- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Against the Grain: Outsmarting Seasonal Market Trends

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

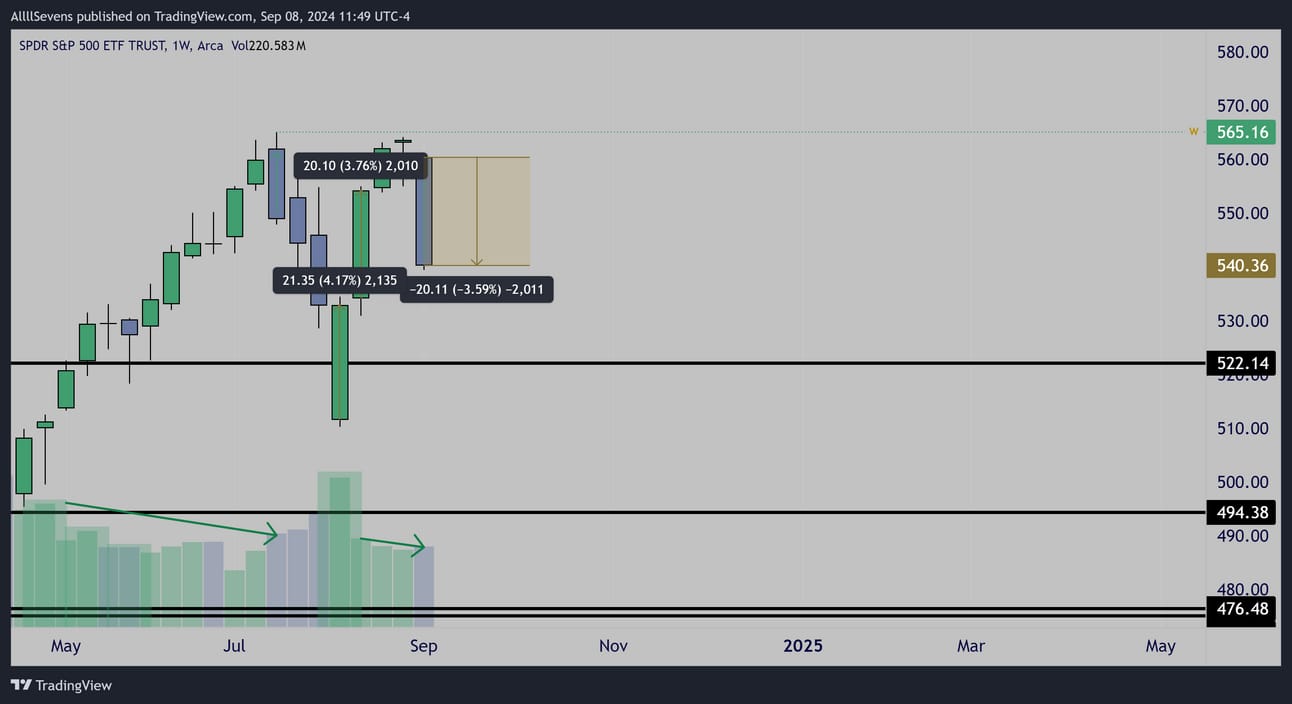

In last week’s newsletter, I outlined the abnormally low volume behind the market’s ($SPY’s) second attempt at a seasonal sell-off. See below.

Weekly Interval

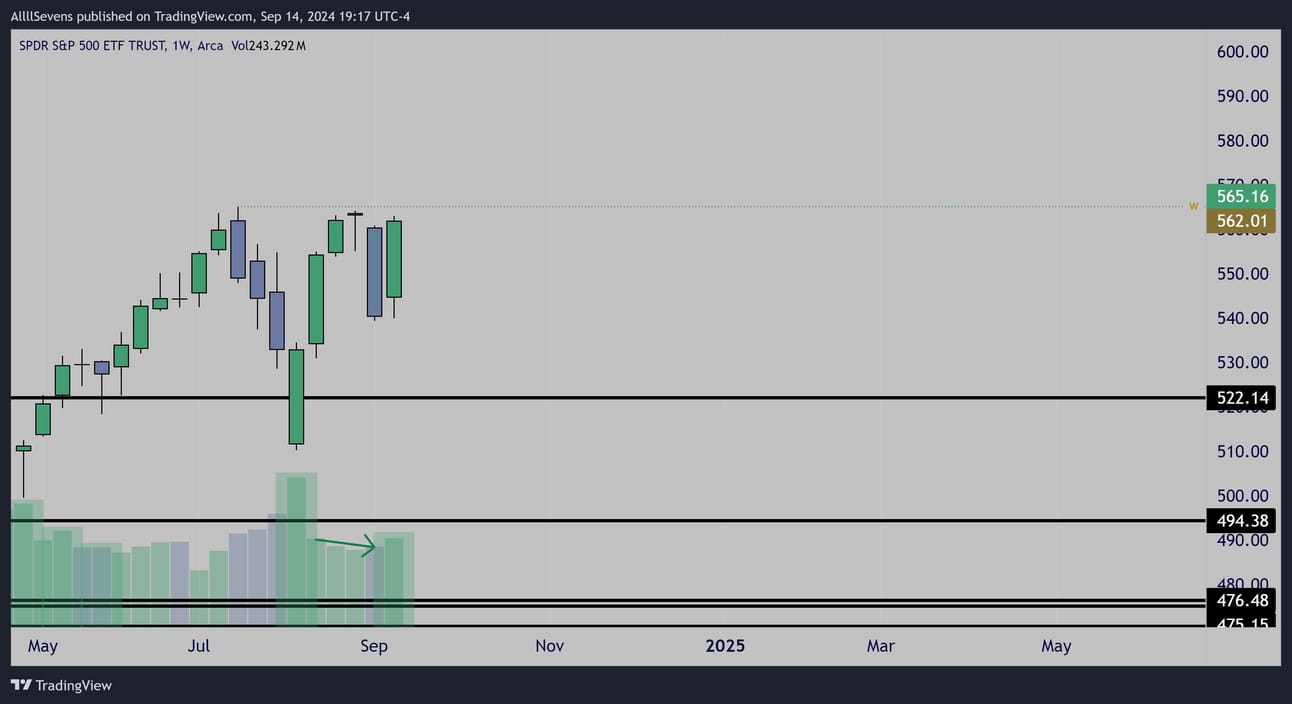

Weekly Interval

The result, last week, was the market’s strongest candle in all of 2024.

+4.01% from the prior week’s close. On increased volume.

I believe this is the market making a statement against seasonal probabilities which suggest price should be trending down during this time of the year.

I have an EXTREME bullish thesis for the broader market during this time.

Please read that here.

As you read, keep in mind the short-term market is very risky and somewhat unpredictable, so if the levels and thesis’s outlined fail, it’s key to manage risk.

I do firmly believe probabilities are heavily skewed to the upside at this time.

This doesn’t mean it’s certain.

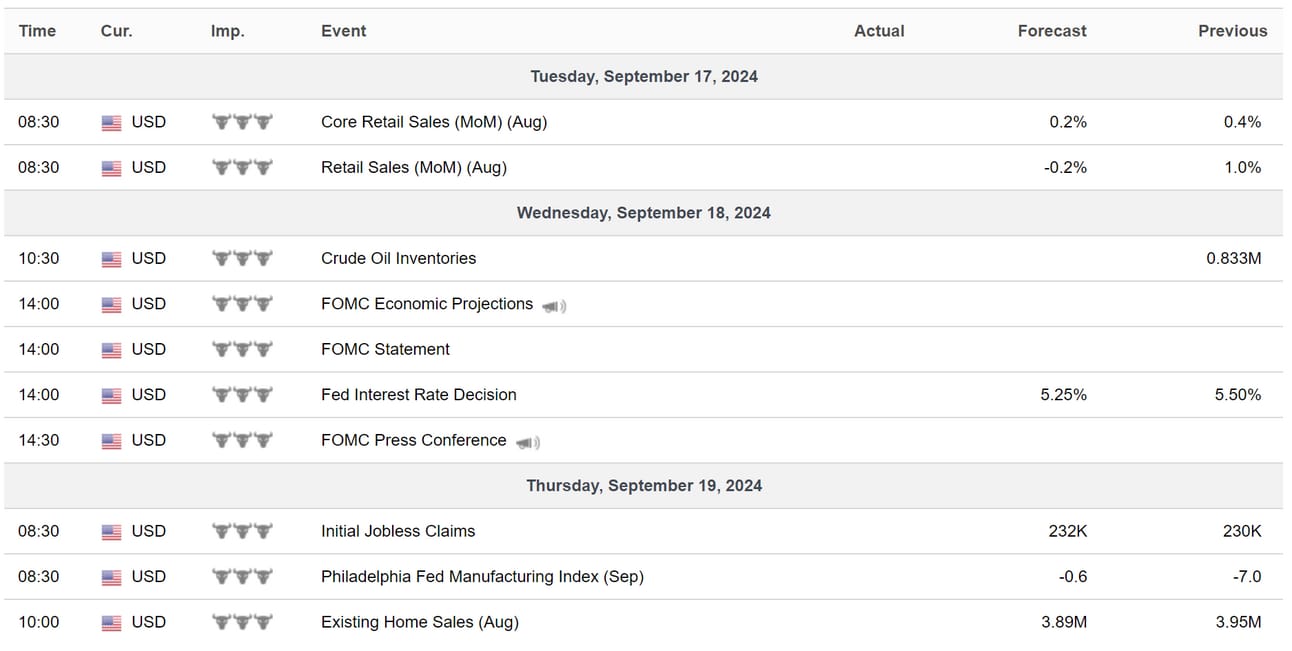

High Impact U.S. Economic Data

QQQ / XLK

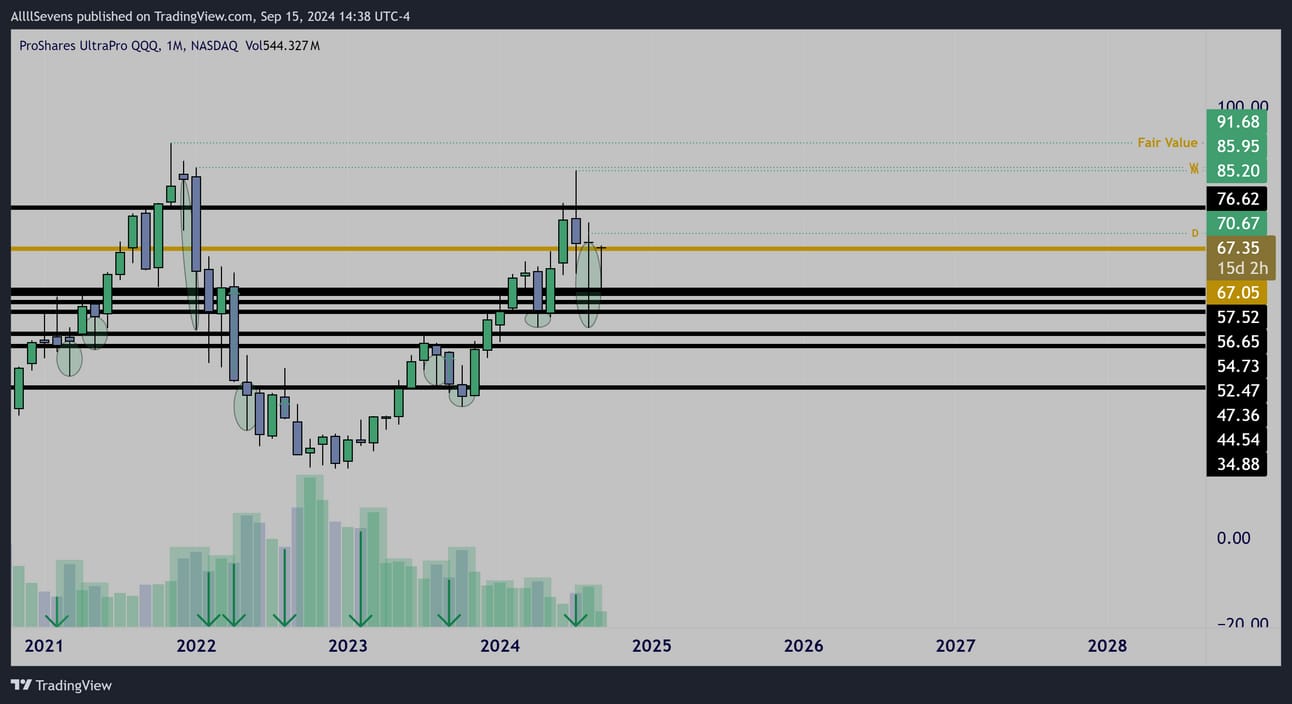

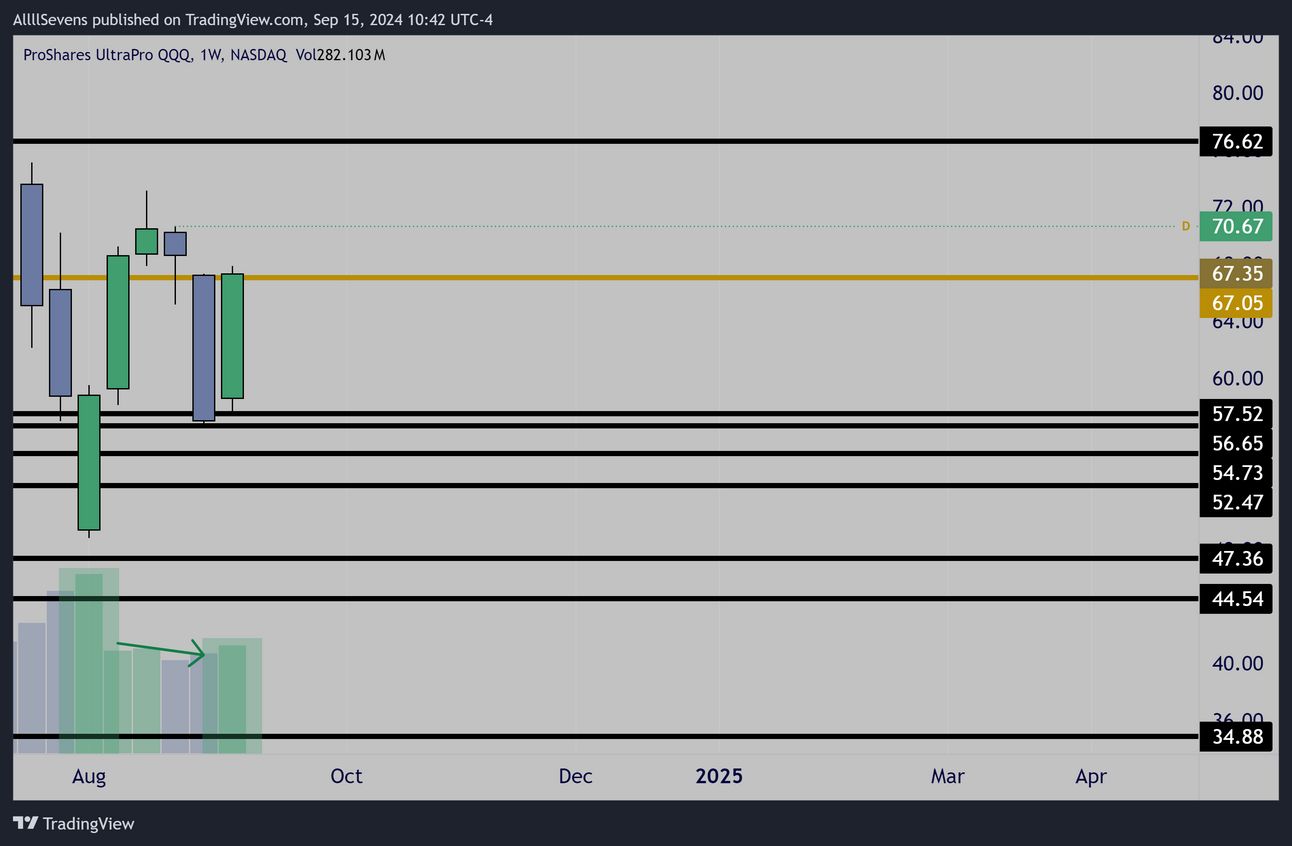

$TQQQ Monthly Interval

Price: $67.05

5.9367 Million Shares

11.95% of Avg. 30 Day Volume

$398M

Just last month, the leveraged $QQQ saw clear institutional accumulation off of it’s largest Dark Pool transaction on record @ $67.05.

Headed into this week, the monthly candle is currently attempting to flip green over this level after successfully retesting the $57.52 DP below.

Weekly Interval

For strong short-term upside continuation, this $67.05 level will be THE KEY.

If it can remain support throughout this week’s incoming volatility with the Fed’s interest rate decision, the market, and specifically Tech related stocks, are likely to explode to the upside as the monthly candle surges green towards $76.62

This would be about a +4.5% rally on the $QQQ

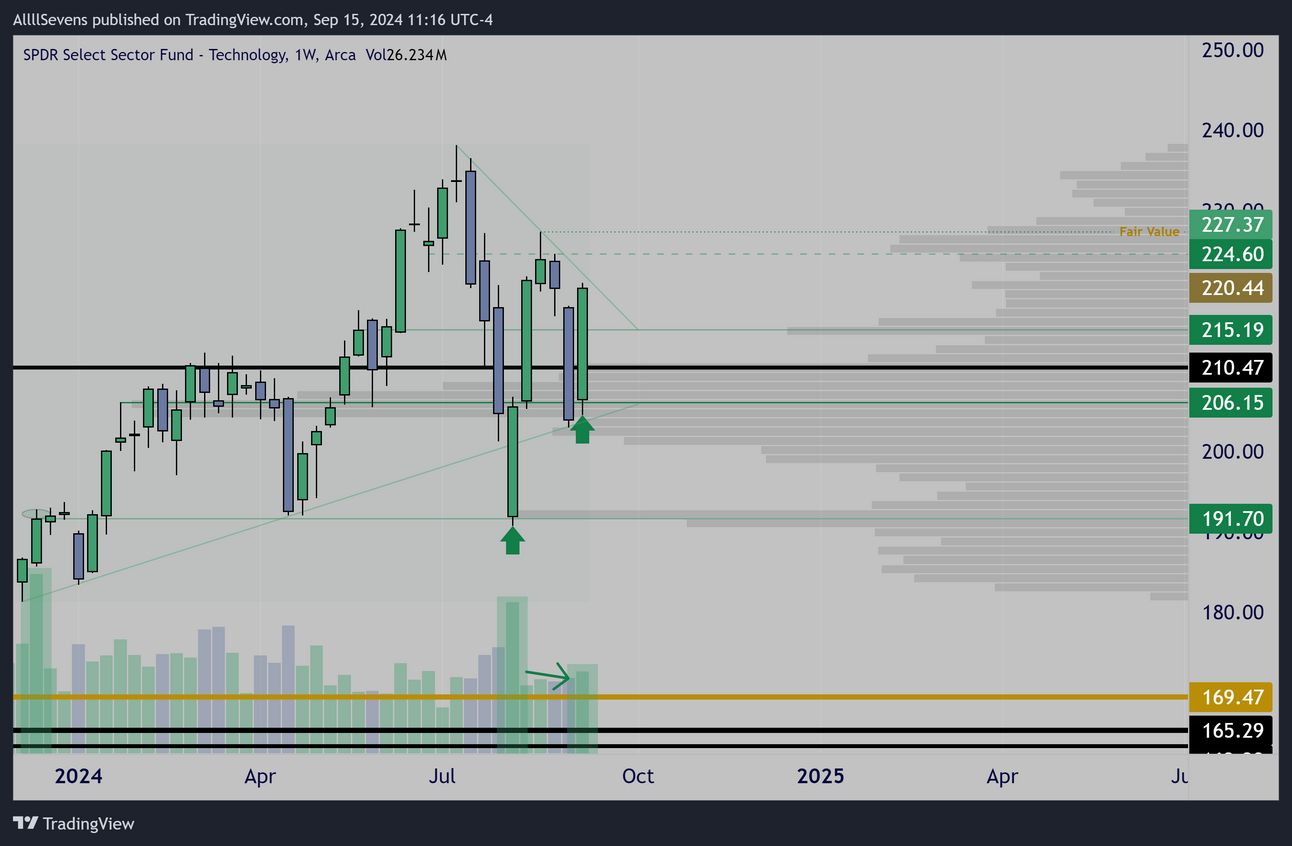

$XLK Weekly Interval

Monthly Interval

The recent price action on the Tech Sector for the $SPY is beautiful.

Not only does it also display the clear strength from bulls right now, but also puts into perspective how relatively sideways price has been over recent months.

In early August, this ETF saw it’s highest volume for all of 2024 defend uptrend support as well as reclaim it’s VPOC @ $206.15

A Dark Pool was then transacted @ $210.47 ($350M) displaying monthly accumulation. Upon retesting VPOC & this Dark Pool over the last two weeks, price held on increased volume. Again, I believe this is a statement.

$SPY Daily Interval

This puts into perspective the fact that the broader market has really been sideways for a whole three months… From compression comes expansion.

In this case, I believe probabilities are stacked to this expansion being up.

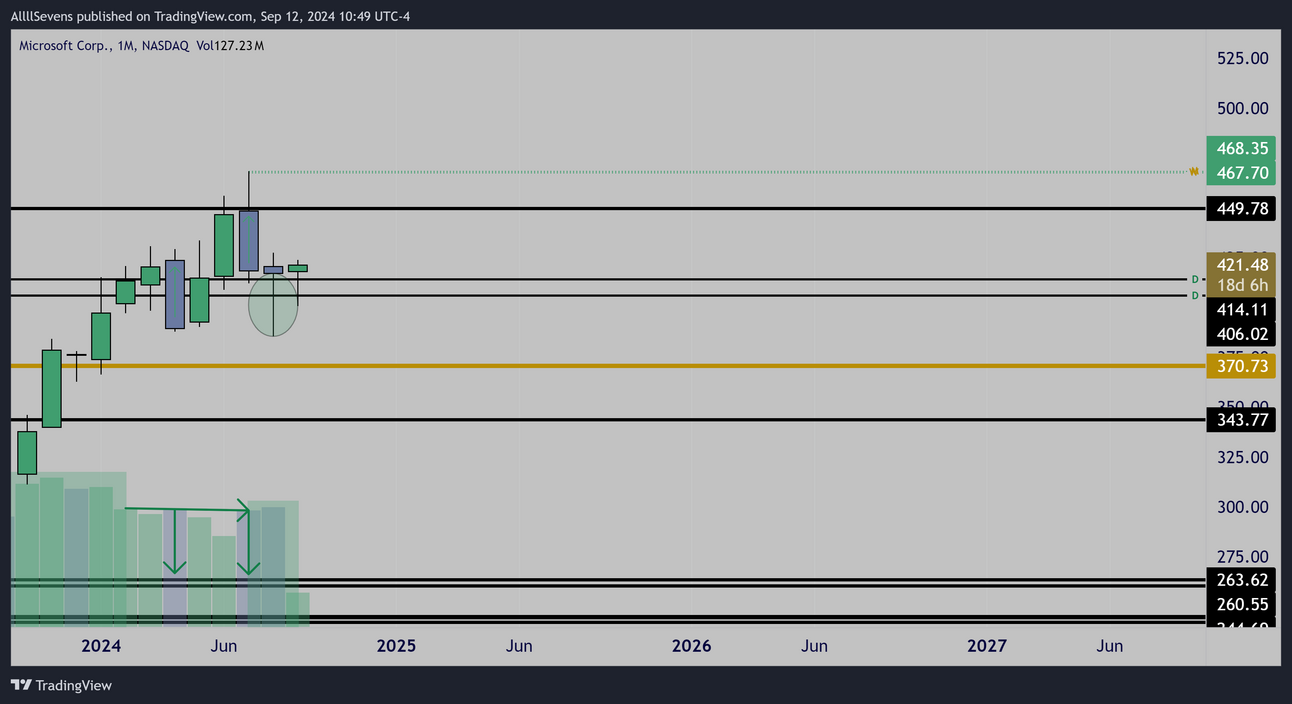

I wrote a newsletter covering my TOP pick in the Tech sector-

Microsoft & the Software Industry as a whole.

You MUST read this.

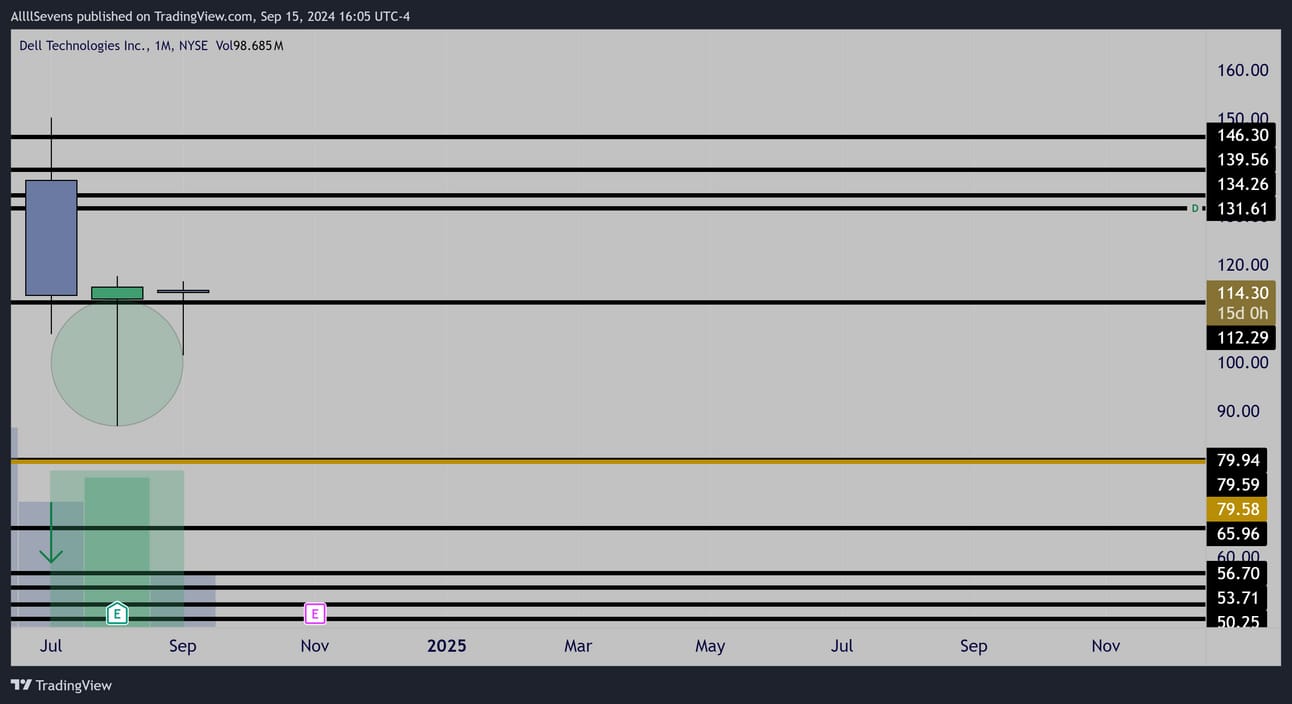

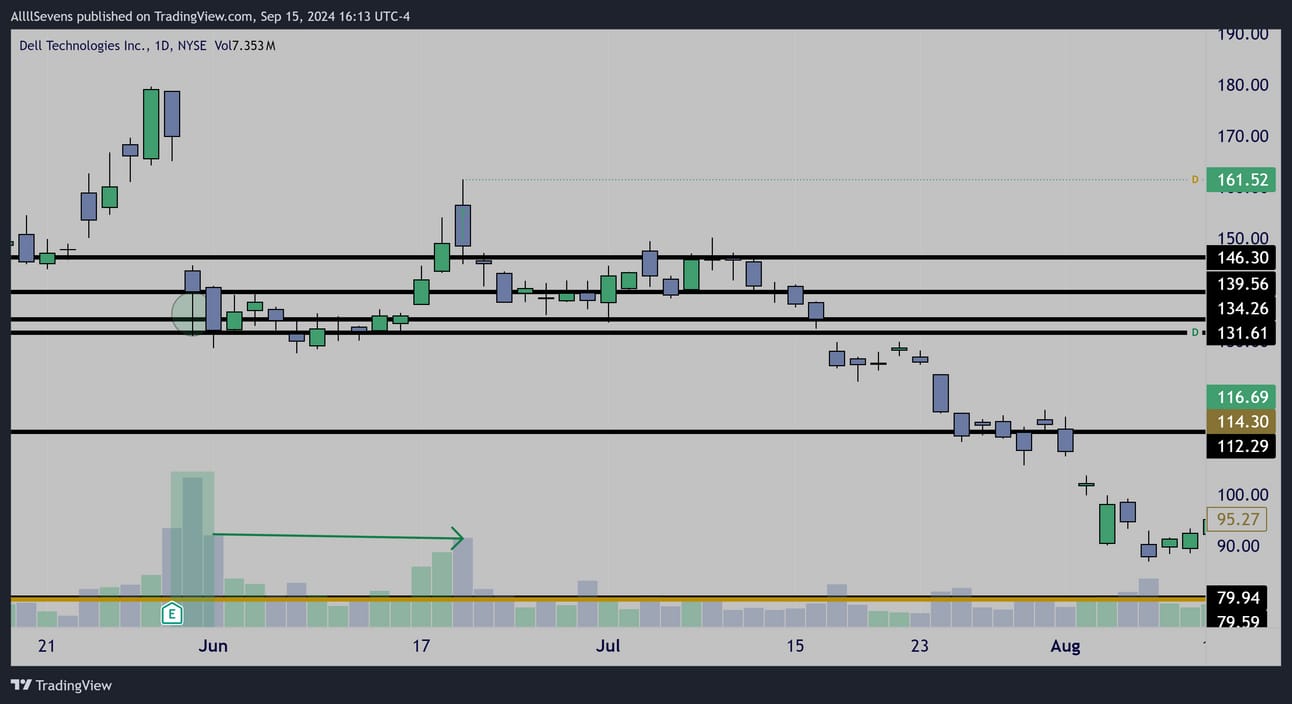

DELL

Monthly Interval

Immediately upon being added to the S&P500, $DELL stock is already seeing active institutional investment. As you may have already noticed, this monthly setup is very similar to the $TQQQ, and I can already actually see some relative strength- you’ll see why when we get to the Daily time frame.

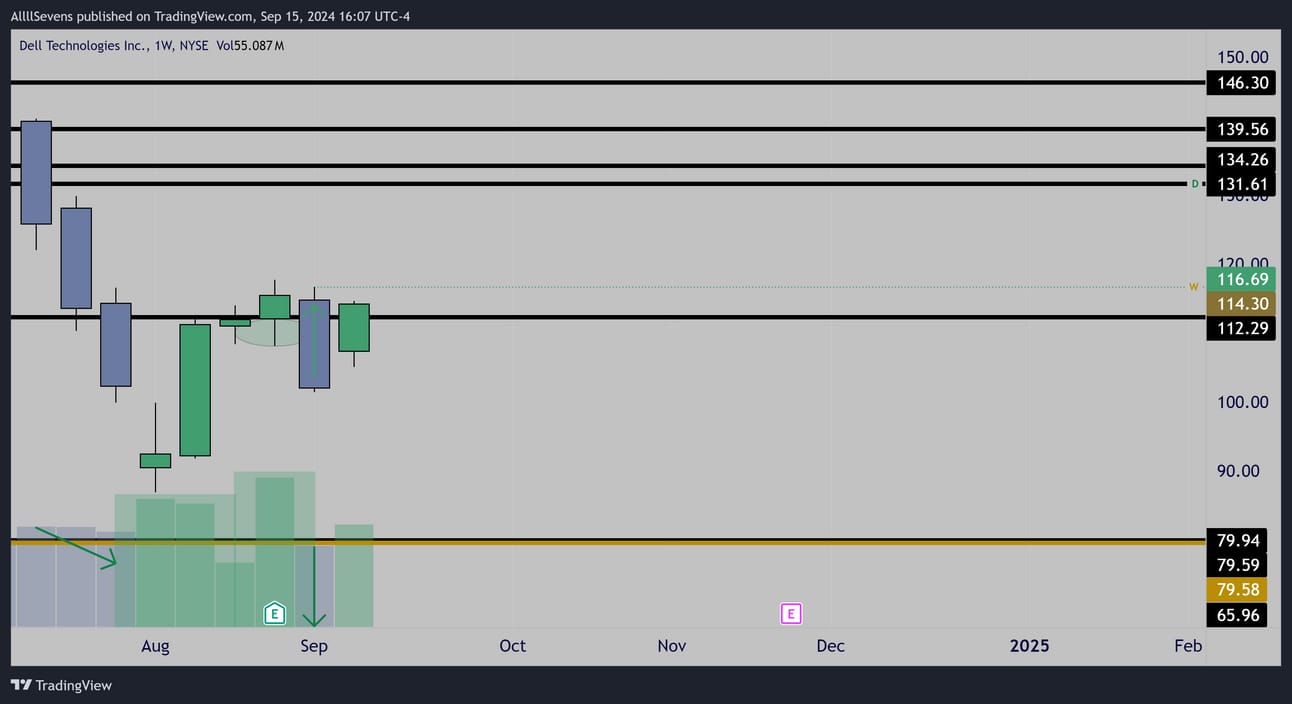

Weekly Interval

This is a truly amazing volume price sequence.

It starts by a very week sell-off from the $130’s which you can also see outlined above on the monthly chart. Quite the decline from the $140’s down to the $110’s- a 40% decline- backed by very notable low volume.

It’s clear what institutions are positioning for here.

Clear & strong buyers are defending the $112.29 DP

I love the sell-off the week before last from this level, again, on very low volume.

This time, followed by an increased volume inside candle right over this DP

This is an A+ setup into the coming week.

If $112.29 can remain support, there is a massive upside range co-coinciding with the range we see on the TQQQ, expect this one is actually much bigger.

If you though this setup couldn’t get better, any better, you’d be wrong.

Daily Interval

Why is this showing some relative strength to the QQQ?

Because there is a PEG over $112.29

HUGE.

Daily interval

Zooming out further, we can see the institutional accumulations here began in the $130’s. I’m excited to continue covering this stock when it one day reclaims that area and wants new ATH’s

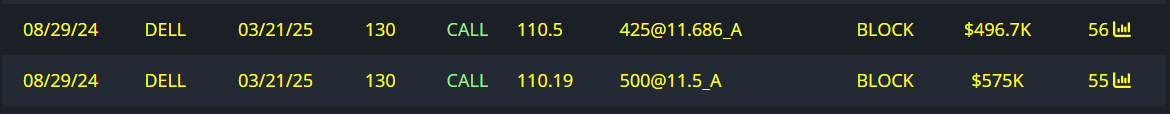

$1M Call Buyer for March

(same expi as out MSFT bulls. hmm)

$2.66M Put Writer for December

$1.01M Put Writer for December 2026

$1M Put Writer for February

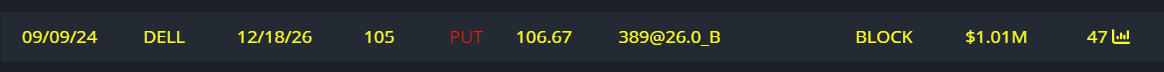

CSCO

6 Month Interval

I wrote about this stock not too long ago-

But, it hasn’t moved and still looks absolutely incredible so I’m covering it again.

Major accumulation in 2022, shown by a large lower wick directly at DP

Retail sell-off in 2022, shown by a much larger candle… on less volume.

Price has since compressed for over 2.5 years.

From compression comes…

Monthly Interval

Absolutely textbook accumulation patterns directly at DP’s.

This gives me a probabilistic edge to expect the expansion from this compression will be towards the upside.

Last month’s bullish engulfing candle with a lower wick off the stock’s largest DP on record makes me think the breakout is very near.

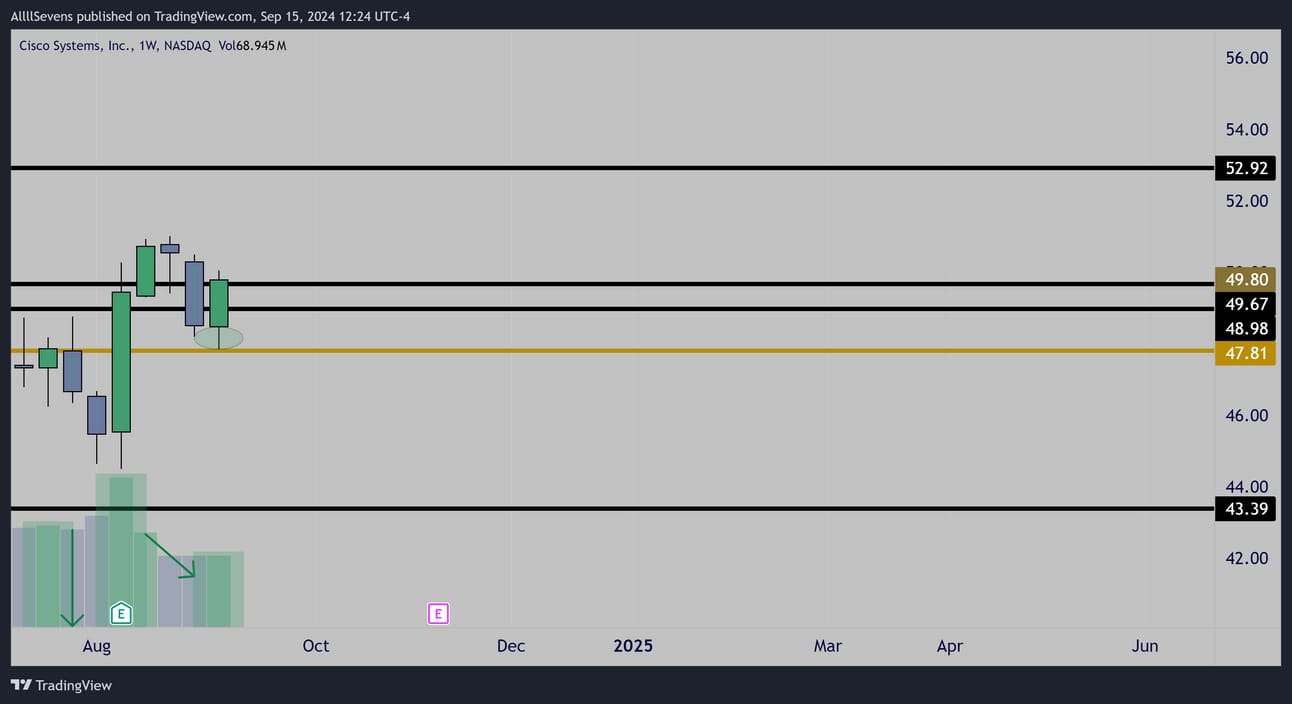

Weekly Interval

Upon retesting demand on decreased volume, a successful bounce has occurred.

If this $47.81-$49.67 area can remain support, I think the bullish positions outlined below will be very profitable on a push to $52.92

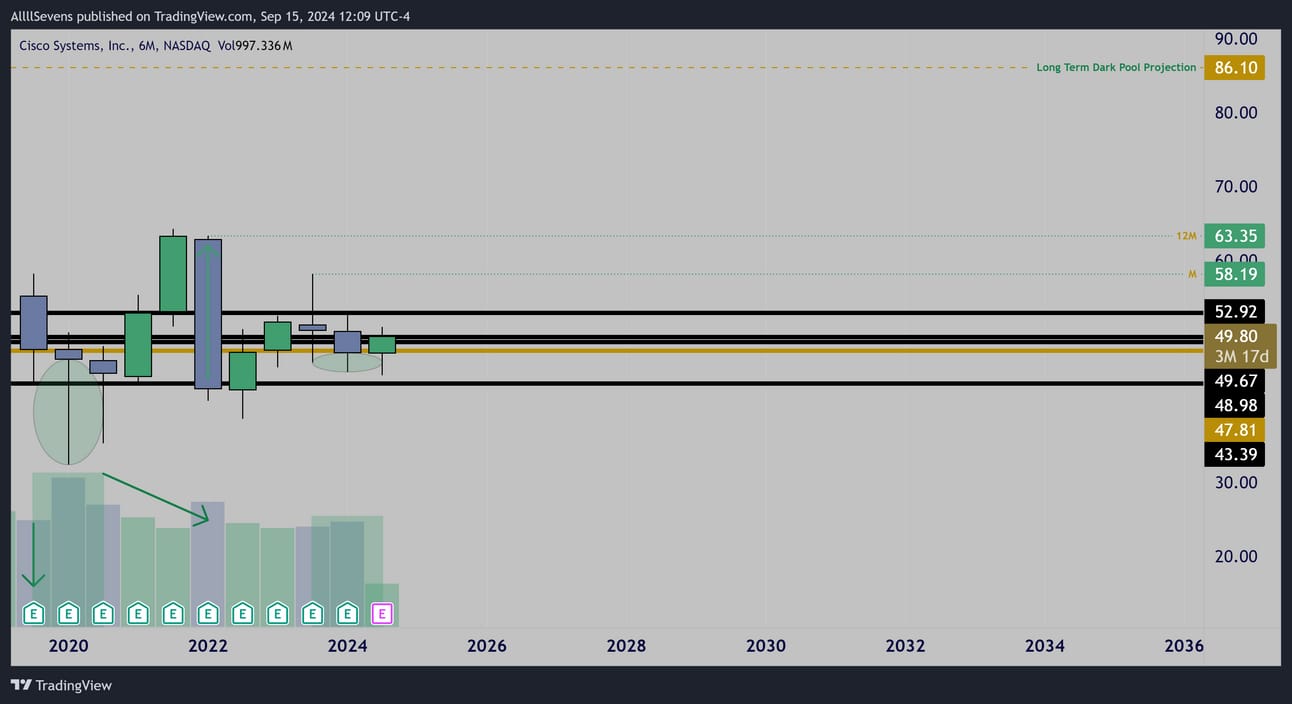

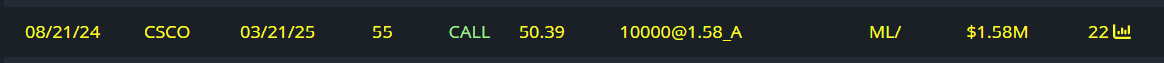

$1.58M Call Buyer for March 2025

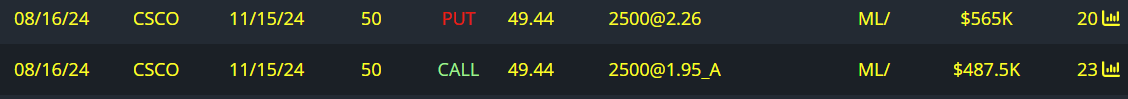

$487.5K Call Buyer for November

$565K Put Writer for November

$265.5K Call Buyer for April

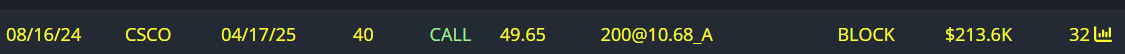

$213.6K Call Buyer for April

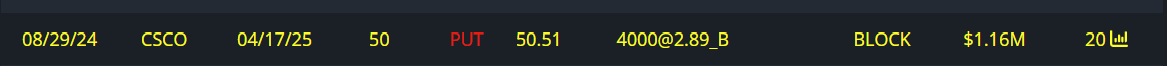

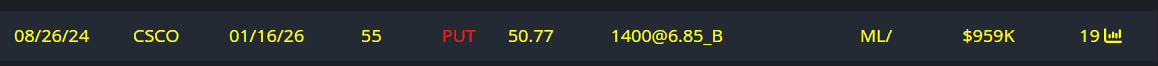

$1.16M Put Writer for April

$959K Put Writer for January 2026

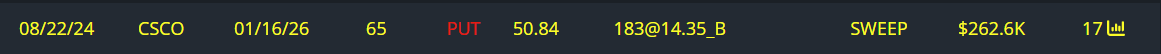

$262.6K Put Writer for January 2026

$230.9K Put Writer for June 2025

Second to the tech theme currently emerging-

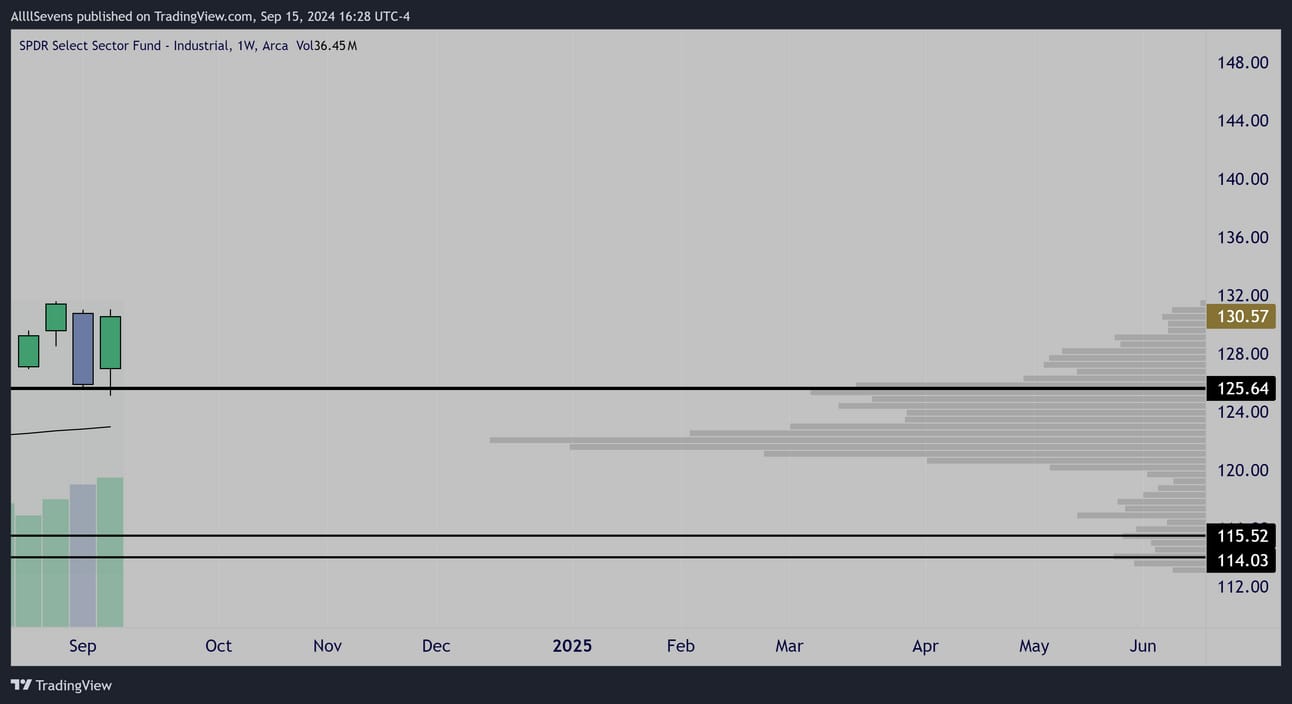

I do not want to let you forget that industrials have a great chance at becoming THE emerging LEADER for the next leg higher in the broader market.

Be sure to read The Dawn of The Bull Market newsletter for the charts.

The key take away is:

The XLI sector has the highest correlation to the RSP, which is really the foundation of the entire idea that the bull market is not only not ending here, but just beginning.

Last week’s $XLI candle is an inside bar, on increased volume, directly at DP.

This is an A+ candle pattern for potential upside continuation.

$HON, one of my top picks in the XLI formed the same exact pattern.

I just wrote a very in-depth newsletter on this one. Read that here.

Bull flows are active and there is a truly amazing LONG TERM setup in play.

ALSO, I know I may be over-loading a bit, but be sure to read my bull thesis on $UBER as well.. This one is absolutely incredible and TRULY unique I promise you.

Read that here.

Not only is UBER a large holding in the XLI, but it also fits the theme of consumer cyclical stocks, XLY, which has also been basing over it’s largest DP on record for the last few months + saw HISTORIC institutional investment during the 2022 bear market, which is outlined in The Dawn of The Bull market.

$XLY Quarterly Interval

$2M Call buyer for January

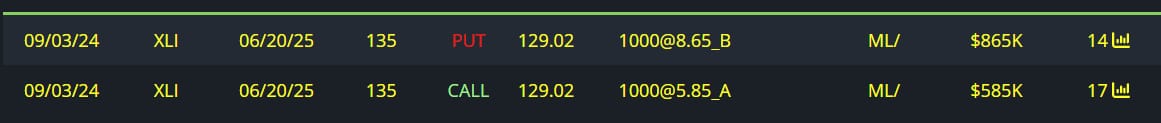

$865K Put Writer for June 2025

$585K Call Buyer for June 2025

$XLI Weekly Interval

GE

SPOTLIGHT newsletter coming on this very soon.

Make sure you are signed up for my newsletters ahead.

Sign up here.

Follow me on 𝕏/Twitter @SevenParr

If you truly find value in my work, please consider upgrading your subscription to AllllSevens+ for just $7.77 per month.

Click here to upgrade.

I will occasionally send a premium newsletter & you will also get access to my Discord where I gather and collect my data throughout the week.

I take chart requests at any time in my Discord.

But, overall, premium is just a way to show your support.

I am working my ass off recently, pushing out the best stock market alpha I possibly can for FREE.

So, if you think my work is worth $7.77, please make sure to upgrade.

I would appreciate it a ton.

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply