of upside expansion that will occur from a strong break and hold.

Given the current environment- I’ll wait for confirmation.

I’m “risk off” and mainly focused on day trading until I state otherwise.

Before I move forward, I just want to make sure I’m not undermining how huge the breakout scenario would be here.

When it happens, it will be huge. Much more profitable than any downside. I’m just saying, as of right now, until we begin that breakout, there is definitely reason to not be aggressively going long this at these high prices below resistance. A pullback would be a blessing.

Let’s talk about my plan for THIS week:

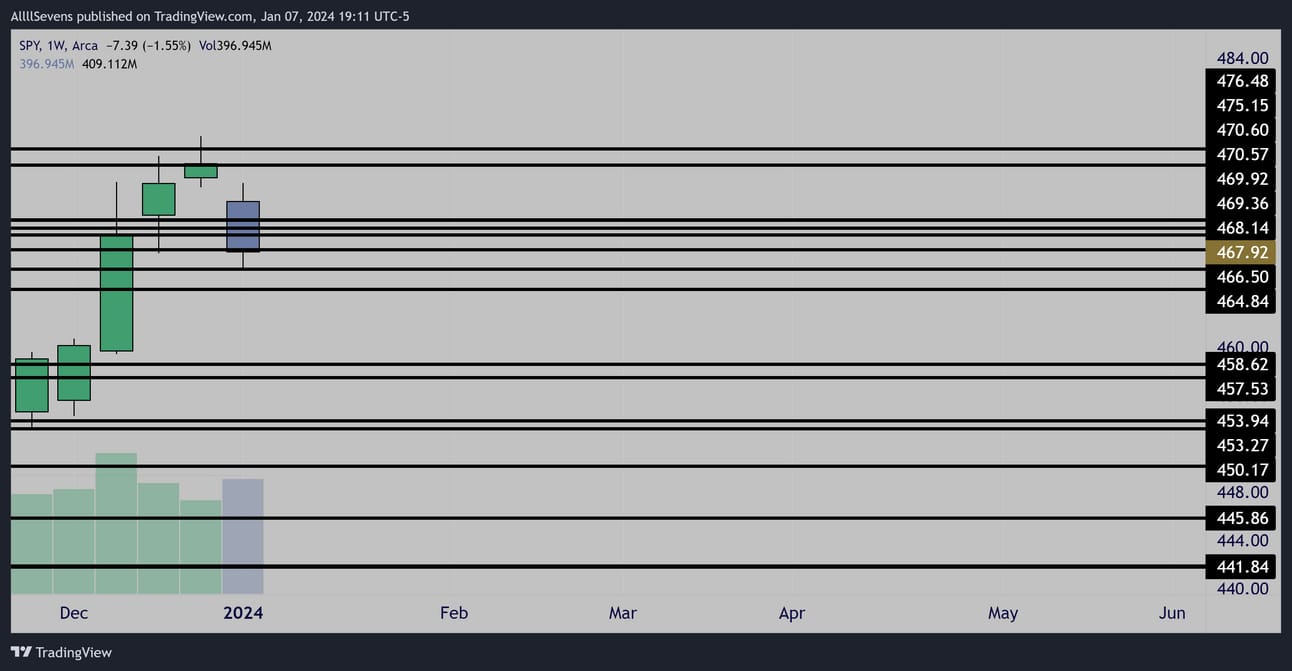

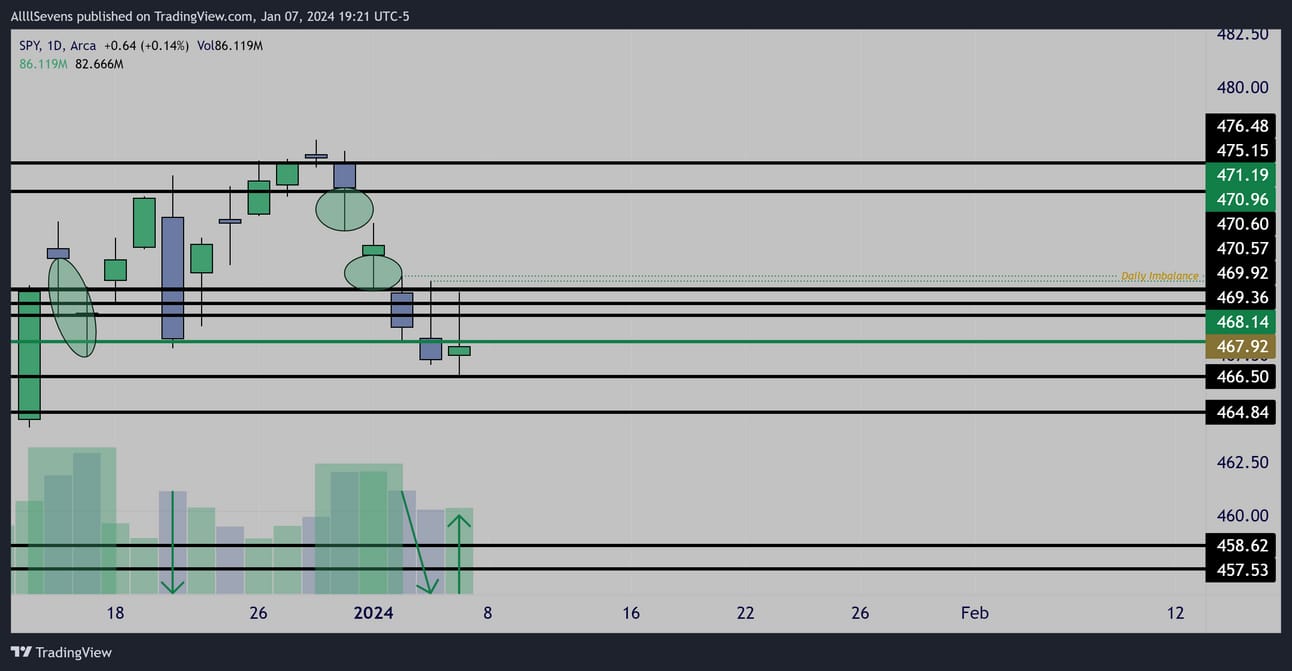

SPY

Weekly

This week’s candle shows a potential “gap-and-go” shift in momentum to the downside. HOWEVER,

A certain condition must be met upon this week’s candle open in order to confirm a shift in trend.

Daily

The daily chart shows that bulls are still very much active.

This doesn’t matter though if trend aggressively shifts to the downside… So what’s the confirmation?

If tomorrow’s candle opens below $468.14, then bears are likely to seize the moment and fully shift momentum to the downside. As long as price remains below this level, I will be focused on downside movements.

if price opens below this level and fails to defend it as resistance, then I am going to anticipate some extreme chop, and I would not be aloud to chase upside confidently.

If tomorrow’s candle opens above $468.14, then bulls are likely to maintain their control of the current bullish trend. As long as this level holds, I will be focused on upside movements market wide.

If price opens over this level and fails to defend it as support, then I am going to anticipate some extreme chop, and I would not be aloud to chase downside confidently.

Normally I would remind you to follow me on Twitter for updates on this outlook and how I’m trading it since it is rather nuanced and slightly subjective, but unfortunately my account has been suspended indefinitely.

I have a plan to get it back- but I’ll need all the help I can get.

More on this in tomorrows newsletter. Please read it!

This weeks premium newsletter was on $ELAN- Elanco Animal Health Inc.

https://allllsevensnewsletter.beehiiv.com/p/allllsevens-elan

It’s $7.77 per month to receive these newsletters as well as get access to my Discord where I’ll be posting my usual twitter content for the time being. In a few days I will be running a free trial period, so if you can wait, wait!

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjrgd

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply