- AllllSevens

- Posts

- Spotlight Newsletter

Spotlight Newsletter

Advanced Micro Devices, Inc. - $AMD

Disclaimer

Before you read this newsletter, it is crucial to understand the following:

-Background: I am a 22 year old college dropout with no formal education or professional experience in the fields of finance, investing, or stock market operations.

-Content Nature: All information I share is purely speculative and represents my personal, abstract opinions.

-Take With Caution: Approach the ideas, concepts, and data presented with a healthy dose of skepticism. They should not be considered as definitive or accurate information.

-Not Financial Advice: This content should in no way be interpreted as financial or investment advice. It does not constitute a recommendation to buy, sell, or hold any securities or financial instruments.

-Investment Risk: Investing and trading the stock market involves significant risk, including the potential for substantial financial loss.

-Professional Consultation: Always consult with a licensed financial advisor or perform thorough personal research before making any financial decisions involving the market.

-Liability Disclaimer: I bear no liability for any financial losses that could result from actions taken based on the information provided.

Lastly,

Understand that while I often speak in certainties, no such thing actually exists.

This is all speculation.

Preface:

Before you read this newsletter, I recently wrote a thesis as to why I think The Technology Sector ($XLK) as a whole, will experience an EOY rally.

Read that here.

I’d also like you to recall the institutional accumulation we recently saw, on the monthly time frame, into the SMH Semiconductor ETF, as well as the triple leveraged SOXL. Truly outstanding volume into the SOXL

Read that here.

$AMD is currently the #5 holding in the $SMH @ 5.37% and it is the #1 holding in the $SOXL @ 6.32%

AMD

Monthly Interval

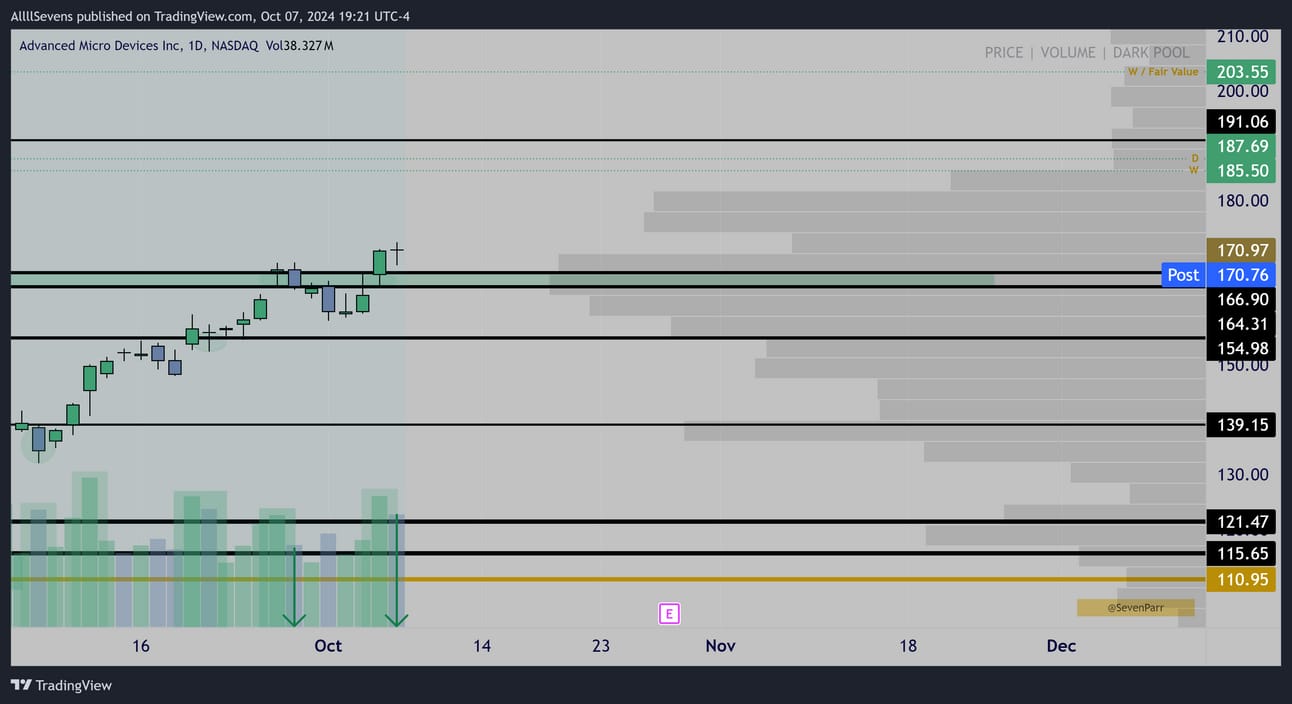

During the 2022 pullback, AMD saw MASSIVE institutional accumulation in the $110-$120 Dark Pool cluster. This remains the dream buy zone for AMD, but right now, the possibility that that this area will not be tested again is very real.

I understand it’s possible- but in this newsletter I will explain why I am convinced it won’t happen, and why I am buying AMD right now.

Since making a new ATH in 2024, price has been trending down and “bull flagging’ on declining volume all year. This is a textbook environment for bullish continuation, and THIS month, it’s possible we’re seeing a breakout begin.

Weekly Interval

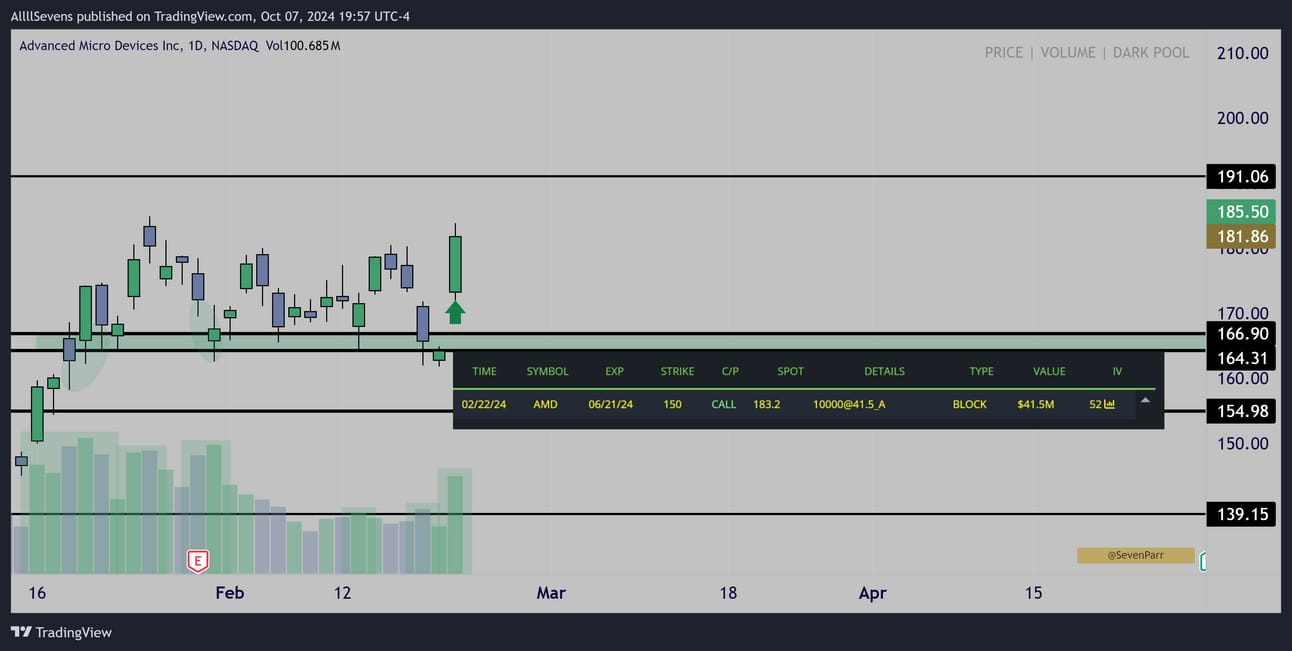

On the weekly time frame, we can see that this $154.98-$166.90 area has been accumulated in the past, so as price potentially breaks trend + reclaims this support, it adds strong conviction to the potential validity of this breakout.

The accumulation in late January to early February is actually extremely notable-

Let me show you something.

Daily Interval

This is what price and volume looked like on the Daily- further confirming the weekly accumulation patters that are visible.

On February 22nd, price gapped up from support on volume and a $40M call block came in…

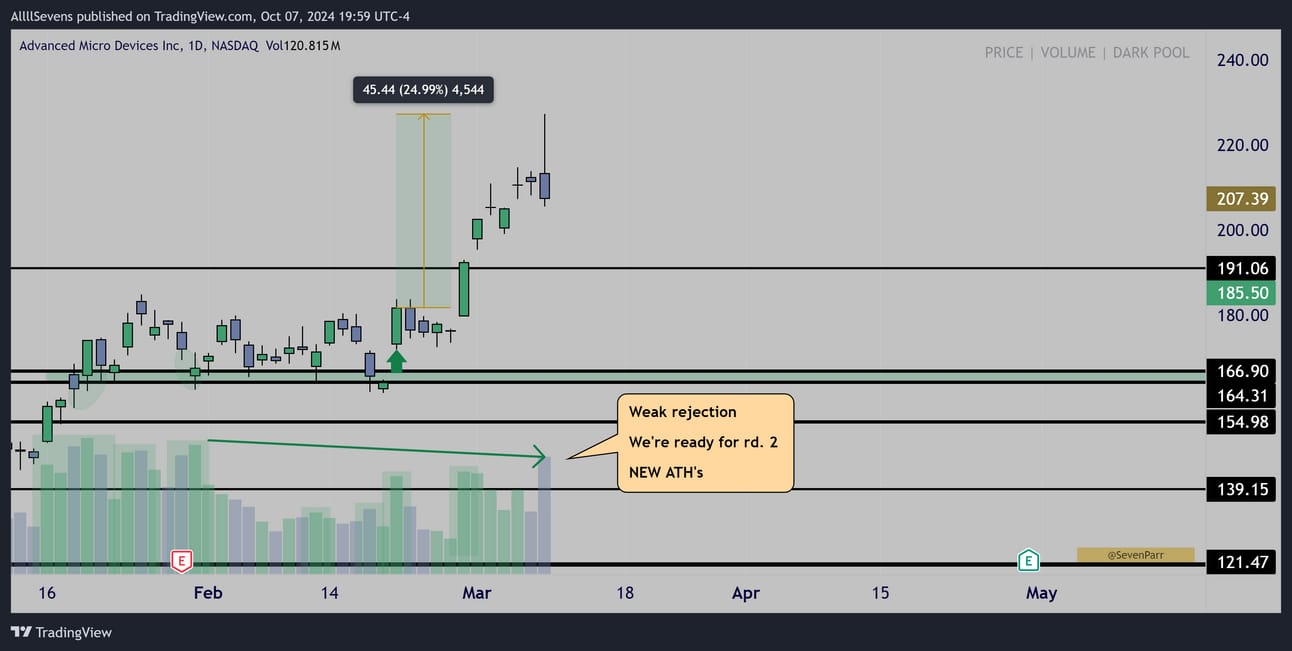

Daily Interval

Price made four inside candles on decreased volume, a textbook continuation pattern, much like what we’re currently seeing on a much larger scale on the weekly and monthly right now-

A 25% rally followed, and took price to it’s current ATH

Immediately notice that yes, the top was on increased volume, but far from “canceling out” the prior accumulations. So, today, as price reclaims this same exact zone…. it begs the question: Are we about to blow past this ATH??

Daily Interval

Beautiful volume price sequence here.

Today’s decreased volume “resting candle” over this shelf is a textbook upside continuation pattern.

Typically, I like to see more congestion, much like what we saw in February, but we don’t always get what we want. I think this sequence plus the monthly and weekly breakouts potentially underway is not to be ignored.

I bought AMD today, and after diving deeper to write this newsletter I have intentions to buy more.

My current portfolio weighting is 3.43% which is neither underweight or overweight. I am thinking about substantially overweighting this to about 10% and re-adjusting to a lower weight after a rally ensues.

This of course, is assuming my thesis is correct, which is not guaranteed.

I could be wrong! About all of this! Probably not though.

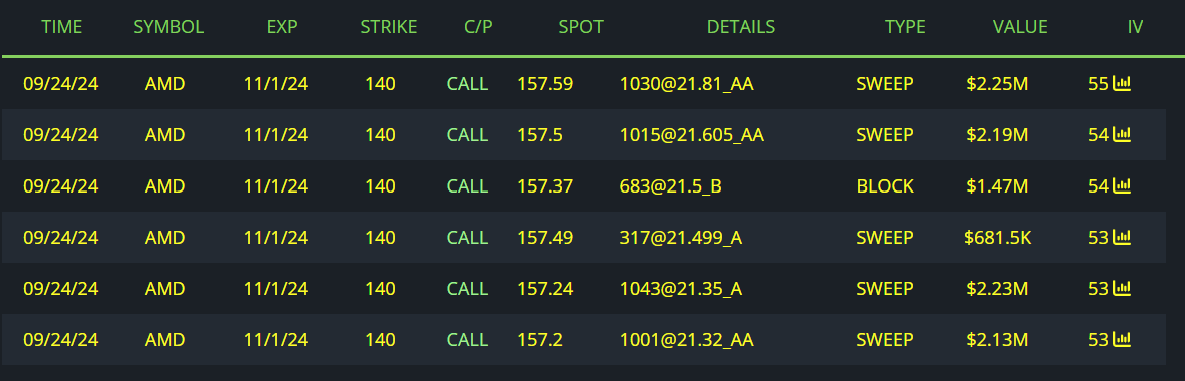

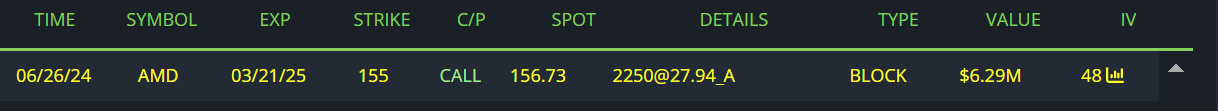

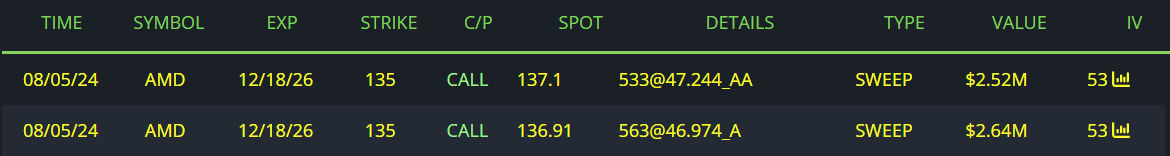

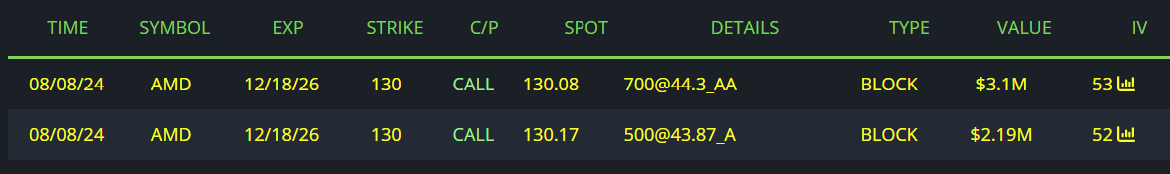

Unusual Options Flow

I’ll sort this into three categories.

#1- Already green and potentially still in their trade with lots of time

#2- Barely green / break even / red on their trade with lots of time

#1:

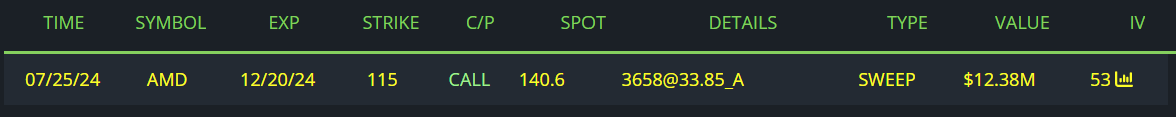

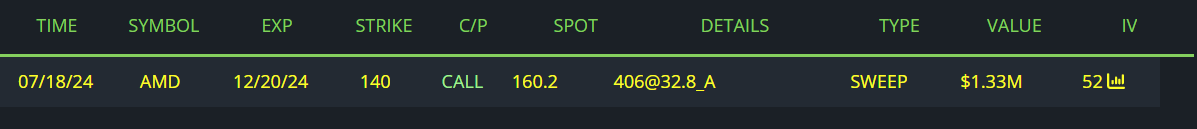

$12M Call Buyer for December

$10M Call Buyer for 11/01

$6M Call Buyer for March

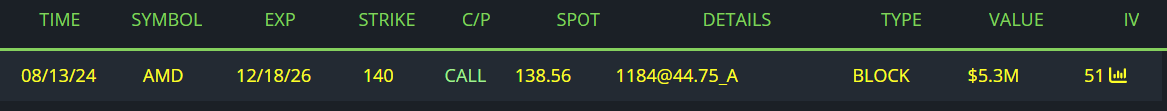

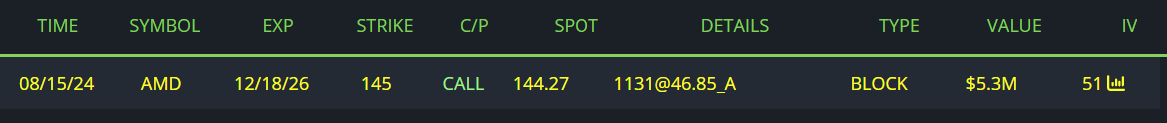

$5M Call Buyer for December 2026

$5M Call Buyer for December 2026

$5M Call Buyer for December 2026

$5M Call Buyer for December 2026

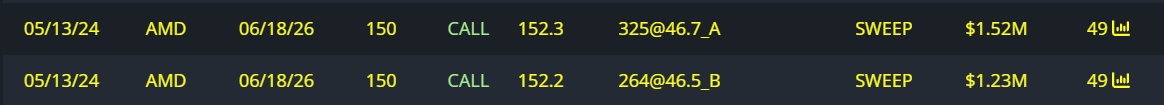

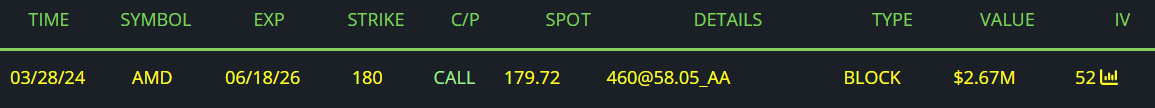

$2.5M Call Buyer for June 2026

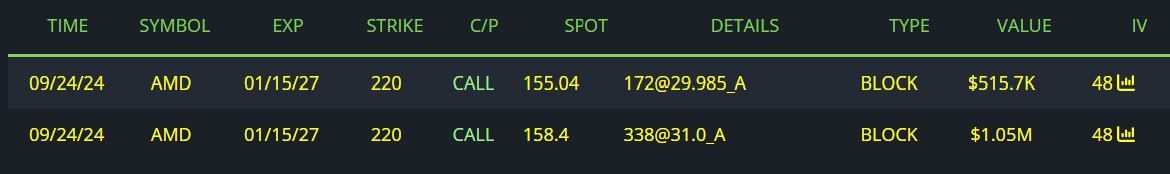

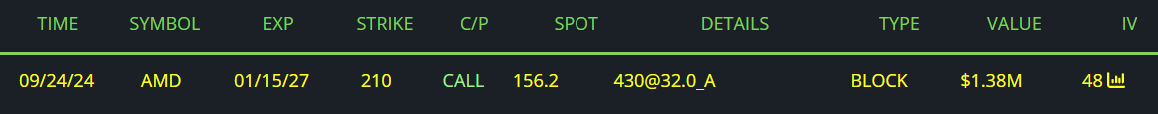

$1.5M Call Buyer for January 2027

$1.3M Call Buyer for January 2027

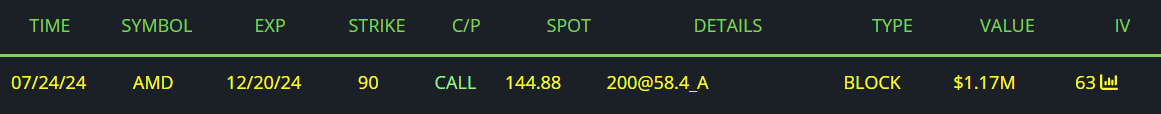

$1M Call Buyer for December

$1M Call Buyer for December

#2:

$19M Call Buyer for 11/08

Executed TODAY

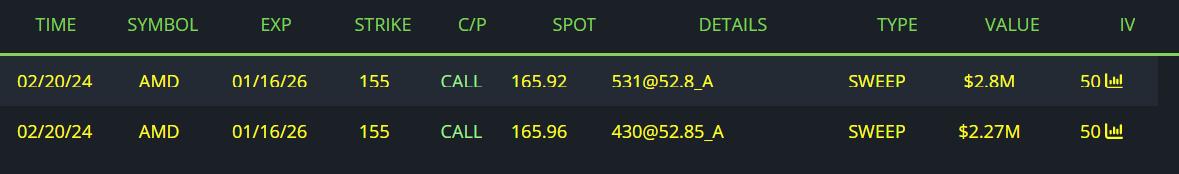

$5M Call Buyer for January 2026

$5M Call Buyer for January 2026

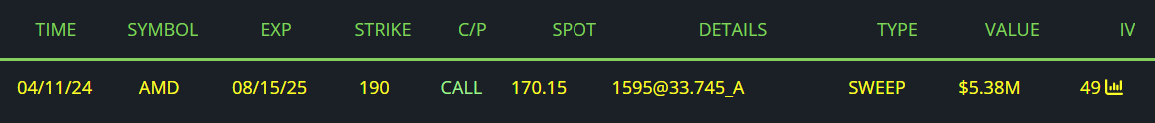

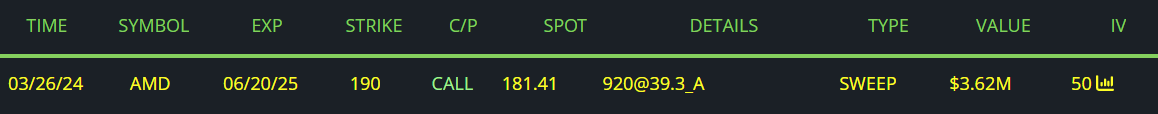

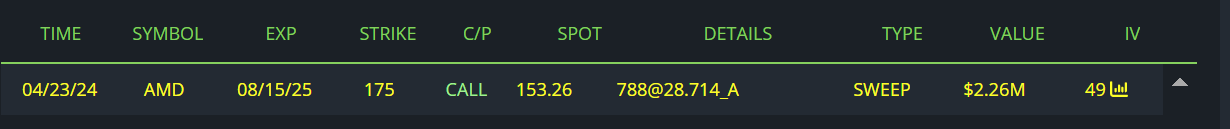

$5M Call Buyer for August 2025

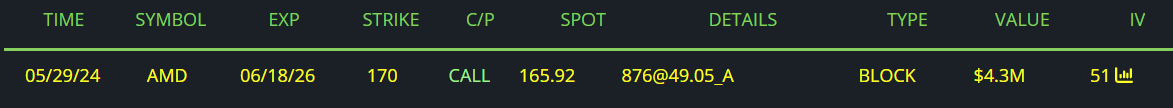

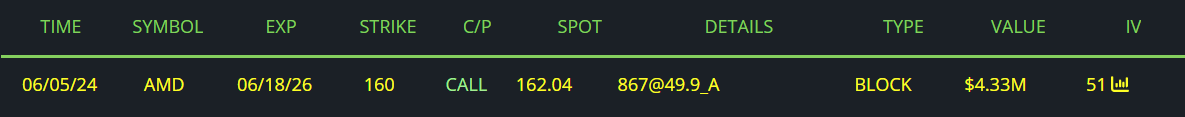

$4M Call Buyer for June 2026

$4M Call Buyer for June 2026

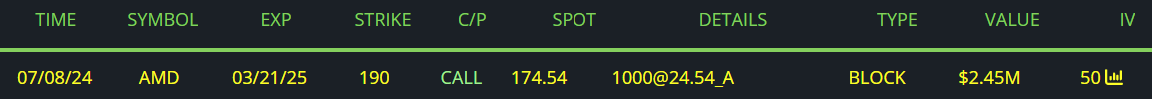

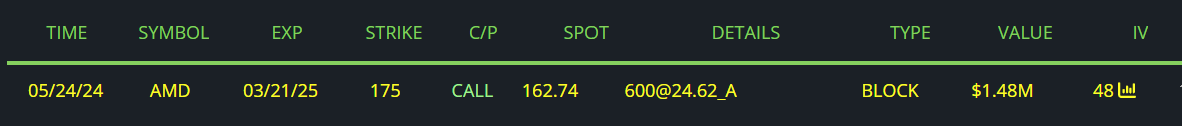

$3.5M Call buyer for June 2025

$2.5M Call Buyer for June 2026

$2M Call Buyer for August 2025

$2M Call Buyer for March

$1M Call Buyer for March

During this massive bull flag on declining volume for the entirety of 2024, following a very healthy push to ATH’s and short-term retail rejection-

Large funds have not only held onto their LT shares, but they have accumulated a substantial amount of call options expecting shorter term upside continuation.

$55M worth of dated calls are already substantially in the green and potentially still holding.

$53M worth of dated calls are potentially still holding and looking to go green on their positions!

$19M of which was executed today and is a very short expi - 11/08

Just ONE month of time!

“Unfortunately” all of this flow is very expensive and definitely not friendly to my personal account. As I already said, I’m going with LT shares here.

Conclusion

The real cherry on top for this setup is what we saw during the January-February accumulation phase and the weak short-term high set by impatient retail investors in March. As price reclaims the same Dark Pools that launched us to ATH’s earlier this year, this time inside a prolonged bull flag, the flow has built an even larger bullish positioning, anticipating a new ATH to come with ease.

This could obviously fail. Nothing is certain.

My long-term target is displayed in the first image shared. I project AMD will reach approximately $350 over the coming years.

Do not forget to read the newsletters mentioned in the preface.

SOXL saw EXTREME accumulation in August.

The SMH saw it’s first institutional accumulation since breaking into new ATH’s.

The TQQQ (leveraged QQQ) saw two of its largest Dark Pools ever, and was also accumulated. And finally, the XLK is compressed for a potential expansion into EOY. And don’t forget AAPL ;)

Sign up for my next newsletter here.

It’s 100% free.

Also make sure you follow me on X.

And if you truly find value in my work, and respect the time I put into these, please consider upgrading your free subscription to AllllSevens+ for just $7.77 per month. Click here to upgrade.

Some exclusive newsletter content is on the horizon.

Only AllllSevens+ members will be able to read it.

AAPL is an example. Amazing thesis there.

Upon upgrading, you will also get access to my Discord where I gather and collect my data throughout the week. It is NOT an alert service.

I take chart requests at any time in my Discord!

Find me on DUB! Here.

-Must read disclaimer.

(I will write a more official newsletter promoting what this is soon)

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply